- Over $3.4B Bitcoin long positions risk liquidation as net taker showed aggressive sells.

- MSTR’s BTC holdings premium back to levels last seen during the 2021 bull run.

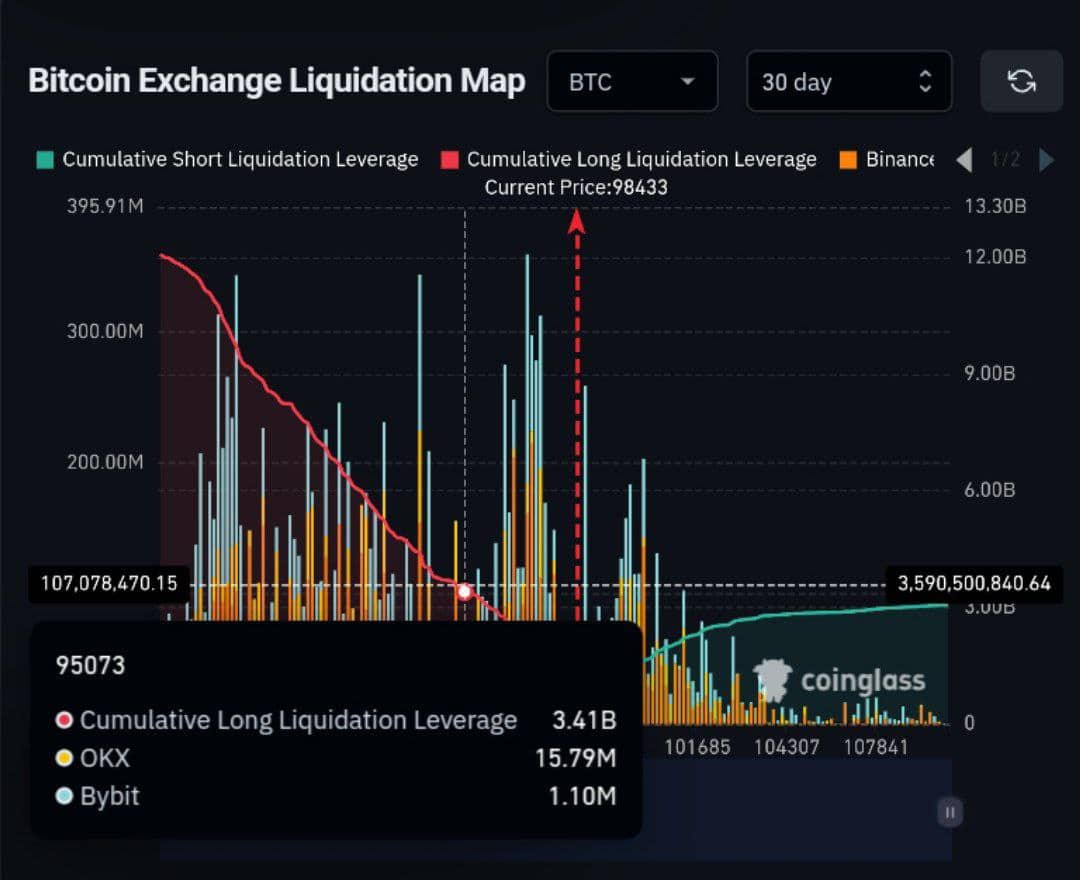

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market, I find myself standing at the precipice of another potential turning point for Bitcoin [BTC]. The $95K level, a formidable barrier for leveraged positions, has once again come into focus with over $3.4 Billion in long bets at risk of liquidation.

Bitcoin (BTC) indicated that the $95,000 mark presented substantial dangers for highly leveraged trades. With the market barely skirting this crucial boundary, approximately $3.4 billion worth of long leveraged wagers were potentially vulnerable to being wiped out.

Based on market trends, large entities or dominant forces (often called “whales”) might seize the opportunity to lower prices to approximately $95,000, potentially causing forced sales.

As a crypto investor, I’ve been closely watching this strategy that’s known for squeezing out over-leveraged positions. It’s a move that could clear the path for Bitcoin to bounce back and potentially reach the $100K milestone.

As an analyst, I’m advising caution: while a predicted downturn isn’t a certainty, the current market configuration strongly suggests it could occur. It’s crucial for traders to remain vigilant and adapt their strategies accordingly.

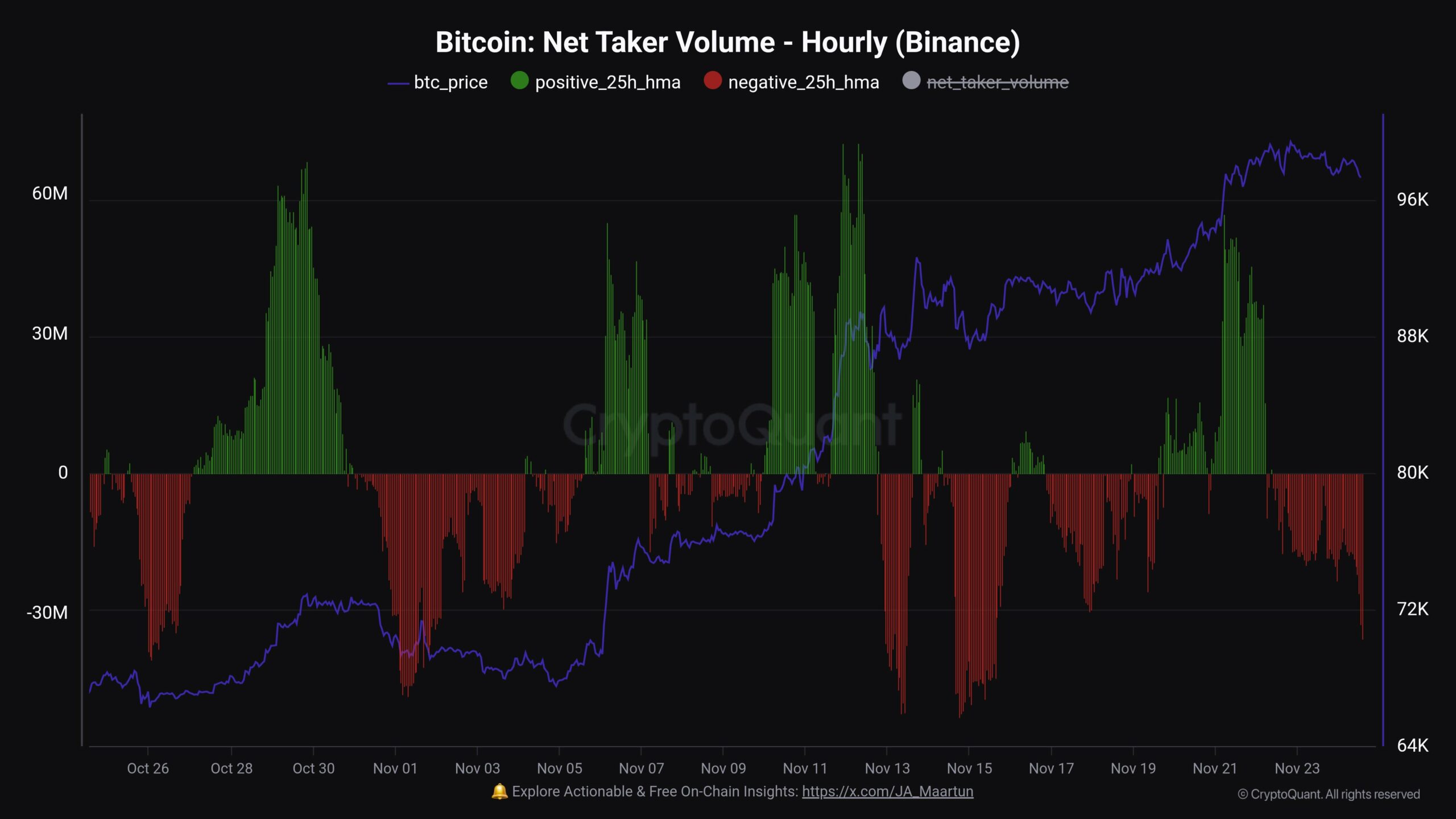

Aggressive sells and profit-taking

Additionally, the strong selling of Bitcoin by Binance could be seen as contributing evidence for this price drop. This short-selling strategy might indicate a predicted dip down to roughly $95,000, allowing them to accumulate more liquidity in anticipation of a subsequent bullish recovery toward $100,000.

Based on the latest data showing a high volume of sellers, there seems to be a general expectation for a planned retreat in the market.

Based on my years of experience trading financial markets, I believe that this move is likely being driven by large traders with significant influence. Their aim could be to force out over-leveraged long positions, a tactic often employed in volatile market conditions. This strategy can lead to short-term losses for some traders, but it’s important to remember that the markets are always evolving and those who adapt quickly tend to come out ahead in the long run.

In light of signs suggesting a deceptive trading strategy, it’s wise for investors to remain vigilant about possible sudden increases in market fluctuations.

From the observed trades, it seems that major players might be preparing for a significant price shift. This underscores the importance of staying alert given the volatile nature of the present market scenario.

Why BTC’s drop maybe short-lived

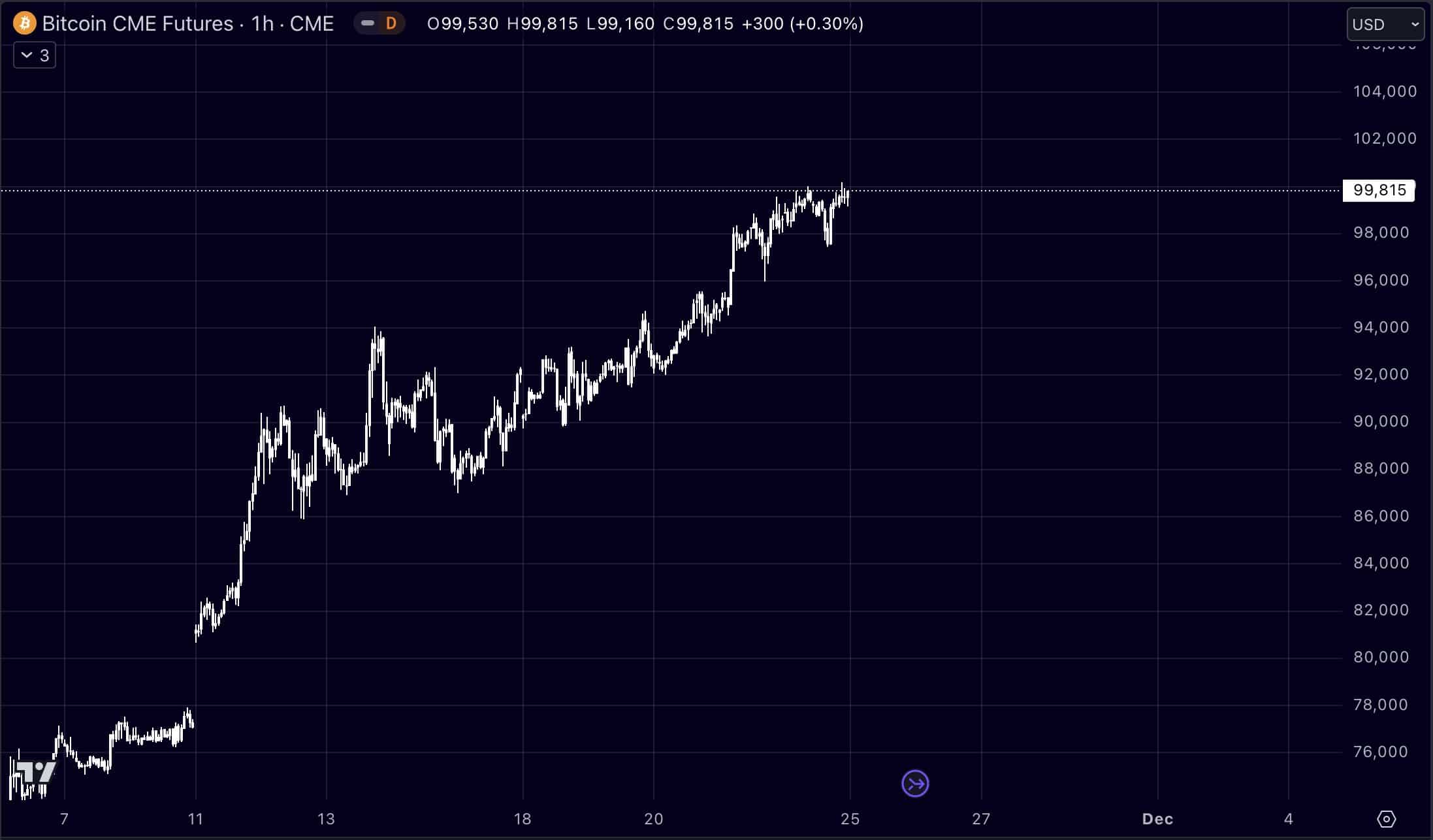

Initially, Bitcoin’s path towards reaching $100K demonstrated both unpredictability and excitement. As Bitcoin danced close to $99.8K on the CME, it suggested that the $100K threshold was about to be broken.

The close distance to a significant point in a prominent futures market indicates that Bitcoin might soon reach comparable values on multiple exchanges. However, the drop back down to $97K suggests that price movements could become unpredictable in the near future.

Given that the cost of the CME has been persistently high, closing at $99,800 suggests a positive outlook. However, traders need to prepare for potential sudden drops or even surges past $100,000.

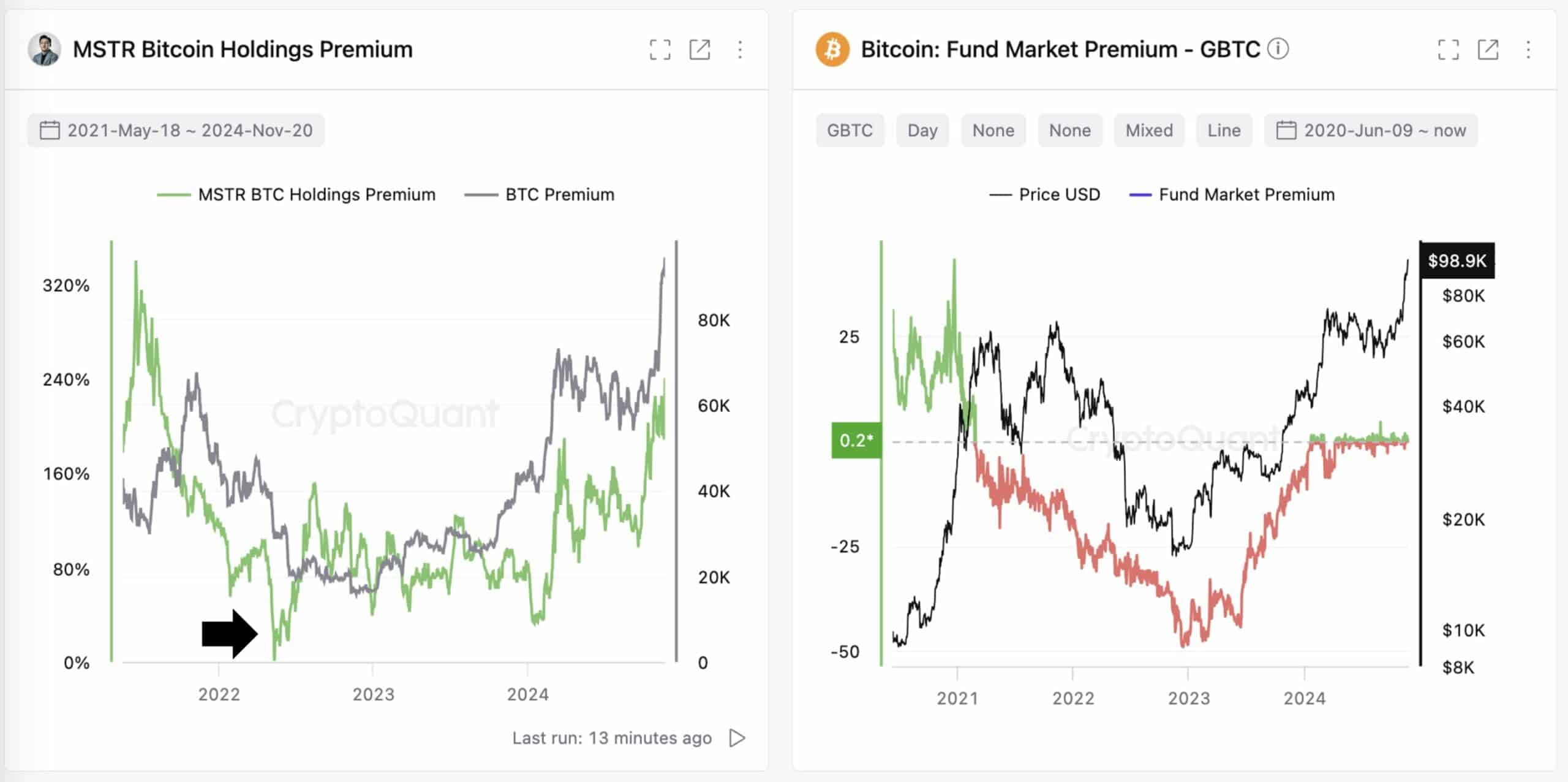

Once more, MicroStrategy’s Bitcoin reserves have regained their peak value from the 2021 bull market rally, demonstrating renewed market enthusiasm similar to that seen earlier.

Contrary to Grayscale Bitcoin Trust (GBTC), which experienced a 48% price reduction during the downturn, MicroStrategy’s value consistently remained above its original cost.

This action demonstrated Michael Saylor’s skillful handling of risks during turbulent periods, adding credence to the idea that Bitcoin’s robustness remains intact.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In the face of the recent market resurgence, it’s clear that Saylor’s strategy for preserving equilibrium amidst the pressures of the 2022 bear market has underscored his substantial impact and insight within the cryptocurrency sphere. I, as a researcher, am deeply intrigued by this demonstration of influence and foresight in navigating such challenging market conditions.

This resilience implies a tactical placement that might benefit long-term investors who want to capitalize on Bitcoin’s market fluctuations. The market continues to be unpredictable, demonstrating the usual volatility characteristic of cryptocurrency trading.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

2024-11-26 09:11