- Nearly $3 billion in BTC and ETH options expire, with traders bracing for major volatility and key price action.

- Market makers reposition amid holiday trading lull as $98K BTC and $3,700 ETH levels dominate attention.

As a seasoned researcher who has navigated through the tumultuous waves of cryptocurrency markets, I find myself bracing for potential volatility as we approach the $3 billion Bitcoin and Ethereum options expiry on December 13th. The current market conditions, characterized by a holiday trading lull and key price levels dominating attention, present an intriguing mix of opportunities and risks.

As an analyst, I find myself closely monitoring the upcoming expiration of options contracts for Bitcoin (BTC) and Ethereum (ETH), totaling approximately $3 billion, scheduled for the 13th of this month. Historically, these expirations have sparked heightened market activity as traders carefully scrutinize potential price fluctuations, making it an exciting period to observe.

Currently, Bitcoin is valued at approximately $100,073, and Ethereum is being exchanged for around $3,881.12, as per the latest figures from CoinGecko.

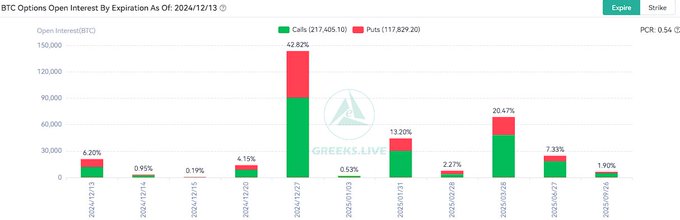

Bitcoin options worth $2.1 billion near expiry

As a crypto investor, I find myself facing an interesting scenario where approximately $2.1 billion worth of Bitcoin options contracts are set to expire. The current put-call ratio is 0.83, suggesting that there are more bullish bets (call options) than bearish ones (put options). This could imply a stronger optimism among investors about the potential rise in Bitcoin’s price. However, it’s essential to remember that this is just one indicator and should not be used as the sole basis for investment decisions.

The max pain point—the price level where most options will expire worthless—is $98,000.

Keeping an eye on future fluctuations, as Bitcoin’s total value currently stands at approximately $1.98 trillion, with around 20 million coins in circulation among traders.

The trading volume for Bitcoin within a 24-hour period has surged to $94.48 billion, indicating an increase in trading activity as the deadline draws near.

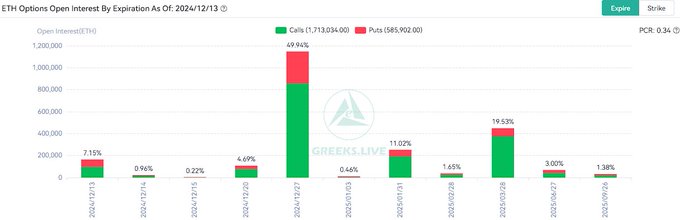

Ethereum options see $640M expire

Ethereum has $640 million in options expiring, with a put-call ratio of 0.68, showing even stronger bullish sentiment than Bitcoin. The max pain point for ETH is $3,700, a critical level that traders are watching closely.

In the last 24 hours, the trading volume for Ethereum has reached approximately $44.47 billion. Its total market value is currently estimated at around $467.65 billion, while the number of Ethereum in circulation amounts to about 120 million units.

Despite experiencing a minor 0.63% decrease over the past day, Ethereum’s weekly progress has been steady, suggesting cautious optimism from traders as they observe and await further developments.

Market makers reposition as liquidity declines

As reported by Greeks.live, market makers are adjusting their stances during these expiration periods, a time that often aligns with lower trading volumes during the holiday season.

Market analysts have pointed out an increase in Anticipated Volatility (AV), suggesting that prices may experience more significant fluctuations because market participants seem to be gearing up for greater price swings. As for the holiday period, analysts at Greeks.live explain that lower trading volume during these times can amplify the volatility in financial markets.

In addition, they pointed out the increasing link between crypto values and the U.S. stock market, implying that fluctuations in stock prices could potentially impact cryptocurrency trends.

Economic data adds complexity

These options will end following a week’s worth of significant U.S. economic events. The inflation rate for November rose to 2.7%, while the core Consumer Price Index stood at 0.3%. This suggests that inflationary issues persist.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Although a reduction in interest rates by the Federal Reserve is anticipated, doubts persist about whether inflation could potentially postpone this easing process.

As an analyst, I posit that the convergence of these elements, including the expiration of substantial crypto options, might escalate market dynamics, potentially leading to increased trading activities.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-13 17:11