Ah, the theater of the absurd! The grand stage of Bitcoin, where short-term holders, those fickle souls with the attention span of a gnat, have once again proven their mettle-or rather, their lack thereof. On-chain data, that omniscient narrator of our financial follies, reveals a spectacle most comical: 60,000 BTC, worth a staggering $6.5 billion, have been hurled onto exchanges in a panic, like peasants fleeing a phantom bear in the woods. 🐻💸

The Short-Term Holders: A Farce in Three Acts

In a missive on the digital square of X, the sage Maartunn, a CryptoQuant community analyst, has chronicled the latest melodrama. The short-term holders (STHs), those who clutched their BTC like a child clings to a lollipop-but only for 155 days-have capitulated with all the grace of a goose in a ballroom. Statistically, the longer one holds, the wiser one becomes; but these STHs, oh no, they are the weak-kneed, the trembling, the first to scream at the sight of a price dip. 🍭💔

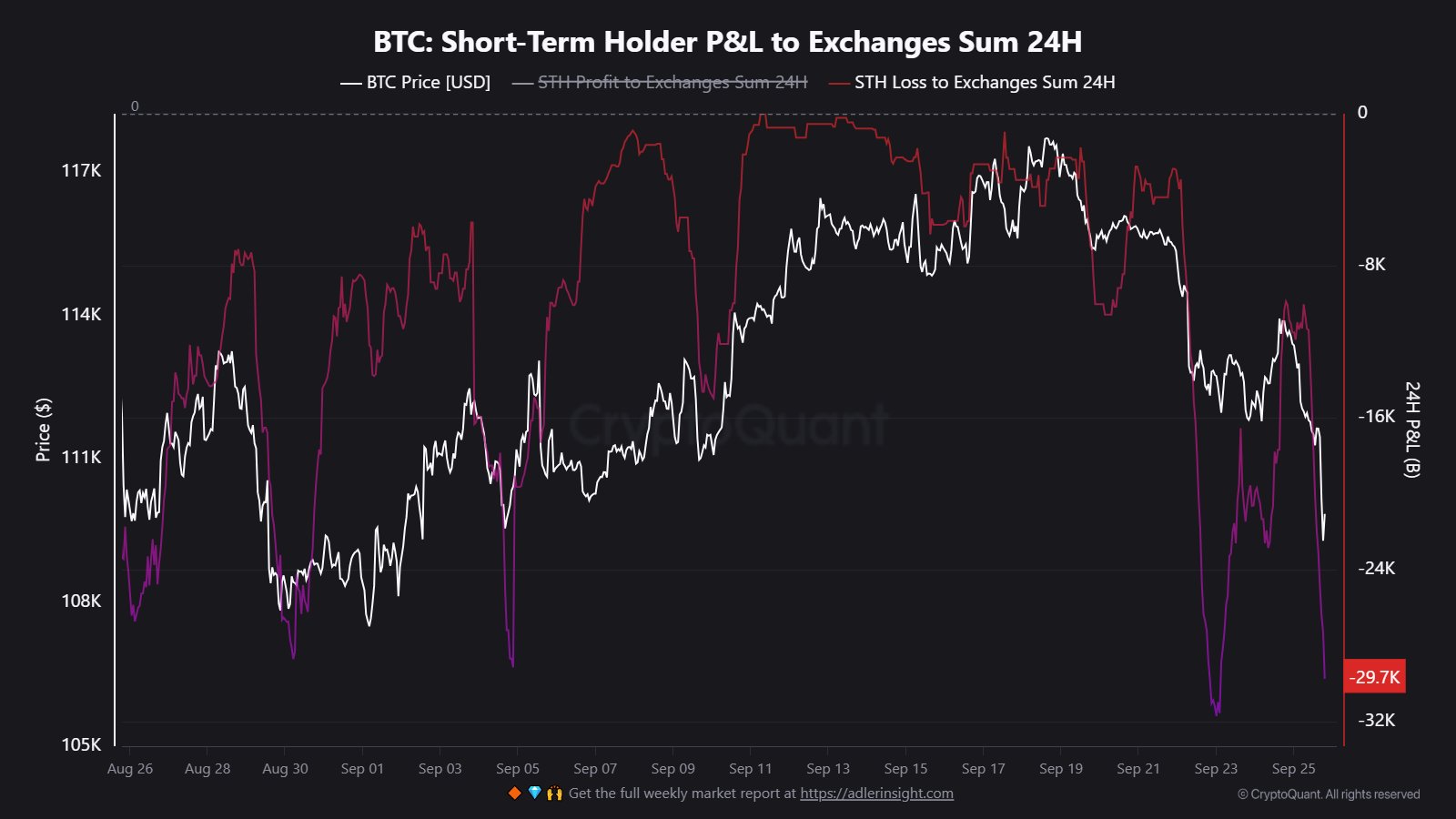

As usual, they have panicked like a cat in a cucumber field. Behold, the chart Maartunn hath shared, a tableau of their despair: loss transactions flowing to the wallets of centralized exchanges like tears at a tragic opera. 🎭

From this graph, it is as clear as a Gogol nose that nearly 32,000 BTC were deposited at a loss during the recent crash. Why, you ask? To sell, of course! For what else would these fickle creatures do but flee at the first sign of trouble? 🏃♀️💨

And lo, the latest decline-BTC dipping below $109,000-has provoked another wave of capitulation, with 29,700 tokens sent to exchanges in 24 hours. In total, over 60,000 BTC have been sacrificed on the altar of fear. “A clear sign of heavy stress across the market,” Maartunn notes, though one might call it a farce of epic proportions. 🤡

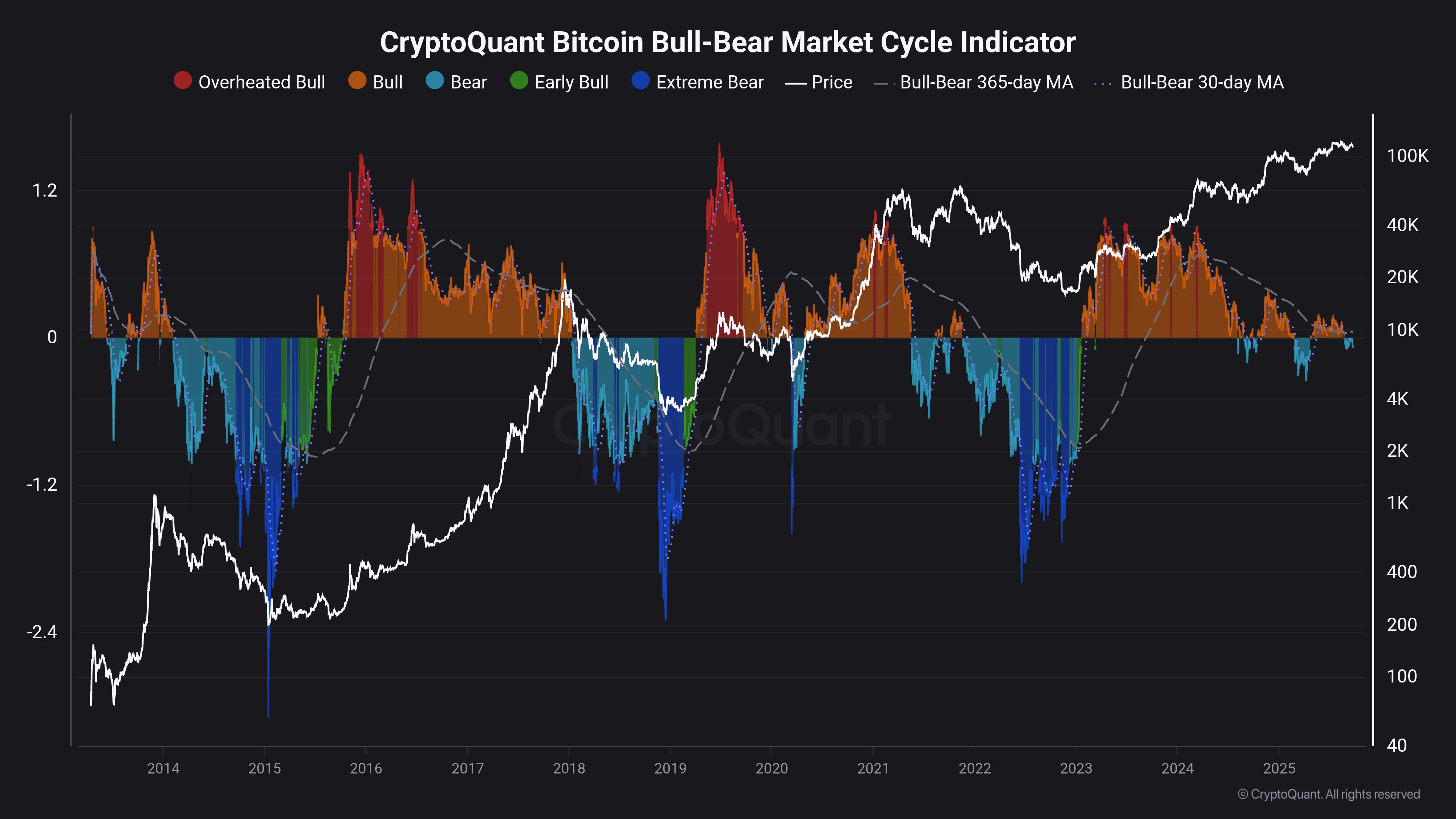

But wait, there’s more! CryptoQuant’s Bitcoin Bull-Bear Market Cycle Indicator-a device as reliable as a Gogol protagonist’s sanity-is flashing a “bear” signal. Behold its grim pronouncement: BTC is in a bearish phase, says Maartunn in another X post. 🌚

This indicator, a concoction of on-chain metrics, declares BTC’s current phase with all the drama of a Russian novel. And the 365-day moving average? It hath been descending like a nobleman into debt. “Historically, most BTC gains happen when this metric is rising, not falling,” Maartunn explains, though one might add: when will these holders learn? 📉

BTC Price: A Tragicomedy

Bitcoin, that fickle muse, has tumbled to $108,900, a decline of over 5.5%. Behold its descent, captured in all its glory: 🌀

And so, dear reader, we leave you with this: a market of panic, a chart of tears, and a cryptocurrency in freefall. But fear not, for in the world of Bitcoin, as in Gogol’s tales, the absurdity is endless. Until next time, may your holdings be long and your nerves strong. 🤑✨

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- JRR Tolkien Once Confirmed Lord of the Rings’ 2 Best Scenes (& He’s Right)

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Greg Nicotero’s Super Creepshow Confirms Spinoff, And It’s Coming Soon

- All Her Fault cast: Sarah Snook and Dakota Fanning star

2025-09-27 09:14