- Bitcoin‘s caught in a snare, you see, because the market’s playing a brand new game where the old rules are just a jest.

- Gold’s getting a glow-up, it seems, with imports on the rise, making BTC look rather small in the safe haven stakes.

Oh, the poor old U.S. Dollar Index [DXY], it’s tumbled down to a five-month low of 103, but Bitcoin [BTC] stands still as a statue, not budging an inch from its usual dance with the greenback.

And while the dollar swoons, U.S. gold imports are positively bursting at the seams, with a whopping $4.9 billion worth pouring in on a single day. Investors are cozying up to the old classics, leaving crypto to shiver in the cold.

With gold guzzling up all the cash and BTC gasping for air, has the big bad macro world thrown a spanner in Bitcoin’s works?

Has Bitcoin Dumped the DXY Dance?

The DXY’s had a proper tumble, a 3.70% nosedive to a five-month low, a spectacle that’s usually the curtain raiser for Bitcoin’s grand parades.

In the grand show of 2017, BTC soared 87x high as the DXY stumbled below 90. Four years on, in the 2021 spectacle, BTC did a 10x leap to the heavens.

But this time? The dollar’s down, but BTC’s painting the town red, with four candles in a row, and it’s a full 22% shy of its $109K all-time high.

This DXY drama followed a jobs report that was weaker than a wet tissue, setting the stage for three juicy Fed rate cuts in 2025.

But hold your horses! Fed Chair Powell’s still got his eagle eyes on, warning of a rate hike if Trump’s tariff tantrums spark a fire in inflation.

It’s a whole new ball game, folks.

In cycles past, BTC was the king of the monetary easy street, rallying as the DXY waned.

But now? Fiscal fireworks – debt, tariffs, and inflation – might just be the new showstoppers, breaking Bitcoin’s cozy dance with the dollar.

Market Mood Swings as Cash Flows Elsewhere

Even with a crypto pow-wow, a feeble jobs report, and the big reveal of a Bitcoin Strategic Reserve, the market’s still got the jitters.

Uncertainty and risk aversion are the new black, with market makers scratching their heads over whether BTC’s got any fireworks left.

As cash dries up and the momentum fades like a bad dye job, the chance of BTC slipping below $80K is looking more likely by the minute.

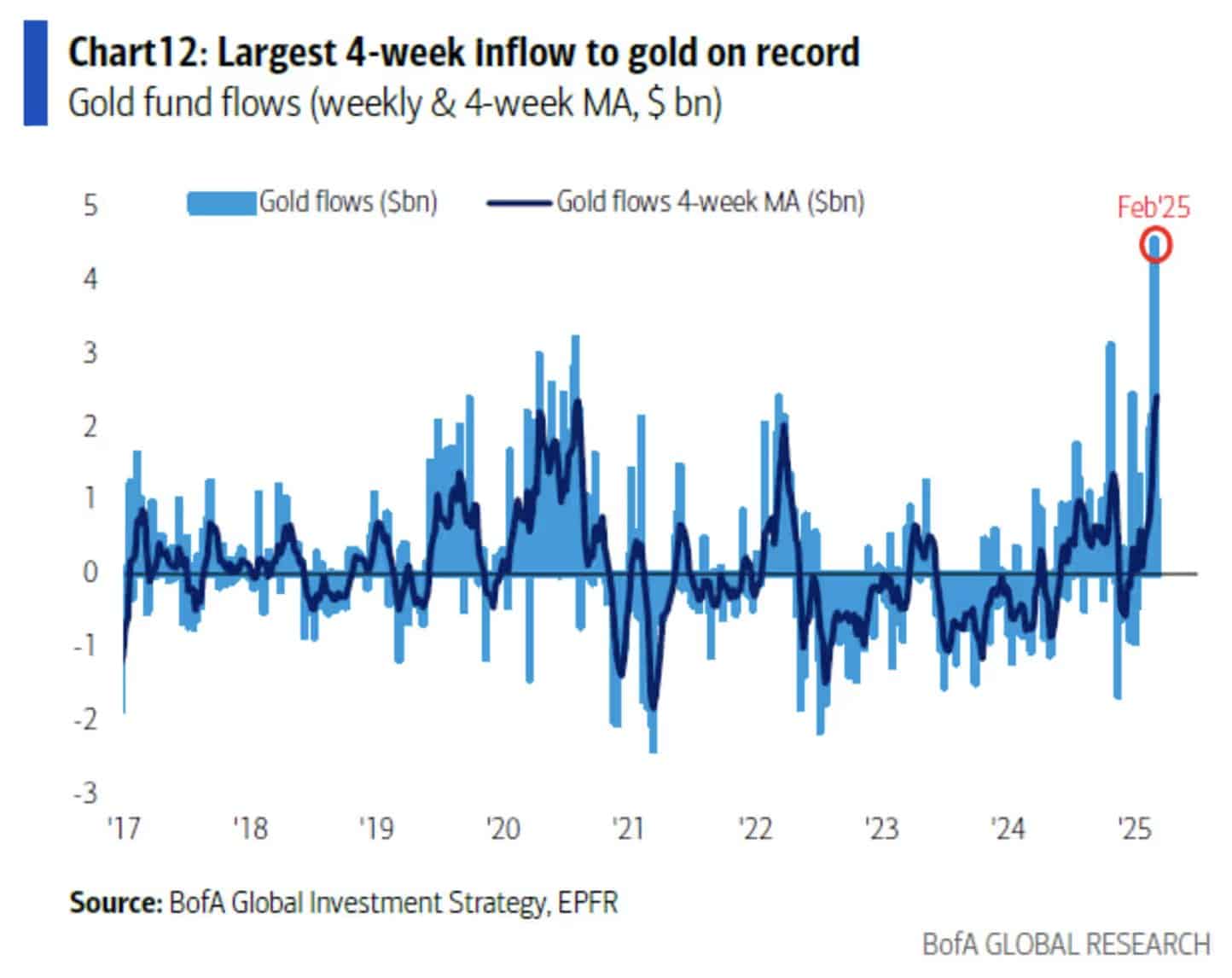

And what’s that in the corner? Why, it’s gold, stealing the show with a record-breaking $4.9 billion cash influx over four weeks.

This macro merry-go-round is turning Bitcoin’s world upside down. With cash swirling into the old safe havens, BTC’s safe-haven crown is slipping.

As old ties weaken and new perils pop up, BTC’s facing a market that’s more unpredictable than a box of chocolates.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Avowed Update 1.3 Brings Huge Changes and Community Features!

2025-03-10 11:11