- Bitcoin millionaires surged by 111% in 2024, driven by new ETFs and Bitcoin highs

- Top crypto hubs like Singapore and Hong Kong benefited from favorable tax policies

As a seasoned researcher who has witnessed the rapid evolution of the financial landscape over the past decade, I must admit that the surge of Bitcoin millionaires and crypto wealth in 2024 is nothing short of astonishing. The meteoric rise of Bitcoin to over $73,000 in March, followed by the approval of spot ETFs in the U.S., has undeniably reshaped the financial world as we know it.

Although Bitcoin’s fall below $60k on August 28 contributed to a downturn in the cryptocurrency market this year, it’s important to remember that Bitcoin had an outstanding run for much of 2024. This provides a glimmer of hope amidst the current market fluctuations.

Crypto wealth report analyzed

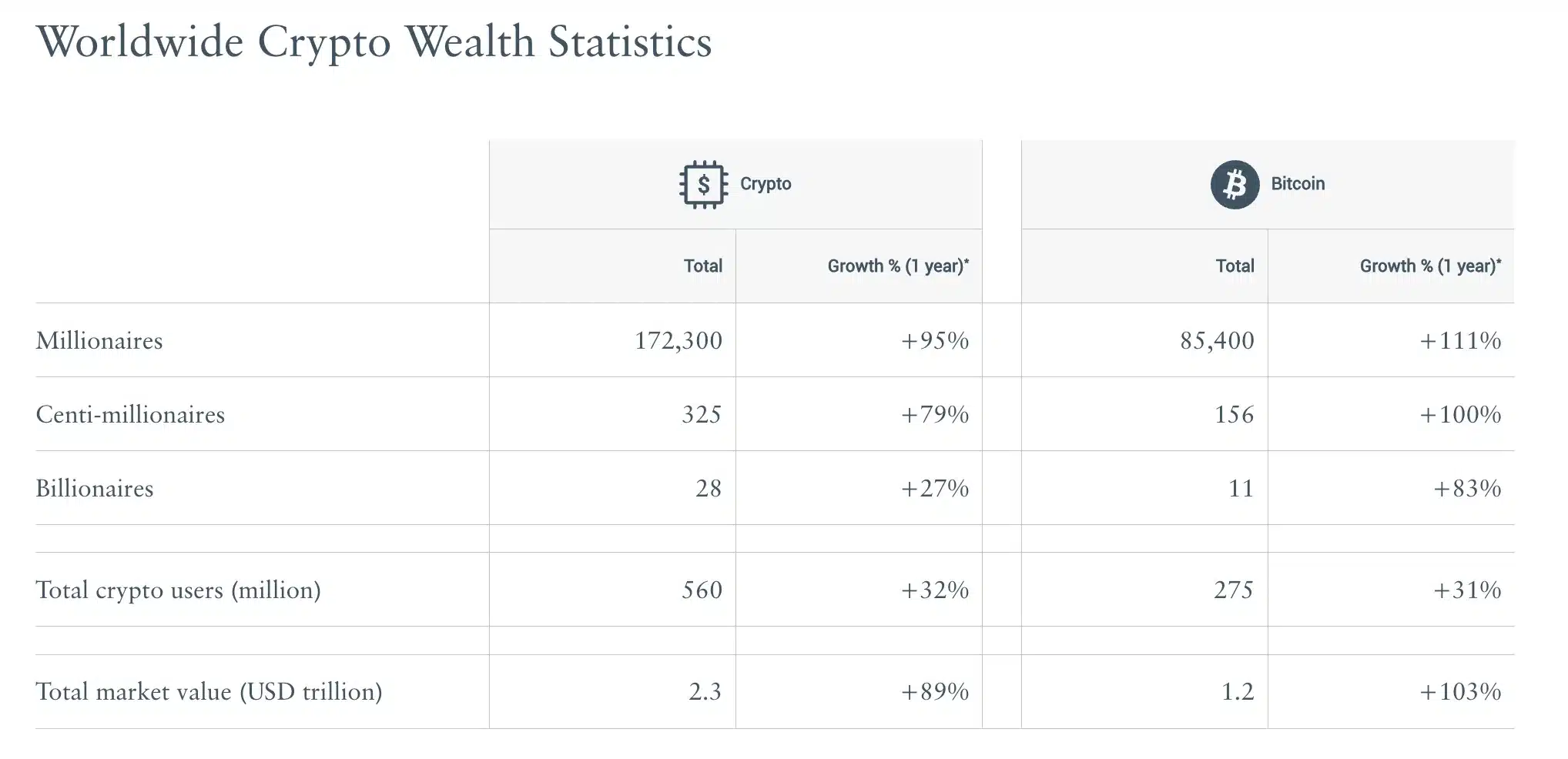

Based on “The Crypto Wealth Report 2024” published by New World Wealth and Henley & Partners, there has been a significant increase of 111% in the number of Bitcoin millionaires over the past year. This figure now stands at approximately 85,400 individuals.

Simultaneously, the count of crypto millionaires has experienced a notable surge, reaching 172,300, which is an increase from 88,200 just a year ago.

The increase in cryptocurrency millionaires during 2024 could be linked to the debut of recently approved U.S. spot Bitcoin ETFs, causing Bitcoin prices to soar to unprecedented levels that year.

Following its peak above $73,000 in March, Bitcoin subsequently stabilized near $64,000 – Representing a substantial 45% rise, albeit with some temporary decline. Regrettably, Bitcoin’s value continued to drop on subsequent price charts.

For the past year, Bitcoin’s worth has significantly increased by approximately 138%. The introduction of these Bitcoin ETFs has notably contributed to this trend, accumulating more than $50 billion in assets since January. This impressive growth follows a prolonged process seeking approval from the Securities and Exchange Commission.

Execs weigh in…

Remarking on the same, Dominic Volek, Group Head of Private Clients at Henley & Partners said,

2024 saw a dramatically different crypto market compared to its earlier versions. Bitcoin soared past $73,000 in March, hitting an unprecedented peak, while the United States finally approved spot Bitcoin and Ethereum ETFs, triggering a massive influx of institutional investments. Now, there’s growing excitement about potential Solana ETFs joining the financial party on Wall Street.

He added,

As an analyst, I am witnessing a groundbreaking shift in the realm of cryptocurrencies. This transition heralds a fresh epoch, characterized by a progressive blending of digital assets with conventional finance systems and worldwide mobility, much like how pollen from one flower spreads to another, fostering growth and diversity.

António Henriques, CEO of Bison Bank and Chairman of Bison Digital Assets, also pointed out,

“As the world of finance continues to advance at a fast pace, cryptocurrencies are posing a significant challenge to the established authority of conventional fiat currencies. With these two financial spheres converging, we find ourselves standing on the brink of a new epoch in global finance. This is an era where the cutting-edge possibilities of digital assets collide with the reliability of traditional money.”

In simpler terms, even though there may be brief ups and downs, a lot of people remain optimistic about the future value of Bitcoin and various other cryptocurrencies.

As Michael Saylor, former CEO of MicroStrategy, aptly put it,

“#Bitcoin is Rules Without Rulers.”

Nation-states step up their crypto game

Ultimately, the findings showed Singapore leading the worldwide cryptocurrency center ranking with a score of 45.7 from a possible 60, trailed closely by Hong Kong and the United Arab Emirates.

These three entities thrive significantly thanks to their advantageous tax structures, particularly the absence of capital gains tax. This perk is especially beneficial for cryptocurrency investors and wealthy individuals.

That’s not all though. Just recently, El Salvador’s Bitcoin reserves grew to 5,851 BTC, worth about $356.4 million.

Starting from September 1st, 2024, Russia has unveiled plans to initiate trials for cryptocurrency exchanges and cross-border transactions.

This demonstrates a resilient faith in Bitcoin’s future prospects, even when faced with temporary ups and downs in the market.

Read More

2024-08-29 07:04