- Bitcoin whale has accumulated 3577 tokens worth $330 million

- BTC has surged by 9.93% during this period

As a seasoned researcher with years of experience tracking the cryptocurrency market, I’ve seen many bull and bear runs, but this current rally is truly remarkable. The whale accumulating 3577 tokens worth $330 million over four days is a testament to the confidence in Bitcoin’s potential.

Over the past period, Bitcoin [BTC] has shown a robust recovery since it hit a low of $66,978. This resurgence has led to five all-time highs being reached. Currently, at a new high of $99,388, Bitcoin isn’t just boosting the profits of existing investors, but also sparking interest among potential new investors who don’t want to miss out on the opportunity (often referred to as FOMO).

Although whales seldom gather together as cryptocurrency prices reach new peaks, many major investors still tend to stockpile more during this upward trend.

Bitcoin whale accumulates $330 million worth of tokens

Based on data from Lookonchain, large investors (often referred to as “whales”) are steadily adding more Bitcoin to their stockpile. In fact, a single whale has amassed approximately 3577 Bitcoin tokens, valued at around $330 million, over the last four days. This accumulation has now increased their total holdings to around 25298 Bitcoin tokens, which equates to roughly $2.5 billion in value.

When whales congregate, it suggests they are assured about the market’s future growth, indicating potential price increases ahead.

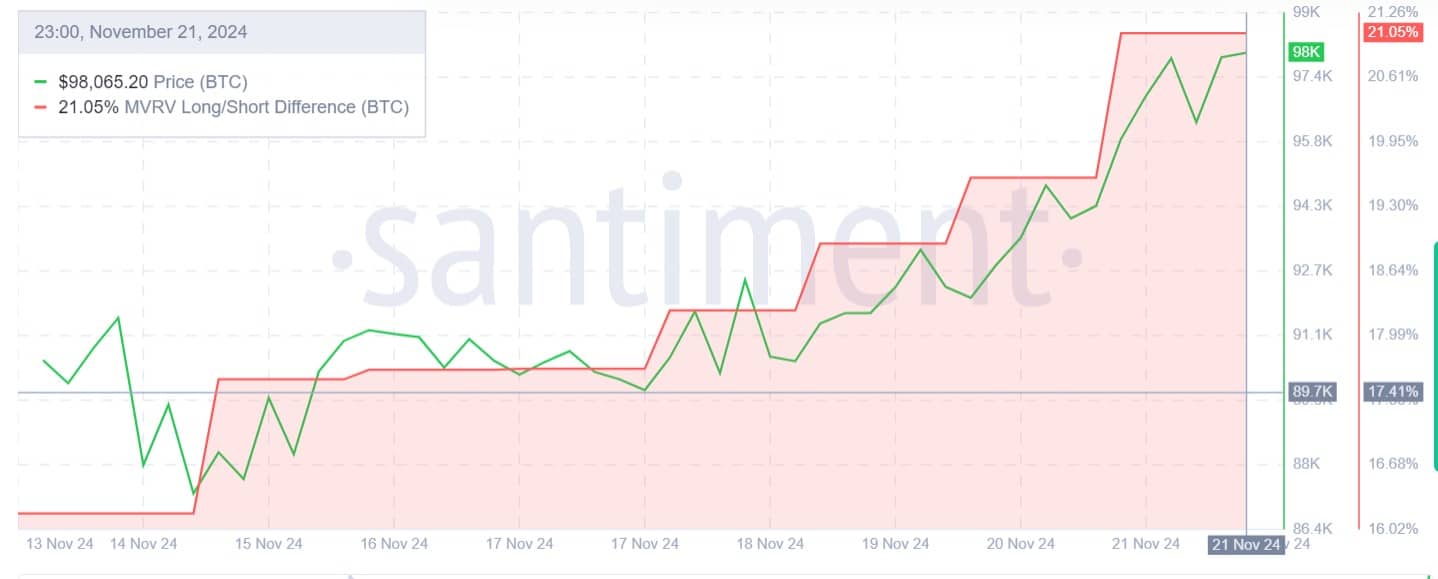

The significant optimism among large Bitcoin investors is clear from the rise in the MVRV long/short gap to 21.05% during the last seven days. An increase in this metric indicates that those holding long positions are currently profitable and expect further price growth.

In simpler terms, the ratio of Bitcoin’s Large Holders sending their Bitcoins to exchanges has significantly dropped from 3.77% to 0.55%. This significant decrease implies that large Bitcoin owners are accumulating more Bitcoin and transferring them away from exchanges.

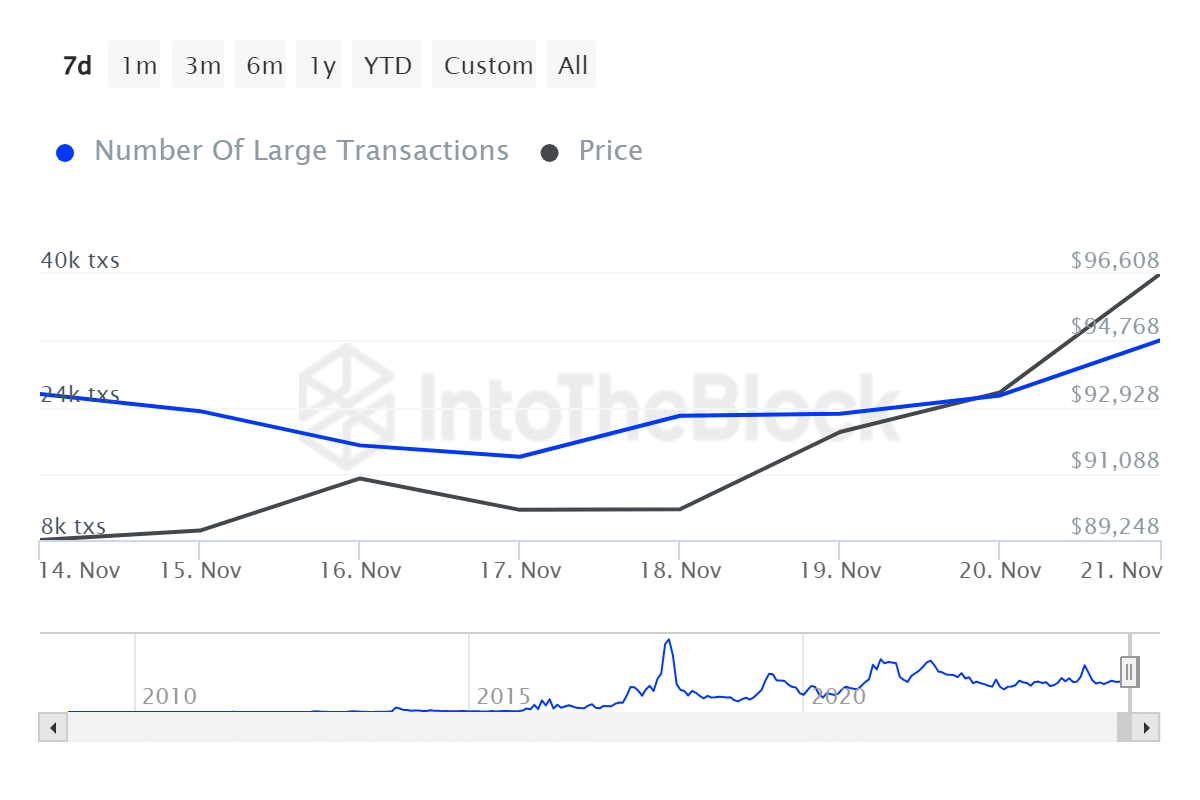

In the end, there’s been a significant increase in large Bitcoin transactions, reaching a weekly peak of 32,020. This suggests that major investors are playing an active role in this market surge, contributing significantly to the recent price spike.

Based on our earlier analysis of the netflow ratio, it’s clear that these transactions involve purchases and transfers to personal wallets.

Consequently, it appears that the market is characterized by a favorable outlook and significant optimism among major investors.

Impact on BTC price charts?

Just as anticipated, the surge in whale presence and activity appears to have significantly influenced Bitcoin’s price trends.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In fact, over the past days, as the above whale was accumulating, Bitcoin has surged from $90407 to $99k.

Similarly, in the last seven days, Bitcoin (BTC) has climbed by approximately 12.82%, currently trading at $98,940 as we speak. This suggests that Bitcoin is exhibiting a robust bullish trend due to heightened activity among large investors or ‘whales’.

Read More

2024-11-22 13:11