- Since September, a persistent imbalance in the buy-to-sell ratio has strengthened BTC’s bullish outlook.

- Investors are acquiring $80 billion worth of BTC monthly, underscoring demand and growing confidence in the asset.

As a seasoned researcher who has witnessed the crypto market’s volatile rollercoaster ride for years, I can confidently say that the current bullish outlook for Bitcoin (BTC) is nothing short of exhilarating. The persistent imbalance in the buy-to-sell ratio, combined with the influx of funds reaching $80 billion per month, paints a picture of growing demand and increasing adoption.

Regardless of brief setbacks, Bitcoin’s [BTC] upward trajectory might continue according to the daily chart analysis. Lately, there was a 0.28% drop, which seems like a typical retreat during the ongoing bullish phase.

AMBCrypto points out that these price swings are a component of Bitcoin’s prolonged surge, and more comprehensive analysis can be found in the sections that follow.

Short-term holders prevent major BTC price decline

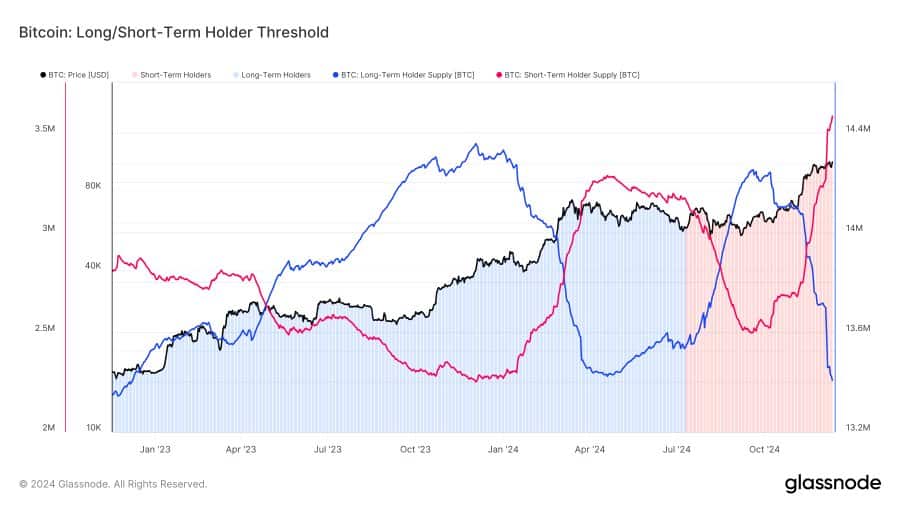

According to a recent analysis by James Van Straten, there has been substantial Bitcoin trading action since September, contributing to the market’s stability in terms of Bitcoin’s price. Currently, the boundary between long-term and short-term holders is at 1.28, indicating a strong trend towards accumulation, suggesting investors prefer to stockpile Bitcoin rather than sell it off.

In simpler terms, this suggests that when someone sells 1 Bitcoin, others are usually buying around 1.28 Bitcoins, demonstrating a consistent and ongoing desire for the cryptocurrency.

Upon a more detailed examination, it appears that those who have held Bitcoin for longer than two years – often referred to as long-term holders – were predominantly behind the selling sprees. Conversely, short-term holders, or initial investors, seem to be primarily responsible for the purchasing surge.

From September up until the present moment, an amount equivalent to 843,113 Bitcoin was offloaded, while approximately 1,081,633 Bitcoin were amassed. On a day-to-day basis, buyers have been acquiring about 12,432 Bitcoin, as opposed to 9,690 Bitcoin being sold each day.

This imbalance in favor of buying reflects bullish market sentiment, as increased accumulation prevents BTC from experiencing a sharp price decline. The sustained demand has likely helped BTC maintain its position above the $90,000 range following its recent all-time high.

Historic moment for BTC

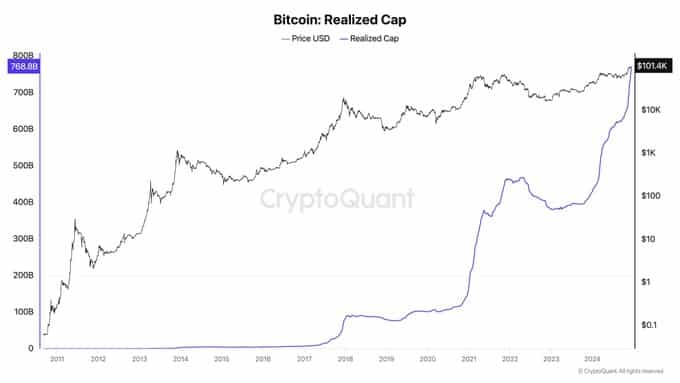

As reported by analyst Ki Young Ju, Bitcoin has experienced a substantial increase in investment, with monthly purchasing activity amounting to approximately $80 billion.

This growth signals a very positive trend for Bitcoin, implying that its popularity among ordinary investors is on the rise. In fact, an increasing number of these investors are buying more Bitcoin than they ever have before.

Ki Young Ju highlighted this momentum, stating:

Approximately half of the money invested in the Bitcoin market throughout the last fifteen years has been poured in during this current year.

Should this trajectory persist, Bitcoin’s future prospects are likely robust, setting the stage for a prolonged price rise.

AMBCrypto also analyzed BTC’s immediate market activity to assess its short-term outlook.

BTC maintains bullish momentum

Although Bitcoin’s price decreased by 0.28% in the last day, market signs still suggest a positive or bullish trend is on the horizon.

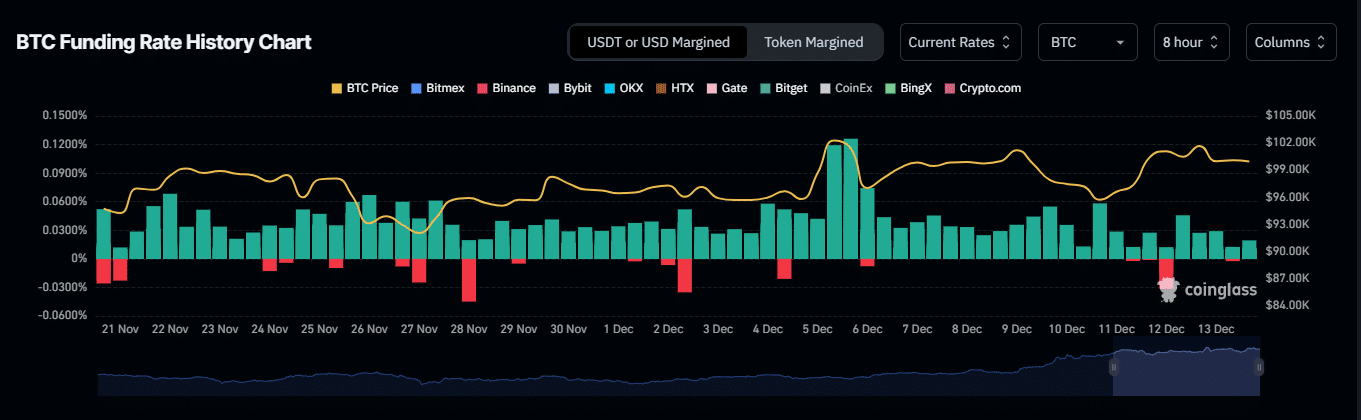

Currently, the funding rate for Bitcoin (BTC) stands at a favorable 0.0100%, based on information gathered within the past eight hours, as per data obtained from Coinglass.

As an analyst, I find a favorable funding rate indicates that long traders are upholding market stability across both the spot and futures sectors. This consistency mirrors a predominantly optimistic outlook and presents potential avenues for additional price escalation.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Furthermore, examining the balance between long and short contracts for Bitcoin suggests that it currently holds a neutral stance at 1. If this ratio shifts significantly either way, it might help predict the potential trend of the market.

Based on Bitcoin’s future perspective and the ongoing positive funding rate, it seems that the present price fluctuations might just be temporary pullbacks. The bulls seem to have the upper hand in this situation.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-14 00:08