- September is seen as a key moment for crypto, as most assets witnessed a decline.

- Market sentiment is currently in a state of fear, which could impact the trend this month.

As a seasoned researcher with years of experience navigating the volatile and ever-changing world of cryptocurrencies, I find myself intrigued by the current state of the market as we enter September. Historically known for bearish trends, this month could potentially buck that trend, setting the stage for a bull run.

Over the past few weeks, the value of Bitcoin [BTC] has shown considerable fluctuations, causing it to dip beneath the symbolic $60,000 threshold.

Although this decrease has affected the entire cryptocurrency sector, it could equally signal an upcoming bull run in cryptos, especially as we approach September – a month that traditionally shows unfavorable patterns in financial markets.

It seems that various signs point towards the possibility that September could mark a shift towards an uptrend for cryptocurrencies, breaking the usual trend.

Exchange reserve declines

One of the key indicators supporting the case for a potential crypto bull run is the declining exchange reserves of Bitcoin and Ethereum [ETH].

Historically, a drop in the amounts of these assets held on exchanges tends to indicate that investors are transferring their holdings to offline or cold storage.

This suggests a mindset that prefers keeping these assets over selling them for the long term. This pattern is frequently followed by a rise in prices, or a ‘bull market’, because it decreases the amount of these assets available for trade on exchanges, leading to increased demand and potential price increase.

At the moment, we find that about 2.62 million Bitcoins are being held in exchanges, marking a continuous decrease. Meanwhile, Ethereum’s exchange reserves stand at roughly 18.7 million, reflecting a similar trend of decline.

The consistent decrease in our reserves, which became more noticeable as last year ended and continues into this one, might signal an upcoming major increase in prices.

Market sentiment: Fear as a precursor to greed

Another factor pointing towards a potential crypto bull run is the current market sentiment, measured by the Crypto Fear and Greed Index.

This measurement assesses the general market mood, with intense fear potentially signaling a good purchasing chance and excessive greed possibly hinting at a market peak. Typically, a transition from fear to greed tends to be followed by an upward trend in the market, often referred to as a ‘bull run’.

According to data from Coinglass, the market is currently in a state of fear.

In this atmosphere, fear can trigger a wave of selling, which eventually gives way to a surge in buying motivated by greed, as market prices start to rise again.

The cyclical nature of market sentiment suggests that a bullish phase could be imminent after a period of fear.

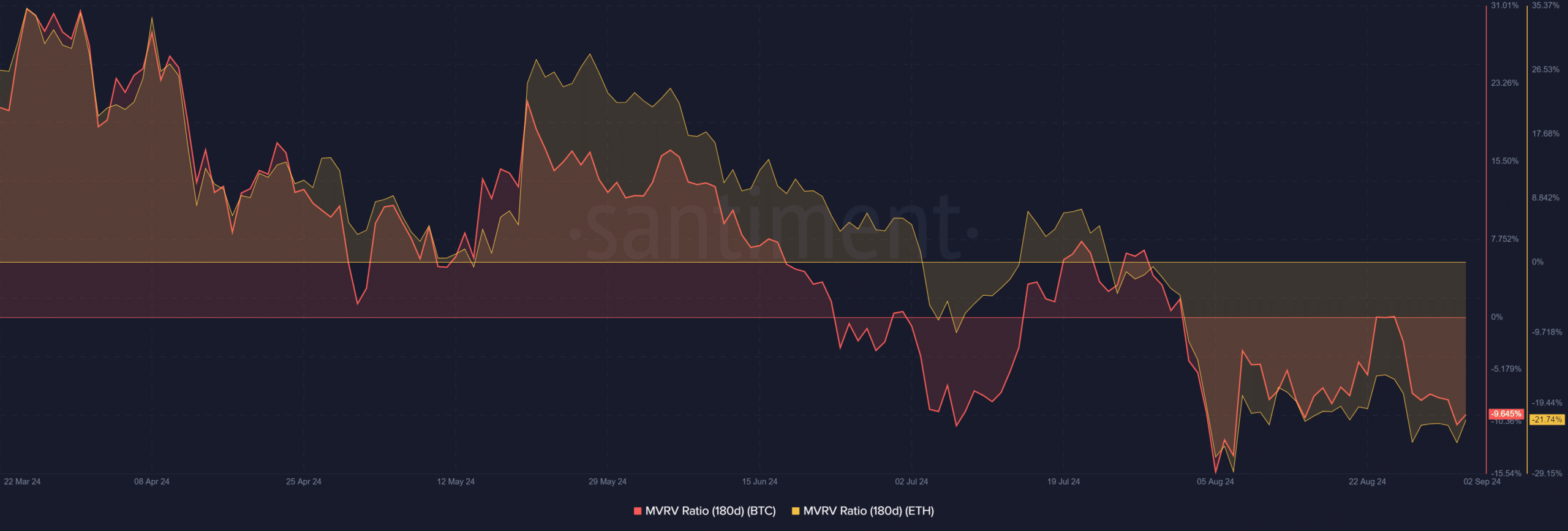

MVRV ratio: A signal for a bull run

The MVRV (Market Value to Realized Value) ratio, as another essential tool, suggests the possibility of an upcoming bull trend. Essentially, this ratio determines if the current market value of an asset surpasses or falls short of its actual worth.

When Multi-Variable Realized Value (MVRV) falls below zero, it often signals that investors are experiencing losses. This could imply that the asset’s current value might be lower than its true worth, potentially setting the stage for an adjustment or correction in the market.

Currently, the moving average value relative to purchase price (MVRV) for Bitcoin stands at approximately -9.6% over the past 180 days. This suggests that many long-term investors are currently in the red, having held onto their Bitcoins with a loss of more than 9%.

In a similar vein, Ethereum’s MVRV has stayed negative since July and is currently approximately -23%, indicating that its holders have sustained losses exceeding 23% at the moment.

It appears that the current low values of the MVRV (Miner’s Verification of Value) indicate that both assets are experiencing substantial price drops, suggesting they may be underpriced. A rise beyond zero in their MVRV could potentially spark a surge in buying activity, leading to an upward trend or “bull market.”

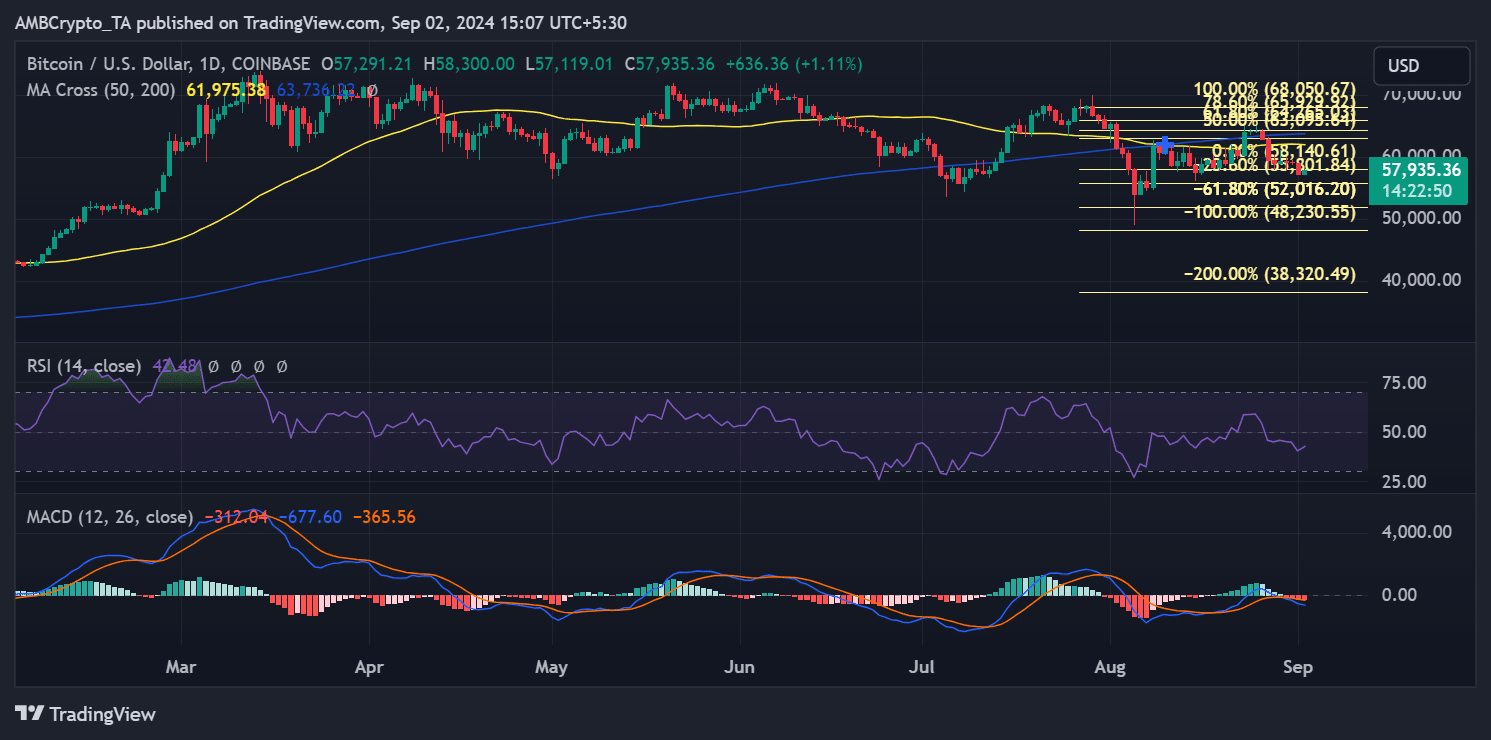

Support and resistance levels

Looking at Bitcoin’s technical analysis, its price dipped below both the 50-day and 200-day moving averages, suggesting that the market could be trending downwards (bearish) or experiencing a period of stability (consolidation).

However, a move above these moving averages could signal the beginning of a new bullish phase.

At the current price point of approximately $52,016.20, the 61.8% Fibonacci support level plays a vital role and should not be overlooked.

As an analyst, I’ve noticed that Bitcoin has recently tested a particular level and is currently trading above it. This could indicate a potential resumption of a bullish trend if we continue to hold above this point.

Furthermore, the price point at approximately $58,140.61, serving as a potential barrier due to being a 38.2% retracement level, is a crucial area to monitor closely. If this level is surpassed, it might signal a new upward trend, indicating the beginning of a bull market.

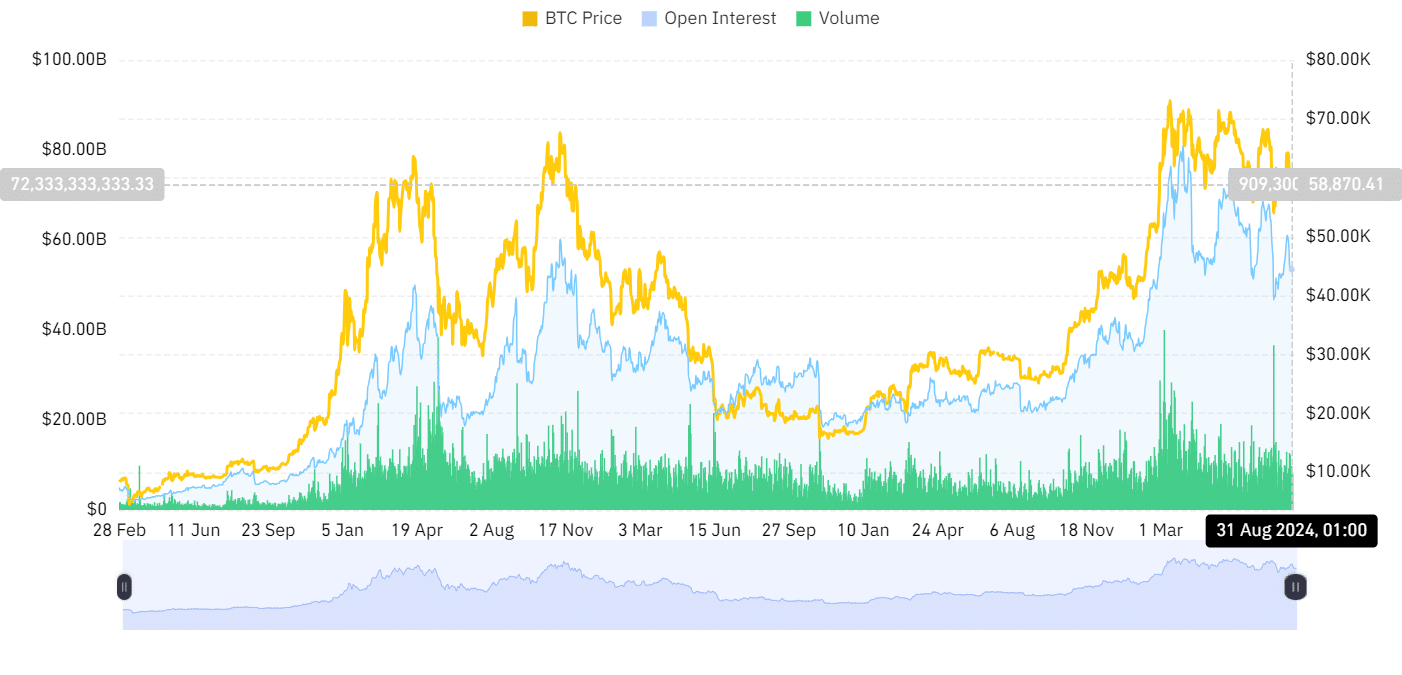

Open interest and volume

When evaluating the possibility of a cryptocurrency market surge, it’s important to take into account both open interest and trading activity levels as well.

To start the year off, a cryptocurrency price surge peaked in March, pushing Bitcoin up to nearly $73,000 – its highest value ever recorded.

Over the given timeframe, both Open Interest and trading volume showed a significant increase. The Open Interest reached an all-time high of more than $75 billion, while trading volume surpassed $199 billion.

The Open Interest dropped to roughly $50 billion, while the trading volume decreased to about $100 billion as well.

If these indicators start climbing once more, particularly when accompanied by optimistic market sentiments, it might signal the commencement of another bull market.

A crypto bull run in September ahead?

As a researcher delving into the world of cryptocurrencies, I find myself intrigued by the historical challenges that the market often faces during September. However, this year, certain telltale signs hint at a potentially different narrative.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As I analyze the current state of the cryptocurrency market, it appears that dwindling exchange reserves, widespread market anxiety, dismal MVRV ratios, and significant technical thresholds are hinting towards the likelihood of an imminent crypto bull run.

Over the next few weeks, it’s likely that Bitcoin and Ethereum will play a crucial role in influencing the overall market direction. If the market sentiment shifts from apprehension to excitement, we might witness substantial price increases.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-02 23:05