-

Bitcoin fees hit a yearly low for the third consecutive week as market volume increased

Repetition of 2019 divergence of BTC and SPX might spur bullish sentiments

As a seasoned crypto investor with a decade of experience navigating the volatile landscape of digital assets, I’ve seen my fair share of market fluctuations and trends. The recent drop in Bitcoin fees for three consecutive weeks has been a welcome development, especially considering that it coincides with an increase in market volume. This trend, combined with institutional investments like NPS’s move to invest in MicroStrategy’s stock for Bitcoin exposure, suggests that we might be on the brink of another bull run.

For three consecutive weeks, Bitcoin transaction fees have reached their lowest point this year, as per IntoTheBlock’s latest analysis, due to the market’s recent period of stability.

After a decrease in transaction costs related to Bitcoin, NPS, one of the world’s largest global public pension funds, committed an investment of $34 million in MicroStrategy’s stocks to gain exposure to Bitcoin.

The move highlights a growing trend among institutions to diversify into Bitcoin through companies with substantial Bitcoin holdings at this time of low fees. This is also a sign of the mainstream increasingly accepting this asset class as viable.

BTC and SPX 2019 divergence repeats itself

In simple terms, the gap between Bitcoin’s performance and that of the S&P 500 (SPX) in recent times mirrors a similar situation from 2019. Back then, after the Federal Reserve (Fed) lowered interest rates, Bitcoin’s price significantly increased. This pattern seems to be reoccurring in 2024, as experts predict another rate cut by the Fed, which might lead to a similar surge in Bitcoin’s value.

Bitcoin’s latest dip followed by a deviation from the SPX resembles the pattern seen in 2019, leading to a substantial increase in value. Although there is doubt, this situation could repeat an often-seen cycle, echoing a common market trend.

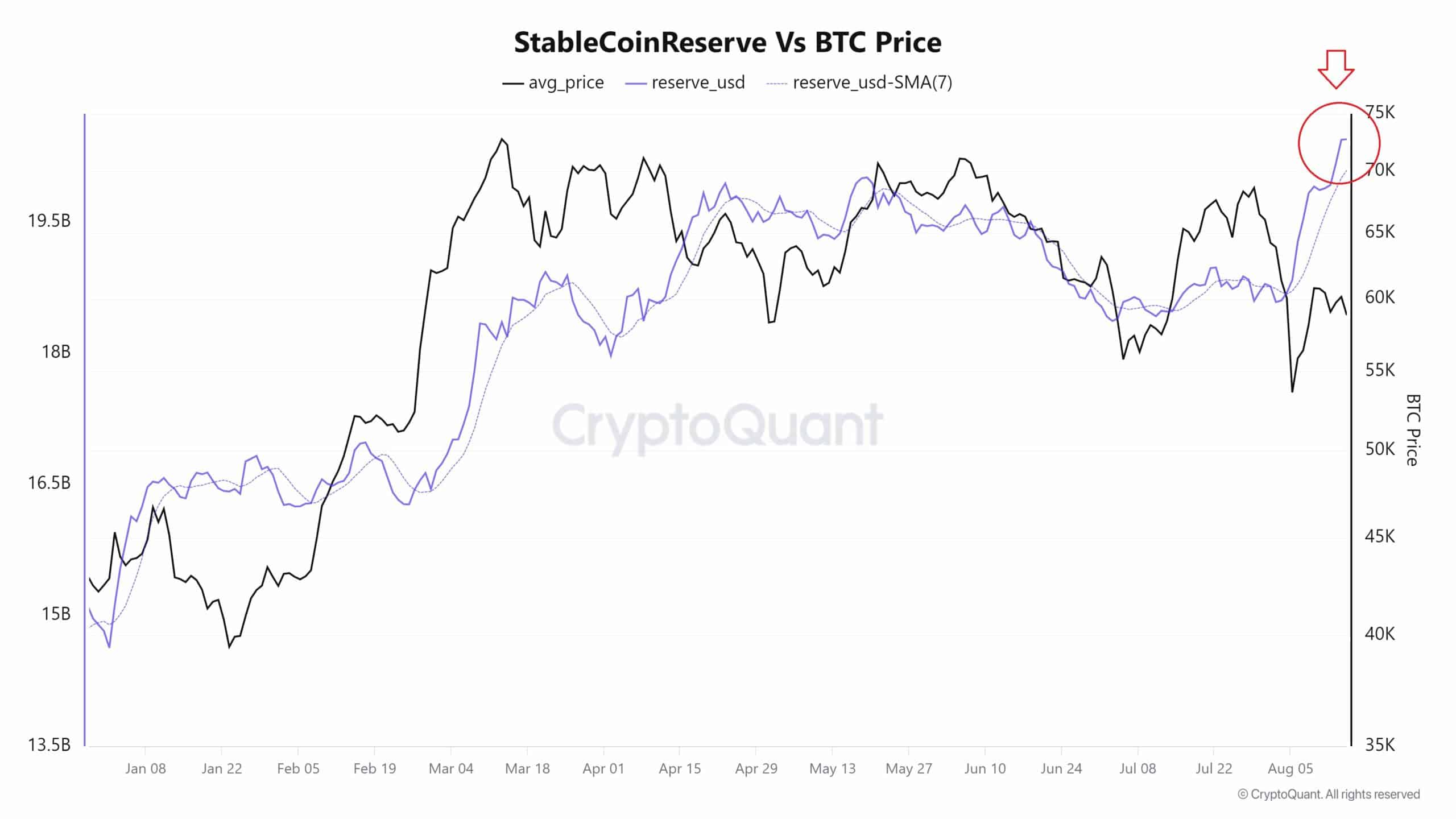

Stablecoins reserves’ influence on BTC price

As a crypto investor, I’ve noticed that the reserves of stablecoins on exchanges are currently at an all-time high. This surge has substantially increased Bitcoin’s purchasing potential, making it a more attractive investment option for many of us in the crypto space.

As a seasoned trader with over two decades of experience in the financial markets, I have witnessed numerous trends and patterns that have shaped the course of various asset classes. Recently, I’ve been intrigued by the surge in Bitcoin (BTC) adoption among major institutions, a development that seems to be gaining momentum based on the broadening wedge pattern visible on the 4-hour BTC/USDT chart.

By the beginning of Q1 2024, a total of 874 financial institutions owned Bitcoin ETFs. This number grew to 1,008 institutions by the end of Q2.

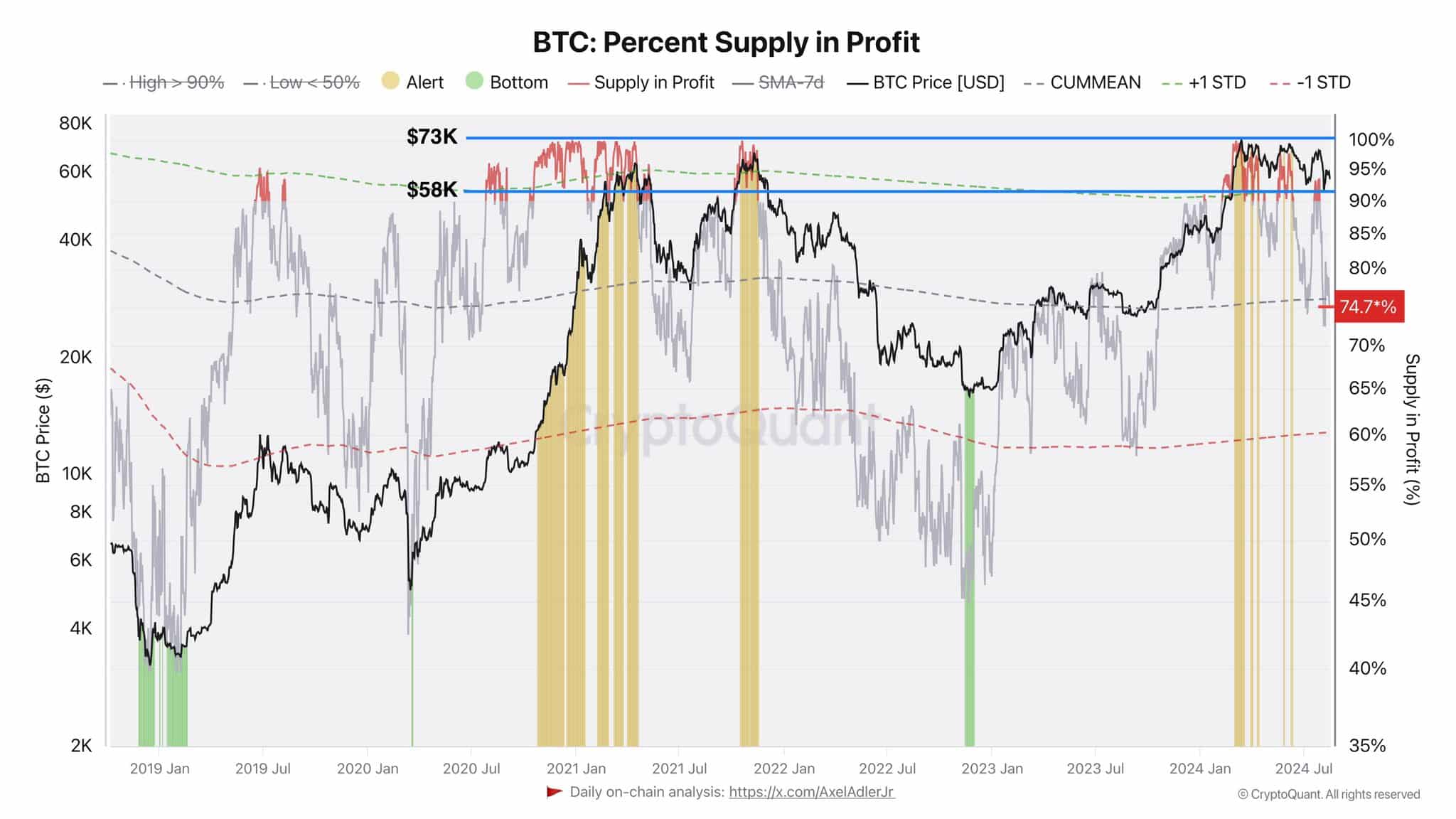

Approximately 25% of all Bitcoins were purchased between $58,000 and $73,000, which amounts to approximately $300 billion. Those investors who bought at this range might be holding onto their Bitcoins in anticipation of future price increases, implying that they believe Bitcoin’s price will continue to climb.

Despite Bitcoin’s slow price action and low retail interest, institutional buying is accelerating though – Another sign of the crypto’s long-term growth.

Based on the latest advancements in the Bitcoin market, it’s possible to identify a potential upward trend over the long term.

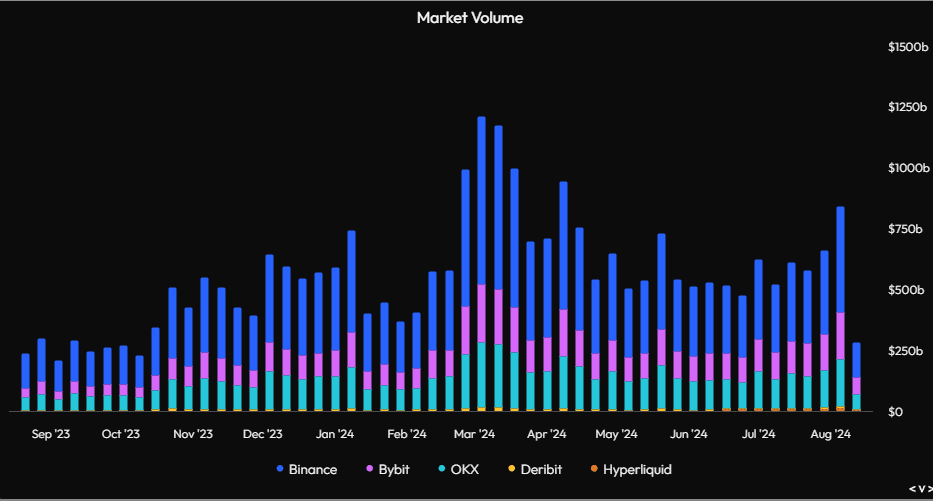

Market volume increases in the midst of low funding rates

After reaching their highest point in March, the markets have experienced a drop in trading activity that suggests they are going through an extended period of consolidation.

Last week, even amidst turbulence in the global stock markets due to the Japanese market crash, there was a noticeable increase in trading activity within the cryptocurrency markets.

This has led to heightened volatility in Bitcoin and other cryptocurrencies.

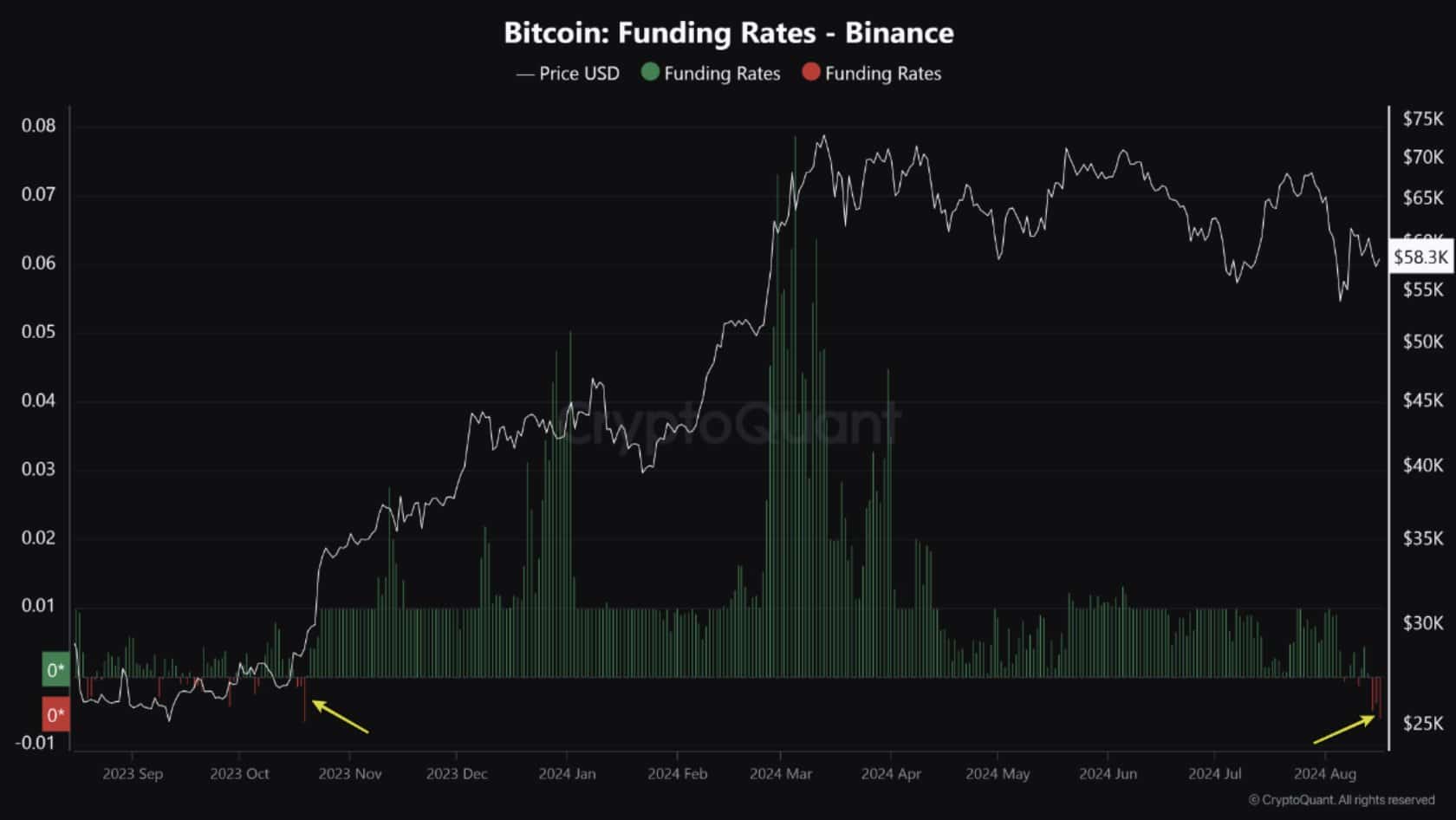

In summary, the funding rates for Bitcoin on Binance have reached their lowest this year. As more short positions accumulate, it’s expected that the price of Bitcoin could potentially increase.

Given that Binance has the most significant portion of the market’s Open Interest, there might be a temporary bearish outlook among short-term traders. Yet, this situation could offer a profitable buying chance for long-term investors and traders who can increase their Bitcoin holdings.

Read More

2024-08-17 09:12