Oh joy, oh rapture! Just when you thought it was safe to dip your toes back into the crypto pool, along comes April with its tariff tantrums, threatening to send Bitcoin (BTC) and friends into another tizzy 🤪. According to the lovely folks at Nansen, there’s a whopping 70% chance of another price dip after April 2. Because, you know, the market wasn’t already a thrilling rollercoaster ride 🎠.

As we stumble into April, the crypto market is all like, “Will we, won’t we?” (face-palm) have another correction. And honestly, who knows? 🤷♀️ But Nansen’s analysts are all, “Hey, there’s a good chance (70%, to be exact) we’ll see another leg down in crypto prices after April 2.” Just what you wanted to hear, right? 😒

Now, let’s talk Trump (because, why not? 🙄). He’s all set to unleash new tariffs on April 2, which, spoiler alert, might just spook the markets all over again. But hey, at least it’s not boring, right? 🎉

In a chat with crypto.news, Aurelie Barthere, Nansen’s principal research analyst, shared her two cents. In short: brief correction, then stabilization, and eventually (fingers crossed) growth 🌱.

“In my main scenario, 70% subjective likelihood, I expect another leg down in crypto prices after April 2… After this second correction, I expect we will be bottoming for the rest of the year…”

Aurelie Barthere (a.k.a. The Crypto Oracle 🙏)

But wait, there’s more! Barthere also mentions that after the (potential) dip, Bitcoin might just rebound, thanks to a supportive macro environment and all that jazz 🎵. So, it’s not all doom and gloom… yet ⛈️.

“For the remaining 30%: it would be if we have already bottomed or if this is just a dead cat bounce…”

Aurelie Barthere (still The Crypto Oracle, just to clarify 🙃)

Uncertainty: The Gift That Keeps on Giving 🎁

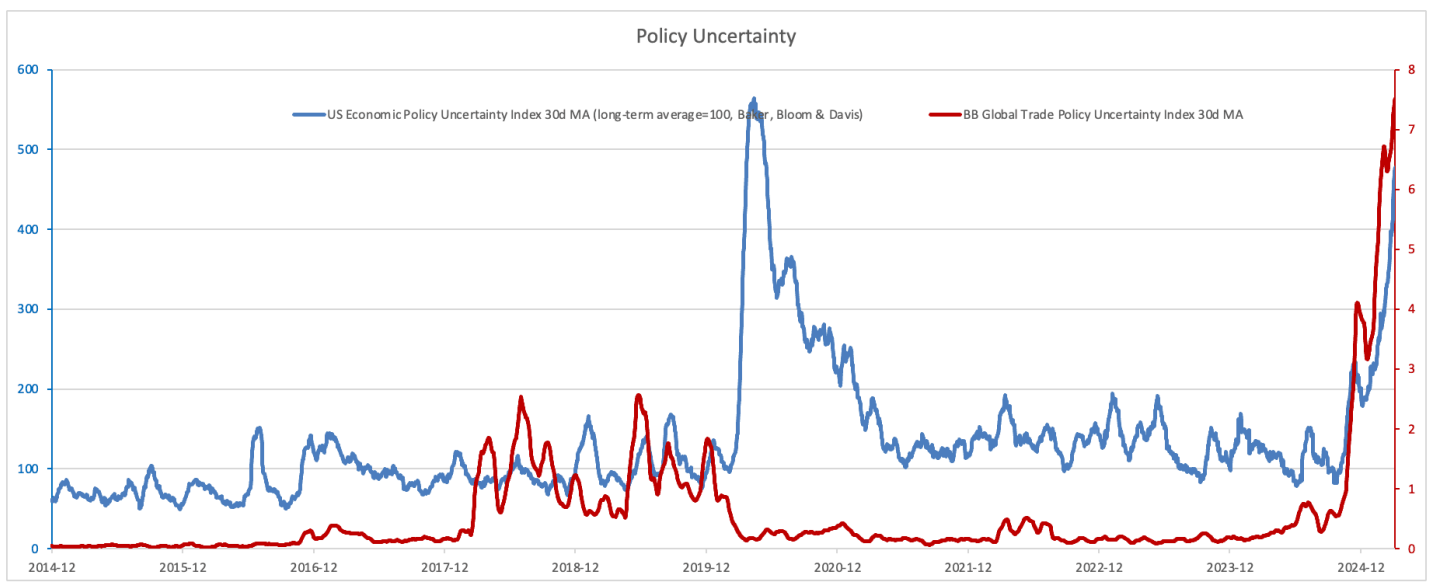

The tariff saga has been a wild ride, with the U.S. policy uncertainty index hitting new highs 📈. But hey, at least some trading partners are negotiating to lower their trade barriers, so that’s a thing 🙌.

“Right now, I think that we are experiencing corrections within a crypto bull market… Why I see this as a bull market still: 1) Ongoing progress on crypto regulation… and 2) U.S. real growth has slowed but is not flashing ‘recession.’”

Aurelie Barthere (yep, still her 🙃)

So, to sum it up: uncertainty might last a bit longer (until Q2, perhaps?), but there’s a 50/50 chance we’ve already peaked on the trade policy uncertainty front 🤔. And, you know, no evidence of a recession… yet 🙅♂️.

No Recession in Sight (Phew!) 🙌

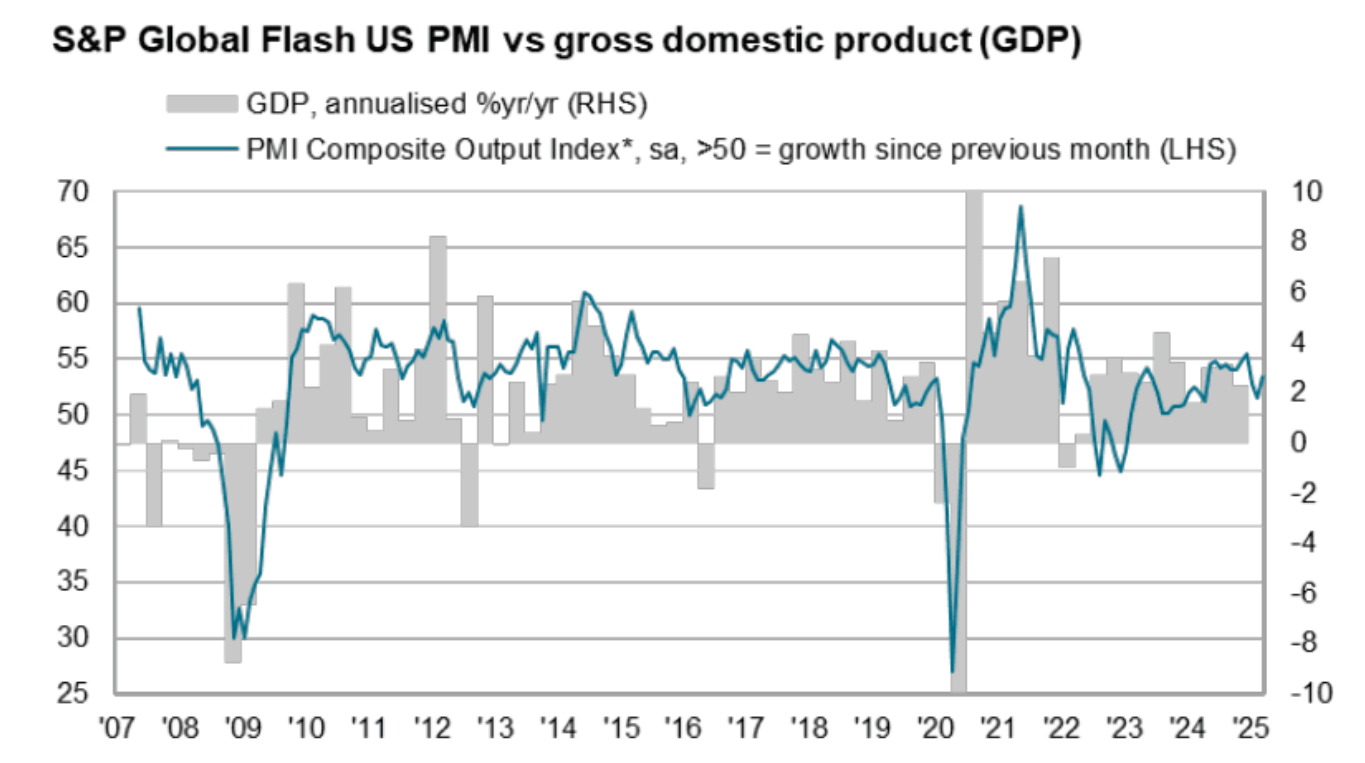

The latest U.S. March flash PMI report shows a 53.5 score, which is, you know, not bad 🙃. Growth is slowing down, but no recession bells are ringing just yet 🔔.

Barthere reassures us that, for now, there’s no hard evidence of a recession. So, let’s all take a deep breath and remember: corrections happen, but the overall bull market is still (probably) intact 🐃.

Stay calm, crypto fans! 🙏 (Or, you know, panic and sell all your Bitcoins. We won’t judge 🤫).

Read More

2025-03-27 19:40