-

WIF was knocked off the $3-zone after prices collapsed in the last 24 hours

Price can now fall as low as $2.53 on the charts

As an experienced analyst, I’ve closely monitored the volatile price action of WIF over the past few days. The sudden decline below the $3-zone after attempting to retest $3.40 is concerning, and based on current chart patterns, the price could potentially fall as low as $2.53.

After the brutal collapse of dogewhat (WIF), its price could potentially decrease more in the market based on AMBCrypto’s assessment. Currently, WIF is priced at $2.57.

At the given moment, the value of the altcoin’s WIF (Weak Hands Indicator) decreased by 15.56% within a 24-hour span. Prior to this significant drop, the memecoin had made an attempt to regain its footing and reach $3.40 again. However, when it dipped below $3.30, the bulls seemed unable to prevent the steep decline, suggesting their power to uphold the price rise was insufficient.

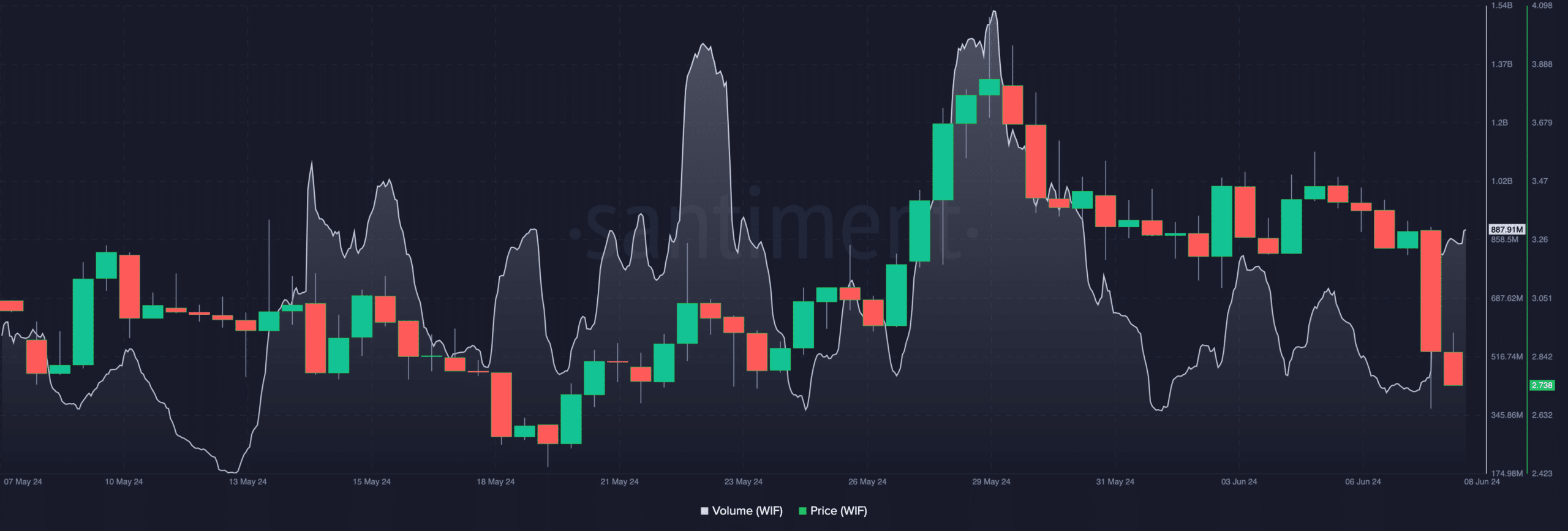

Noting WIF‘s data, it’s significant that trading volume spiked during the price decline. Indeed, Santiment reports a remarkable 112% increase in volume over the past week.

Sellers are giving WIF a hard time

As a crypto investor, I’ve noticed that when the trading volume of a token increases, it usually means there’s growing interest in that particular asset. More buyers and sellers are entering the market, leading to a surge in transactions. However, for WIF, the heightened trading volume coinciding with a price decline was a red flag for me. It suggested that selling pressure was significant and intense, potentially outweighing buying demand.

If the volume keeps rising but WIF faces difficulties, the price may decrease towards the next support level of 2.53. Should this support be successfully defended by buyers, a price rebound could ensue.

If the token is unable to hold its ground against bearish forces, its price may drop as low as $2.34. Contrary to the uptrend it exhibited in late May, the token’s recent trajectory has been downward.

As a crypto investor, I’ve seen an exciting rise in the token’s price, which reached a high of $4. Many optimistic voices speculated that we might even surpass the coin’s All-Time High (ATH) of $4.85. However, despite this promising start, the cryptocurrency hasn’t been able to maintain these heights. At present, I’m looking at a 43.36% decrease from its ATH on the charts.

Technical setup is within a close range

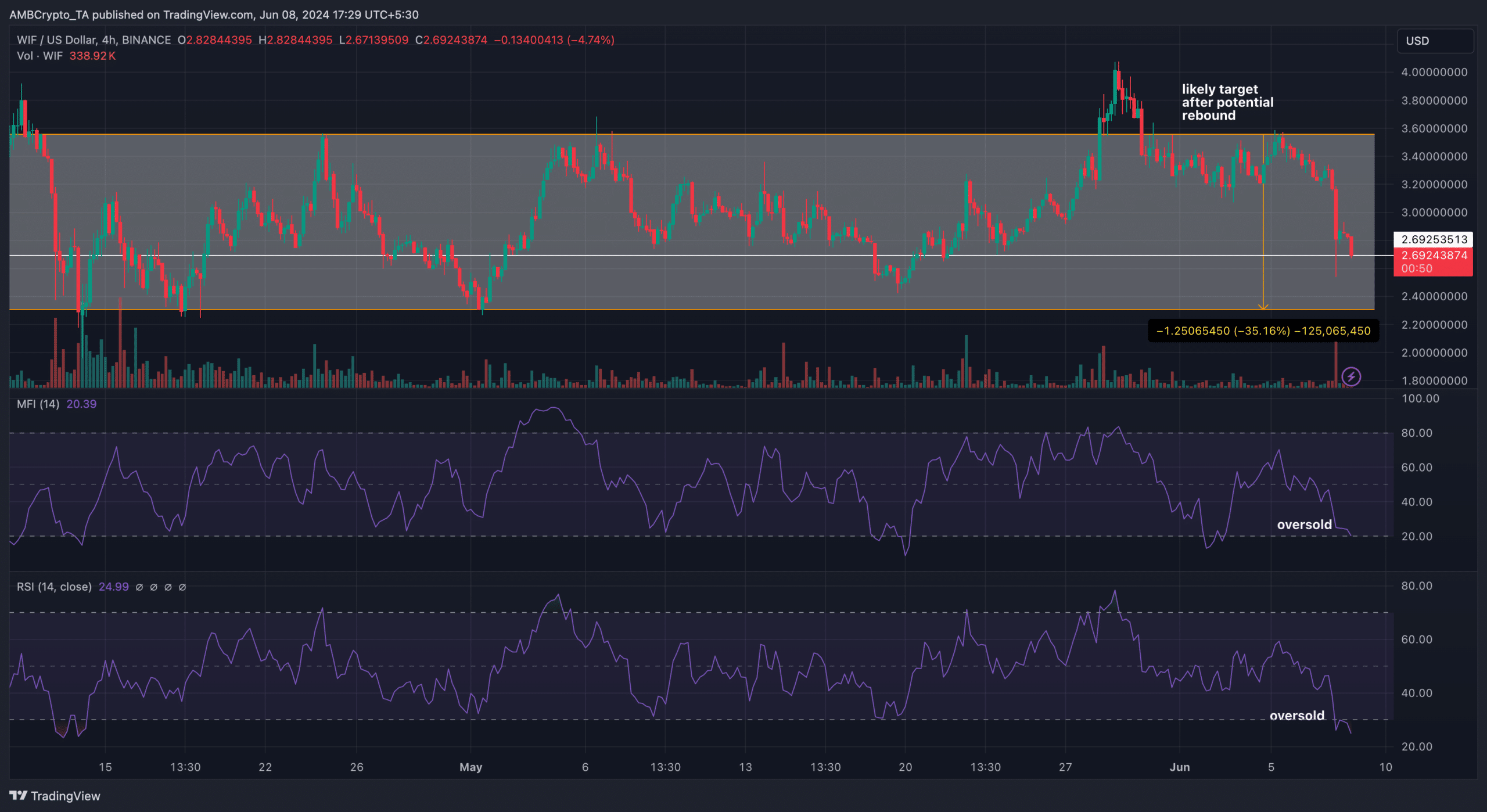

Based on a technical examination by AMBCrypto, the RSI of WIF against the US dollar, as shown in the 4-hour chart, stood at 24.99.

As a market analyst, I would explain that the Relative Strength Index (RSI) is a popular momentum indicator that measures the magnitude and velocity of price movements in a financial instrument. When the RSI falls below 30, it signals that the asset has been oversold, potentially indicating a buying opportunity for some traders. Conversely, an RSI reading above 70 suggests that the asset has been overbought, which may signal a potential selling opportunity based on the market trends and individual investment strategies.

Based on WIF‘s condition, it appeared that the token had been oversold. Consequently, there was a possibility of an price rebound. Nevertheless, further analysis suggested that this could occur without the token dipping down to $2.45 once again.

The Money Flow Index (MFI), in addition to the Relative Strength Index (RSI), signaled that WIF was oversold based on its reading of 20.40. Normally, a MFI value above 80 indicates an overbought condition, while a reading of 20 suggests an oversold situation.

The price drop might present a favorable chance to acquire the memecoin at reduced costs. Considering the current trend, purchasing WIF between $2.30 and $2.69 could potentially yield positive results.

With heightened purchasing demand, there’s a possibility that the price will bounce back on the graphs, potentially reaching a level of $3.55. Caution is advised for traders in this scenario.

Realistic or not, here’s WIF’s market cap in PEPE terms

When selling demand outpaces normal levels for WIF, its price may drop below the intended mark. Furthermore, should this occur, recovering from those lows could prove challenging, potentially leading to a surge past $4 within a few weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-09 01:16