- The high Bitcoin spot ETF netflows showcased the bullish belief.

- The weekly price action of BTC remained firmly bullish.

As a seasoned researcher who has witnessed the evolution of Bitcoin since its inception, I must say that the current bullish sentiment surrounding BTC is truly reminiscent of the early days of the internet – a transformative technology that was initially met with skepticism but eventually became an integral part of our daily lives. The high net flows and bullish price action of BTC, coupled with the recent approval of Bitcoin spot ETFs in the U.S., indicate a growing confidence in this digital asset.

Bitcoin [BTC] saw its spot ETF approved in the U.S. on the 10th of January 2024.

In a significant step for Bitcoin’s history, the United States Securities and Exchanges Commission has given its approval for the start of trading on the first eleven Bitcoin spot Exchange-Traded Funds (ETFs).

Over the last 15 years, the concept of cryptocurrency, initially designed as a decentralized, secure, and direct exchange system without intermediaries, has undergone significant transformation.

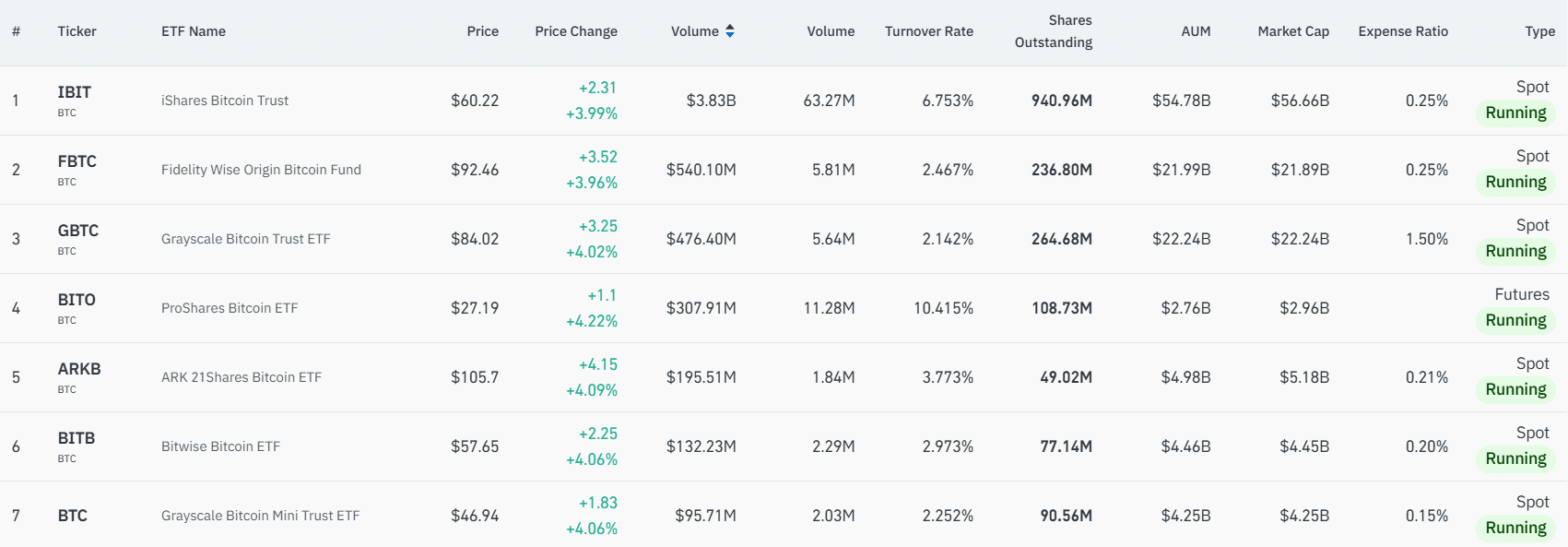

The largest BTC spot ETF, IBIT, has a market cap of $56.66 billion (price x shares outstanding).

Over the last fortnight, the ETF inflow data indicated a steady increase in investments towards BlackRock’s iShares Bitcoin Trust, suggesting a very optimistic investor mood.

Bitcoin ETF investors are a large profit

Given that IBIT is the largest exchange-traded fund focused on real estate, we can examine its price chart for analysis. As you’ve seen, it started trading on the 11th of January, peaking at $30 on that very first day.

To determine the current profit earned by the investor who purchased $1000 worth of shares, we need to find out the difference between the initial investment and the current value of those shares. If the shares have appreciated since the purchase, the profit will be the increase in value; if they’ve decreased, it would represent a loss.

If we disregard trading costs, taxes, and service charges, shares purchased at the closing price on the 11th of January would have increased in value by approximately 100.7% and would now be valued at around $2,007.

Looking back, if I had made a purchase when Ripple (XRP) was trading at $22.02 on the 23rd of January, I’d be sitting on an impressive gain of approximately 173.46% before factoring in any costs. That initial investment of $1,000 would now have ballooned to a substantial $2,734.6!

Weekly chart hints at $152k

It appears from the Fibonacci analysis that further increases in price are probable. On the weekly graph, the overall market trend indicates a strong bullish stance. Over roughly a month, we’ve observed a period of consolidation around the $100k level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Over the last seven days, Bitcoin (BTC) has been on an upward trend and seems to have turned the $103,800 level into a support. If the weekly closing price surpasses this point, it would be a clear indication of a very optimistic outlook for BTC.

As a researcher, I’ve identified potential future bullish price points for Bitcoin that could excite investors. These targets are anticipated at approximately $122,400, $133,900, and $152,500. For those invested in Bitcoin, whether through ETFs or the coin itself, the coming months may bring even more reason to celebrate.

Read More

2024-12-17 16:07