Right, so Bitcoin, or BTC as it’s known to its friends (and enemies, because let’s face it, everyone has an opinion), has apparently shrugged off a rather substantial financial whoopsie. We’re talking a cool $359.7 million vanishing in a puff of digital smoke. One might expect a bit of a wobble, perhaps a dramatic fainting spell, but no. BTC is just standing there, dusting itself off like it’s just misplaced its car keys.🔑

- Apparently, BTC decided that a measly $359 million long squeeze was beneath it and remained stubbornly above the short-term realized price ($86.5K). One can almost hear it scoffing.

- The price recovery, described as suggestive of spot market strength, apparently needs to pull its socks up if it wants to achieve further upside. Honestly, the demands placed on these digital currencies are outrageous.

Bitcoin [BTC] is proving that it is, in fact, resilient, despite a sharp liquidation event that wiped out $359.7 million in long positions. Which, when you think about it, is quite a lot of money. Gone. Poof. See, even the numbers are sad.

As volatility continues to grip the market with the tenacity of a particularly clingy octopus, short-term levels are now more important than ever to gauge what lies ahead for the king coin. Or, as some prefer to call it, that digital thingy that everyone’s arguing about.🐙

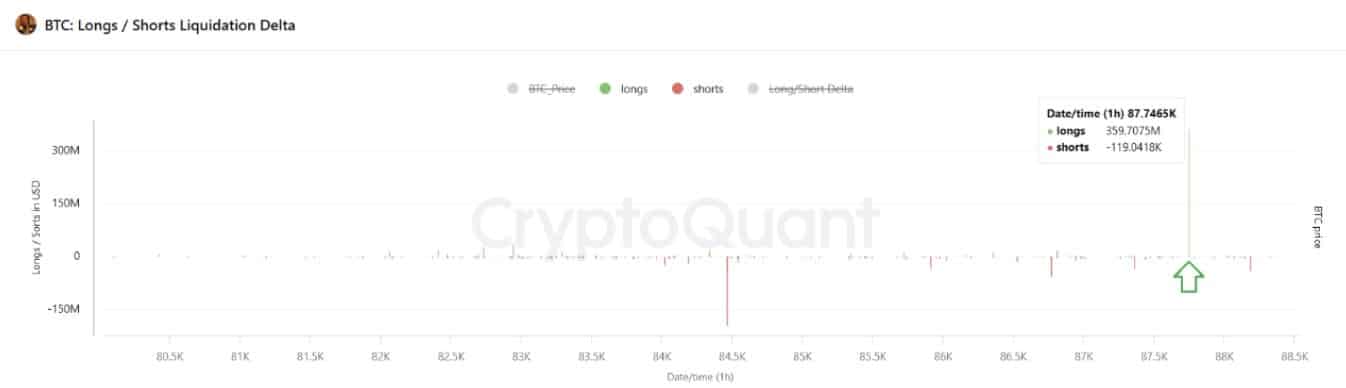

Massive long liquidation but no breakdown

According to CryptoQuant data, which sounds terribly official, the market recently witnessed a large-scale long squeeze, with nearly $360 million in long positions flushed out in a single hour. That’s got to sting. Like accidentally sitting on a cactus kind of sting.🌵

Interestingly, and by “interestingly,” I mean “against all reasonable expectations,” this was not accompanied by a sharp downward price spiral. Instead, BTC bounced back quicker than a rubber chicken at a comedy convention and traded at around $86,000, indicating strong buyer support and a distinct lack of panic selling. Perhaps everyone was too busy making tea.☕

This recovery indicates that, despite over-leveraged traders facing losses, spot market participants remain steadfast. Or possibly just stubborn. It’s hard to tell the difference sometimes.

The liquidation event appears to have corrected overheated derivatives positions, potentially paving the way for more sustainable upward movements. Think of it as a digital colonic. Cleansing, but not necessarily pleasant. 🚽

Bitcoin price holds above short-term realized price

Another encouraging signal comes from the Realized Price – UTXO Age Bands chart. Yes, I have no idea what that means either. It sounds important, though. Charts are always important, right?

At the time of writing, BTC was above the short-term realized price for the 1-day to 1-week cohort at $86,000 and the 1-week to 1-month cohort at $84,000. These levels often act as support zones for short-term holders. Imagine them as tiny digital safety nets, woven from hope and slightly frayed at the edges.

//ambcrypto.com/wp-content/uploads/2025/03/BTCUSD_2025-03-28_06-24-21.png”/>

Moreover, the MACD line remained above the signal line, albeit with narrowing divergence, a possible sign of consolidation before the next leg up. Which, in layman’s terms, means… well, nobody really knows, do they? 🤷♂️

A retest of the $90,000 psychological level appears likely if momentum picks up again. Because numbers ending in lots of zeros are always scarier. And more impressive. Simultaneously.

What next?

Bitcoin’s resilience after liquidation and its ability to remain above key realized price levels highlight strong demand. So, people still want it. Good to know.

However, cautious optimism is necessary, as BTC requires sustained momentum and higher volume to break out of its range. If buyers successfully protect short-term support zones, the next bullish movement could already be unfolding. Or it could all go horribly wrong. Place your bets! 🎲

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

2025-03-28 14:19