Bitcoin, that fickle lover of chaos, took a dive last week, plummeting 15% and skulking beneath the $100,000 and $95,000 marks like a disgruntled gremlin. 🧙♂️💸

Michael Saylor’s Strategy, ever the bold adventurer, bought 8,178 BTC for $835.6 million at a price that’s now looking less like a genius move and more like a dare to the market. 🤪📉

Strategy’s Holdings And Recent Buys

Now holding 649,870 BTC-equivalent to 3.2% of the entire crypto universe-Strategy’s portfolio is a mix of triumph and existential dread. At current prices, it’s worth $59.38 billion, but let’s not forget the 22% paper gain. Because nothing says “I’m rich” like a spreadsheet. 📊💰

Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK

– Michael Saylor (@saylor) November 17, 2025

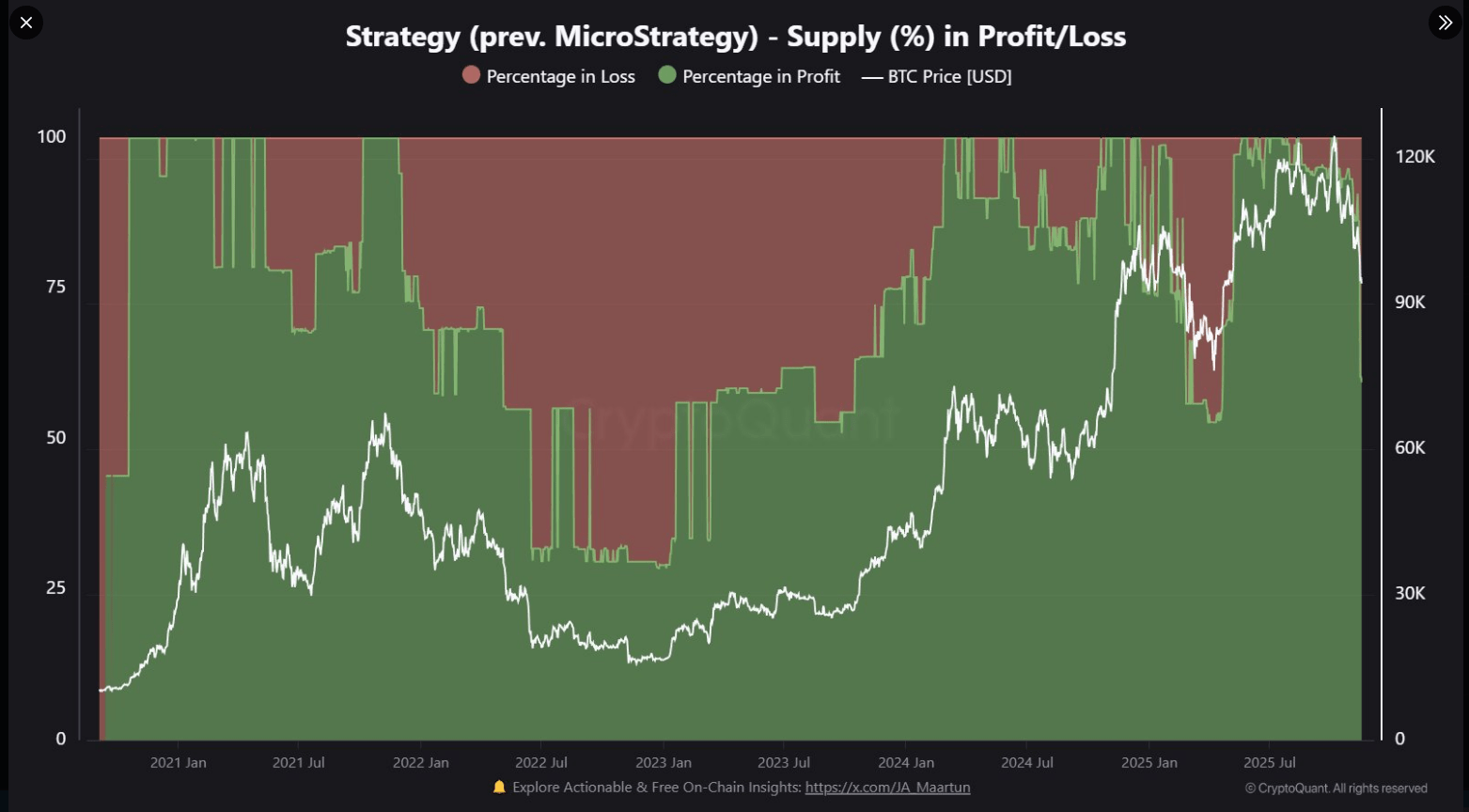

CryptoQuant’s breakdown reveals that 40% of Strategy’s stash is now in the red, because nothing says “I’m a genius” like buying high and hoping for a miracle. 🙏💫

The newest 8,178 BTC purchase is down 10.5%, costing the company $88 million. Because nothing says “financial stability” like losing eight figures in a week. 🧠💥

Saylor’s Portfolio Turns Red?

He announced the purchase of 8,178 BTC at an average price of $102,171, about 10% above current market levels.

This recent bitcoin move puts ~40% of Strategy’s 649,870 BTC holdings in the red, with only 60% still in profit.

– CryptoQuant.com (@cryptoquant_com) November 18, 2025

Short-Term Losses Amid Long-Term Gains

While parts of the position sit in the red, Strategy’s longer-term view remains optimistic. The 22% gain is a far cry from the 33% loss in 2022-2023, which was probably a bad day at the office. 🧠📉

Early last month, Strategy had a peak profit ratio near 68%-proof that markets are as reliable as a toddler’s promises. 🧸🌀

Saylor treats dips as chances to add coins, a strategy that’s either brilliant or a gamble with the universe’s dice. 🎲💸

A Fraud?

Peter Schiff, the gold-obsessed oracle of skepticism, called Strategy’s approach a “fraud.” Because nothing says “I’m right” like calling someone a fraud and then challenging them to a debate. 🤬💸

Schiff warned that if Bitcoin loses its charm, Strategy’s finances could go the way of a dodo. 🦌💥

For the rest of us, the lesson is clear: even the richest people can have a bad week. And by “bad week,” we mean losing 15% of their portfolio. 🤷♂️📉

Strategy’s newer purchases have reduced headline returns, but they didn’t erase the overall gain. Because nothing says “I’m diversified” like holding 649,870 BTC. 🧠💸

Short-term results? Poor. Long-term? Depends on whether Bitcoin gets a promotion or a demotion. 🚀📉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- The Best Members of the Flash Family

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

2025-11-19 18:06