- Whale accumulation and technical indicators suggest LINK could rebound from its critical $21 support.

- Rising transactions, active addresses, and falling reserves reinforce confidence in LINK’s bullish potential.

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself drawn to Chainlink [LINK]. The recent whale activity and technical indicators suggest that LINK could rebound from its critical $21 support, which is reminiscent of the classic “buy low, sell high” strategy.

In the bustling cryptocurrency market, Chainlink [LINK] is causing quite a stir. Over nine newly activated wallets withdrew approximately 362,380 LINK, which equates to around $8.19 million, from Binance within a span of 48 hours. This substantial movement by whales suggests growing enthusiasm for LINK’s prospects, fueling rumors of an impending price surge.

As I analyze the current market situation, it’s clear that Chainlink is currently trading at $21.87, marking a 4.62% decrease over the past 24 hours. These fluctuations suggest a possible change in momentum that might significantly alter its course ahead.

Key resistance level could define LINK’s next move

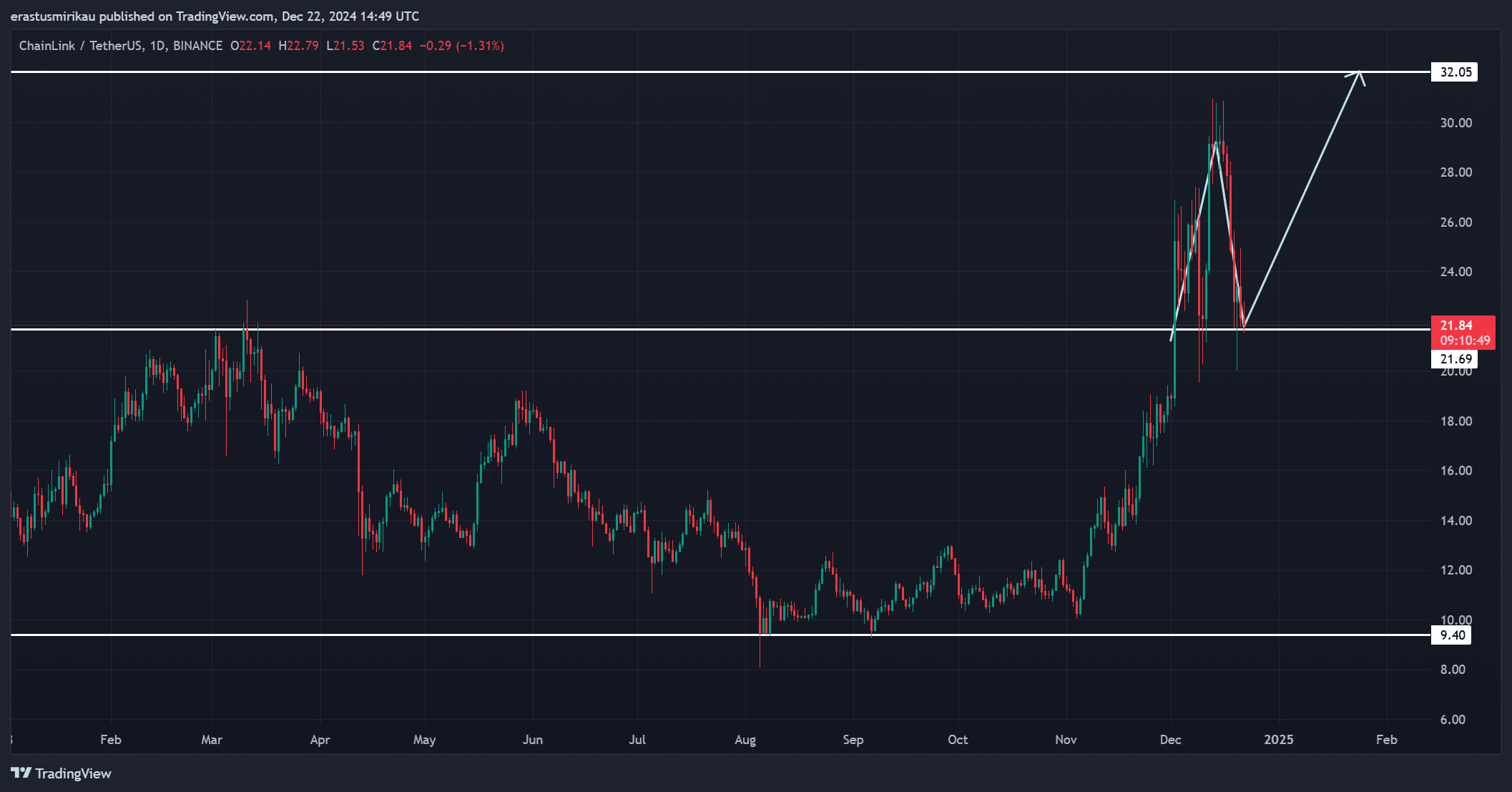

As an analyst, I find myself observing a crucial juncture for Chainlink (LINK). Following a significant climb to reach $32 in November, LINK has since retreated to its current position around $21, which appears to be a substantial support zone. Should this level hold firm, it could potentially function as a springboard propelling us back toward the previous high of $32.

If Chainlink can’t maintain its current level, it might drop even more, reaching lower points of support. Keep a close eye on those price points because they will determine the short-term direction for LINK.

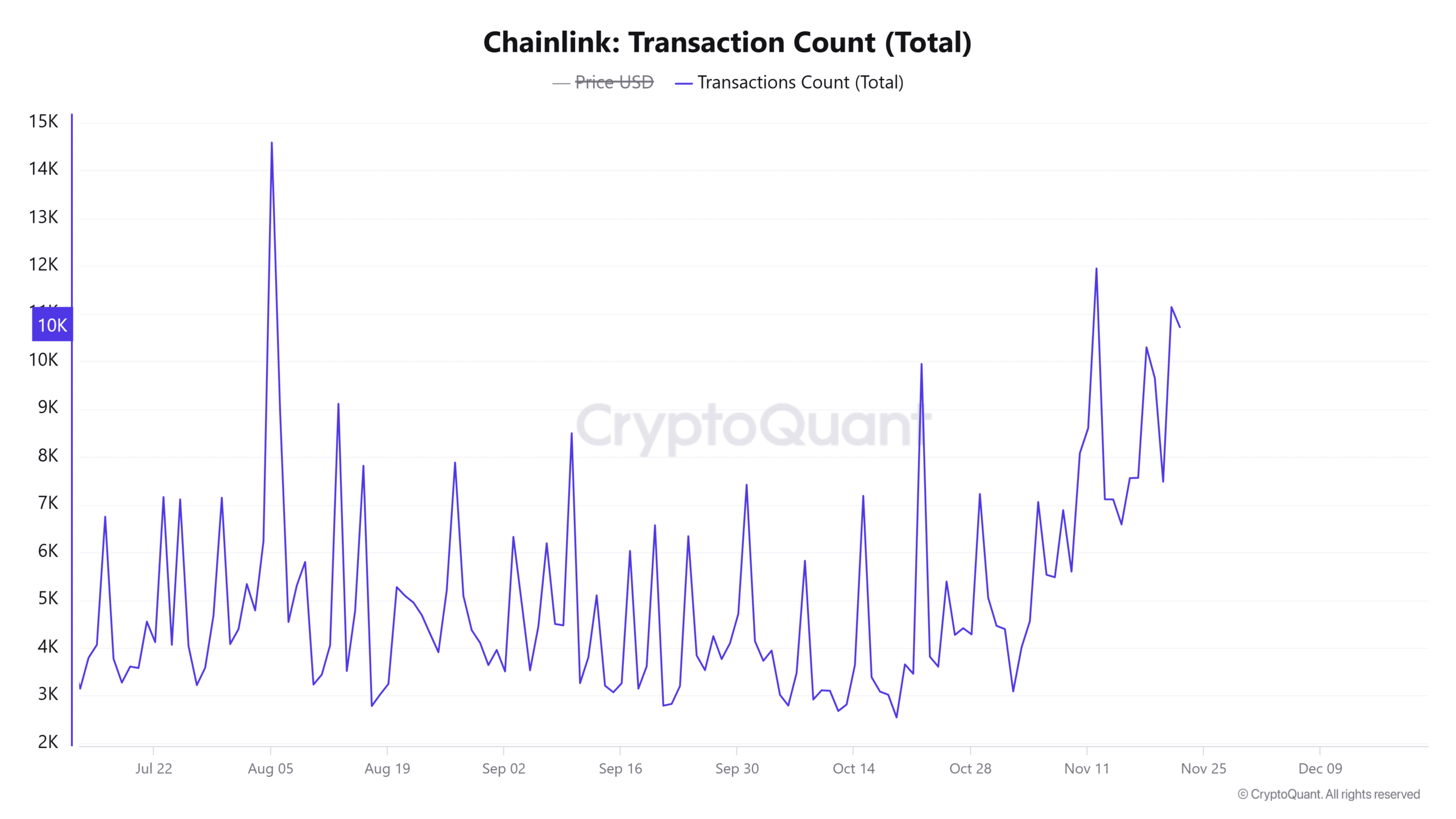

LINK’s growing transactions hint at brewing activity

In the past 24 hours, the number of transactions on Chainlink grew by approximately 0.76%, reaching a total of 10,000. This surge suggests more on-chain action and a revitalized level of attention from market players.

Furthermore, a rise in this value frequently aligns with price fluctuations, hinting at potential major shifts in Chainlink’s price trajectory. As such, this indicator highlights the market’s expectation for Chainlink’s upcoming price trend.

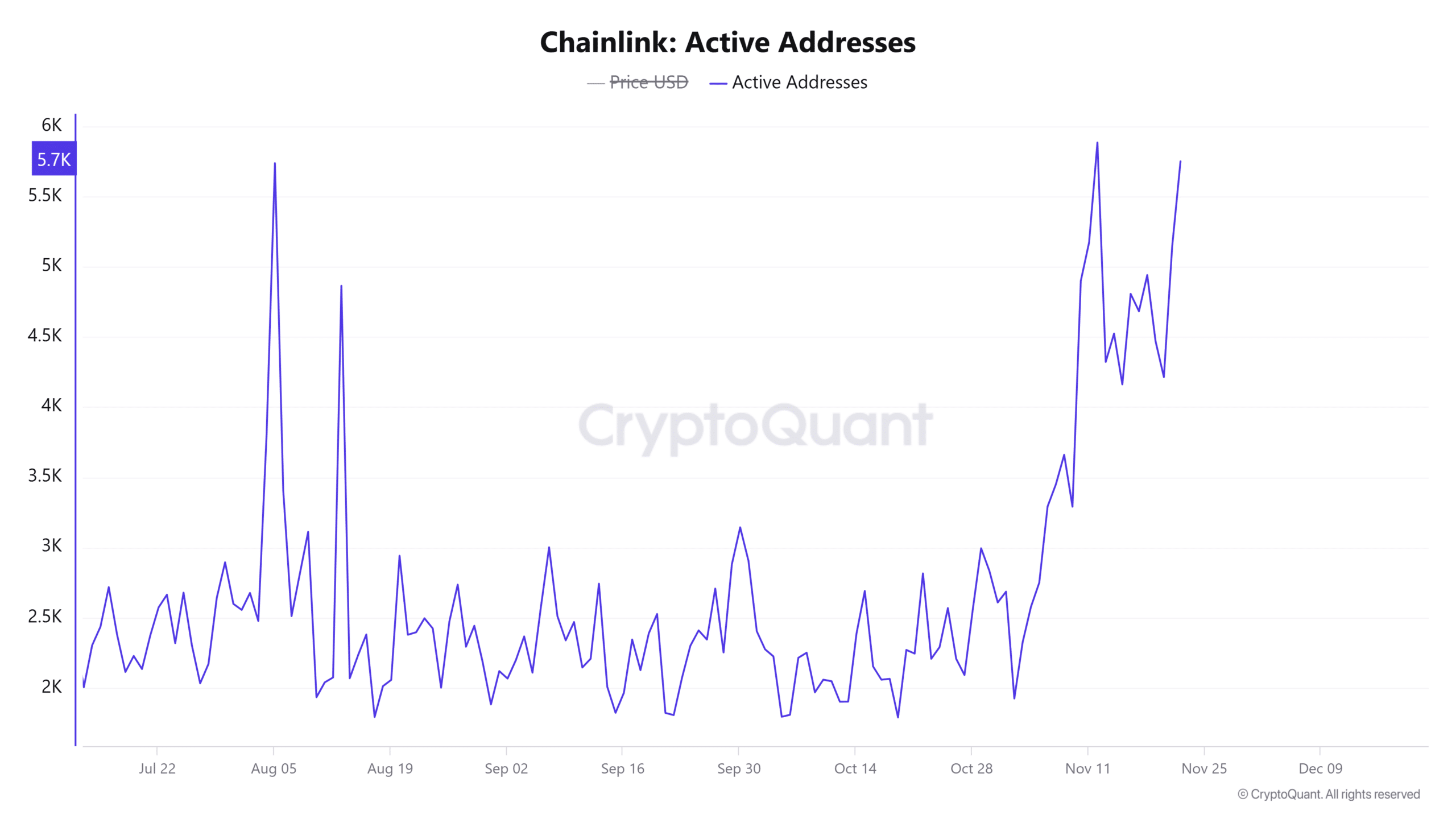

Rising active addresses reflect network confidence

Active addresses also grew by 0.83% in the past day, reaching 5.7K. This rise aligns with whale accumulation, signaling stronger engagement within Chainlink’s network.

As a cryptocurrency investor, I find it encouraging to see an uptick in active addresses associated with LINK. This trend suggests growing interest and adoption, fueling optimism about its potential growth. In essence, this data underscores the notion that the LINK network is primed for continued expansion.

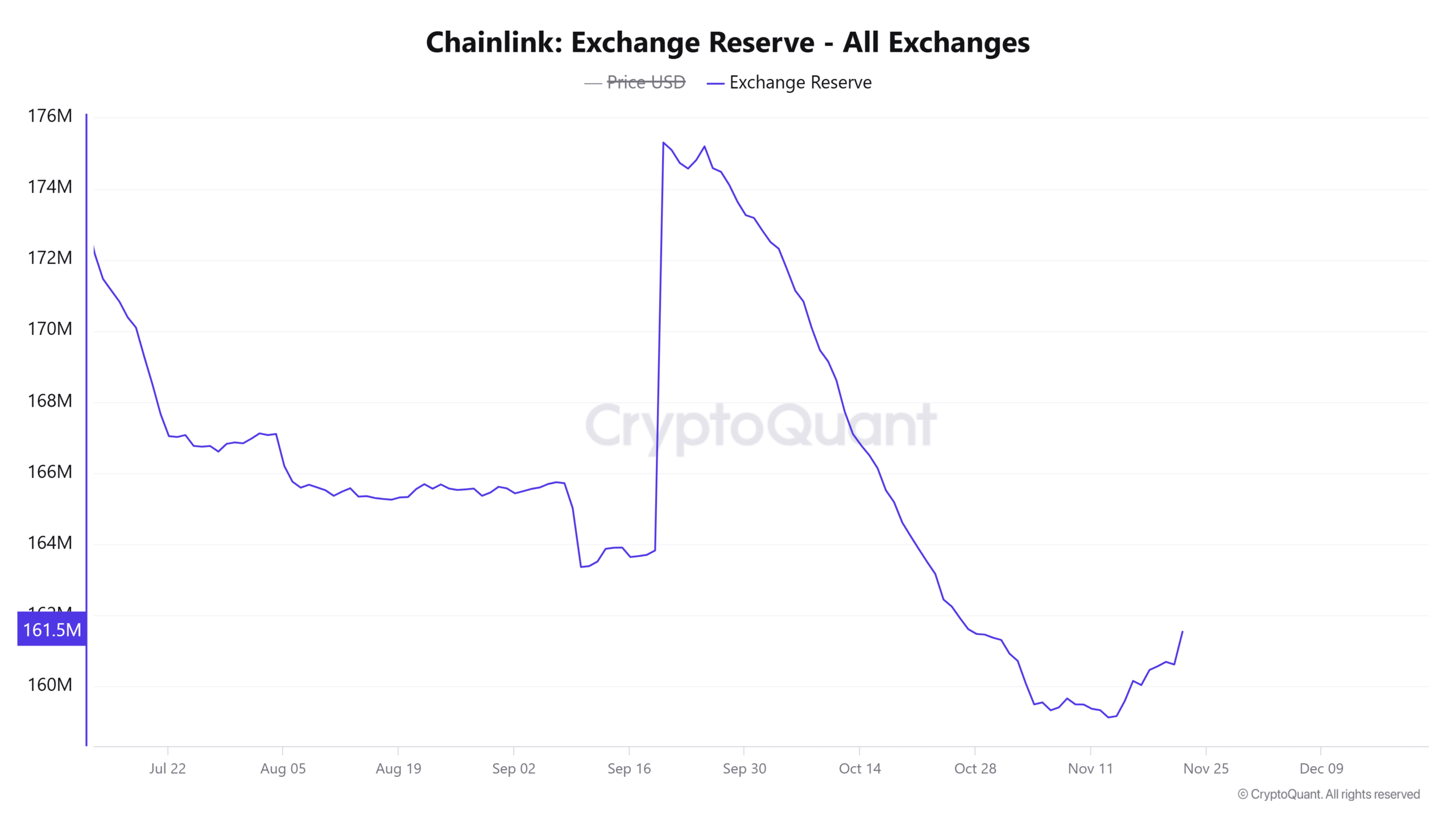

Declining exchange reserves could limit selling pressure

Exchange reserves for Chainlink fell by 0.26% to 161.5 million over the last 24 hours. This decline suggests reduced selling pressure as holders move tokens off exchanges, potentially to hold for the long term.

Furthermore, the increasing number of whales (large investors) and decreasing reserve amounts provide strong evidence supporting the prediction of an upward price trend.

Based on the latest whale activities by LINK, along with an increase in transactions, active addresses, and a decrease in exchange reserves, it appears that the future trend could be quite positive or bullish.

Given current trends, it seems likely that Chainlink could regain its $32 resistance level soon, as long as it continues to hold its crucial support at $21.87.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-12-23 10:15