- Bitcoin could start October on a bullish note, supported by a hidden pattern.

- The probability leans strongly in favor of this scenario.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull and bear runs. The current scenario seems to be leaning strongly towards a bullish start for October, supported by a pattern that has emerged post-halving periods.

Over the past weekend, Bitcoin (BTC) showed signs of a bullish trend, temporarily reaching just above $60,000. However, it subsequently pulled back, currently trading at $58,272, indicating a temporary pause following its upward momentum.

Prices are falling back, and many people are pinning their hopes on an upcoming interest rate reduction by the Fed; however, it’s crucial to remember that this isn’t the only factor at play. As Bitcoin marks its 148th day since the halving event, some concealed pattern hints that a significant surge could occur sooner than anticipated.

History suggests rebound possibility

The chart highlights a recurring trend in the Bitcoin cycle emerging after each halving season. For context, Bitcoin halving is a deflationary model occurring every four years, reducing the Bitcoin supply by half.

Source : X

From an economic standpoint, a reduced supply increases the value of each coin. Consequently, each cycle typically sees an upward trend begin after an average of 170 days.

Four years back, on May 11th, Bitcoin underwent a halving. After about 170 days, it reached the $40K mark in its daily price chart for the first time. Approximately 480 days later, around early August, a more substantial peak saw Bitcoin surpassing $50K.

After every halving event, a similar trend seems to recur. If this pattern persists, Bitcoin may climb up to $70,000 during the initial week of October, but it might encounter resistance at that level. Furthermore, the upcoming Federal Open Market Committee (FOMC) meeting could potentially impact this theory.

While the historical pattern seems optimistic, it’s crucial to consider real-world circumstances. So, could a possible recovery occur within the next 23 days?

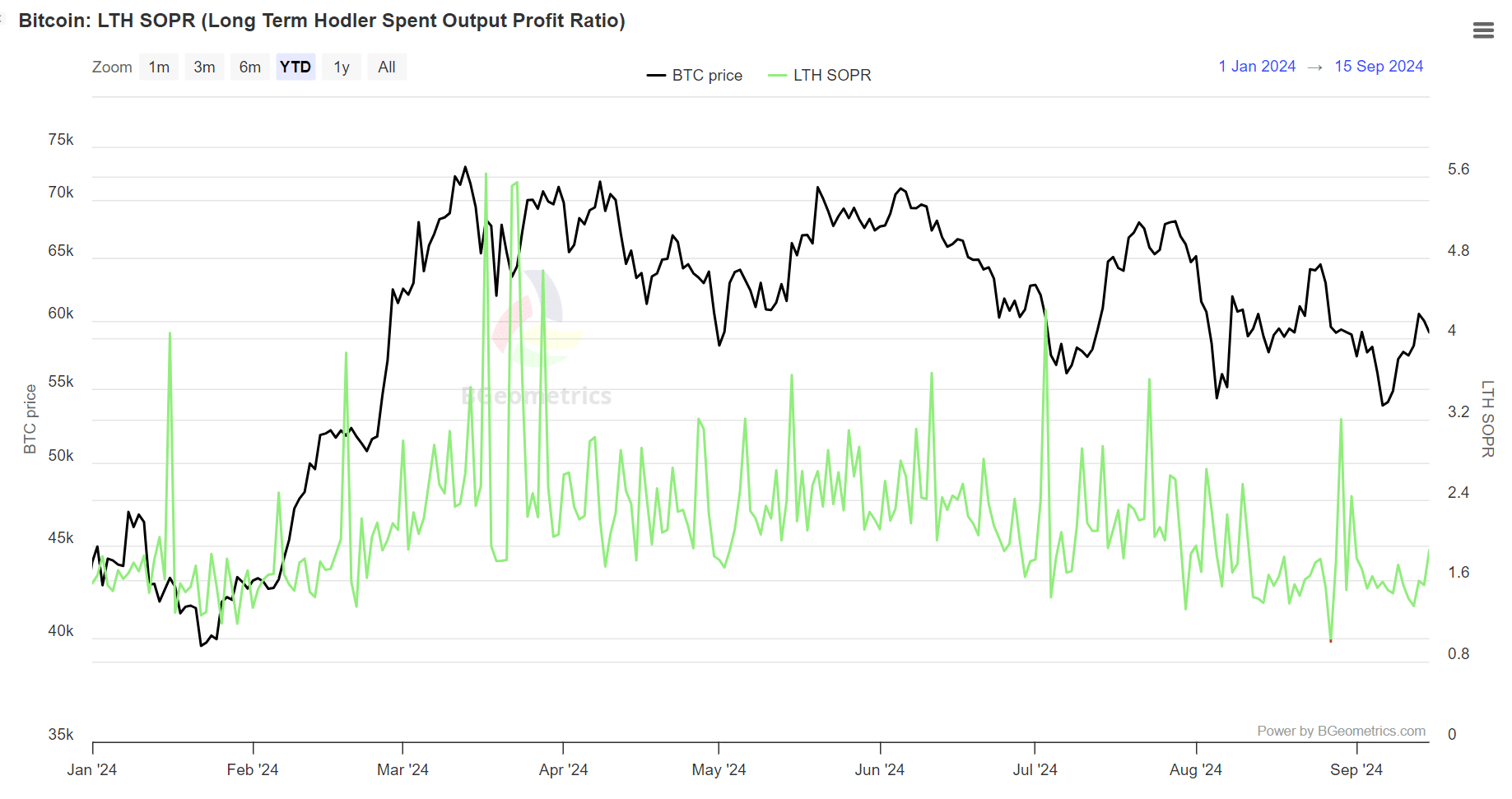

LTH reinforced their support for Bitcoin

Experienced investors express optimism about an upcoming price adjustment. In the past, a growing Long-Term Holder SOPR has typically bolstered every bull market, suggesting that long-term investors are cashing in their gains.

Source : BGeometrics

When there’s an increase (uptick), it suggests optimism. However, if the price fails to follow this trend, it might challenge the anticipated adjustment. In such cases, long-term investors might choose to cash out their profits instead of facing potential losses.

Essentially, when people who’ve held Bitcoin for a while are making a profit, it suggests that the current market worth is robust. If this pattern continues, a turnaround may be on the horizon. Yet, if the price drops below $57K, it could indicate some worry.

A substantial number of investors are represented by the LTHs, yet their sentiment doesn’t entirely encapsulate the overall market confidence in an upward trend during October.

That said, analyzing futures traders can provide better insights.

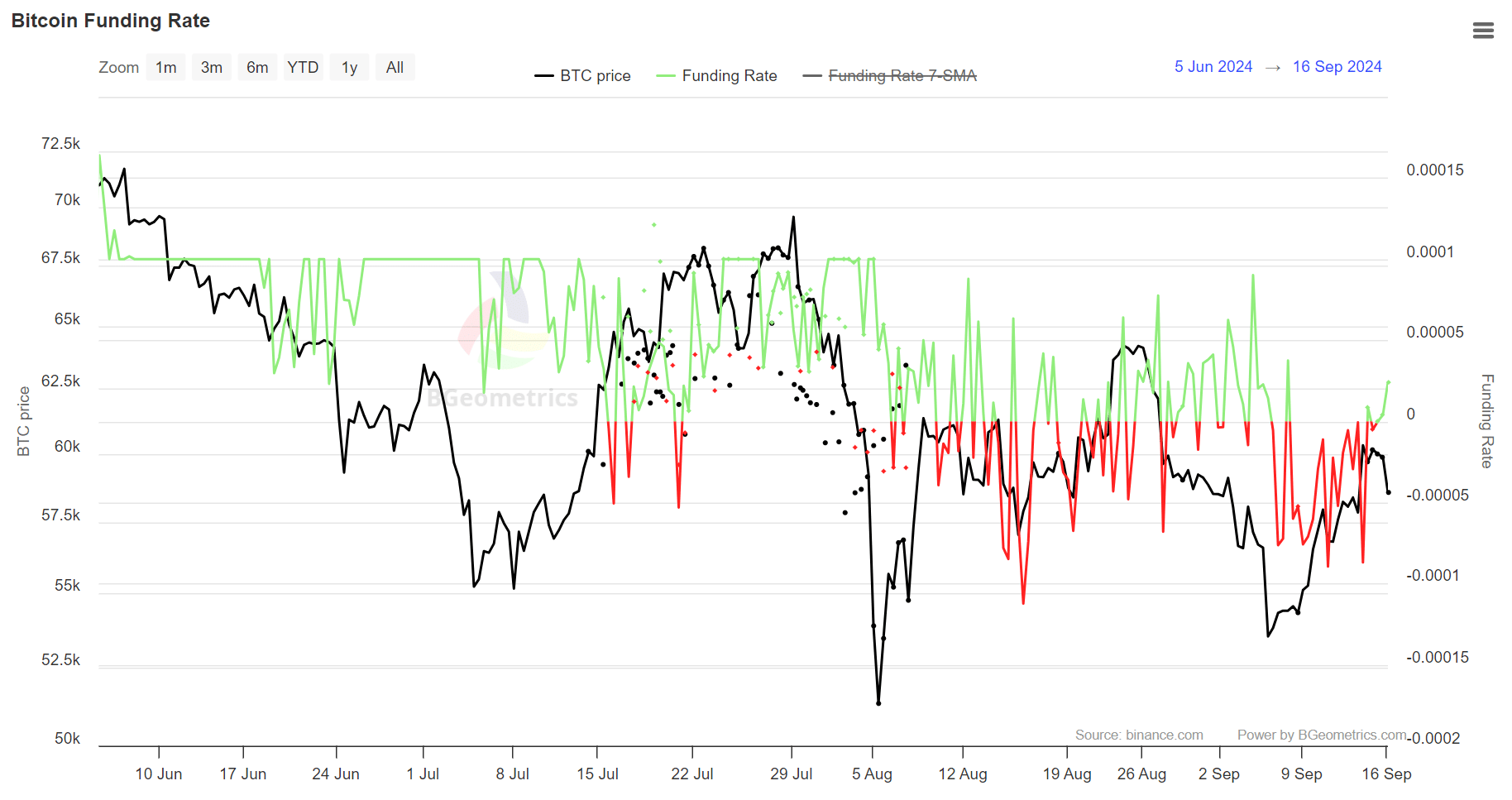

Renewed confidence among Bitcoin future traders

For some time now, shorts (individuals who sell Bitcoin with the expectation of buying it back later at a lower price) have been dominant in the derivatives market. However, longs (those who buy Bitcoin with the intention of holding it for a potential increase in value) are making a comeback, as evidenced by the current positive funding rate. Typically, a positive funding rate signifies optimism among futures traders, implying they anticipate an upward trend in Bitcoin prices.

Source : BGeometrics

As a researcher, I find it intriguing that my observations align with previous predictions made by AMBCrypto. They had suggested that a positive sentiment typically paves the way for Bitcoin (BTC) to challenge significant price thresholds. This synchronicity in our findings adds credibility to both perspectives.

A steadier increase in funding rates might boost the odds of a Bitcoin recovery within the upcoming fortnight, as the current situation is valued, but could benefit from more consistent optimism.

It’s quite unexpected, even with its recent resurgence, that Bitcoin dipped below $60K, hinting at possible external influence.

Although it shows a minor deviation, other elements could counterbalance its lasting influence. The query persists: Will the decreasing trend continue?

What now?

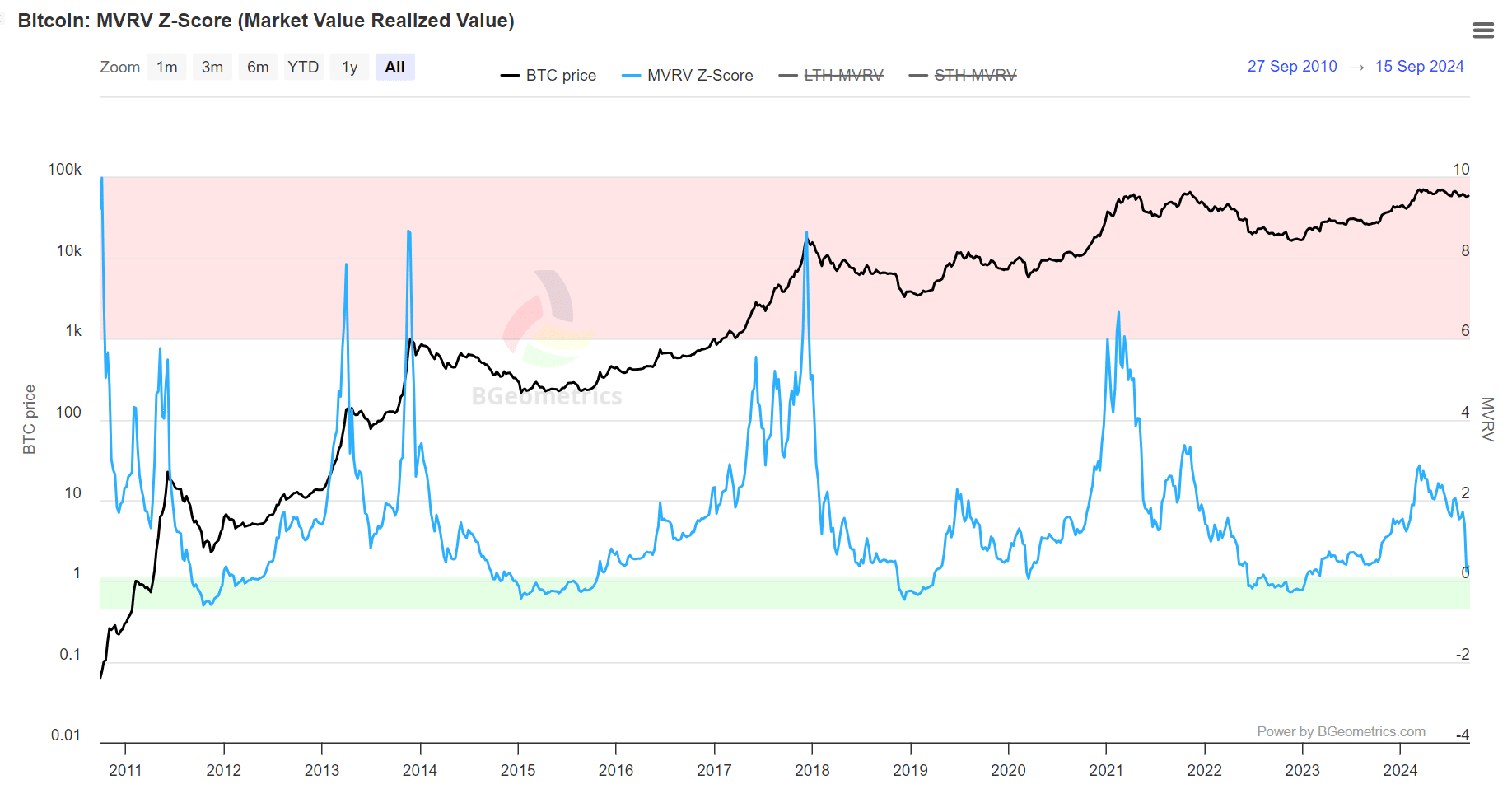

The graph demonstrates that the MVRV-Z score is nearing the “green area,” a spot where it’s usually underpriced. Purchasing Bitcoin at such times often leads to significant profits, as Bitcoin prices tend to surge following these periods.

Source : Bitcoin Magazine Pro

If the historical halving trend continues, the current Market Value to Realized Value (MVRV) is similar to what it was around mid-September four years ago – a time when the Z-score moved into its pink box, an indicator that the market cycle peak was near. The charts presented suggest this could be the case.

Read Bitcoin (BTC) Price Prediction 2024-25

As reported by AMBCrypto, if recent sellers choose to abstain and long-term holders continue to keep their Bitcoin, along with a dominant presence of long positions in the perpetual market, we might see October kick off with Bitcoin being tested against the potential market peak at around $70K.

If this plays out, the halving effect hypothesis would be confirmed as “true.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-16 19:04