So, Bitcoin’s decided to take a little slide down the cosmic banana peel, and according to CryptoQuant CEO Ki Young Ju, it’s all because the macro liquidity party has run out of punch. 🥳 Unless someone spikes the bowl with spot ETFs, we’re apparently in for a bear market that’ll make hibernation look like a rave. 🐻💤

The Great Bitcoin Bear Shuffle

Ju, ever the chart wizard, whipped up a composite on-chain dashboard that looks like a traffic light on a bad day-mostly red. 🚦 He posted on X (formerly Twitter, because why not rename everything?): “Most Bitcoin on-chain indicators are bearish. Without macro liquidity, we enter a bear cycle.” Basically, it’s like trying to start a campfire with wet wood. 🔥💧

The chart, a glorious red-to-green heatmap spanning 2021 to 2025, shows ten CryptoQuant metrics stacked behind the BTC price. It’s like a mood ring for the market, and right now, it’s screaming “mood: grumpy.” 😠 Highlights include the MVRV Z-score, CryptoQuant P&L Index, and the Bull-Bear Cycle Indicator-all throwing shade at Bitcoin’s recent antics.

Ju’s take? On-chain data is so last season. Now it’s all about macro conditions and ETF flows. 🌊 “If you think macro gets better next year, you buy. Otherwise, you sell,” he quipped. “I’m not a macro expert, so find macro bros. New ETF inflows are the key.” Basically, ETFs are the superhero Bitcoin needs, but does it deserve? 🦸♂️💰

In simpler terms, if ETFs don’t swoop in like financial Batman, Bitcoin might just take a nap for a while. 🦇 But Ju’s not hitting the panic button yet. He reckons we’re not looking at a 2022-style crash (remember that? Good times. 😅). Thanks to Michael Saylor’s Strategy holding onto its 650K BTC like a dragon hoarding gold, we’re probably safe from a -65% nosedive. 🐉✨

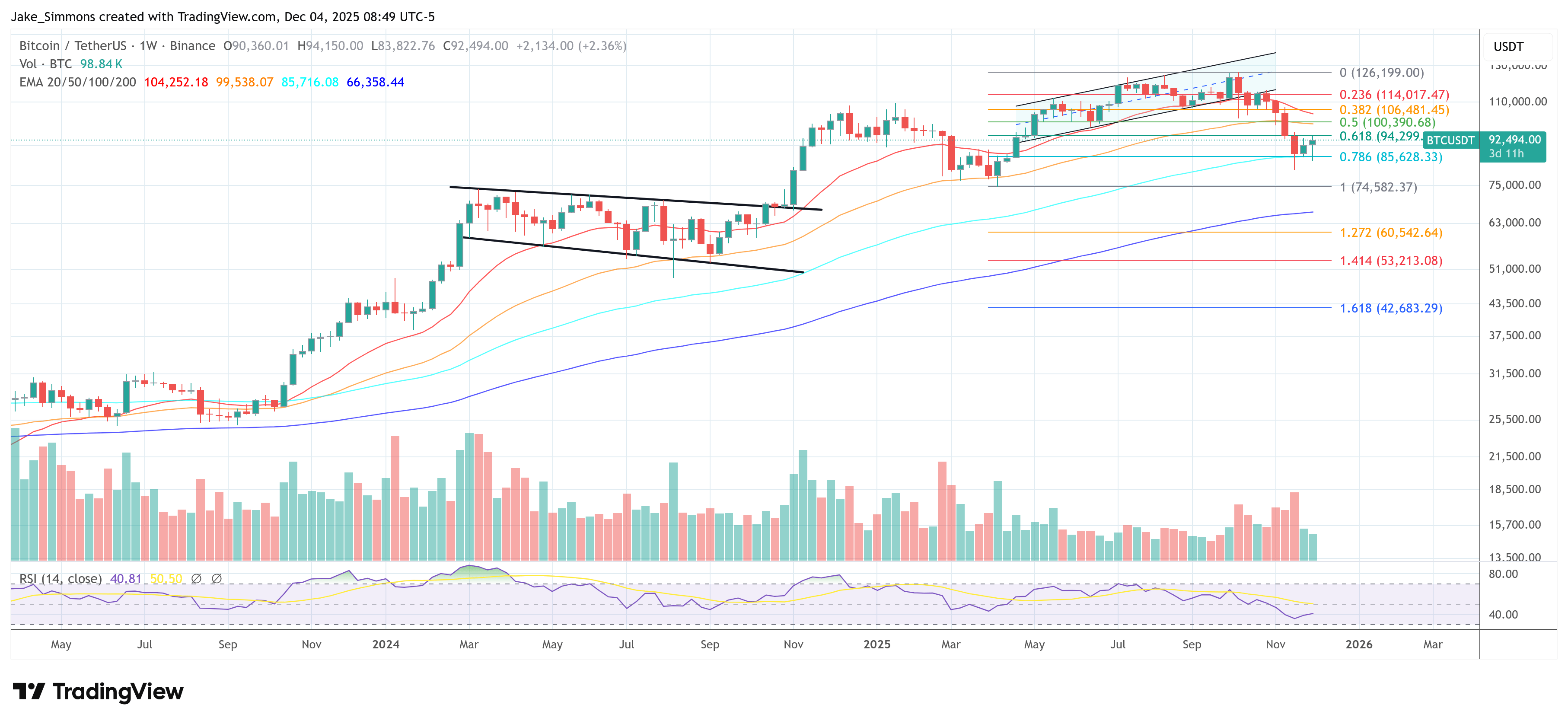

The current pullback? Just a “substantial” dip, not a full-on plunge. “We’re about -25% from ATH now,” Ju said, “and even if a bear cycle comes, it’ll likely be more of a sideways shuffle than a dramatic crash.” So, less “skydiving without a parachute” and more “strolling through a mildly confusing maze.” 🧩

Long-term holders, take a deep breath. Ju’s advice? “Avoid panic selling.” 🧘♂️ While the on-chain indicators are flashing red like a disco floor, the structural backdrop has allegedly improved. “Bitcoin has more liquidity channels now, so the long-term outlook is obviously strong, imo,” he added. ETFs and deeper institutional involvement are the unsung heroes here. 🎭

At press time, Bitcoin was chilling at $92,494, probably wondering where all the macro liquidity went. 🍹

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Thanos Comics (September 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

- 10 Movies That Were Secretly Sequels

2025-12-05 04:23