- Whales purchased 360M XRP, igniting speculation of a sustained bullish breakout

- Historical whale activity revealed mixed outcomes, highlighting the potential for both rallies and retracements

Historical context – Do whale purchases lead to sustainable gains?

As a seasoned researcher who has navigated through countless market cycles and trends, I must say that the recent 360 million XRP purchase by whales has indeed piqued my interest. While it does ignite speculation of a potential bull run, history has taught me that whale activity can lead to both rallies and retracements.

I remember vividly the time when whales went on a shopping spree in mid-2023, only for the gains to evaporate within weeks. On the other hand, the whale-driven rally in late 2023 showed signs of a more sustained uptrend. So, while I’m intrigued by the current surge, I’m also cautious about potential volatility.

The technical setup seems to lean bullish, but as they say in this business – “Bull markets climb walls of worry.” The key lies in understanding whether this excitement translates into increased adoption and consistent buying pressure or fizzles out as speculative fervor subsides.

And let me leave you with a little humor – I remember back in the days when I was just starting out, I used to think that predicting market trends was like predicting the weather – 50% accurate. Now, I realize it’s more like trying to predict the weather on Mars! But hey, who needs accuracy when you can have fun, right? Let’s see where this XRP journey takes us!

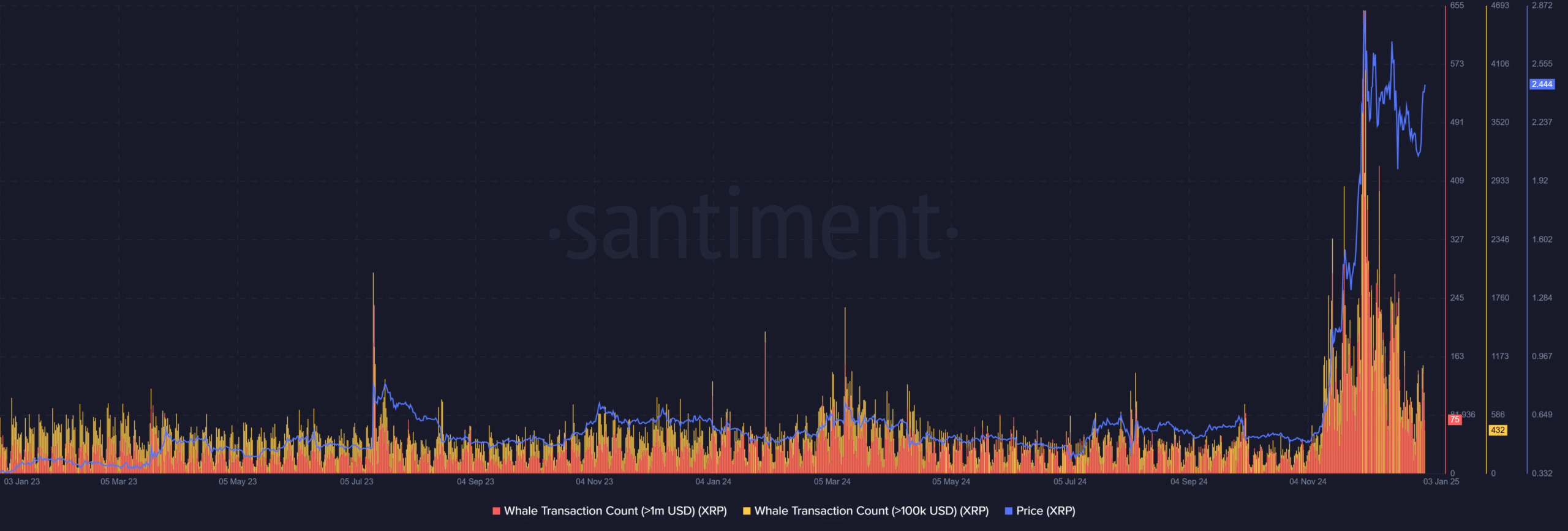

Examining the past trends of XRP reveals a pattern where large-scale transactions (over $100K and $1M) by ‘whales’ tend to coincide with significant price increases.

For example – In mid-2023, a large increase in whale purchases was followed by a substantial surge, yet this growth period was brief, as prices soon fell back within a few weeks. However, the whale-led rally towards the end of 2023 demonstrated a more prolonged upward trend; after peaking, the price levels remained elevated and steady.

This consistently emphasizes a common pattern – Whale actions may create temporary excitement, but the long-term robustness of prices is influenced by broader market trends, retail involvement, and significant triggers from the fundamentals.

Considering the current upward trend caused by whales, it’s important to exercise caution – Past events indicate a possible risk of fluctuations, not necessarily a certain prolongation of the bull market.

XRP – Gauging breakout potential

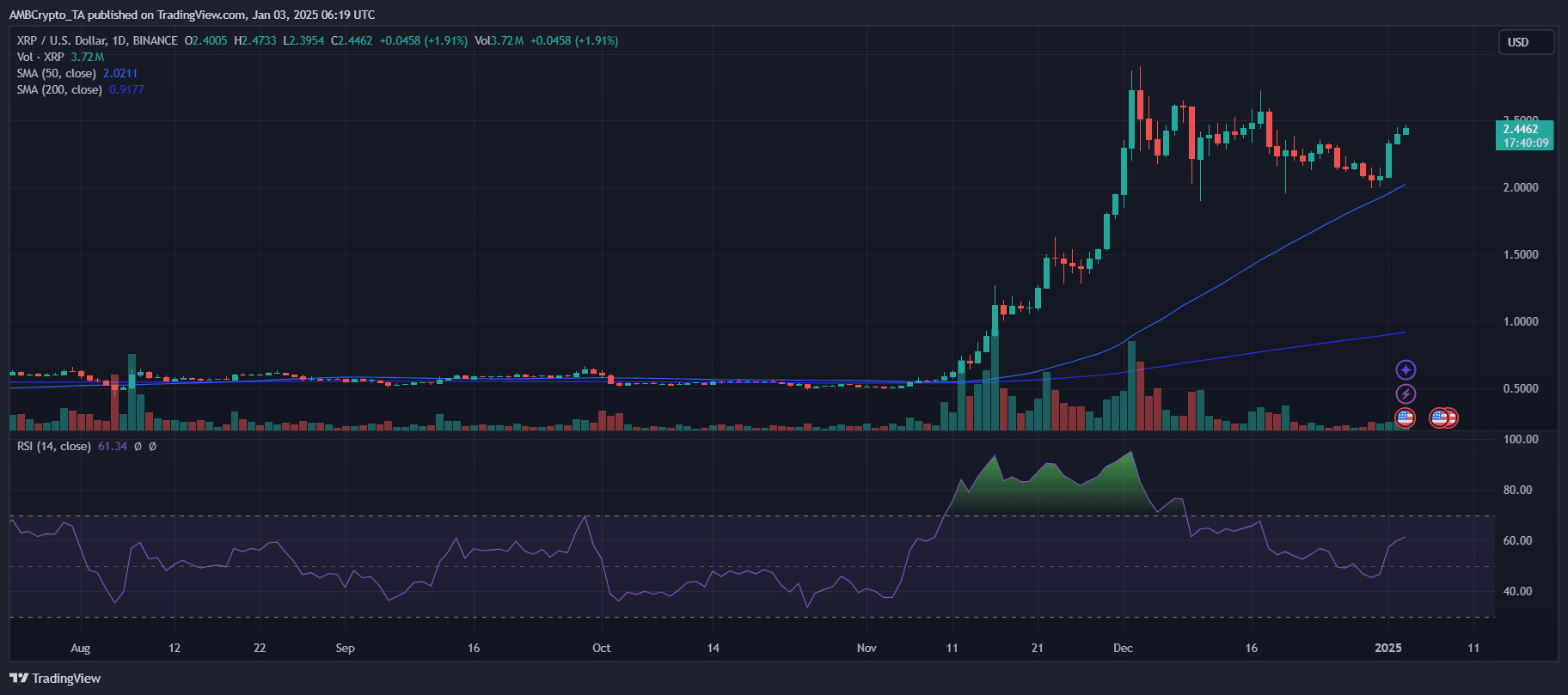

The graphical representation of XRP’s pricing shows a clear upward trend, and the daily chart emphasizes a substantial level of support situated above the 50-day Simple Moving Average (SMA). This critical point has frequently functioned as a catalyst for positive price surges.

The 200-day SMA seemed to be distant too, highlighting long-term bullish sentiment on the charts.

As a researcher, I’ve noticed that the Relative Strength Index (RSI) suggests a bullish trend without pushing too far, indicating potential for further growth before we reach overbought territory. Moreover, I’ve observed an increase in trading volume during market surges, which points to genuine investor interest rather than speculative fluctuations.

If the price rises above $2.50 – an important psychological and horizontal resistance point – it could lead to a breakout, possibly aiming for $3.00. But if this level isn’t surpassed, there might be a period of stabilization. As of now, the technical structure appears to favor the bulls, with increasing volume and RSI divergence being crucial factors for further progression.

Key insights

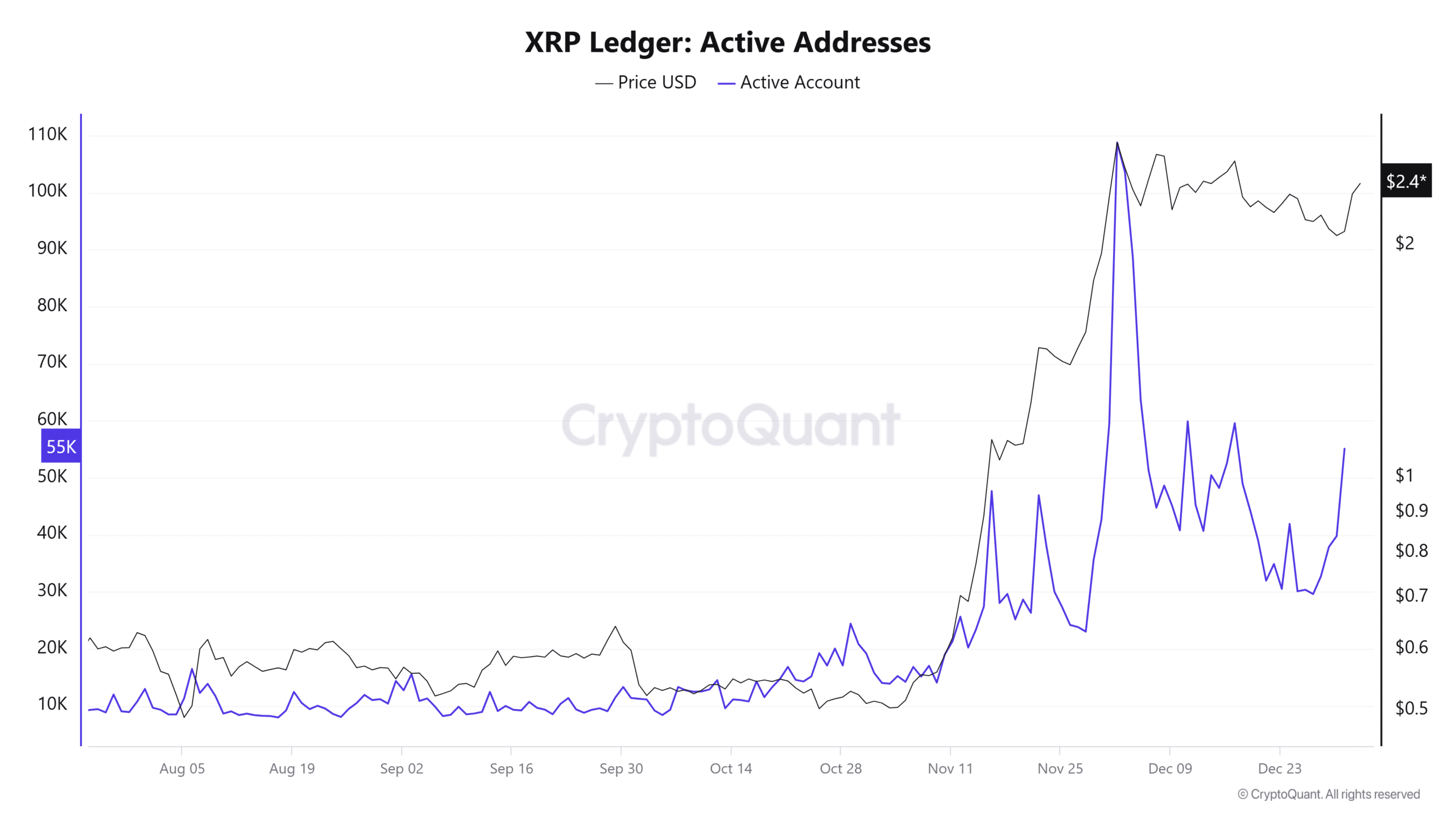

The active user chart highlighted a notable increase in user interaction, reaching its highest point concurrently with price spikes. This implied growing retail and institutional attention, which is typically a sign that increased volatility could follow.

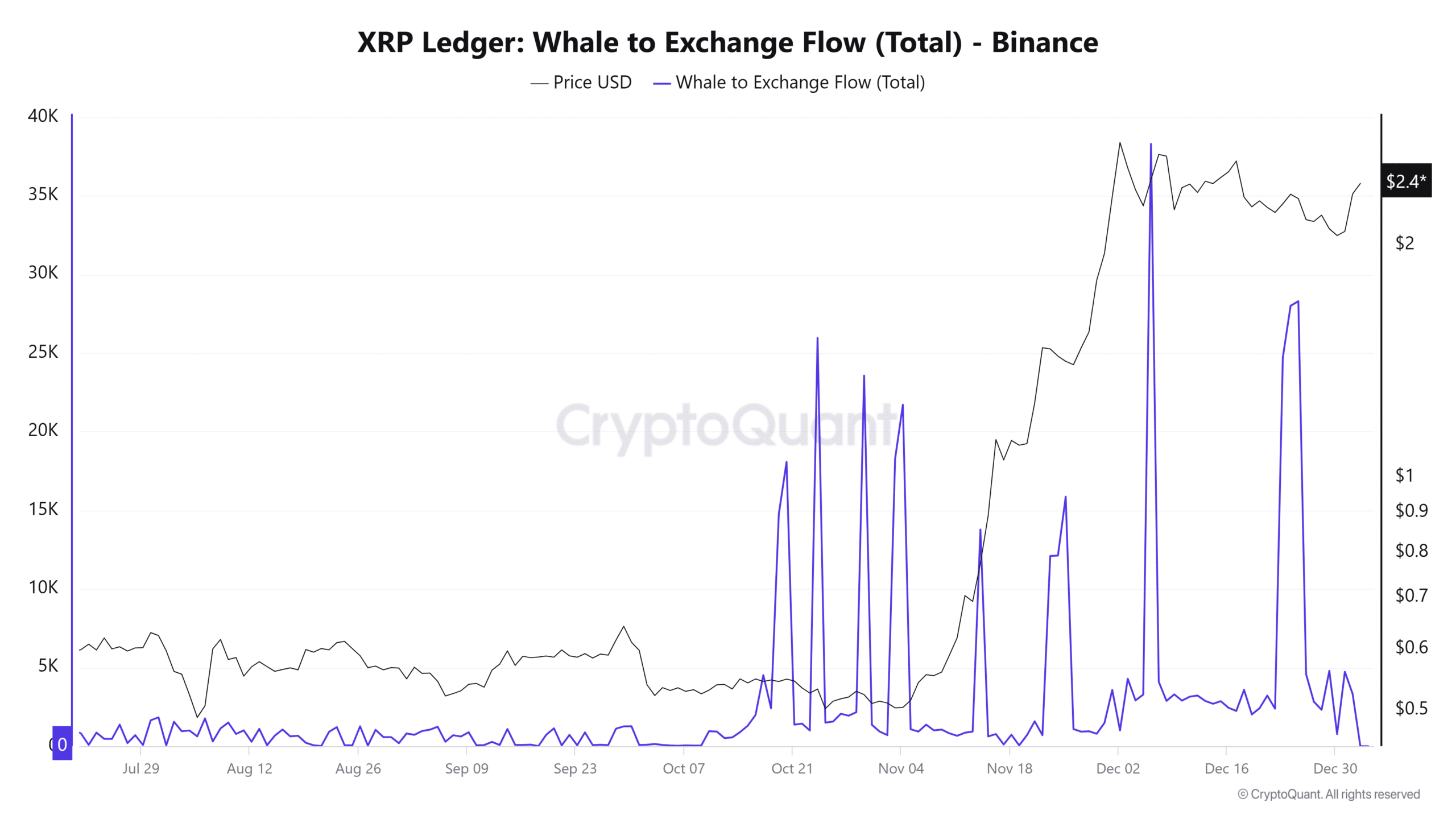

During periods of price increase, it appears that whales (large holders) are transferring their tokens to exchanges, as shown in the flow chart exchange process diagram. This could suggest either profit-taking actions or adjustments in market position by these significant players.

Such actions might indicate a level of caution, since large amounts of inflow into exchanges could potentially create a demand for selling.

During a hike in cryptocurrency trading activity, the increased involvement suggests a wider base of participants. However, for continued price growth, it’s crucial that there is a decrease in large investor (whale) sell-offs and ongoing retail investor support to soak up liquidity.

Riding the high or caution ahead?

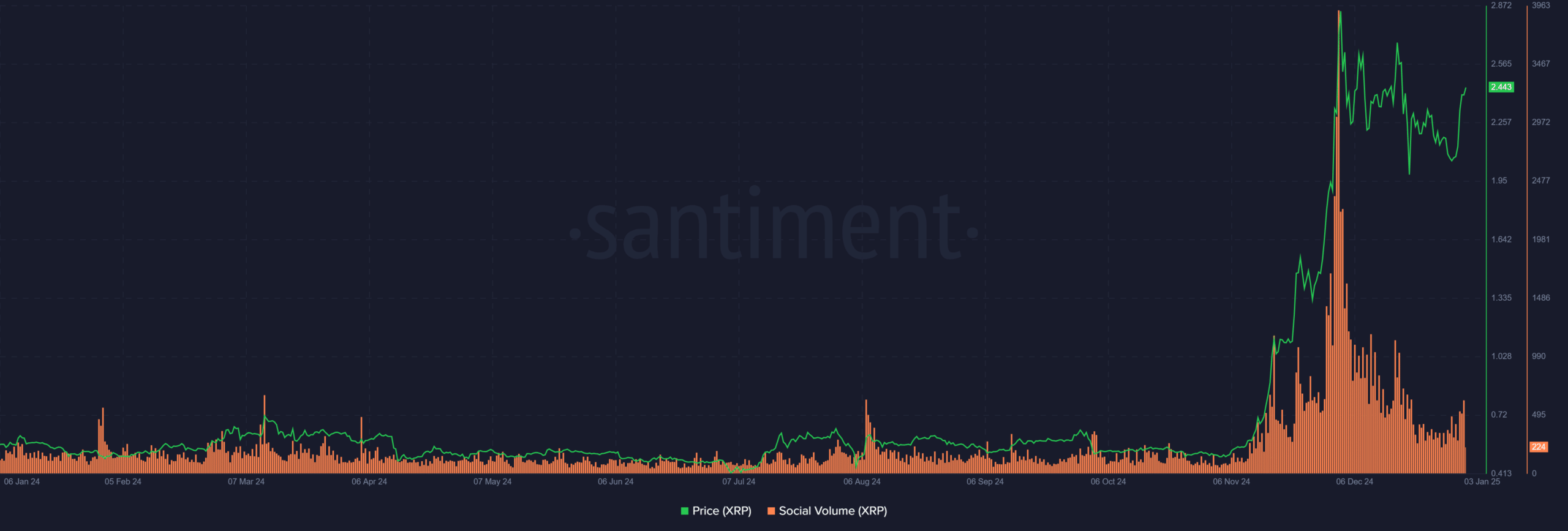

In summary, the Cryptocurrency Fear and Greed Index stood at 74, suggesting a high level of optimism bordering on greed, while an increase in XRP’s social media activity hinted at elevated curiosity and enthusiasm within the crypto market.

Historically, such elevated sentiment has often coincided with price tops, as euphoria takes hold.

As optimism propels this current surge, it’s crucial for investors to exercise caution since significant pullbacks frequently occur when excessive enthusiasm takes over.

Achieving sustainable growth hinges on whether this enthusiasm leads to broader acceptance and persistent demand, or if it dwindles when speculative interest subsides.

Read More

2025-01-03 17:12