As a seasoned crypto investor with battle-tested nerves and an eye for market trends, I’ve seen my fair share of bull runs and bear markets. But this latest surge of Bitcoin to $106,000 ATH is something truly extraordinary. The combination of institutional demand and tightening supply has created a perfect storm that’s driving the price skyward.

The price of Bitcoin hit a record peak of $106,000, fueled by an extraordinary increase in institutional interest and scarcity in the over-the-counter (OTC) market.

Over the past month, on-chain analysis shows a substantial decrease in Bitcoin held by OTC desks, while the need for Bitcoin seems to be growing faster than its availability. This imbalance has led to a tightening of supply, which has in turn propelled Bitcoin’s rapid price surge.

Bitcoin institutional accumulation grows

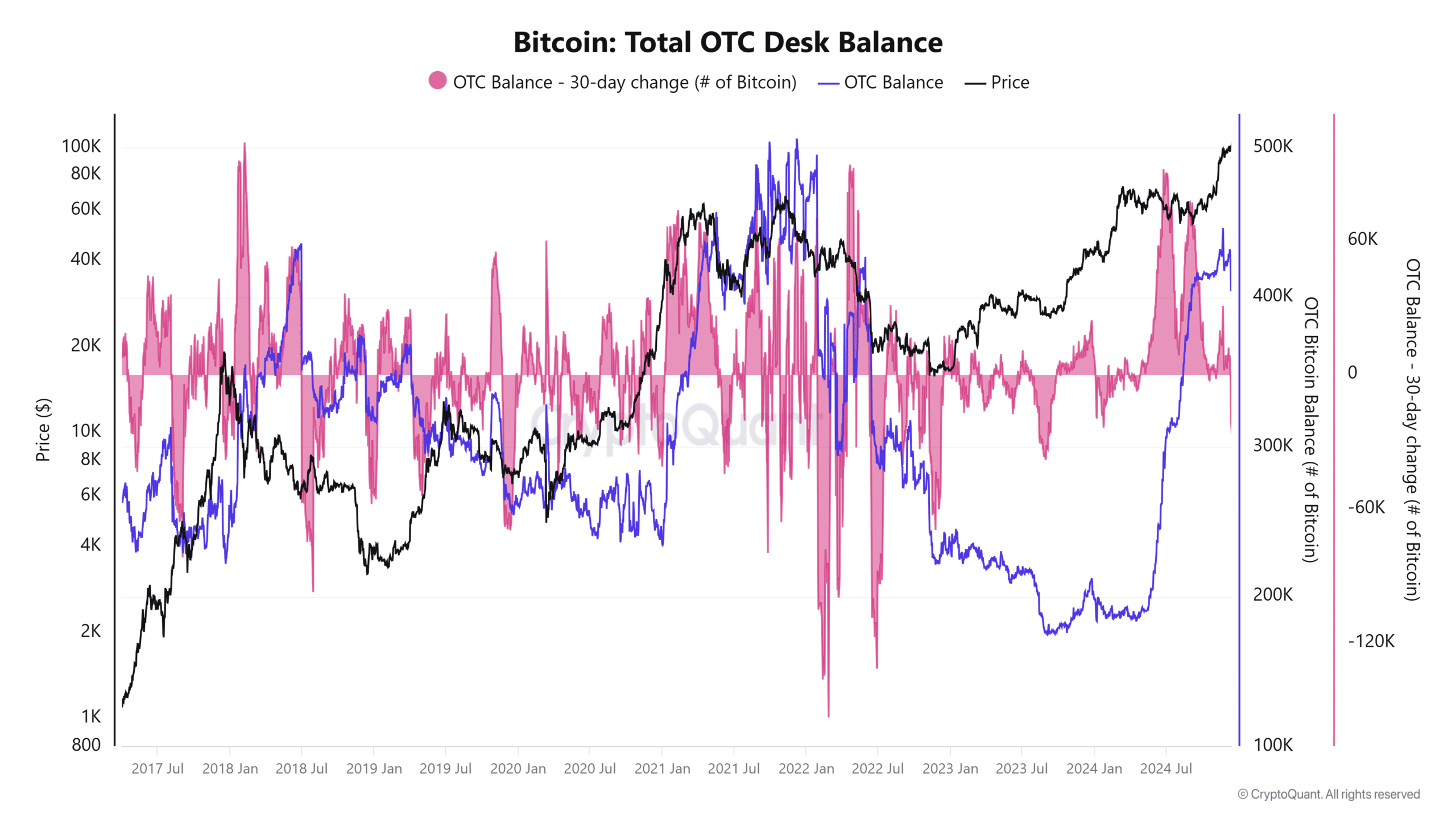

Examining the Bitcoin Over-The-Counter (OTC) Balance graph, as reported by CryptoQuant, shows a significant decrease in OTC balances, representing the most substantial drop experienced this year. In just the last month, over 25,000 BTC has been withdrawn from these desks, with a total of 40,000 BTC leaving them since November 20th.

Large institutional investors and wealthy individuals often buy significant quantities of Bitcoin through Over-the-Counter (OTC) trading desks, which helps them avoid affecting the regular market prices. When large amounts of Bitcoin are bought in this way, it indicates that institutions are actively amassing Bitcoin, thereby reducing the amount available for other market participants to purchase.

As a crypto investor, I’ve noticed an intriguing correlation between the diminishing Over-the-Counter (OTC) reserves and Bitcoin’s surge to unprecedented heights. This alignment suggests that institutional interest is driving Bitcoin’s upward trajectory, simultaneously creating a scarcity in the market due to increased demand, yet failing to replenish the supply as quickly.

Demand outpaces supply, fueling price momentum

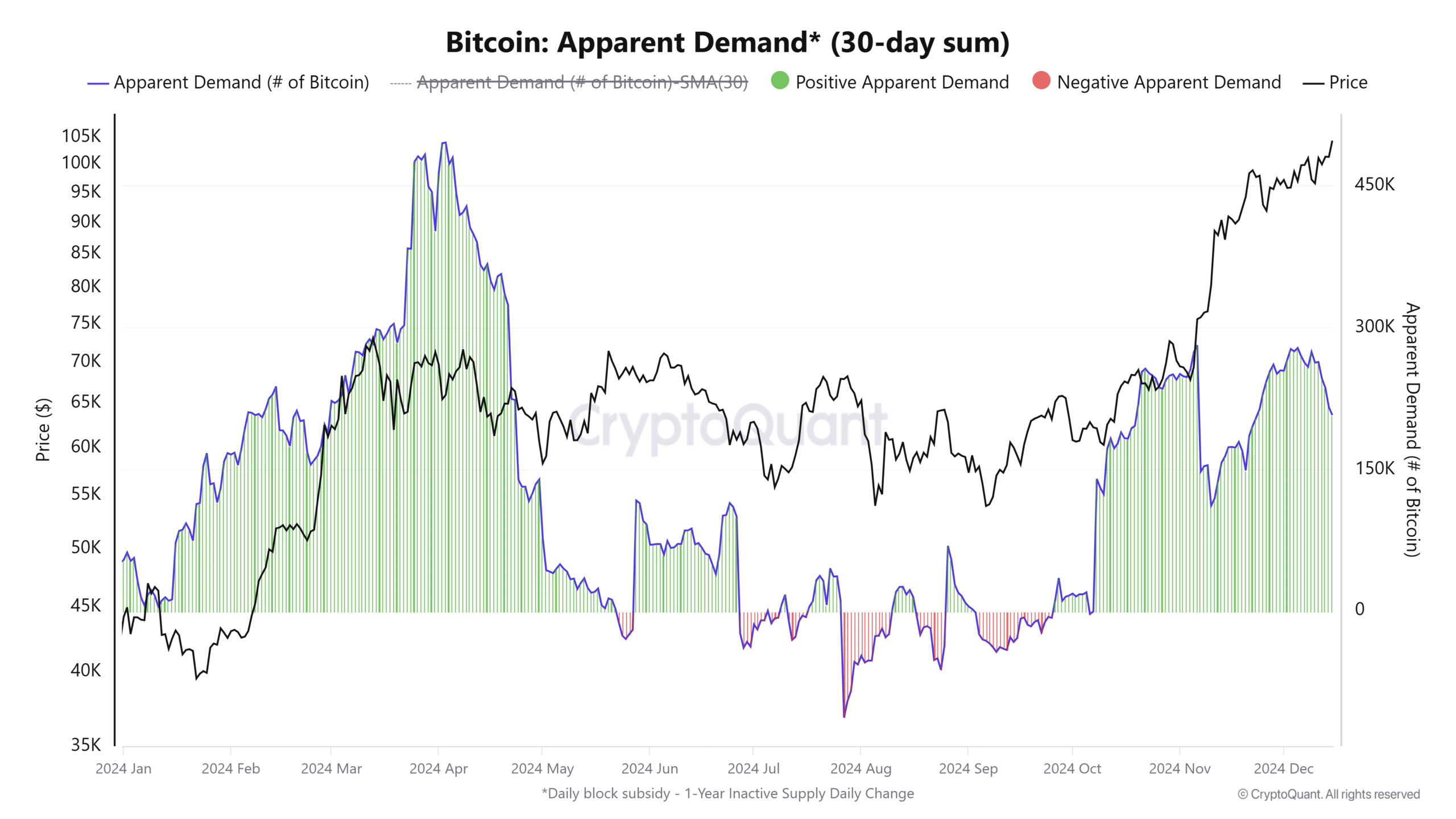

Examining the Bitcoin Demand Graph supports the storyline that demand is on the rise. This graph monitors the total amount of Bitcoin being absorbed into the market, and it’s clear that this figure has significantly increased since November, indicating a steady upward trend as the market surge continued.

As an analyst, I’ve observed a trend where the demand for Bitcoin (BTC) appears robust and favorable. This is primarily due to the fact that BTC inflows have been consistently higher than outflows, indicating a market climate that favors accumulation over disposal.

With rising demand, Bitcoin breached significant barriers, hitting its present peak at around $106,000.

As a crypto investor, I’ve noticed an intriguing dynamic unfolding. The decrease in Over-the-Counter (OTC) balances, coinciding with a surge in demand, has led to a significant supply constraint. This unique combination has crafted an optimal atmosphere for Bitcoin’s unprecedented success, breaking multiple performance records.

Bitcoin price action confirms strong bullish sentiment

Based on the chart analysis, it’s evident that Bitcoin is exhibiting a strong bullish trend. This trend is marked by consecutive peaks and troughs rising in value, which suggests a robust market condition. Furthermore, Bitcoin continues to stay above its 50-day and 200-day moving averages, hinting at continuous backing for the upward surge.

Moreover, it’s observed that trading activity spikes during significant uptrends, suggesting that the price surges are backed by robust investment from both large-scale institutions and individual traders.

right now, the Relative Strength Index (RSI) is around 70, indicating a powerful surge in momentum. Yet, it’s also hinting at the potential for brief stabilization or sideways movement as the market processes its latest increases.

Institutional demand and supply squeeze drive BTC higher

The significant rise of Bitcoin to $106,000 is primarily driven by a growing interest among institutions and a decrease in the circulating supply. Large investor purchases have emptied Over-the-Counter (OTC) desk balances, showing their aggressive buying behavior, while the demand remains higher than the available stock.

These elements have contributed to a tightening of the Bitcoin supply, causing it to reach unprecedented peak prices.

– Read Bitcoin (BTC) Price Prediction 2024-25

In the short term, some consolidation might take place, but over the long haul, the general sentiment remains strongly positive towards Bitcoin, with institutional trust and the appetite for it continuing unabated.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-18 06:16