-

Data showed that the BTC max pain was set at around $61,000.

BTC was trading in the $53,000 price range.

As an experienced analyst, I believe that the upcoming Bitcoin options expiration on July 5th is a critical event for the BTC market. With approximately $1 billion worth of contracts set to expire, the potential for significant market volatility cannot be ignored. The put/call ratio of 0.65 indicates that a larger number of call contracts are due to expire, which could lead to increased buying pressure if BTC prices rise above their strike prices.

The Bitcoin derivatives market was approaching a point where a large number of positions were set to expire, potentially leading to substantial price movements for Bitcoin [BTC].

As a researcher studying market trends, I’ve noticed that this forthcoming event is closely linked to recent price fluctuations. It has the potential to significantly impact market stability and potentially increase volatility.

The approaching expiry could have a substantial impact on market behavior as investors reposition themselves in light of changing price trends.

Bitcoin prepares for options expiration

Based on AMBCrypto’s examination of Bitcoin options, roughly 18,000 such contracts are set to conclude on the 5th of July, carrying an estimated total worth of about one billion dollars.

In simpler terms, the number of call options approaching their expiration in the Bitcoin derivatives market is approximately one and a half times greater than the number of put options. The put/call ratio of 0.65 signifies this imbalance.

The point of maximum distress, representing the most significant potential losses, is marked at $61,500. This figure is notably above the present market prices, particularly in light of this week’s considerable market decline.

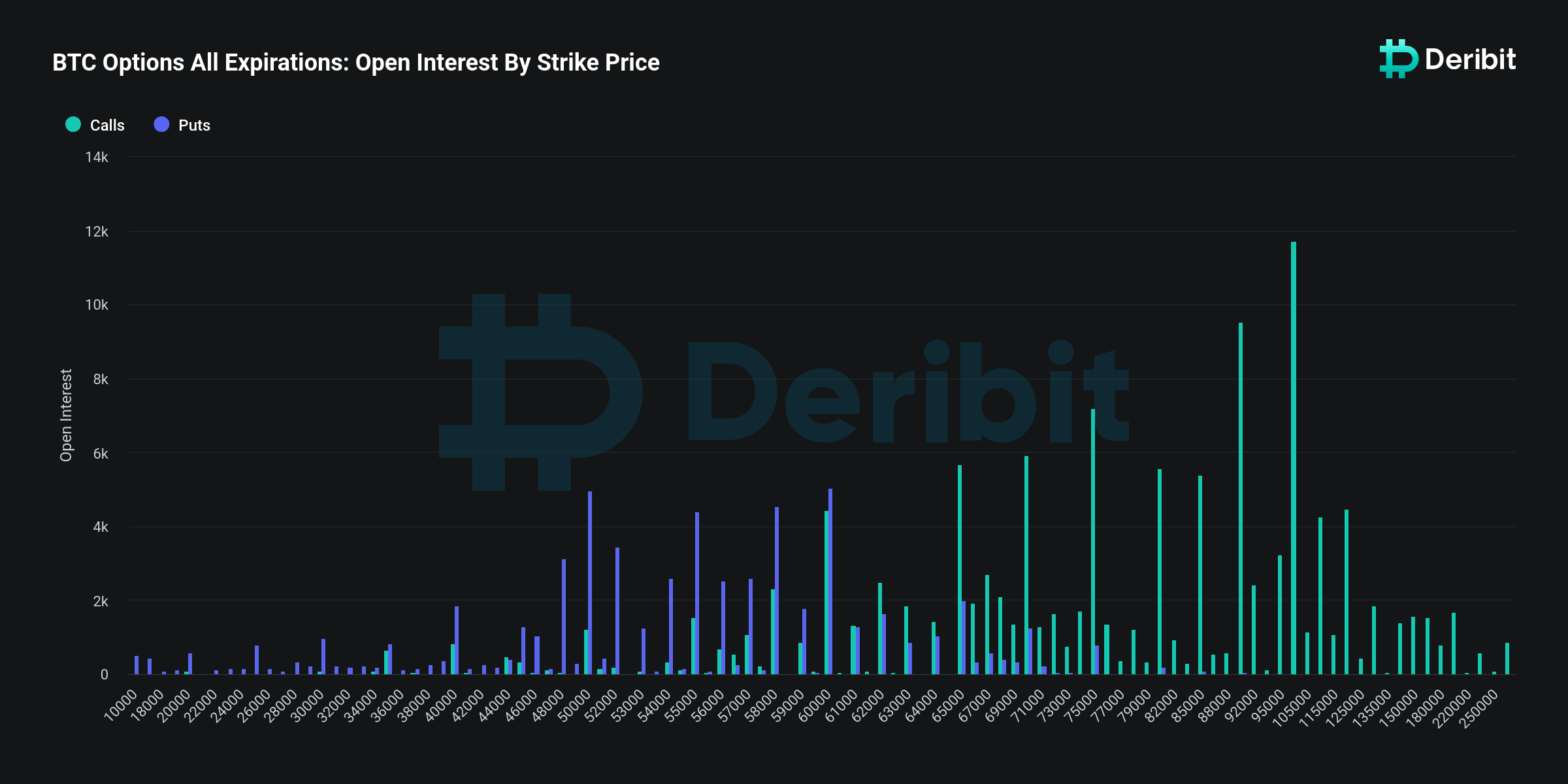

As a researcher examining Open Interest data on Deribit, I observed that a substantial portion of it was concentrated at higher strike prices. Specifically, there were approximately $532 million and $665 million in open positions at the $90,000 and $100,000 strike prices, respectively.

An extra factor contributing to the market’s downward trend is the ongoing whale sales, which amplify the effect on price levels.

More Bitcoin options could expire

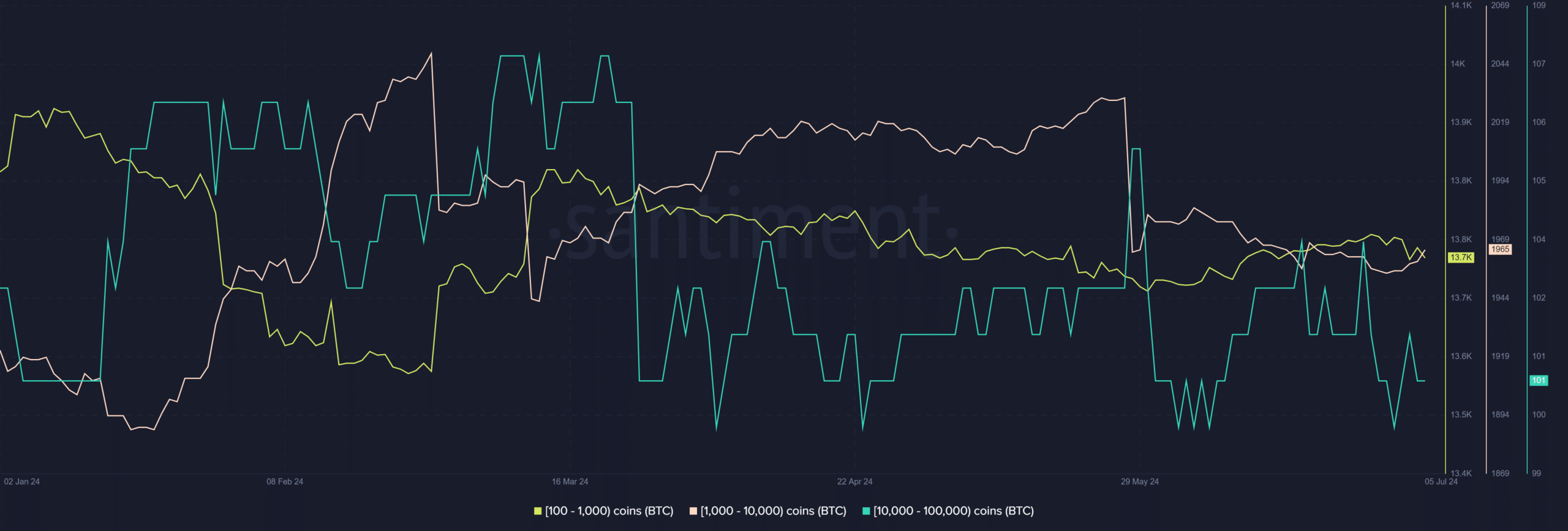

Based on an analysis by AMBCrypto, it appears that bitcoin’s larger investors, referred to as “whales,” have been disposing of their bitcoins in recent times.

Wallets containing between 100 and 1,000 Bitcoins and those with 10,000 to 100,000 Bitcoins have seen significant decreases in value over the past few days.

In simple terms, these whale wallets have collectively sold off large quantities of Bitcoin, amounting to millions of dollars.

Approximately 13,700 wallets hold between 100-1,000 Bitcoins, whereas roughly 101 wallets contain between 10,000 to 100,000 Bitcoins.

A notable decrease in Bitcoin holdings by significant investors indicated a wider change in attitudes towards the cryptocurrency.

Bitcoin falls into the oversold zone

Based on an analysis by AMBCrypto using the Relative Strength Index (RSI) indicator on Bitcoin’s daily price chart, it was identified that Bitcoin was experiencing overselling, with the RSI reading falling beneath the 30 threshold at that moment.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Additionally, the Bitcoin price hovered near the $53,300 mark, falling beneath its long-term moving average (represented by the blue line). This previously supportive line, now acting as a barrier, is a result of recent downward price fluctuations.

The present market attitude toward bears is influencing this transition, significantly impacting the Bitcoin options expiration process today. This influence is shaping trading tactics and altering investors’ market forecasts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-06 00:08