-

Massive inflow of ETH into exchanges as ICO continue to sell

The Dencun upgrade has seen ETH lose some revenue going to L2s

As a seasoned analyst with years of experience in the cryptocurrency market, I find myself deeply concerned about Ethereum (ETH) at this moment. The influx of ETH into exchanges and the continuous selling by an ICO participant have created a perfect storm that could potentially lead to a significant drop in its price.

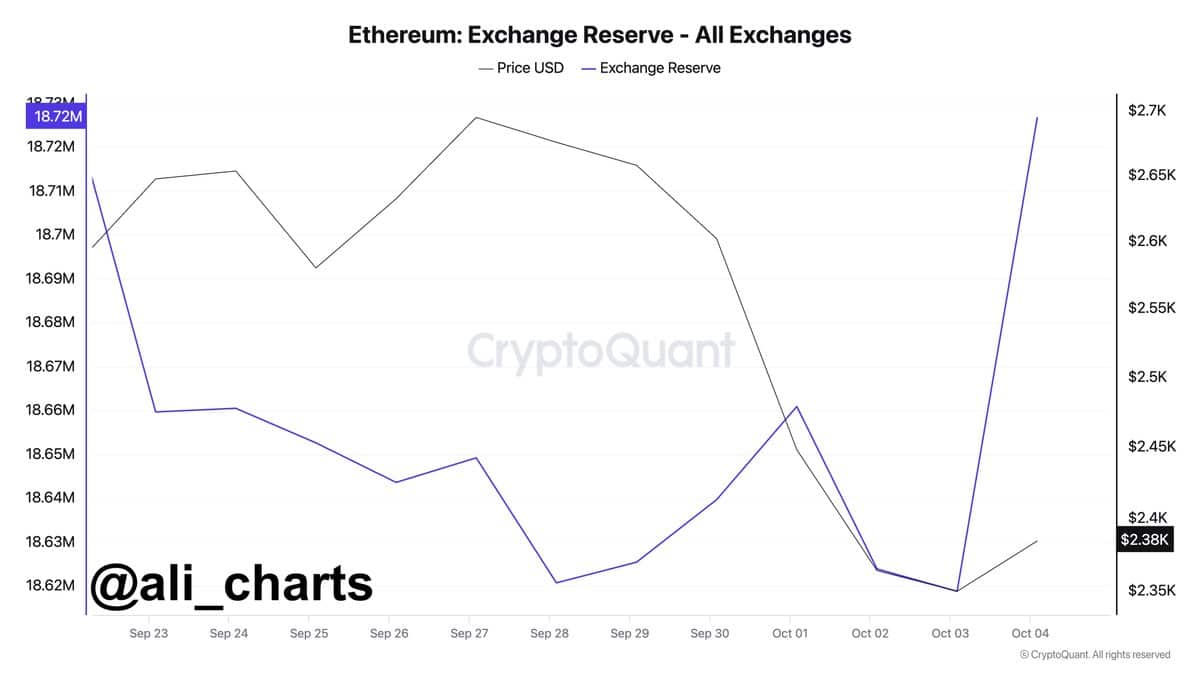

Recently, Ethereum (ETH), the second-largest digital currency following Bitcoin (BTC), has been experiencing a surge in selling activity. Notably, there’s been a trend of traders transferring Ethereum to cryptocurrency exchanges.

Currently, more than 108,000 units of Ethereum, approximately equivalent to $259.2 million, were transferred to exchanges over the course of a single day.

An increase like this usually suggests that the Ethereum (ETH) price might decrease. This is due to the fact that increased supply, when accompanied by unchanging demand, generally leads to a drop in prices.

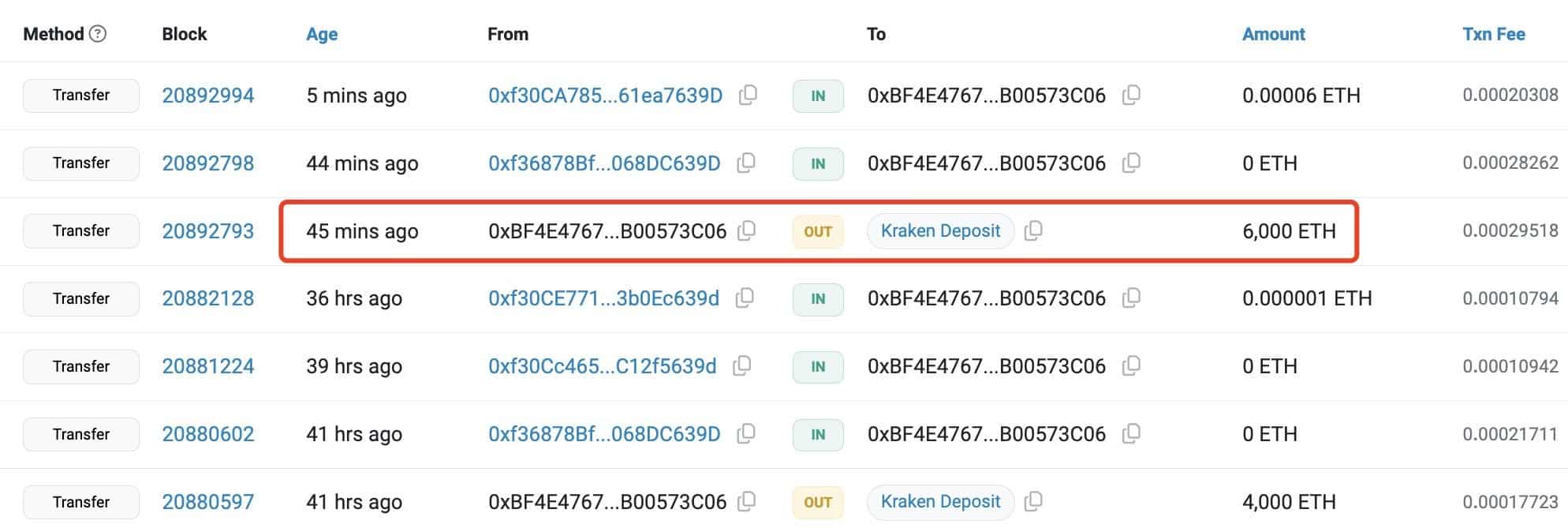

As a crypto investor, I’ve been gradually offloading my Ethereum holdings recently, following my participation in an Initial Coin Offering (ICO).

More recently, they offloaded approximately 6,000 Ether (ETH) valued at around $14.11 million, increasing their total sale amount to 40,000 ETH since September 22, 2024. These transactions were executed at an average price point of $2,525 each.

Regardless of any transactions made, the individual involved in the ICO retains around 99,500 Ether, which is roughly equivalent to $238 million. This substantial amount suggests that there could be a significant amount of Ether up for sale in the future.

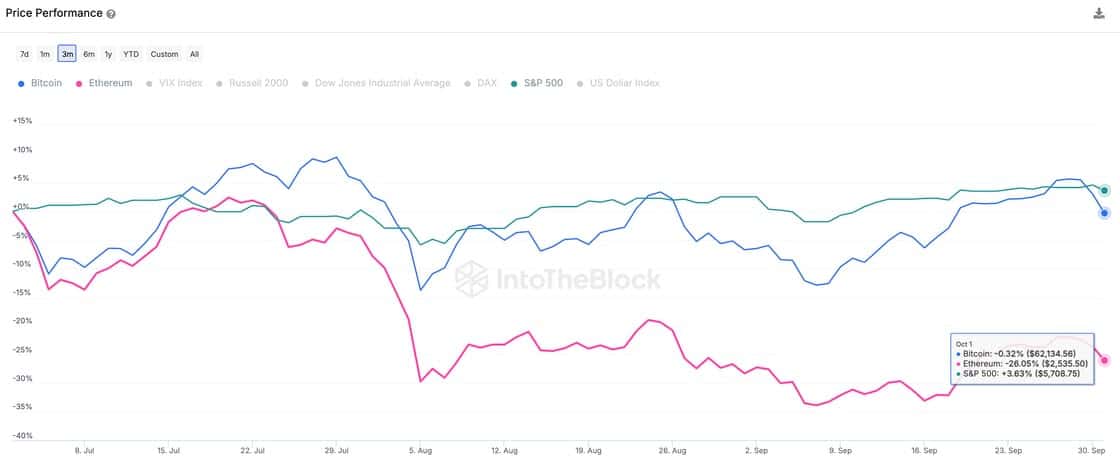

ETH’s price performance compared to other assets

ETH has also been underperforming, compared to other risk-on assets like Bitcoin and the S&P 500.

Over the last quarter, Bitcoin experienced a minor dip of 0.32%, whereas the S&P 500 demonstrated a healthy growth of 3.63%. However, Ethereum suffered a substantial loss, decreasing by approximately 26% during the same period.

The cost of transactions on the Ethereum network has dropped by 43.9%, now standing at approximately $247.6 million. This significant decrease in fees may be a factor in Ethereum’s current challenges. Over the last three months, the volume of activity on Ethereum’s Mainnet has also decreased.

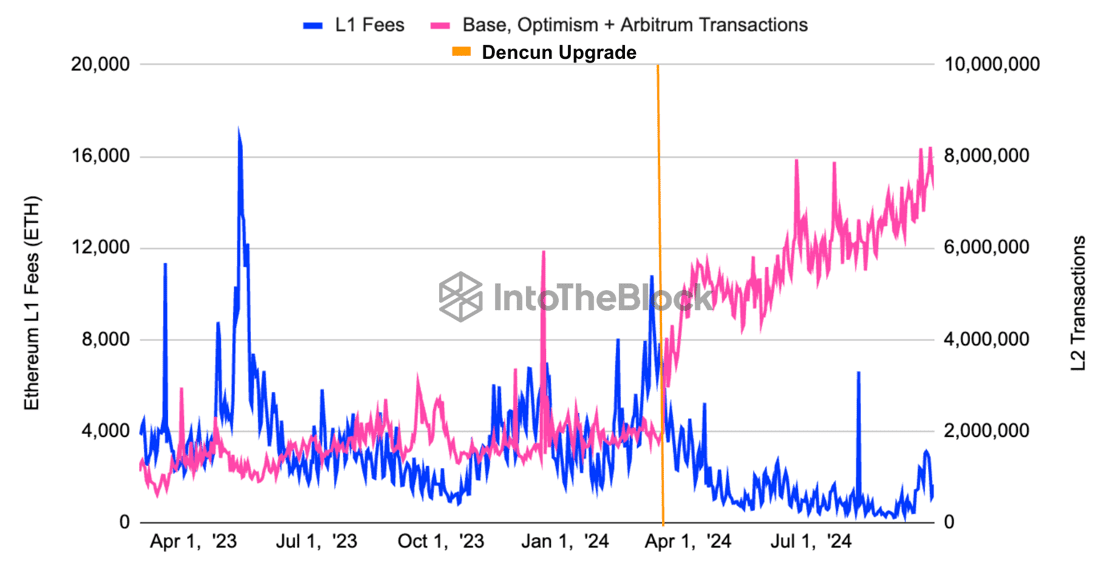

The Impact of the Dencun upgrade

It’s worth noting that the Dencun upgrade has contributed to Ethereum’s relatively poor performance. This update, incorporating EIP 4844, significantly decreased the transaction fees on Layer 2 (L2) by more than ten times, leading to a surge in L2 activity.

Due to this development, transaction fees on Ethereum’s main network have dropped significantly, hitting an unprecedented minimum. Consequently, the rate at which Ether is destroyed (or “burned”) has decreased, causing the cryptocurrency to revert back to an inflationary state following a period of deflation.

The dip in trading activity during the summer and the stagnation in traditional markets led to a significant decrease in Ethereum transaction fees, reaching levels not seen in years. This decrease in fees and reduced Ether burning are analogous to a company experiencing decreased income and stopping share repurchases. Given these circumstances, it’s no wonder that Ethereum’s price has faced challenges.

Furthermore, it’s unclear just how much long-term advantages Ethereum (ETH) could potentially reap from the miner extractable value (MEV) of Layer 2 solutions.

L2s’ Influence on ETH and Optimism’s rise

Ultimately, it’s worth noting that OP, a prominent Layer 2 solution within Ethereum’s network, has observed its governance token surpassing other tokens in terms of performance.

In the third quarter, the price of OP relative to ETH increased by 28%. This growth can be attributed to a surge in on-chain activity on Layer 2 solutions, which has resulted in OP’s performance surpassing that of Ethereum.

Optimism’s increasing influence, fueled in part by Coinbase’s operation of Base L2 on the Optimism network (Optimism Superchain), underscores the expanding power of Layer-2 solutions. This trend persistently impacts the value of Ethereum.

Read More

2024-10-05 19:04