In the dusty plains of the financial frontier, Michael Saylor, the sage of Strategy, emerged this week with a proclamation that rattled the canyons of Wall Street. He claimed, with a wink and a nod, that the rumored tariffs on gold imports by the U.S. government would send investors scurrying like prairie dogs, abandoning their shiny metal for the digital oasis of Bitcoin. 🌵💰

“Bitcoin,” he declared in a Bloomberg interview, “lives in cyberspace, where the only borders are the limits of imagination, and tariffs are as useless as a screen door on a submarine.” 🚀✨

He went on, with a twinkle in his eye, to extol the virtues of Bitcoin’s weightless existence and lightning-fast settlements, painting gold as a relic of a slower, heavier age. “Gold is like a mule,” he quipped, “while Bitcoin is a jet plane.” 🐌✈️

The Digital Gold Rush

Others in the industry, like Simon Gerovich of Metaplanet, chimed in with their own brand of wit. “Gold is heavy, slow, and political,” he said, “while Bitcoin is light, fast, and free. It’s the difference between a typewriter and a smartphone.” 📡📱

Metaplanet, a Japanese firm with a penchant for digital treasure, recently dropped $54 million on Bitcoin, bringing their hoard to a staggering 17,595 BTC-roughly $1.78 billion. That’s enough to make even the most stoic investor’s eyes widen like a cartoon character’s. 😲💸

These numbers, my friends, are the stuff of legend, the kind of figures that make corporate treasurers rethink their allegiance to the old guard of gold. 🏛️🔄

Markets: A Tale of Two Assets

The markets, ever the fickle beast, reacted with split personalities. Gold futures soared to record highs as traders, like ants to sugar, swarmed to price in the potential costs of tariffs. Meanwhile, Bitcoin traded sideways, as calm as a summer breeze, dipping less than 1% in 24 hours. It’s as if one asset was dancing to a polka while the other was meditating in a monastery. 🎢🧘

This divergence, my dear reader, is a testament to the great financial schism of our time: some seek the comfort of the tangible, while others bet on the intangible. It’s a battle of the ages, fought not with swords and shields, but with algorithms and hash rates. ⚔️🔢

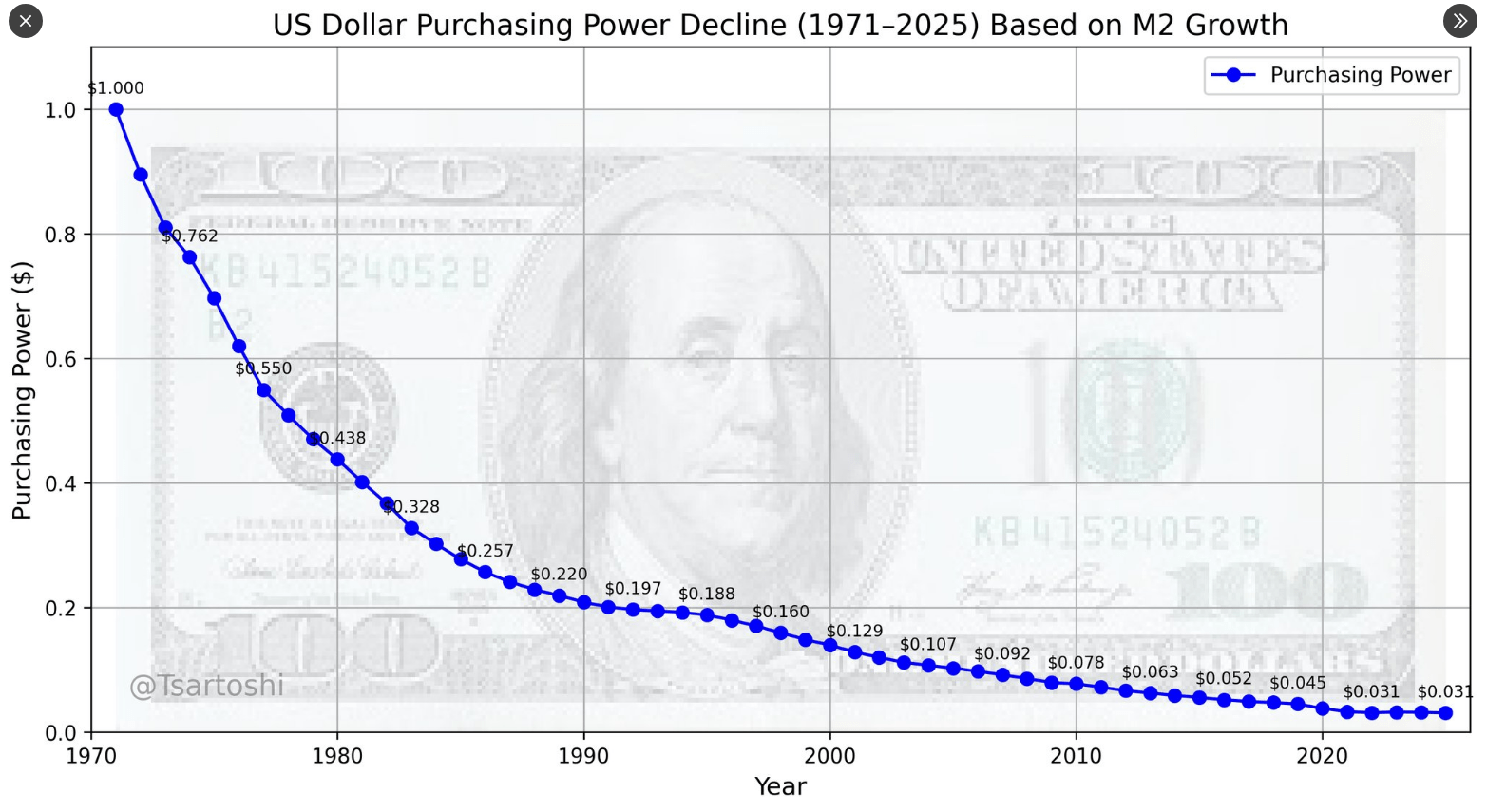

This is the purchasing power of the U.S. Dollar

This is the ultimate chart pattern for all fiat currencies

Some think Gold is a great store of value (preserving its purchasing power) – and it is

But the ultimate store of value will prove to be Bitcoin $BTC

– Peter Brandt (@PeterLBrandt) August 8, 2025

Peter Brandt, the grizzled veteran of the trading trenches, threw his hat into the ring with a chart that tells a tale as old as time itself. The U.S. dollar, once mighty, has shriveled like a raisin in the sun, its purchasing power plummeting from $1.00 in 1971 to a measly $0.031 in 2025. That’s a 95% decline, folks-enough to make even the most ardent fiat enthusiast pause and ponder. 📉🤔

Brandt, with the wisdom of a man who’s seen it all, argues that while gold has held its ground, Bitcoin is the new sheriff in town, ready to take the crown as the ultimate store of value. 🏆🔗

And so, the debate rages on, fueled by tariffs, tweets, and the timeless human desire to find something-anything-that holds its worth in a world of uncertainty. Institutional giants like Strategy and Metaplanet are placing their bets on Bitcoin, while gold’s record highs remind us that the old ways still have their adherents. It’s a financial tug-of-war, and we’re all here for the show. 🎪🎟️

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Thanos Comics (September 2025)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- Resident Evil Requiem cast: Full list of voice actors

- Best Controller Settings for ARC Raiders

- Best Shazam Comics (Updated: September 2025)

- How to Build a Waterfall in Enshrouded

- PS5, PS4’s Vengeance Edition Helps Shin Megami Tensei 5 Reach 2 Million Sales

- The 10 Best Episodes Of Star Trek: Enterprise

2025-08-09 19:16