-

Analysts forecast a potential downturn for Solana, as the SOL/BTC pair continues to lag behind ETH/BTC

If this anticipated drop materializes, it could echo across other SOL pairings

As a researcher who has closely observed and analyzed the cryptocurrency market for several years now, I find myself cautiously optimistic about Solana’s future. The recent downturn forecasted by analysts, with the SOL/BTC pair lagging behind ETH/BTC, is indeed concerning. However, I have learned in this volatile market that trends can change swiftly and unexpectedly.

Over the past day, the SOL/USD pair has encountered difficulties much like other crypto pairs due to the wider market’s volatility, resulting in a 4.52% decrease. Currently, it is being traded at approximately $147.09, despite reaching a high of $162 when the week commenced.

Moreover, we observed a drop in the value of SOL/BTC from its weekly high of $0.0025359 to $0.0024544. This downward trend hints at potential weakness across multiple SOL trading pairs, which may face further losses if analyst predictions hold true.

Bearish outlook for SOL?

crypto expert Benjamin Cowen has pointed out on Twitter that the SOL/BTC ratio seems to be following the pattern of the ETH/BTC ratio, which could potentially indicate some significant repercussions from this similarity.

As a crypto investor, I found Cowen’s analysis intriguing as it drew parallels between the past performance of ETH/BTC and a potential future trend. Back in 2017, after reaching its peak, ETH/BTC experienced a steep drop of approximately 90%. Interestingly, following this downturn, it skyrocketed by an astounding 500%. Currently, we find ourselves in another downward phase for the pair.

In the same manner, Solana (SOL) versus Bitcoin (BTC) exhibited a similar trend, experiencing a 90% decrease after reaching an unprecedented peak in 2021, and then soaring by approximately 500%. If this historical pattern continues, it is possible that SOL/BTC could encounter a significant decline. Interestingly, Ethereum (ETH) versus Bitcoin (BTC) is currently trading within this potential downtrend by the end of the year.

However, despite this gloomy outlook, Cowen is optimistic about the pair’s long-term recovery after this corrective phase.

According to him,

“[SOL will] bounce into 2025, before dropping again in 2026.”

It has been verified by AMBCrypto that this correction will impact not just the SOL/BTC pair, but also popular pairs such as SOL/USDT and SOL/USD. Given their widespread trading, these pairs may be subject to comparable drops.

SOL/BTC correction will affect other SOL pairs

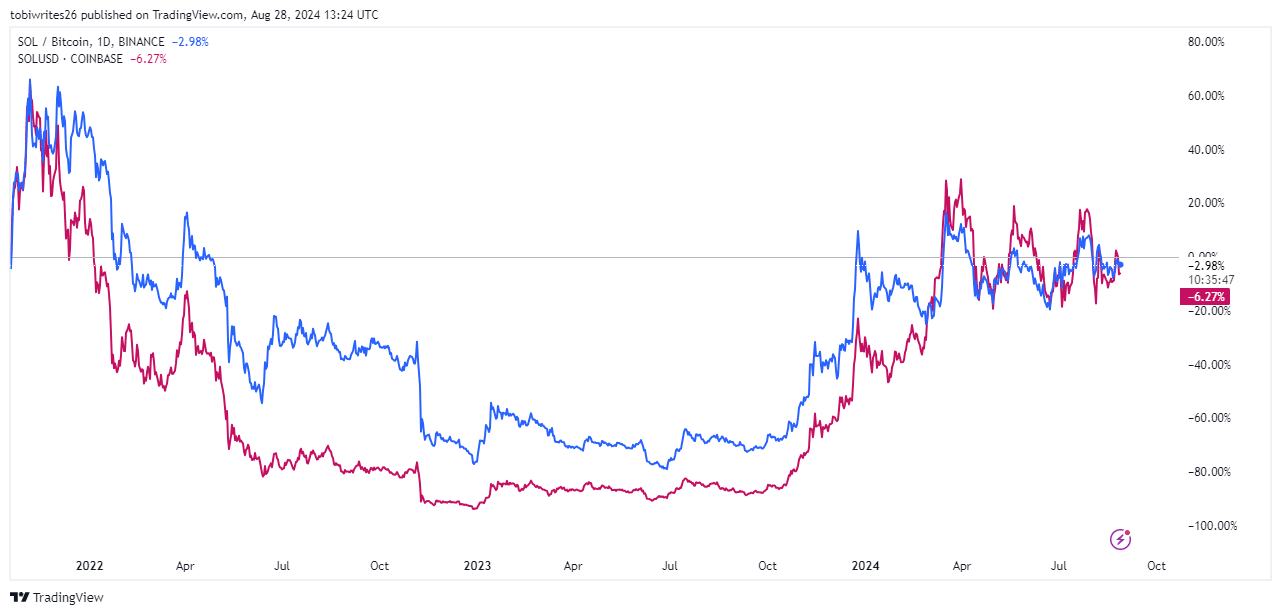

Looking at the graphs for SOL/BTC (in blue) and SOL/USD (in purple), it’s clear that their paths have been quite similar, with both assets reaching comparable peaks and valleys. However, there are occasional differences in their trajectories.

The chart below illustrates this alignment in their price movements, showcasing a very similar overall trend. Entering a corrective phase, SOL/BTC could erase gains for both long-term traders and investors.

If SOL/BTC buckles the trend observed in ETH/BTC and ascends to greater heights, it’s likely we’ll witness similar increases in associated currency pairs too.

Ascending triangle could shift the SOL/BTC narrative

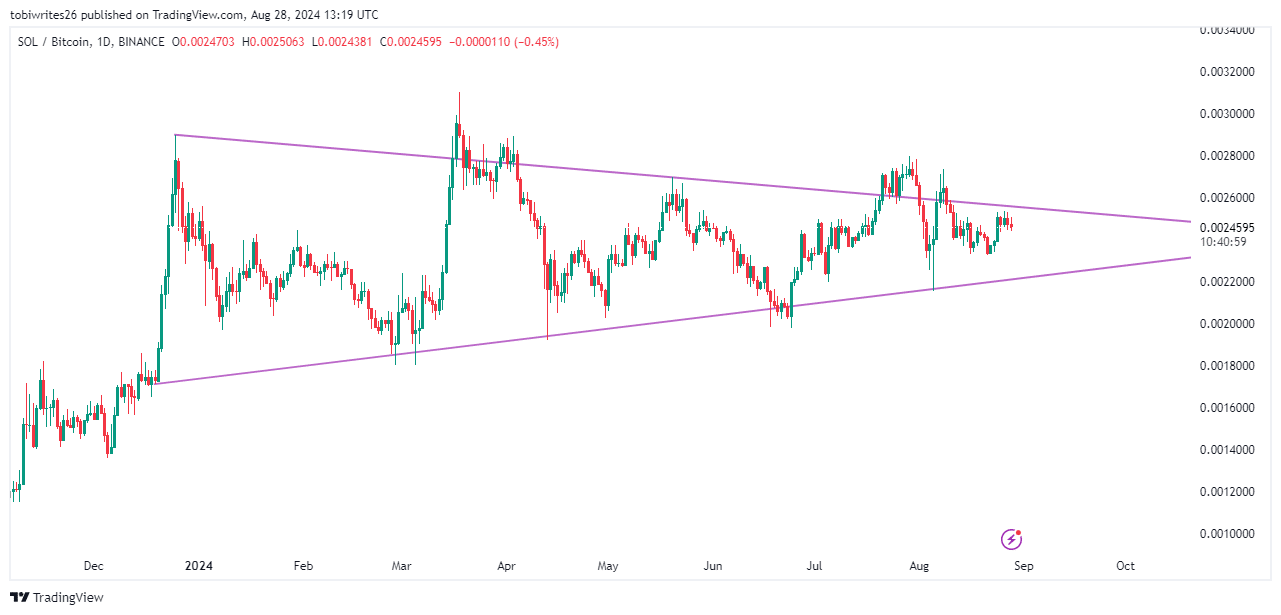

Currently, when I’m typing this, Solana (SOL) against Bitcoin (BTC) is found in an optimistic ascending triangle formation on the daily chart.

For a prolonged time, this structure generally asks for the price to stay inside it, after which there’s a possibility of it rising significantly.

It’s worth highlighting that this structure is crucial, as a comparable setup in 2021 preceded Solana/Bitcoin (SOL/BTC) reaching a fresh peak (ATH) at $0.0046700.

If this trend continues, it might indicate a shift from the historical correlation between SOL and BTC relative to ETH and BTC, which could catapult it to unprecedented levels. (First person: As an analyst observing this data, I find this potential shift intriguing.)

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-29 10:16