- Bitcoin Spot ETFs saw inflows worth $253.54 million on 11 October, coinciding with a 3% price hike

- Ethereum Spot ETFs continue to struggle though, with cumulative negative netflows of -$558.88 million

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself closely monitoring the trends and inflows into Bitcoin and Ethereum Spot ETFs. The recent surge in inflows for Bitcoin ETFs, totaling $253.54 million on October 11, coupled with a 3% price hike, is indeed an encouraging sign. This positive momentum suggests that institutional investors are increasingly bullish about Bitcoin and could be a harbinger of further price appreciation.

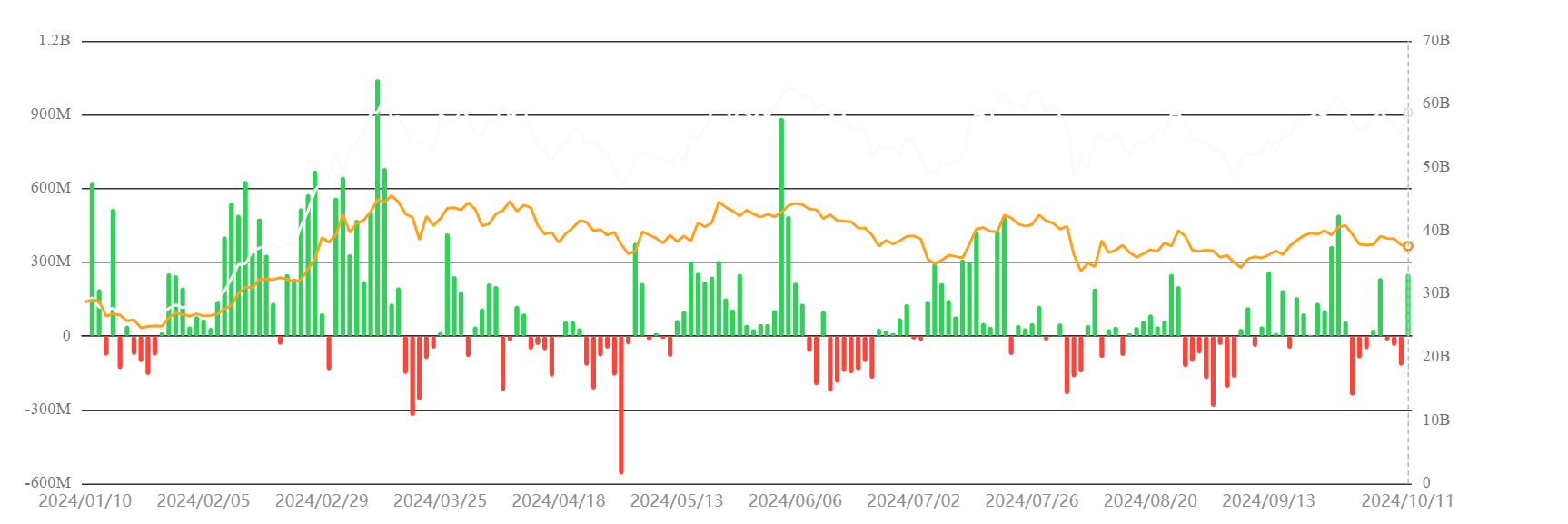

Last week, Bitcoin Spot Exchange-Traded Funds (ETFs) experienced an increase in overall investment, which was the second such rise this week. Out of the four primary Bitcoin Spot ETFs, it was these that accounted for the inflow. However, some other funds did not receive any new investments during this period.

Currently, Ethereum spot ETFs have consistently shown a decrease in their total assets (net outflows). This trend puts them at a disadvantage compared to Bitcoin, which is experiencing more favorable movements.

Bitcoin ETFs see positive inflows

Based on information from SosoValue, there were inflows totaling $253.54 million into Bitcoin ETFs on October 11th. This marked the second instance of investment during that particular week, as it followed a series of three straight days where these ETFs experienced outflows.

During this timeframe, it was Fidelity, Ark 21 Shares, Bitwise, InvescoGalaxy, and VanEck who attracted investments (inflows) in their respective ETFs. However, BlackRock and other ETFs did not receive any new investments (flows) during the same period.

Looking at the details, it’s clear that Fidelity led with a massive $117 million in inflows, while Ark 21 Shares came in second with about $97.6 million. Bitwise added $38.8 million, and the rest was divided among the other ETFs.

Currently, as I’m typing this, the accumulated inflow for Bitcoin spot ETFs amounts to $18.81 billion, and their total net worth is $58.66 billion.

Bitcoin’s price rally and ETF inflows align

The increase in investments into Bitcoin spot ETFs corresponded with a rise in BTC‘s price. After a series of days with decreased investment and falling prices, Bitcoin experienced a surge of more than 3% on October 11, rising from $60,279 to $62,518. This upward trend persisted on October 12, with Bitcoin being traded at approximately $63,000 at the time this text was written.

If Bitcoin continues its upward trend over the weekend, there may be more Exchange Traded Fund (ETF) investments in the following week – An indicator of increasing investor attention.

Ethereum spot ETFs see negative netflows

Contrarily, Ethereum spot ETFs have not experienced the same surge in positive investments as Bitcoin ETFs. On October 11th, Ethereum only had a minor investment of $3.06 million, but seven out of nine Ethereum ETFs reported no inflows at all, with no investments seen the day prior as well.

– Read Bitcoin (BTC) Price Prediction 2024-25

The running tally of net inflows for Ethereum Spot ETFs currently stands at a deficit of $558.88 million, with an overall asset value of $6.74 billion. Although there have been occasional surges of investment, the performance of Ethereum’s Spot ETF has been weaker compared to Bitcoin’s, suggesting a tougher market landscape for Ethereum investors, as indicated by its underperformance.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- PI PREDICTION. PI cryptocurrency

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

2024-10-13 04:07