- Massive accumulation of Bitcoin by institutions as retail investors panic-sell.

- USDT dominance bearish reversal pattern to trigger Bitcoin rally.

As a seasoned crypto investor with a few battle scars and victories under my belt, I find myself intrigued by the current market dynamics. The massive accumulation of Bitcoin by institutions while retail investors seem to be panicking sellers is reminiscent of the old adage, “Buy when there’s blood in the streets.”

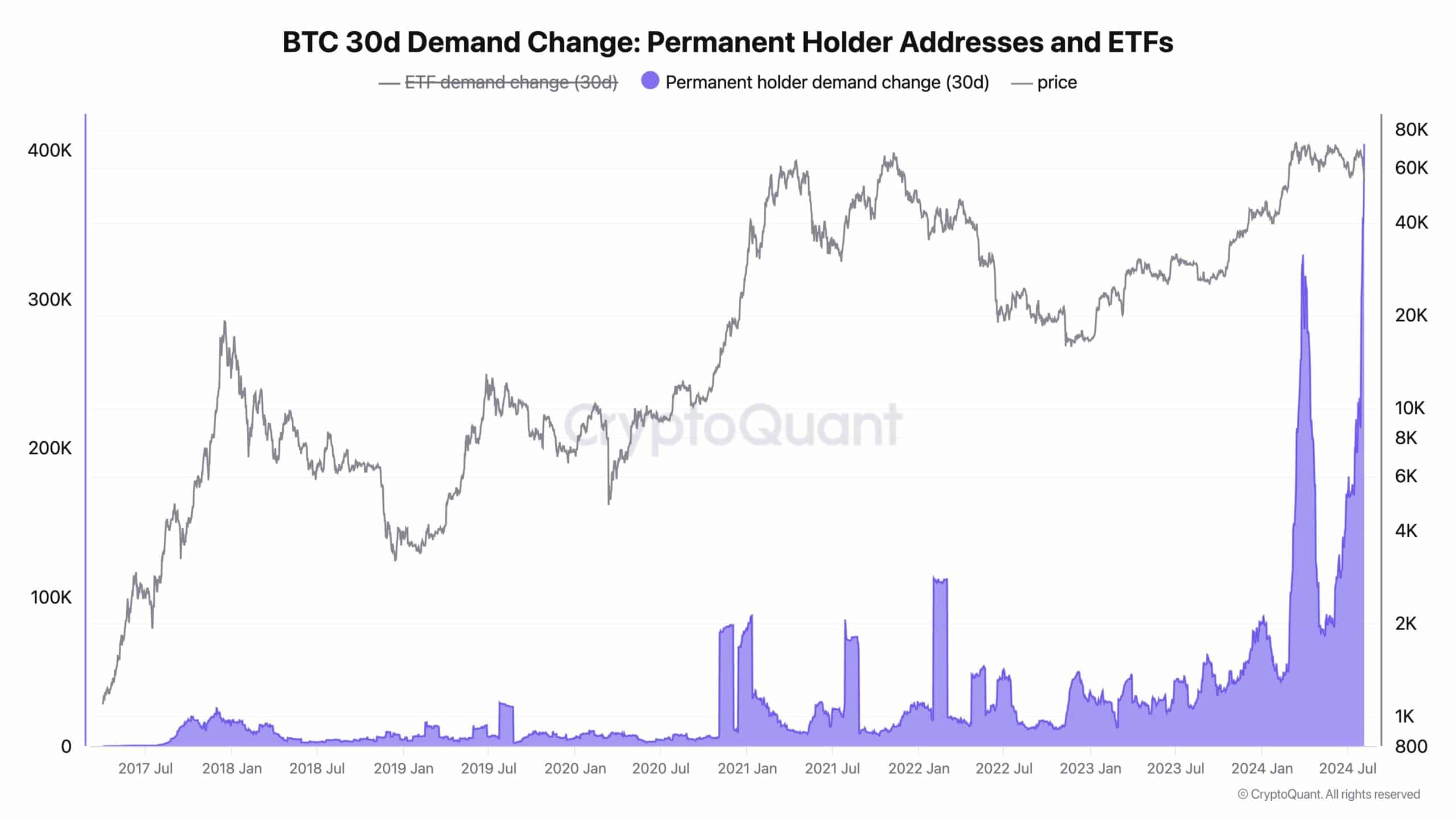

Over the last month, approximately 404,448 Bitcoins, valued at around $23 billion, have been transferred to long-term wallets based on on-chain information, suggesting a substantial increase in holding.

Individual investors, preoccupied with matters like the German government’s sell-off or Mt. Gox problems, might later find themselves regretting their decision not to capitalize on the price drop – a chance that institutions seemingly took advantage of by purchasing stocks during the latest market downturn.

BTC weekly chart mirrors 2019/20 BTC cycle

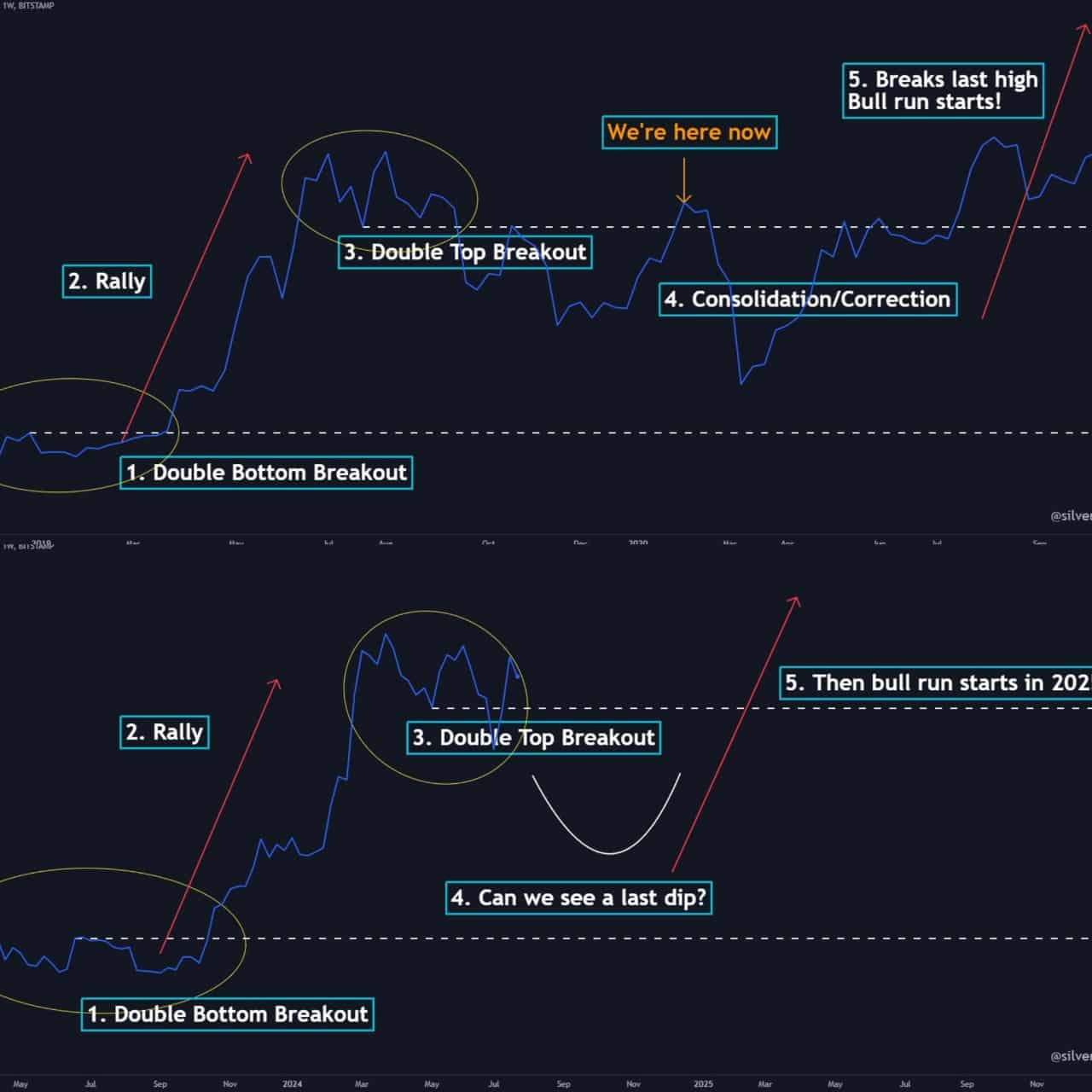

Over the past few weeks, there have been numerous alerts regarding investors and speculators potentially growing too optimistic, disregarding crucial signals visible on the Bitcoin weekly graph.

As someone who has been closely following market trends for over two decades, I find this year’s chart strikingly similar to the 2019-20 cycle. It reminds me of a rollercoaster ride, with its double bottom (the low points), a peak with a double top (high points followed by a dip back down), a break (a significant decline), and then a rally (an upward trend). The parallels are uncanny, making me wonder if history might repeat itself.

At the moment, Bitcoin (BTC) appears to be undergoing a corrective period, which might represent its final drop before another surge. This stage has sparked considerable interest from institutions, as large amounts of Bitcoins are being transferred to long-term storage wallets.

Are we seeing history repeat itself?

USDT dominance falls, Bitcoin rises

A decrease in the dominance of USDT (Tether) frequently leads to an increase in cryptocurrency prices. This trend was clear during ‘Crypto Black Monday’, a day when approximately $1.7 billion worth of crypto assets were sold off.

The dominance of USDT encountered a significant resistance level, which it failed to break through, suggesting a possible change in the market trend’s direction.

The 50-day exponential moving average was also retested, confirming the trend reversal. This event highlighted the high volatility of the crypto market and the inherent risks involved.

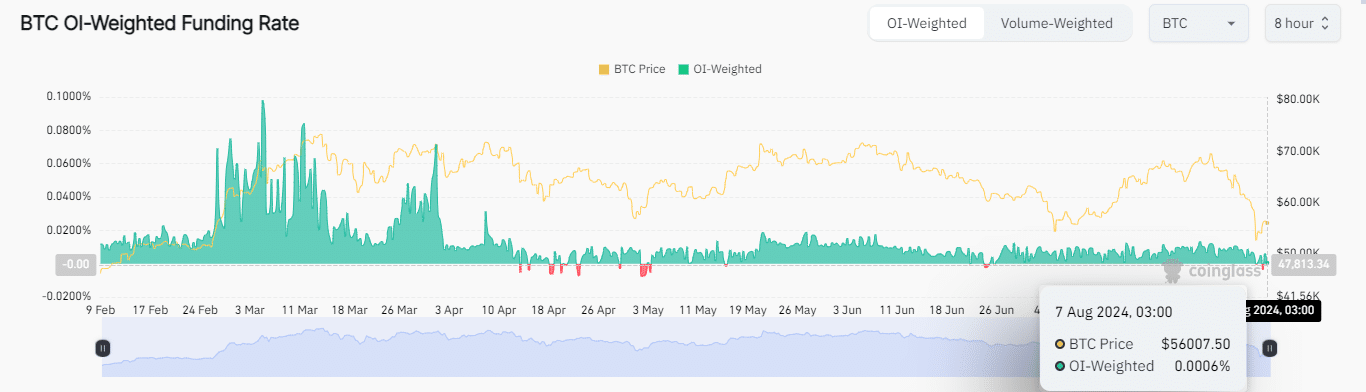

Bitcoin volume-weighted funding rate vs institutional buys show divergence

A difference arises when two similar indicators head in opposite ways, possibly hinting at an upcoming change in the market trend.

Is your portfolio green? Check the Bitcoin Profit Calculator

A falling Bitcoin funding rate suggests a bearish trend, but heavy institutional buying outpacing retail selling indicates a possible reversal.

This market correction might last 4 to 8 weeks, followed by a potential rally in Q3 2024.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-08-07 21:11