- Ethereum whale sends 5,000 ETH to an exchange.

Spot ETF approval is yet to impact the ETH price trend.

A large-scale Ethereum (ETH) investor moved approximately $15 million in assets to an exchange following the announcement of potential ETF approvals in Hong Kong.

Has the whale’s transfer affected the price, and has the ETF approval also influenced the price?

Ethereum whale takes profit

According to data from Lookonchain, a Ethereum wealthy individual transferred 5,000 ETH, equivalent to more than 15.4 million dollars at the time, to the Kraken exchange.

After a closer examination, it was discovered that a single whale had taken out 96,638 Ethereum (ETH) from Coinbase in September 2022. With ETH being worth approximately $1,567 during that period, the value of this transaction exceeded $151.4 million.

It’s plausible that the recent transfer was made to take advantage of profits, considering Ethereum (ETH) has reached a price above $3,000. Currently, this large wallet owns approximately 76,638 ETH, which translates to over $233.5 million in value.

Ethereum continues decline

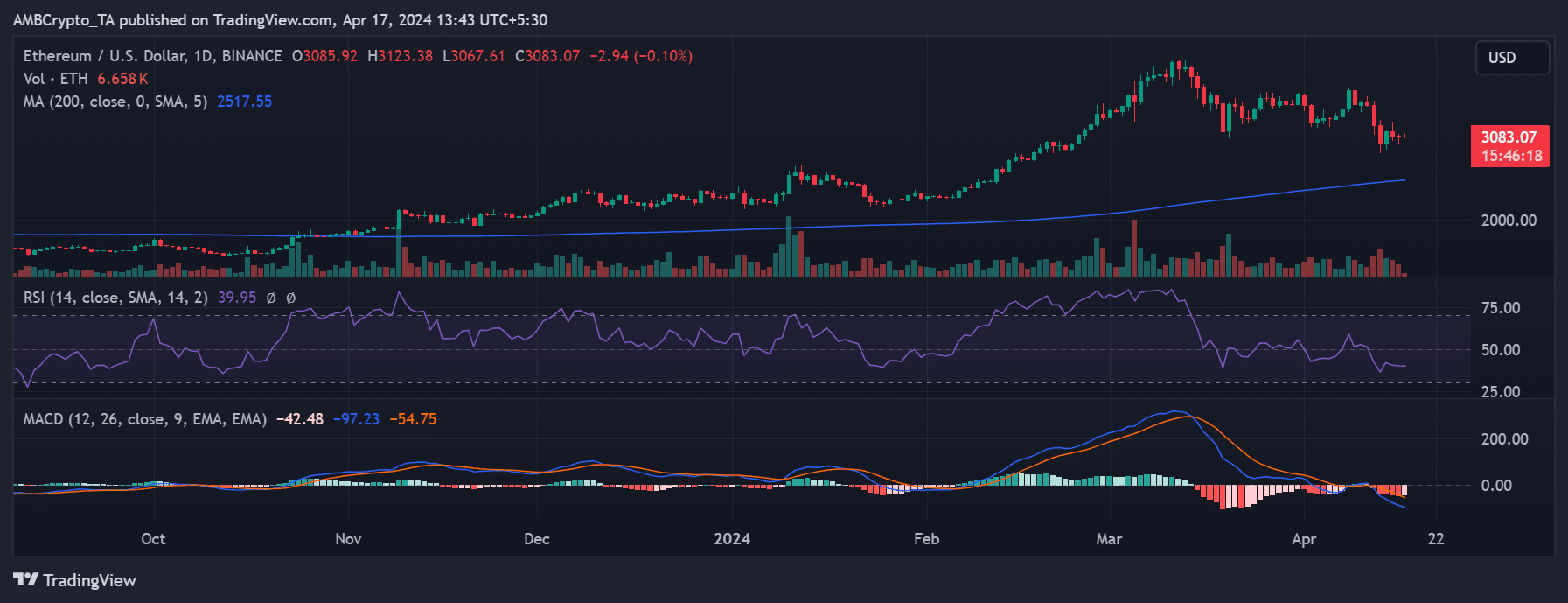

Examining the daily Ethereum chart shows that it hasn’t been profitable recently. The cryptocurrency dropped after a 4% rise on the 14th of April, marking a three-day streak of decreases.

Despite these declines, it has retained the initial 4% gain from the beginning of the week.

As of the time of writing, ETH was trading at around $3,080, marking a decrease of less than 1%.

In addition, the decreases have strengthened Ethereum’s downward momentum, as shown by its Relative Strength Index (RSI) being close to 40 and its Moving Average Convergence Divergence (MACD) line lying beneath zero.

The combined data suggest a significant downward trend for Ethereum, contradicting earlier optimistic reports from Hong Kong.

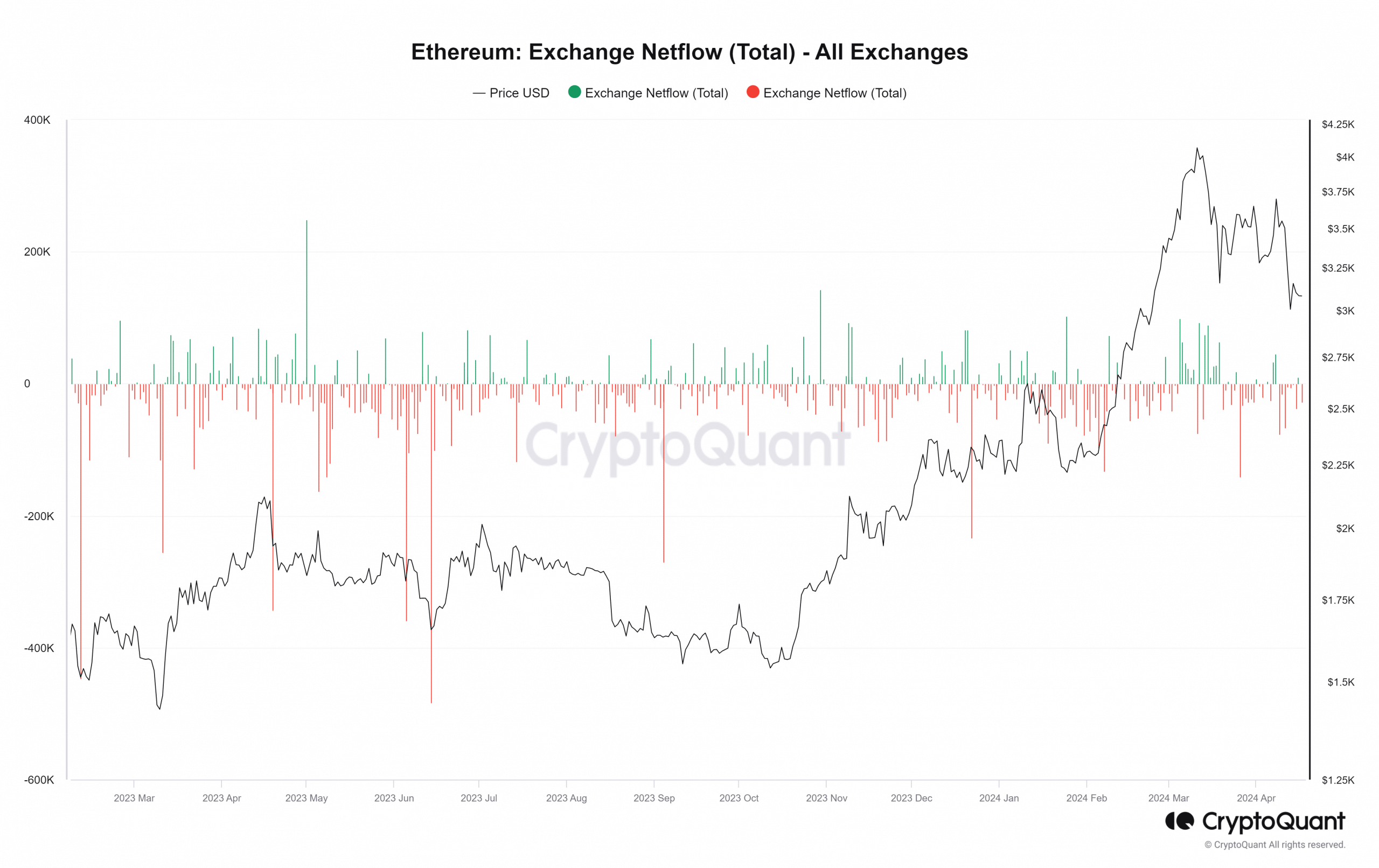

As of press time, Ethereum’s netflow data indicated a trend of increased ETH leaving exchanges.

Despite a net inflow of 10,230 ETH to exchanges by the close of trading on April 16th, there is currently an outflow of over 27,000 ETH as of now.

ETF approval yet to impact the ETH price trend

Several reports have indicated that Hong Kong has recently given the green light to proposed Ethereum and Bitcoin spot ETFs.

It’s surprising that the Ethereum price hasn’t shown a significant reaction after the approval was announced, possibly due to the fact that no clear-cut statement has been issued by the SEC yet.

It’s important for investors to exercise caution before getting overly excited, given the history of false reports about Bitcoin ETF approvals being circulated.

Read Ethereum’s [ETH] Price Prediction 2024-25

Upon confirmation from officials, the market reaction could be minimal since trading activity is relatively low.

In simpler terms, the trading volume for Bitcoin ETFs in the US is much larger than what’s expected in Hong Kong markets. This means that price changes driven by trading activity in Hong Kong may not have a big impact on the overall market.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Ethereum ETF Day 1 beats ‘20% of BTC’ estimate – What’s next?

- Solana memecoin BODEN feels the heat after Biden’s exit: Will SOL suffer?

2024-04-17 22:15