-

Massive movement of BTC into long-term storage.

Open interest and technical indicators are bullish on Bitcoin.

As a seasoned analyst with over two decades of market observation under my belt, I can confidently say that Bitcoin’s current trajectory is reminiscent of the 2017 bull run, albeit on a grander scale. The massive movement of BTC into long-term storage and the surge in open interest are indicative of a market primed for significant growth.

As an analyst, I’m observing a persistent rise in Bitcoin’s [BTC] value, with the price peaking at around $64,000 before a brief dip to $63,700. This momentary pullback should not be cause for alarm, as Bitcoin appears set to continue its upward momentum once this retracement phase ends, potentially leading to further gains.

One key reason behind Bitcoin’s rising price this year has been the removal of approximately 210,000 Bitcoins from exchanges.

It seems that Bitcoin holders are progressively transferring their coins to cold storage for a prolonged period, lessening the urge to sell immediately. This shift could lead to less supply available on exchanges, potentially causing prices to rise, possibly by Q4 of 2024.

History of Bitcoin’s falling wedge pattern

The historical trends of Bitcoin’s price lend credence to an optimistic perspective. Similar to how it has done since its debut in 2009, Bitcoin often forms a falling wedge pattern. This pattern is usually followed by a significant rise.

The development of this Bitcoin pattern, spanning from 2021 to 2023, has led to an intense surge in its price following a phase of stability or holding back.

At present, Bitcoin appears to be forming a descending broadening pattern, which is typically followed by a breakout. If this happens and Bitcoin surpasses the $70,000 mark, it could potentially climb towards $100,000 over the next few months, particularly if the Federal Reserve decides to lower interest rates in September.

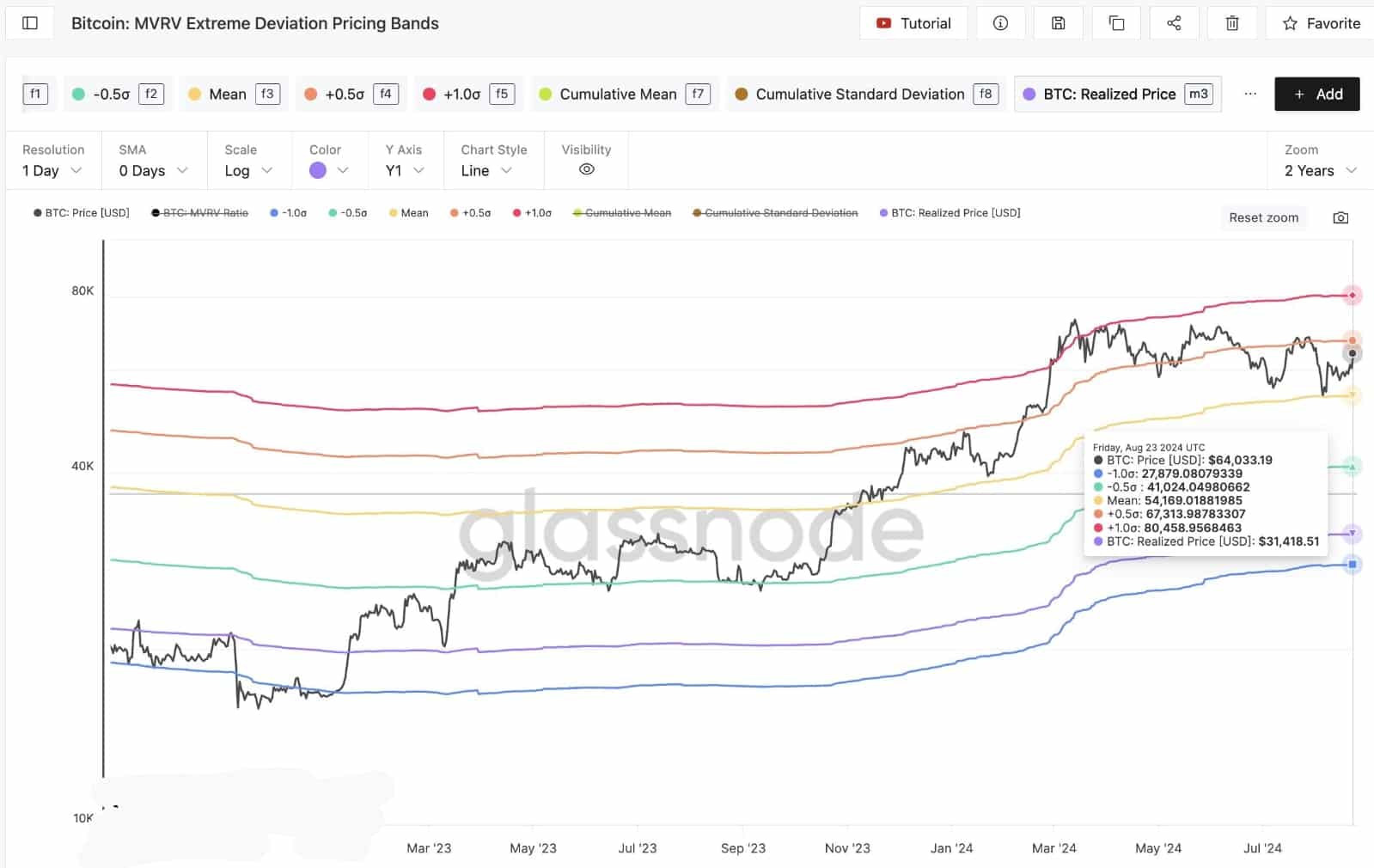

Bitcoin MVRV extreme deviation pricing bands

One important aspect impacting Bitcoin’s possible upward momentum is the MVRV (Market Value to Realized Value) pricing ranges. This metric helps determine the average profit or loss of all coins that have been moved on the market, providing insights into potential price movements.

A significant resistance level at $67,300 is crucial for Bitcoin to clear. Breaking past this level could pave the way for BTC to reach $80,500.

Due to recent fluctuations in Bitcoin’s price and the fact that approximately 210,000 Bitcoins are being stored for long terms, reducing market selling pressure, it appears more probable than ever that we might witness a breakthrough of the resistance level. This potential breakthrough could pave the way for even higher Bitcoin prices in the future.

Bitcoin classic slow movement closes the CME gap

Moreover, Bitcoin’s performance relative to the CME closing price during the weekend was crucial in preserving market equilibrium.

As a researcher observing the market dynamics, I’ve noticed that the seamless transition at the Close of the Cryptocurrency Market Event (CME) has maintained market stability, offering a robust base for the bullish surge that commenced last Friday. Should Bitcoin persist in this trajectory, it could potentially ignite fresh buying sprees, further fueling its price escalation.

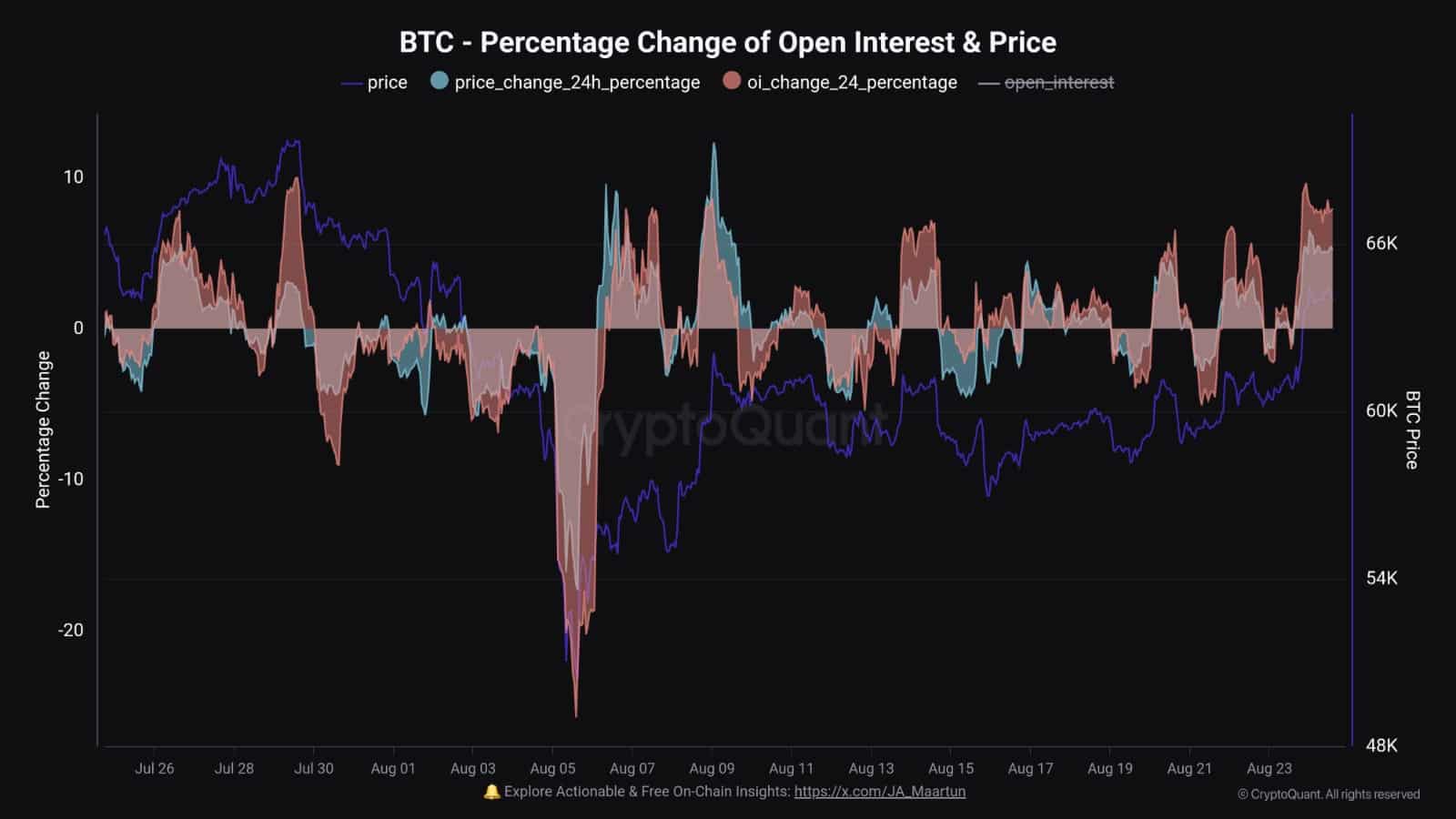

Bitcoin Open Interest rises

To wrap things up, it’s worth noting that the open interest in Bitcoin has significantly increased, even as its price has dipped recently. Interestingly, this trend has occurred on two previous occasions. Typically, such a pattern has been followed by swift price rebounds and new record highs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher observing the surge in open interest, I anticipate that the price of Bitcoin will persistently climb higher throughout the remainder of the year, fueled by this ongoing upward trend.

In simple terms, it appears that Bitcoin could see significant growth in the upcoming months as several factors seem to be falling into place, potentially boosting its value.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-08-27 06:16