- Bitcoin’s recent 5% dip to $95K isn’t a typical shakeout of weak hands.

- With all economic signs pointing to a volatile rally ahead, it’s time to stay sharp and cautious.

As a crypto investor, I’ve been enjoying a week of respite, but it seems the crypto market isn’t done tossing us curveballs yet. Yesterday, Bitcoin [BTC] displayed a stark red candlestick on its daily chart, hinting at a 5% dip in its value.

Surprisingly, overheating isn’t the culprit here. So, who’s pulling the strings this time?

The hum suggests a possible instance of “manipulation”. Without any clear technical indicators predicting a fall, this dip seems more like a deliberate action rather than a natural market adjustment.

Either way, the risk is sky-high

Fresh statistics have emerged, showing robust PMI figures, numerous job vacancies, and an unexpectedly robust U.S. economic performance. However, this was swiftly followed by a steep decline in unstable assets, representing the second significant tumble within a short period of time.

Initially dropping to $91,000, Bitcoin experienced its first fall, having reached an all-time peak of $108,000 only two weeks prior. However, true to its characteristic resilience, it swiftly recovered, regaining the $100,000 mark in a mere seven days.

Similarly, the recent decrease in BTC might indicate a bullish trend. Even though the U.S. Dollar Index (DXY) reached a two-year peak at 109.27, a 5% drop suggests resilience.

Moreover, it’s worth noting that Bitcoin tends to recover strongly, particularly when large institutional investors enter the market and absorb available resources, which might imply an impending supply shortage.

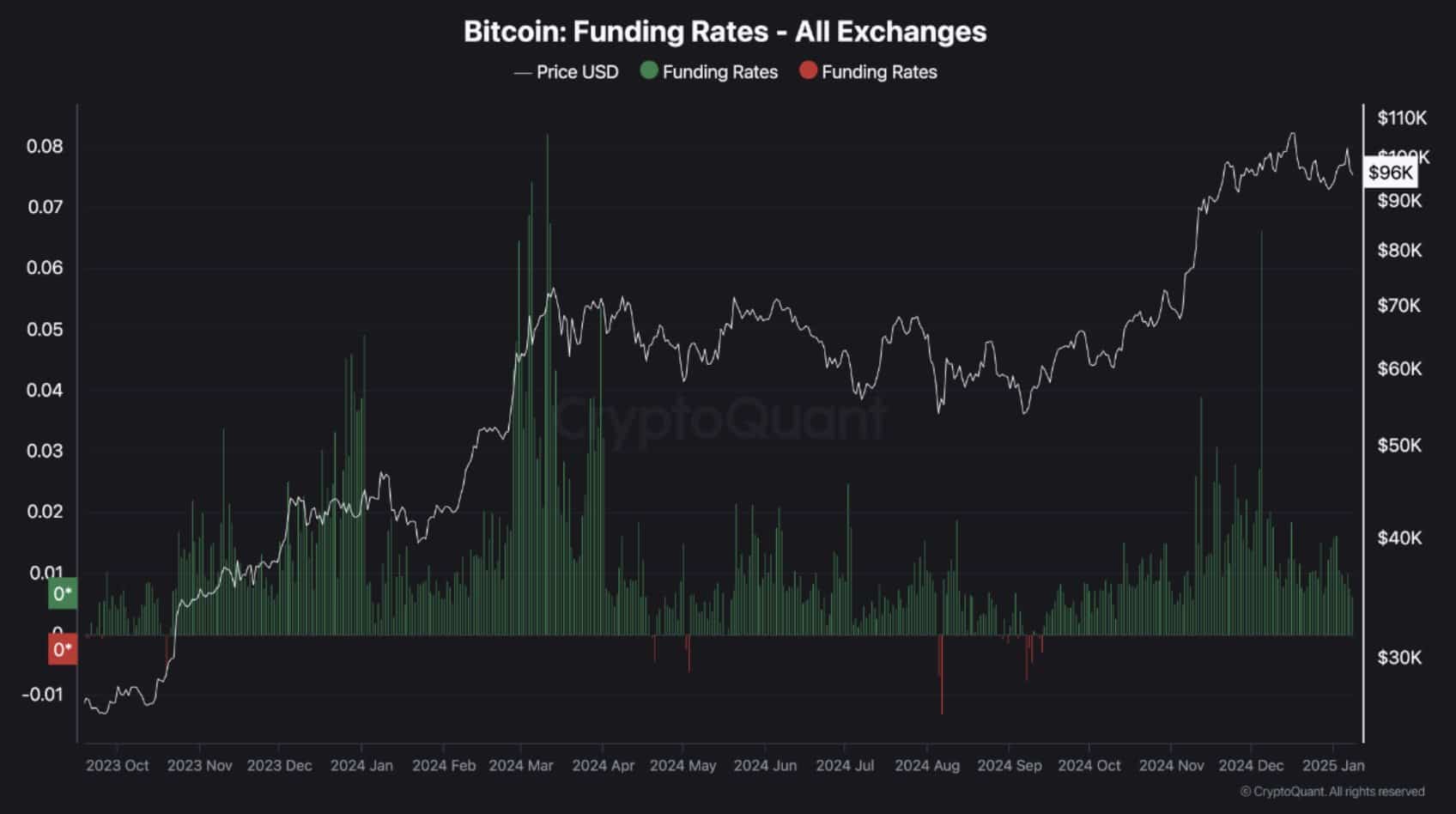

Despite a seemingly positive market recovery, there’s a concern looming – the sense of risk prevalent among investors. This uncertainty has resulted in a massive loss of over $114 million in long positions, leading to a steady decrease in Funding Rates.

This action may be setting up a mental hurdle, especially challenging for individual retail investors and day traders, as they might be hesitant due to their search for an opportune time to jump back in for potentially higher returns.

If the difference between the new price and $102K is substantial, it might act as a catalyst, restoring confidence in the market.

So, where is the next Bitcoin bottom?

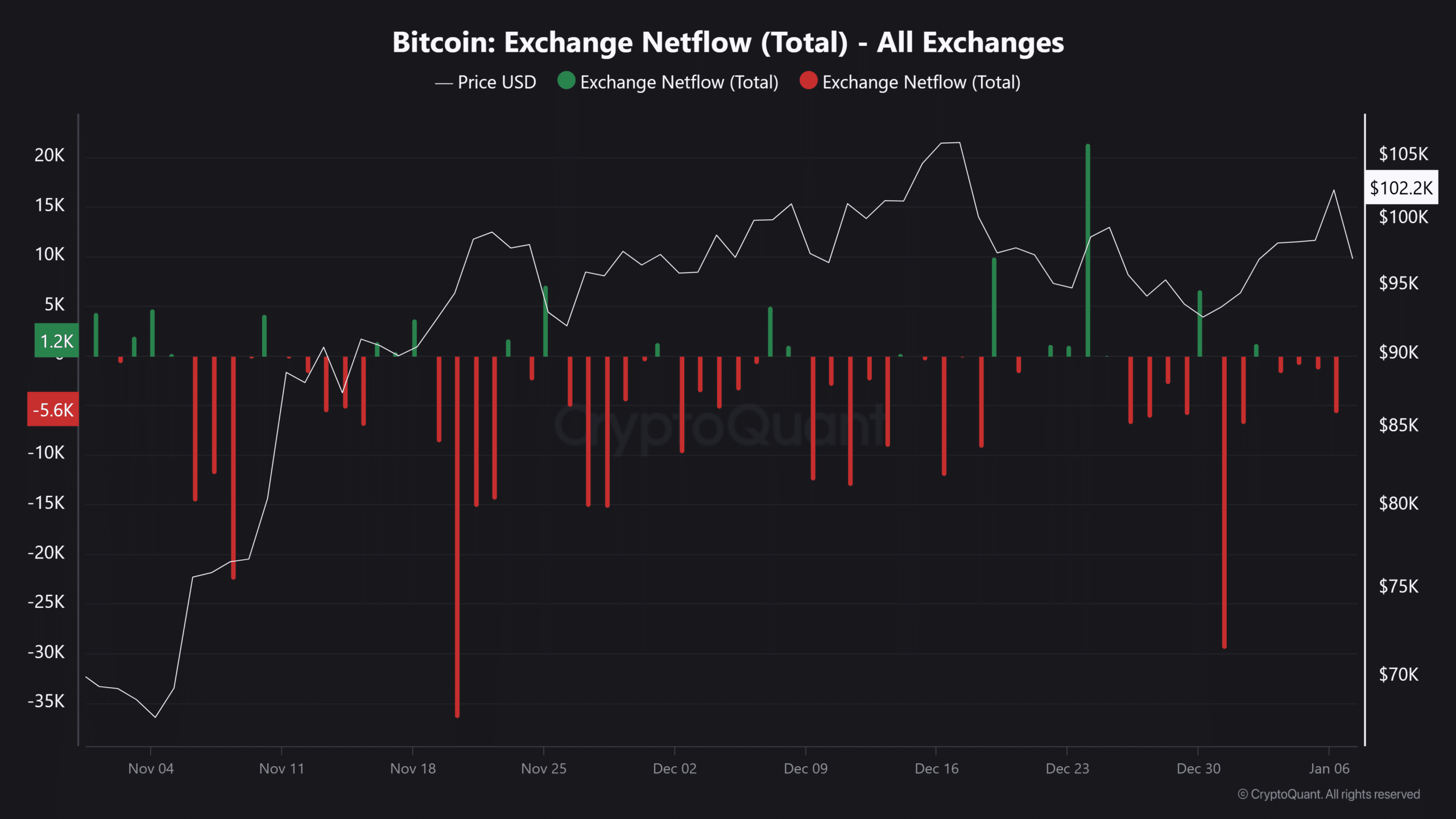

Previously noted, as Bitcoin fell to $91K, it demonstrated a robust recovery. Upon further inspection, it appears that retail investors significantly returned to the market, causing a net outflow of approximately $25K – the largest monthly outflow recorded.

However, there’s a surprising turn of events: despite the overall flow showing a negative trend, it’s currently only at a relatively modest level of $5K, far from reaching critical points.

It seems like the predicted “buying at a dip” point hasn’t been fully activated as of now, which aligns with AMBCrypto’s assumption that the market is holding out for a suitable catalyst before making significant moves.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Even though the memories of the latest market downturn are still vivid, a quick recovery could be overly optimistic. Instead, you might find yourself waiting longer for the market to stabilize.

Instead of an immediate dramatic drop, a potential dip towards the range of $89,000 – $91,000 might offer an attractive point to keep an eye on.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-09 11:03