- Crypto shorts worth $371M were squeezed, showing the rise of speculative dominance.

- However, weak fundamentals could quickly reverse this momentum.

As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a mix of excitement and caution as I navigate this dynamic market. The recent squeeze of $371M in crypto shorts, driven by the election buildup and bullish sentiment, has propelled Bitcoin to new heights. Yet, I remain wary of the potential for weak fundamentals to reverse this momentum.

The election buildup sparked massive liquidity in the options market, wiping out $371 million in crypto shorts and driving Bitcoin [BTC] to a new ATH of $76K.

Following a 0.25 percentage point reduction in the FOMC rate, which has boosted the market by almost 2%, it’s clear that the bullish trend is unstoppable. This upward push could potentially propel Bitcoin to reach $78,000, with retail investors flocking in due to favorable sentiments towards Bitcoin.

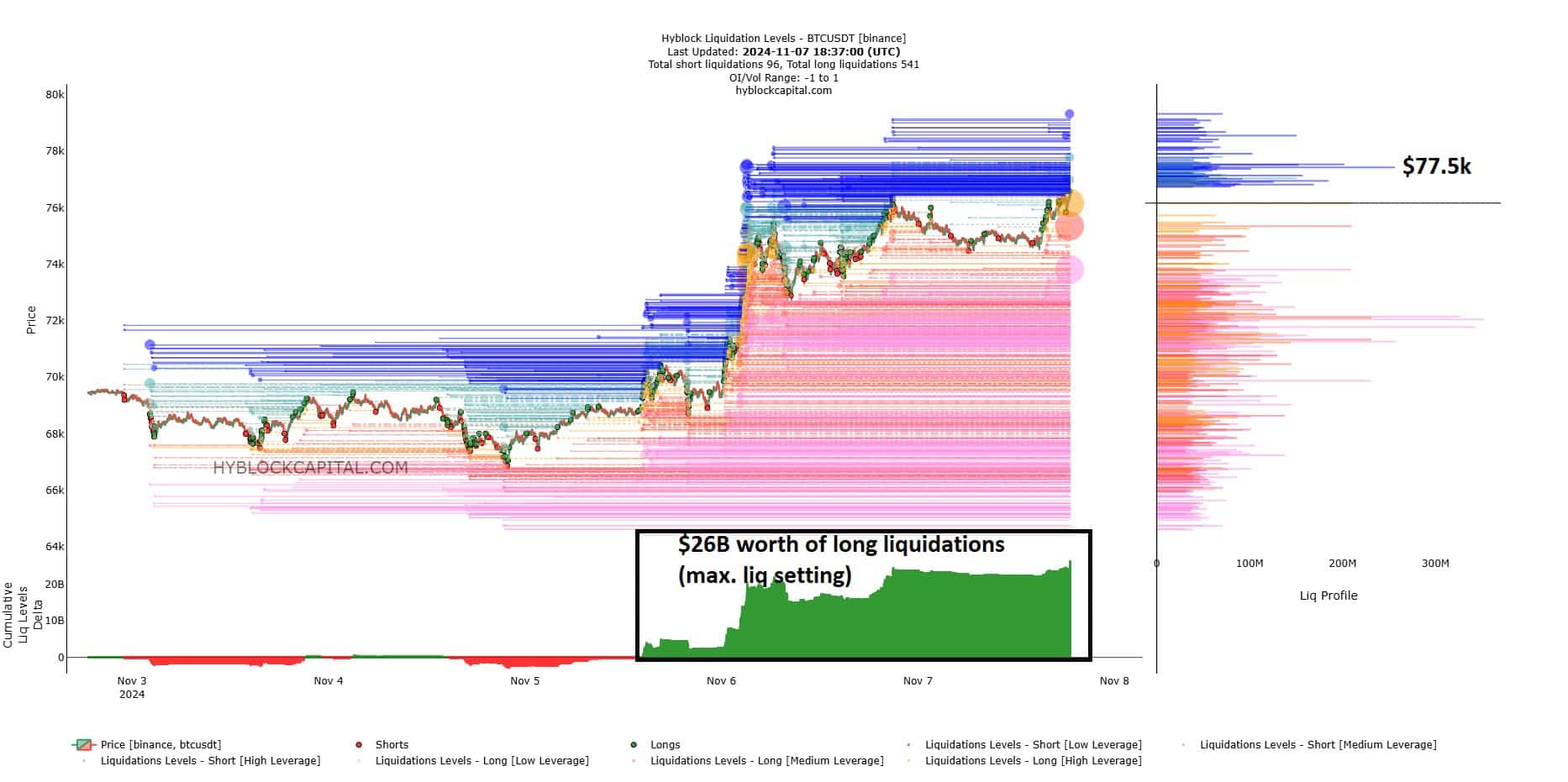

On the other hand, it’s evident from the data that there are many unrealized long positions, or “long liquidations.” This situation might lead to a ‘long squeeze,’ an event where these positions are forced to be closed before the weekend. Consequently, a slight market correction could potentially shake out those who jumped in due to fear of missing out (FOMO), posing a significant risk.

Source : HyblockCapital

In essence, people who rushed into investments due to excitement may face potential risks if the market shifts negatively.

At this pivotal juncture, devising a well-thought-out plan is imperative. Relying solely on impulsive speculations without a strong foundation in fundamentals could potentially lead to unfavorable outcomes.

Volatility brewing as the derivative market evolves

The approach leading up to the election, along with notable endorsements, seems to be setting up a favorable scenario for Bitcoin to possibly hit $80K before the current month ends.

Over time, following an election, there have been comparable responses, but over the last four years, the derivatives market has significantly changed. Notably, the Open Interest (OI) has reached a record-breaking peak of $45 billion.

With an increase in betting, it’s clear that the market momentum is becoming progressively influenced by speculative investments. This is evident when looking at the large-scale liquidation of $371M in crypto short positions.

Over the last three days, there have been $26 billion worth of new long positions created, with investors wagering that a bull market could occur, fueled by optimism stemming from Donald Trump’s election win.

Although this points towards an optimistic trend, if there’s insufficient robust buying activity, it might lead to a long squeeze situation, potentially preventing Bitcoin from hitting its $80K goal.

As a crypto investor, I find myself shifting my attention back to the core aspects of each project, assessing the market’s response to the ever-changing trends.

Can crypto shorts become more vulnerable?

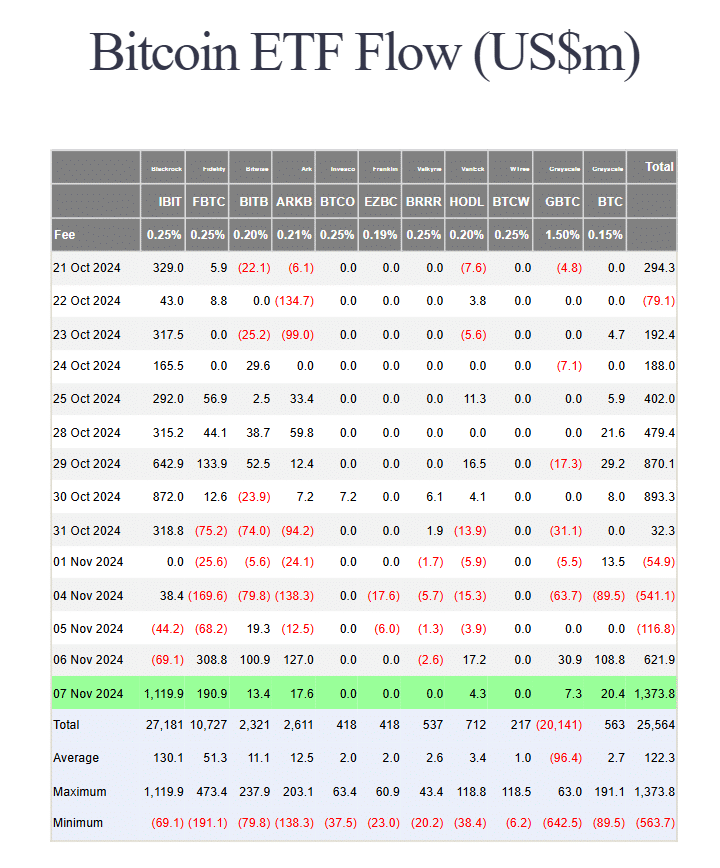

A current AMBCrypto analysis shows that individual investors are taking advantage of Bitcoin’s drop in price, propelling it to record levels as it approaches a market low point. Simultaneously, institutional interest is escalating, with Bitcoin ETFs experiencing a $1.3 billion increase in investments – the highest since their debut.

Source : Farside Investors

To maintain a solid base at around $76,000 for a possible jump to $100,000, it’s essential that there’s continuous buying from both individual and institutional investors. Absence of this support might jeopardize the upward trend by triggering a prolonged sell-off.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Instead, if there is solid backing, it’s probable that more people will take long positions, which could make short positions in crypto progressively more risky.

As an analyst, I find myself optimistic about the current Bitcoin (BTC) rally. Should this momentum hold steady, we might witness a prolonged uptrend, possibly propelling BTC beyond the $80K mark. Nevertheless, it’s crucial to closely scrutinize the derivative market at this juncture, as its movements could significantly impact the overall trajectory of Bitcoin prices.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-11-09 00:08