- USDT supply jumped by 0.37%, aligning with Bitcoin’s 2% decline from the previous day.

- If confidence in a recovery fades, massive capitulation might follow.

As a seasoned crypto investor with battle-scarred fingers from past market fluctuations, I find myself both intrigued and cautious about recent developments. The increase in USDT supply seems to be a mixed bag; while it could potentially support future Bitcoin price increases, the surge in liquidity might also signal a flight to safety as investors hedge against potential losses.

In the current market compression, the value of stablecoins has soared significantly. Specifically, from September 9th onwards, both USDT and USDC market capitalization have grown by a combined total of $1.153 billion—with USDT rising by $410 million and USDC climbing by an additional $743 million.

This coincided with Bitcoin’s [BTC] rise to $60.5K, a 12.04% gain in a week.

Therefore, the increase in investment played a significant role in Bitcoin’s rise. Given that the market is currently experiencing a downturn and moving towards a bearish correction, are investors hopeful for a rebound in prices?

Increase in USDT supply

While Bitcoin saw a 2% decline on the 16th of September from the previous day, USDT circulating supply jumped from $54.14B to $54.34B.

As an analyst, I’m observing that this surge in liquidity could potentially boost Bitcoin prices over the next few days, given a reduced need for USDT as a safeguard. In simpler terms, if investors start relying less on USDT as a secure asset, more money might flow into Bitcoin, causing its price to increase.

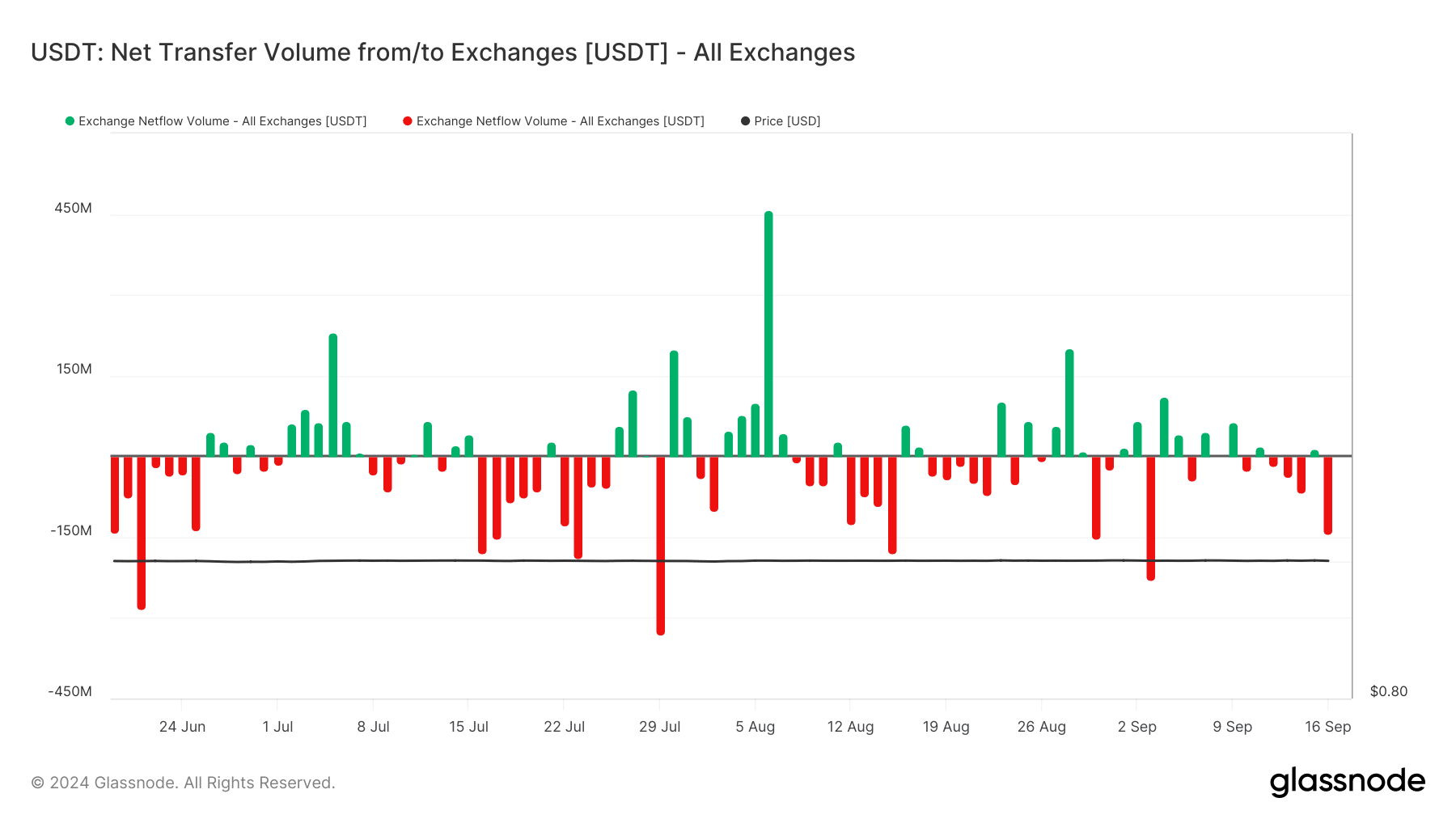

Surprisingly, the chart below presents a sharp contrast to this expectation.

Source : Glassnode

Due to the recent earthquakes, there has been widespread panic among involved parties, as indicated by successive outflows of funds. It seems that investors might be moving their assets into USDT for security purposes, while Bitcoin’s value decreased. This suggests a liquidity change rather than a direct link between the two events.

In simpler terms, it appears that the rise in USDT (Tether) availability didn’t directly coincide with a surge in Bitcoin demand. Other potential influences could be responsible.

16th September marked the occasion when Tether’s treasury produced a total of 1 billion USDT tokens. This action led to an increase of approximately 0.37% in its overall supply.

While this could suggest confidence in price recovery, it may also reflect liquidity demand or market hedging, not direct optimism.

Therefore, other dynamics must be considered to gauge true confidence.

Stablecoin outflows could spark capitulation

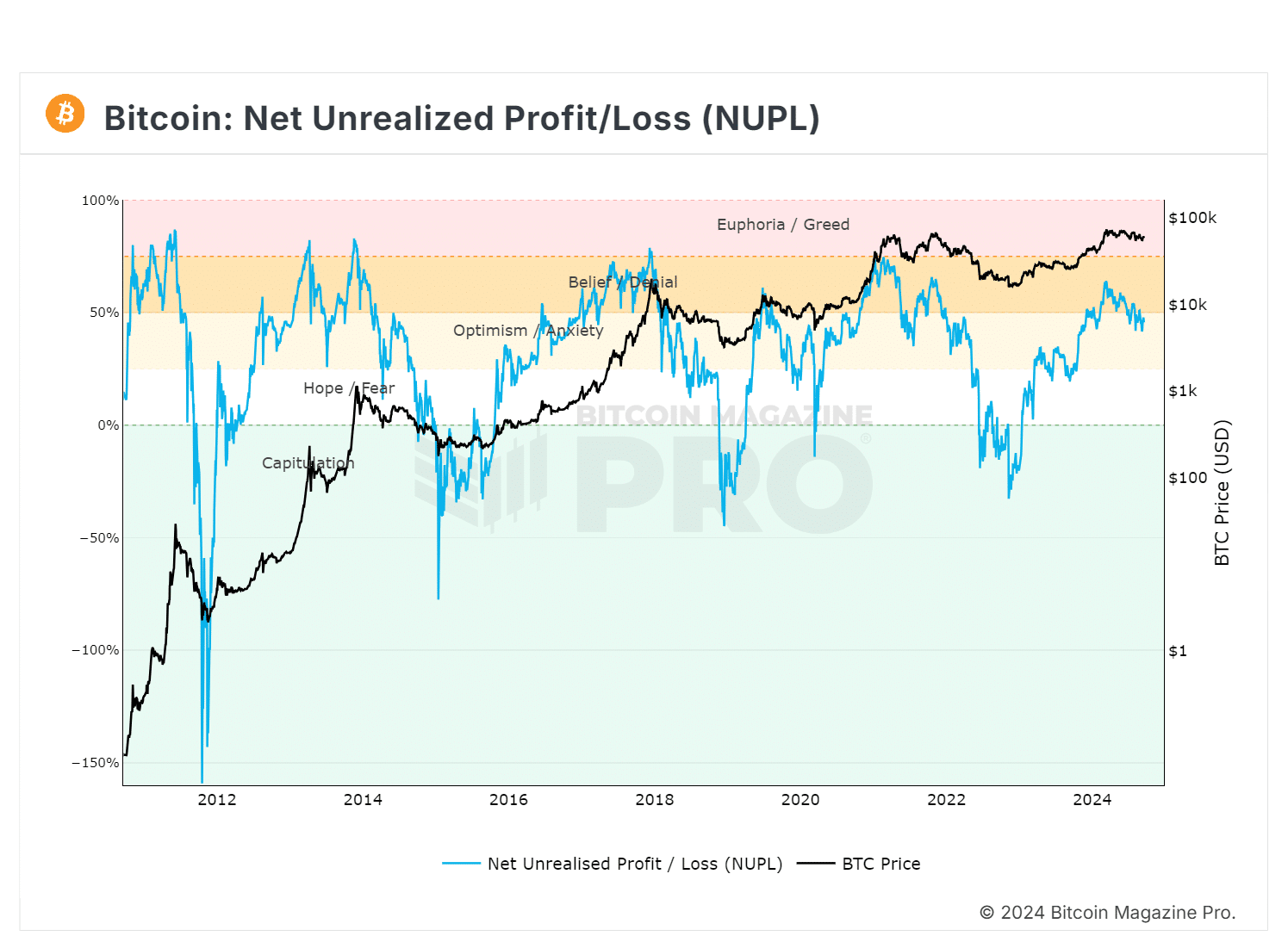

The graph indicates that the majority of Bitcoin owners are currently making a profit, suggesting a positive trend (bullish). However, this could also indicate that the market peak might be approaching since excessive profits could trigger profit-taking, potentially leading to market corrections.

Source : Bitcoin Magazine Pro

Instead, a growing amount of USDT being withdrawn might lead to the NUPL becoming negative, suggesting potential unrealized losses and possible attempts to sell in order to recover these losses.

After the Federal Open Market Committee (FOMC) meeting, the specific details should become more apparent. If the bulls take a firm stance, it’s possible that those who have already made profits will choose to keep them.

Approaching the $55K level might lead to an increase in USDT withdrawals, suggesting a possible wave of sell-offs or panic among investors.

Read Bitcoin (BTC) Price Prediction 2024-25

On the 3rd of September, there was a significant movement of $230 million worth of USDT that left exchanges. This occurred as Bitcoin experienced a nearly 3% drop in value, following a 4% increase the day prior.

In my analysis, it appears that investors might be moving their funds towards safer assets, leading to a significant drop in Bitcoin’s price. Within a span of merely three days, Bitcoin dipped below $54K. If this pattern persists, there’s a possibility that Bitcoin could revert to the same support level once more.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-17 18:16