-

$4.7 billion in BTC and ETH options are set to expire, potentially influencing market volatility.

Technical analysis on the chart shows us possible price movements for Bitcoin and Ethereum following the options expiry

As a researcher with extensive experience in the cryptocurrency markets, I find today’s event particularly intriguing. With over $4.7 billion in Bitcoin and Ethereum options set to expire, market volatility is a certainty.

Today in the financial world, there’s immense interest in the cryptocurrency market as it prepares for a major development.

In the last 24 hours, Bitcoin (BTC) has experienced a 1.4% increase in value and now costs around $68,223. On the other hand, Ethereum (ETH) has risen by 0.7%, with its current price being approximately $3,733.

The past two weeks have seen significant growth for Ethereum, with a impressive 23.3% rise. This surge may be attributed to the U.S. Securities and Exchange Commission’s recent decision to approve a spot ETF for the asset, adding to its momentum.

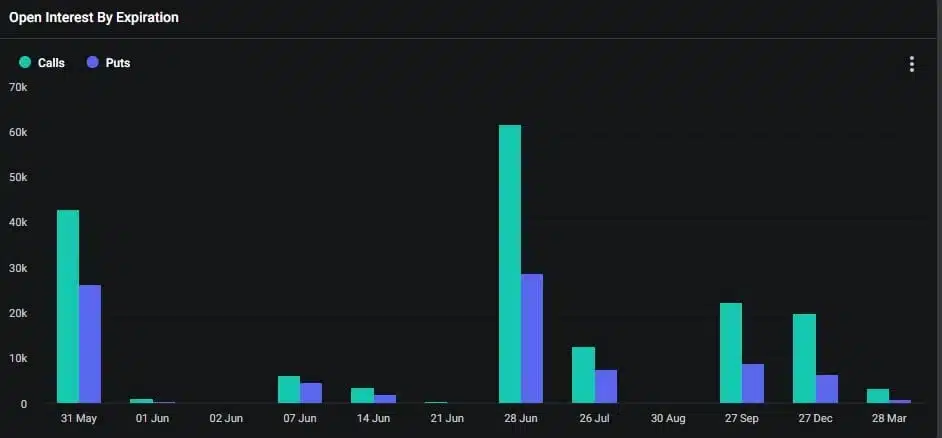

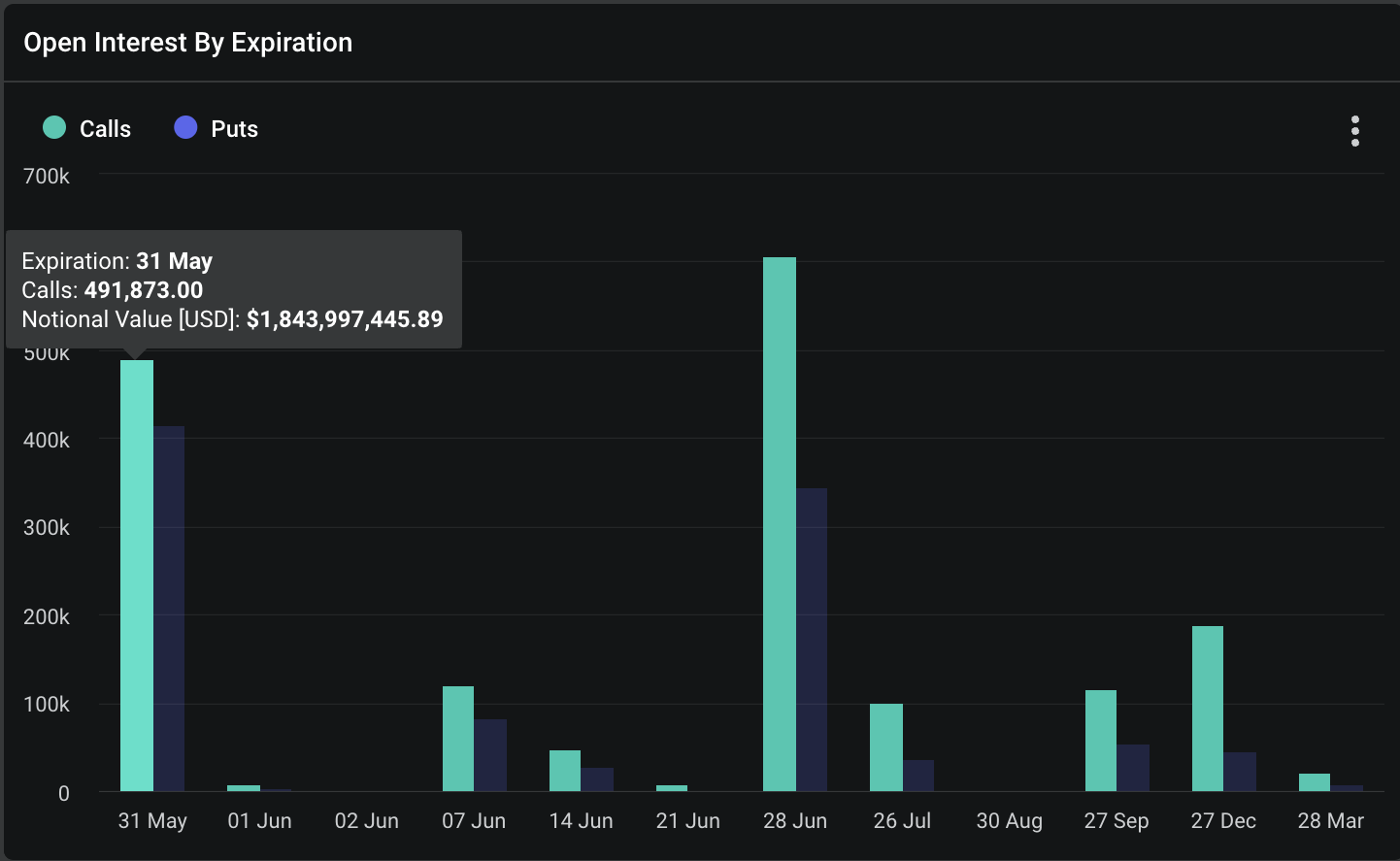

As a researcher studying the cryptocurrency market, I’m excited to note that today, May 31st, marks a significant milestone: the expiration of approximately $4.7 billion worth of Bitcoin and Ethereum options contracts in notional value.

Decoding crypto options

In the realm of cryptocurrencies, traders are offered the chance to acquire call or put options on an underling asset, similar to traditional finance. With these contracts, one is granted the ability, not the requirement, to execute a buy (call) or sell (put) transaction at a predetermined price prior to expiration.

Based on the data from the Deribit platform, there’s a predicted rise in market turbulence due to today’s expiration of Bitcoin and Ethereum options contracts. This anticipation stems from the significant number of these contracts about to be settled.

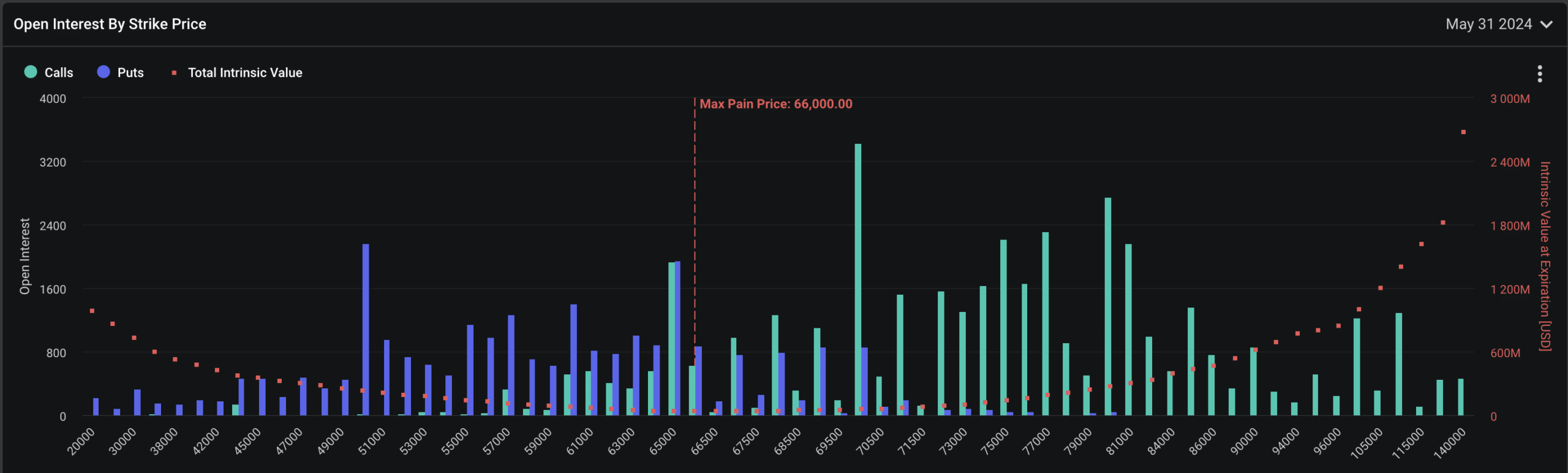

An examination of the Bitcoin options market reveals a greater prevalence of call options over put options, signaling a bullish attitude amongst traders. More precisely, the put-to-call ratio for Bitcoin currently hovers around 0.61, implying that a larger proportion of bullish contracts are in play.

The point of maximum financial harm for option holders is estimated to be approximately $66,000, which is significantly less than the current market values.

As a researcher studying the options market, I’ve observed some intriguing trends. Specifically, I’ve noticed that there are a large number of options with strike prices up to $100,000, amounting to a significant open interest worth approximately $886 million. Contrastingly, there is a substantial open interest of around $519 million at the $60,000 strike price. This suggests a notable discrepancy between bullish and bearish sentiments in the market.

Notably, the current notional value for BTC calls options stands at $2.9 billion.

In the case of Ethereum, approximately $1.8 billion worth of Ethereum call options are set to expire during the day, while the put-to-call ratio stands at 0.84.

The ratio indicates that Ethereum’s short-term pricing outlook is evenly considered among traders. Simultaneously, the open interest in Ethereum futures is approaching record highs, driven by speculative trading fueled by the anticipated ETF approval.

Technical analysis and market forecast

As a seasoned market analyst, I believe conducting a thorough technical examination of Bitcoin (BTC) and Ethereum (ETH) charts is indispensable for anticipating their potential reactions to today’s substantial options expiry events.

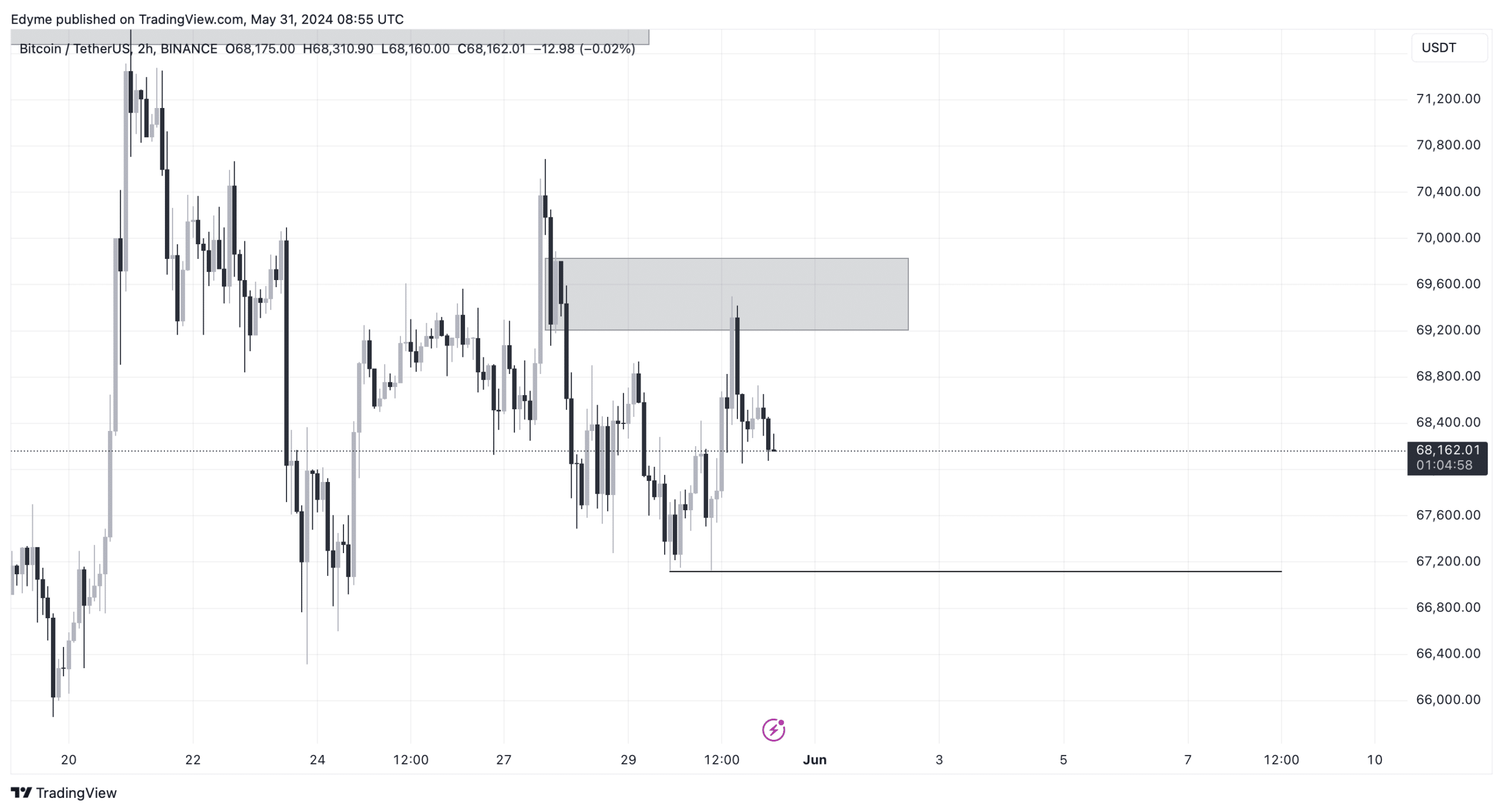

As a researcher studying cryptocurrencies, I have observed that Bitcoin’s daily price swings often position it in a premium zone. This situation typically serves as a warning for potential sellers, who may be looking to offload their holdings and move into the discount zone before a possible market reversal.

Examining Bitcoin’s price action more closely on the 4-hour chart uncovers a significant resistance area where it has run into selling pressure in recent trading, potentially leading to further declines.

As a crypto investor, I’ve noticed that even though there hasn’t been a significant drop below this support level after it was tested, the 2-hour chart indicates another supply test. This could suggest a brief decline towards the $67,000 mark, potentially representing the first major downward trend on the 4-hour chart.

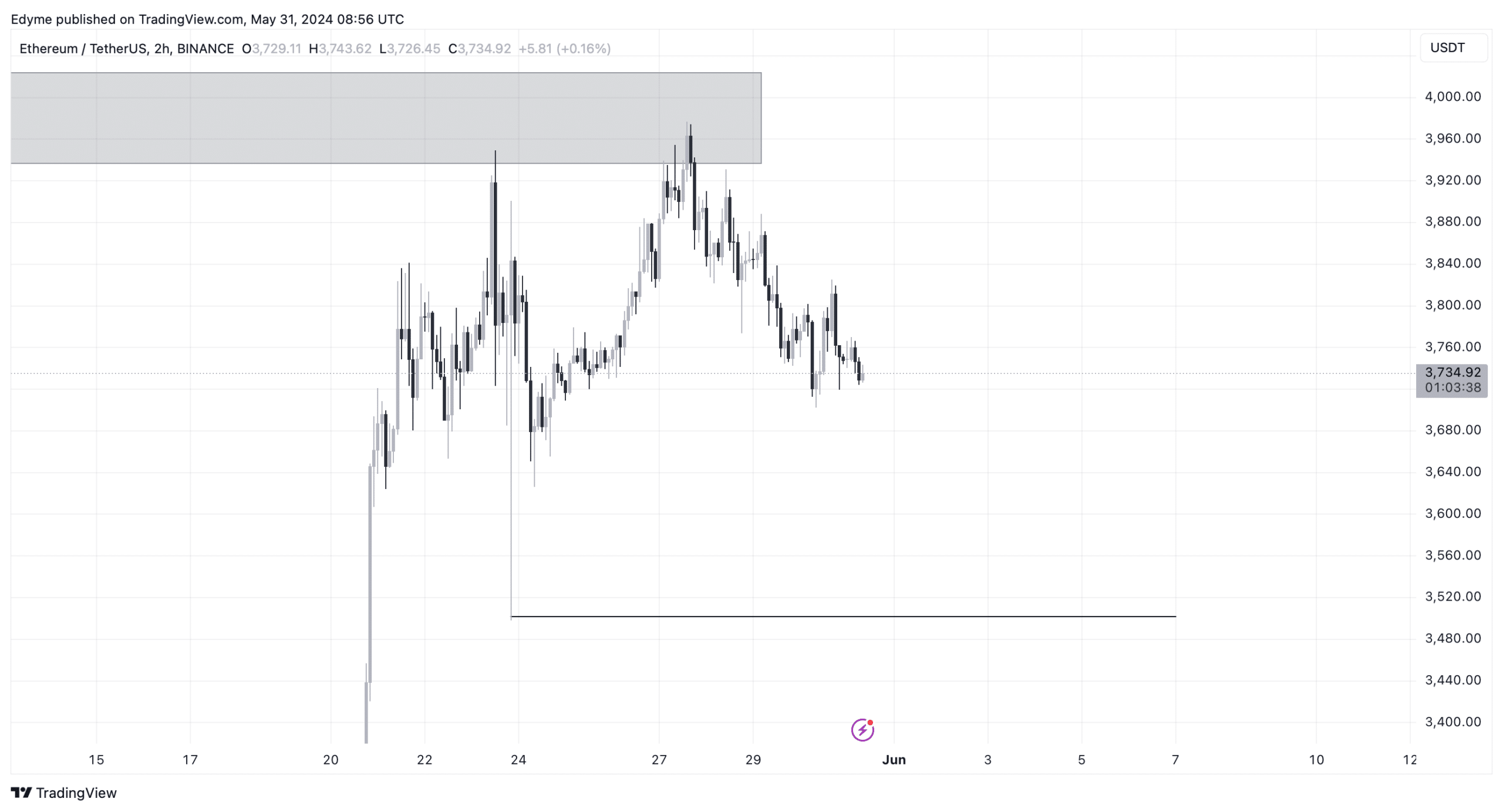

Ethereum has encountered resistance at a particular level on its 4-hour chart, potentially signaling an upcoming price decrease since it continues to trade above its daily chart’s key resistance level.

The chart of this asset over a two-hour timeframe indicates minor ruptures, implying a potential continuation of the decline towards the $3,500 mark.

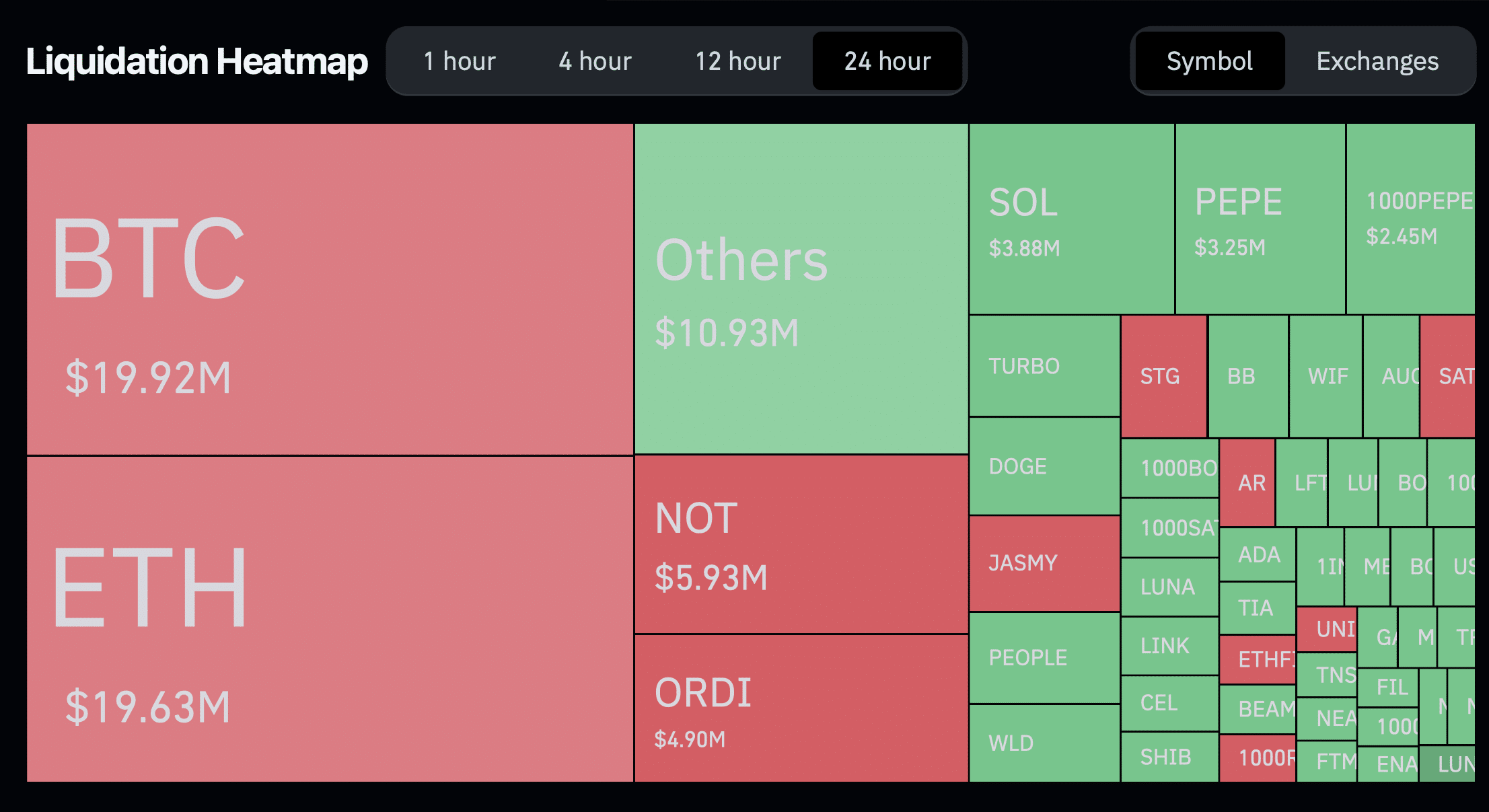

As a crypto investor, I’ve noticed that recent market fluctuations have caused setbacks for some traders in both digital currencies.

Based on data from Coinglass, Bitcoin traders have experienced about $19.92 million in liquidation events, and Ethereum traders have faced around $19.63 million in similar situations.

Read Bitcoin (BTC) Price prediction 2024-25

As a researcher, I’ve come across an intriguing observation from AMBCrypto regarding Bitcoin’s technical indicators. Specifically, the Relative Strength Index (RSI) stands at 53.85, while the Money Flow Index (MFI) amounts to 57.94.

The data suggests a market equilibrium, in which neither buyers nor sellers hold significant power, resulting in stable pricing or limited price fluctuations.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-05-31 20:08