- Over 300,000 ETH were withdrawn from exchanges in the past week alone.

- The ETH price has continued its slight uptrend.

As a seasoned researcher who has navigated numerous crypto market cycles, I find it fascinating to observe the recent trends with Ethereum [ETH]. The significant drop in exchange reserves and the subsequent price movement around $2,500 suggest a shift in investor sentiment that could potentially stabilize ETH’s future performance.

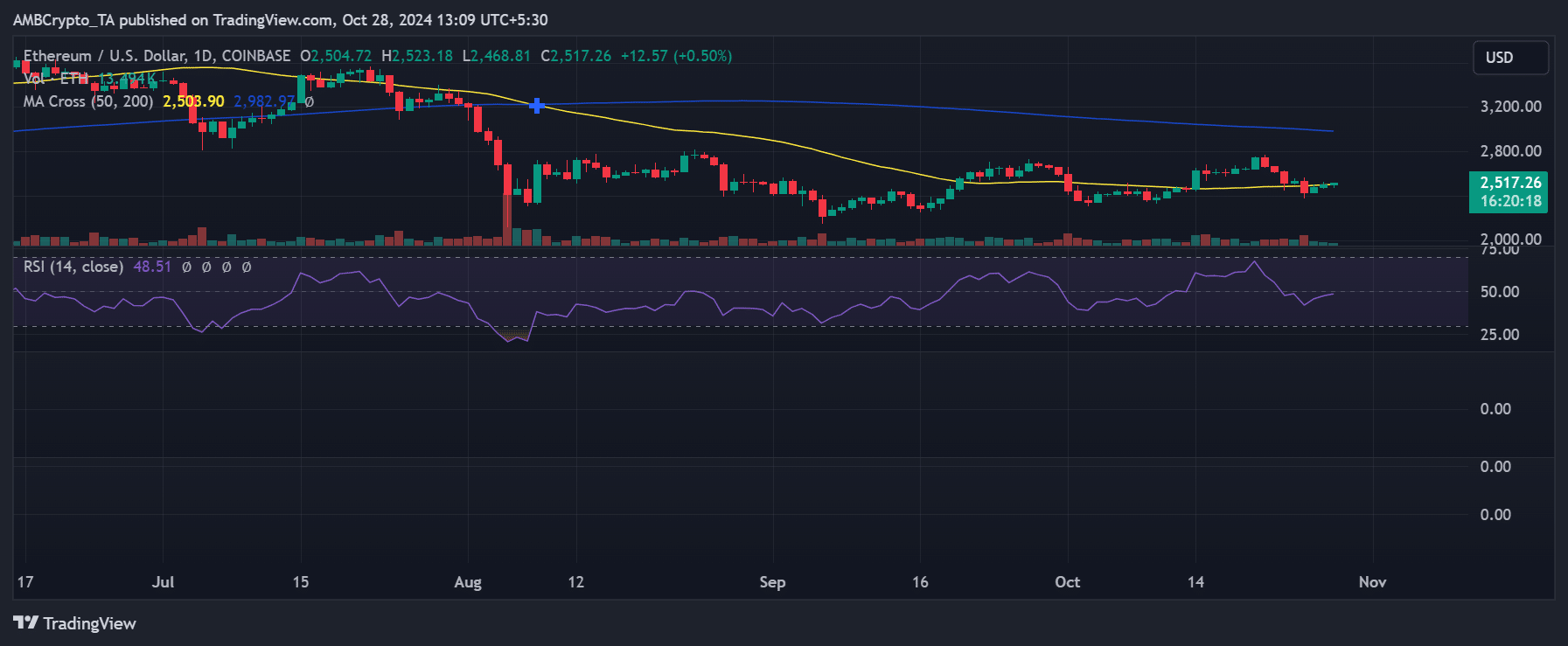

The current fluctuations in Ethereum‘s [ETH] value near the $2,500 level could be due to a substantial decrease in exchange-held ETH. This decline suggests a possible shift in investors’ attitudes or preferences.

A decrease in available reserves on exchanges frequently suggests that investors are transferring their Ethereum holdings to personal wallets, which usually signifies a long-term investment plan rather than an immediate intention to sell. This transition might play a crucial role in maintaining ETH’s price stability and influencing its future market behavior.

Over $4 billion in Ethereum withdrawn from exchanges

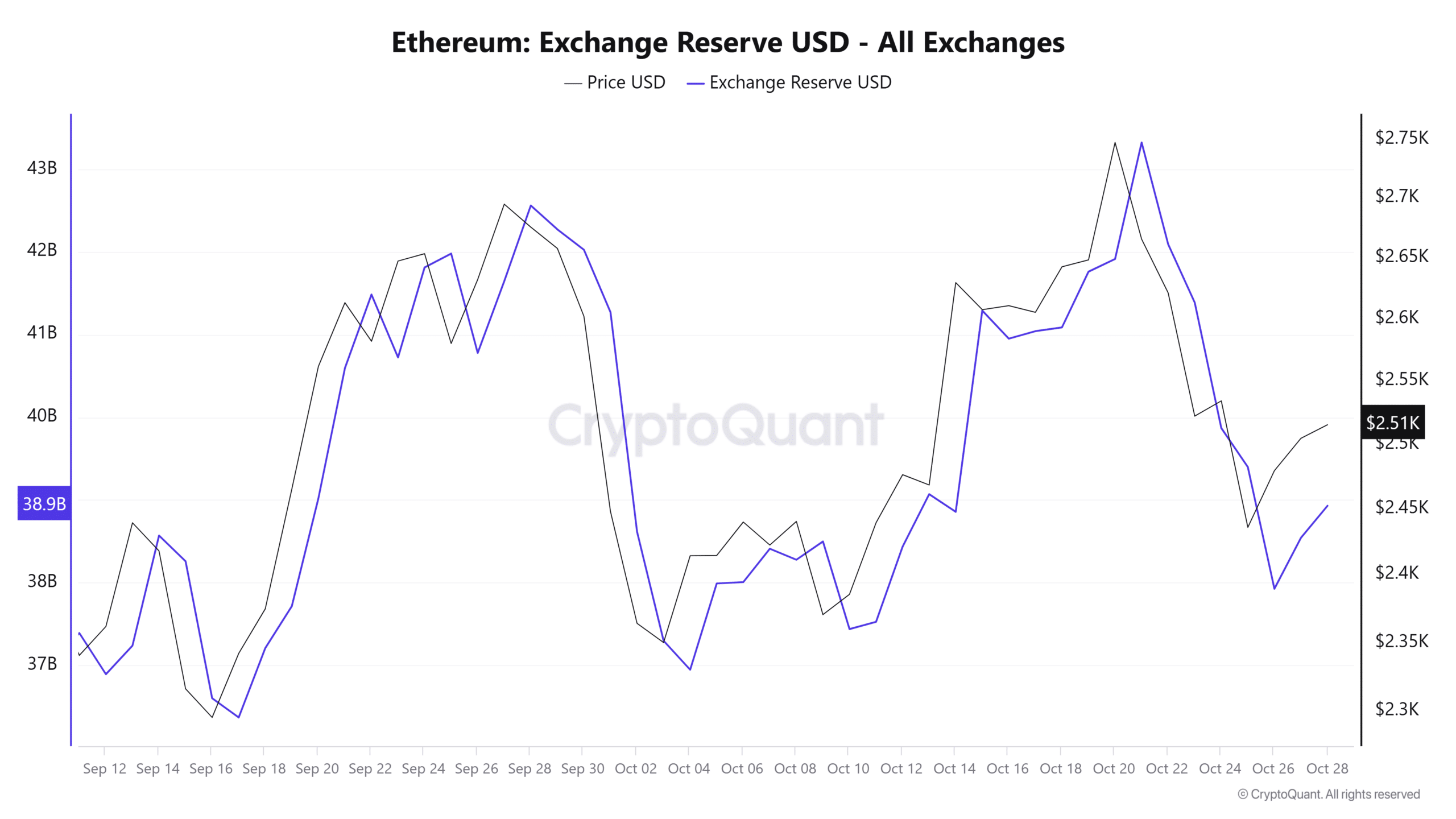

Based on information from CryptoQuant, it appears that the amount of Ethereum held on exchanges has significantly decreased. In just a couple of weeks, the value dropped from around $42 billion to about $38.9 billion. This decrease represents approximately $4 billion worth of Ethereum being transferred off exchanges.

Investors appear to be adopting a buy-and-hold approach instead of frequent trading, as suggested by recent market movements. Notably, this shift comes amidst Ethereum’s current price range of around $2,400 to $2,700.

Ethereum withdrawal coincides with price consolidation

This pattern of withdrawals coincides with Ethereum’s recent difficulties in breaking through resistance points approximately at $2,600. By transferring their assets away from exchanges, investors might be expressing faith in its future worth.

In simpler terms, this action might lessen the urge to sell, especially if the number of reserves on the exchange keeps decreasing over the next few days. This could lead to a more stable price because there would be fewer tokens readily available for quick trading, assuming demand remains consistent.

How declining Ethereum reserves could impact price stability

Decreased holdings of exchange reserves typically means less accessible funds. This situation might lead to increased market stability or rising prices when demand stays constant. If there aren’t many tokens easily found on exchanges and a strong buying interest arises, it can cause larger price fluctuations.

With Ethereum seeking momentum following its recent drops, these exchange withdrawals indicate a change in investor attitudes. It suggests that holders are becoming less likely to sell, thereby lowering the possibility of massive selling waves.

On the other hand, maintaining a steady demand is vital. If the demand decreases, Ethereum might face challenges in overcoming resistance points, which could result in an extended phase of sideways movement.

Short-term outlook for Ethereum

The drop in foreign currency holdings might indicate a phase of price stabilization, potentially leading to an increase in value. Maintaining the $2,500 price floor and a continuing decrease in reserves could create a solid basis for a lasting comeback.

Read Ethereum (ETH) Price Prediction 2024-25

As an analyst, I foresee that under favorable market conditions, enhanced demand for Ethereum may materialize, leading to a surge of purchasing activity. This could potentially propel the price upward, paving the way for additional gains.

Even though recent data suggests a hint of optimism, it’s important to note that if market conditions change and demand drops, Ethereum (ETH) could still encounter resistance at key levels. Long-term investors have demonstrated remarkable resilience amidst the continuous market ups and downs.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

2024-10-28 23:03