Oh joy, oh rapture! 🎉 Q2 is here, and with it, a slew of US economic data that’ll put your crypto investments through a spin cycle 🔄. Buckle up, folks! 🚀

Traders and investors, gather ’round! You’ll be on the edge of your seats as a plethora of US economic data releases threatens to upend Bitcoin (BTC) and altcoin prices. Because, you know, volatility is just what you needed to spice up your week 😒.

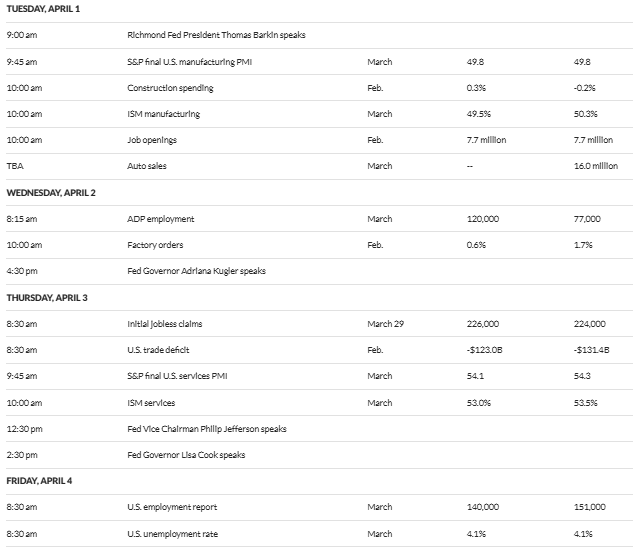

5 US Economic Data To Watch (aka Your Week’s Stress Inducers)

These macroeconomic indicators will either make your crypto portfolio sing or cry – possibly both, because, why not? 🎶

“Buckle up—volatility’s knocking. Right on time for the monthly shake-up,” some wise guy on X quipped. 🙄

JOLTS (Job Openings and Labor Turnover Survey) – The Economy’s Confidence Booster (or Not)

April 1st (no foolin’!). This report’s like a window into employers’ souls. Strong job openings (> 7.7 million)? 🚀 US dollar up, Bitcoin down. Weak showings? 📉 Rate cuts, here we come! (Maybe.)

ADP Employment – A Sneak Peek at Payrolls (Don’t Get Too Attached)

Wednesday, April 2. Private-sector payrolls. Median forecast: 120,000. Beat it, and crypto might take a hit. Miss it (sub-77,000), and Bitcoin’s your new BFF 🤗.

Liberation Day – Tariffs, Trade Wars, and Crypto Chaos (Oh My!)

Also April 2. New tariffs might just crash the party (and markets). Analysts predict up to 15% crypto crashes. You’ve been warned 🚨.

“…new tariffs on all US imports,” said Joseph Politano, economic policy analyst. Because what could possibly go wrong? 🤷♂️

“April 2nd is like election night… 10x more important than any FOMC,” Alex Krüger predicted. No pressure 🙅♂️.

Initial Jobless Claims – The Weekly Labor Market Pulse (Don’t Have a Heart Attack)

Thursday, April 3. Fewer claims? 🙌 US dollar strong, crypto meh. More claims? 🚨 Crypto to the rescue! (Maybe, possibly, don’t quote me.)

US Employment Report (a.k.a. The Big Kahuna)

Friday, April 4. The main event. Strong report? 🚀 US economy’s got this, crypto’s meh. Weak report? 📉 Recession fears, Bitcoin cheers ( possibly, no promises 🤷♂️).

“BofA Securities expects a pickup in job growth for March. Keep an eye on those numbers,” crypto researcher Orlando noted, stating the obvious 🙄.

So, crypto enthusiasts, there you have it. Track those estimates, watch the markets flip out, and… well, good luck 🤞. Oh, and Fed Chair Jerome Powell will drop some knowledge on Friday at 11:25 a.m. EST. Because you weren’t anxious enough already 😅.

As of this writing, BTC’s at $82,192, down 1% in 24 hours. But hey, who’s counting? 🤑

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-03-31 12:46