- Bernstein projected a BTC target of $50K for a Harris win and $90K if Trump wins.

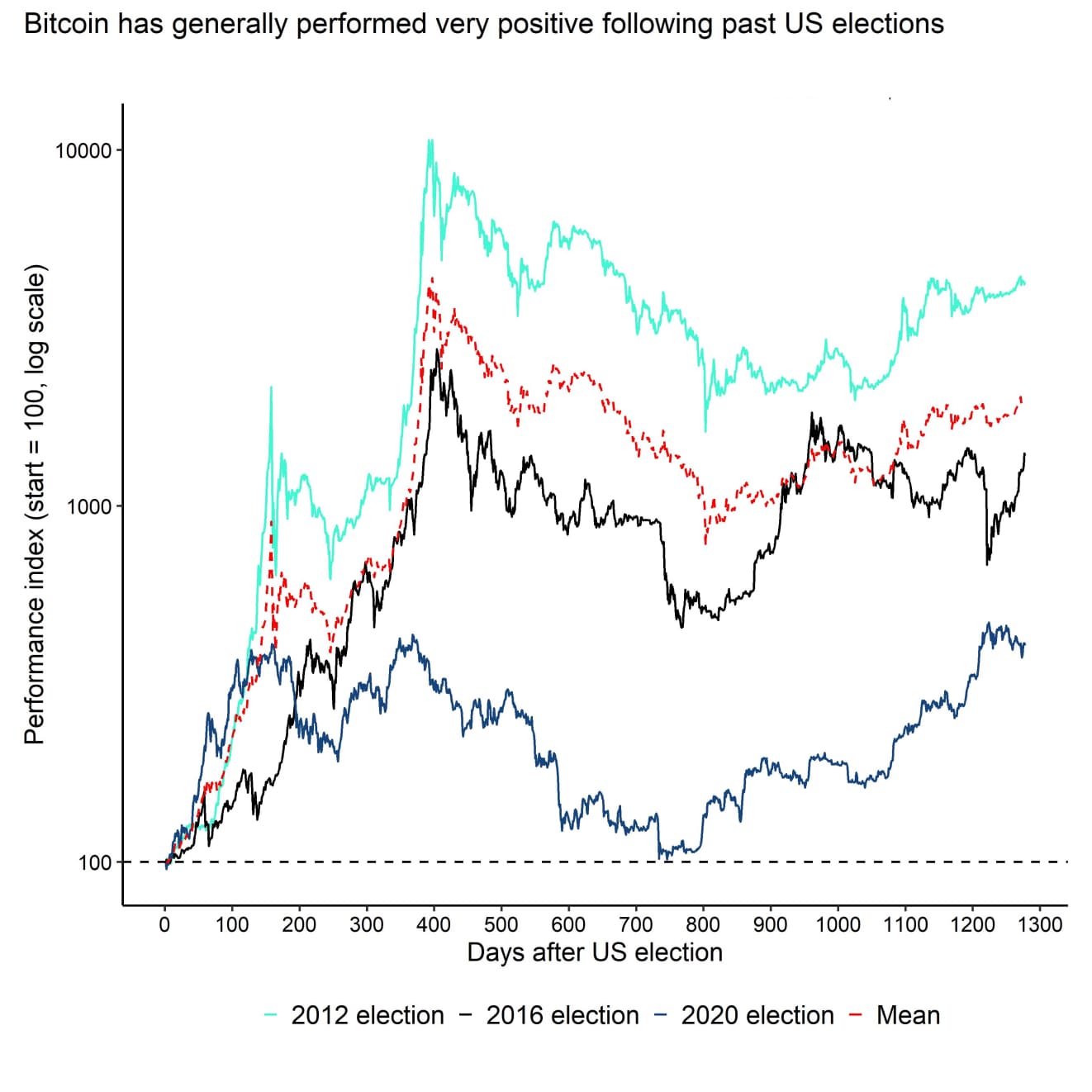

- Beyond short-term noise, BTC has always seen positive growth in past elections.

As a seasoned crypto investor with a knapsack full of lessons from past market cycles, I find myself intrigued by these election-related BTC price targets. Having weathered Bitcoin’s rollercoaster rides through three previous U.S. elections, I can attest to its resilience and propensity for growth amid the political noise.

Bitcoin could see ‘$90K or $50K’ based on U.S. election outcome, analysis says…

Today marks a significant day for U.S. elections, and it’s important to consider that the immediate effects of the election results on Bitcoin [BTC] could be substantial.

As a crypto investor, I’m keeping a close eye on the upcoming election and its potential impact on Bitcoin prices. The latest Bernstein outlook suggests that if Harris wins, we might see Bitcoin reaching around $50K. On the other hand, if Trump secures another term, Bitcoin could rally within a range of approximately $80K to $90K.

As an analyst, I believe that the aggressive standpoint expressed by Harris is a significant factor contributing to the prediction of Bitcoin reaching $50,000.

If Trump wins, some experts predict Bitcoin could reach a new all-time high due to his supportive views on cryptocurrency.

BTC’s election price targets

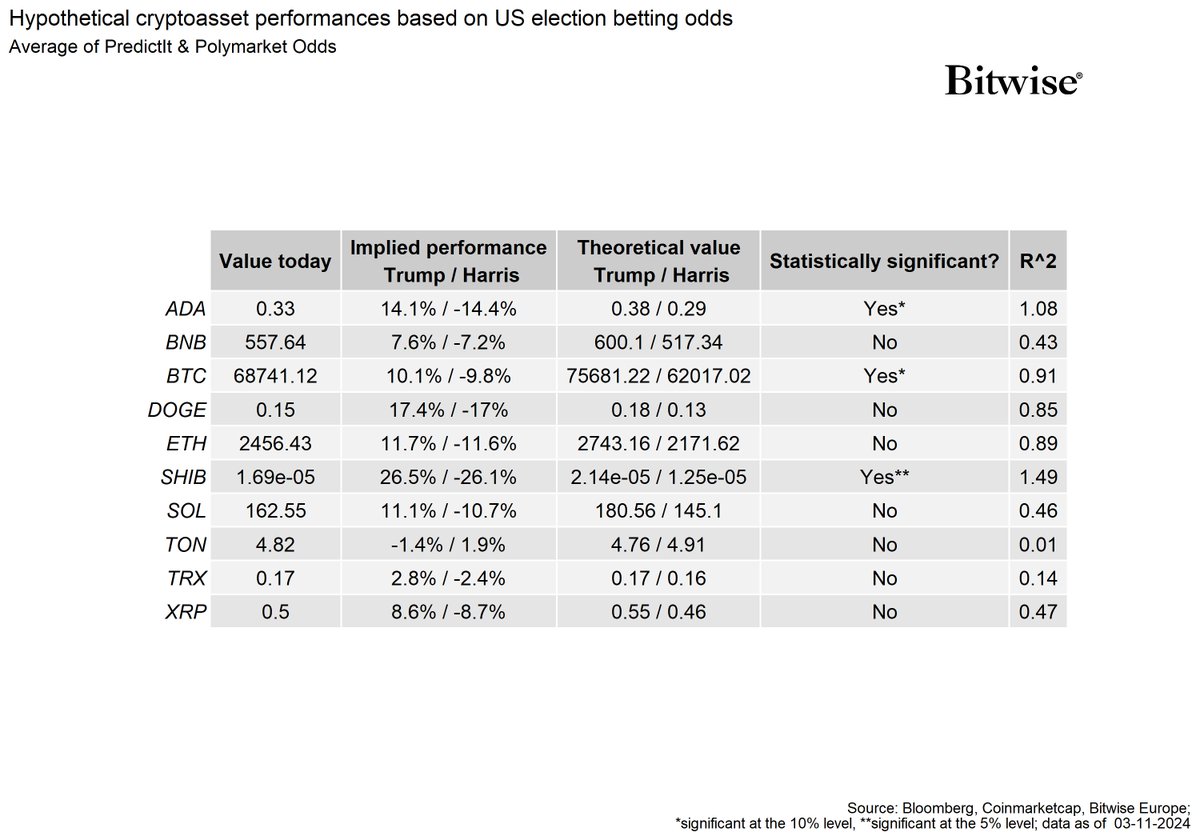

Amberdata and Bitwise, two entities focused on blockchain analysis and asset management, have both predicted similar future trends, albeit with slight variations in their specific targets.

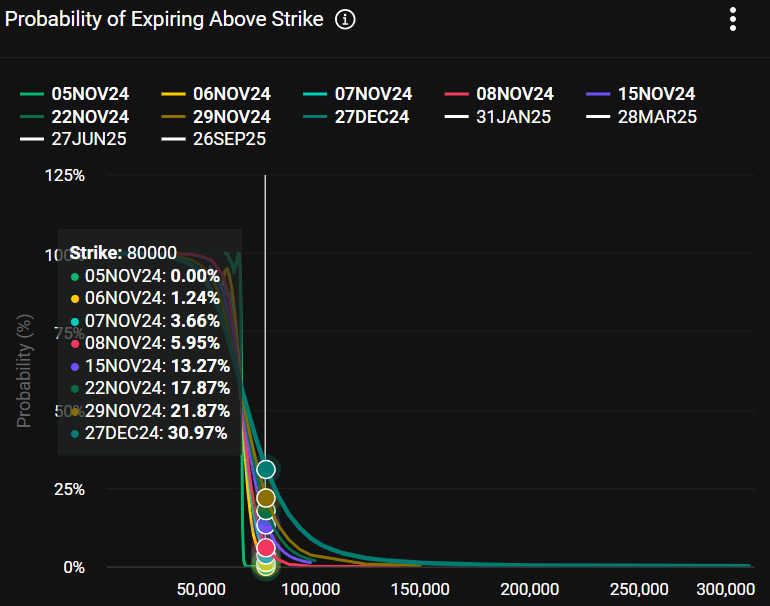

Based on predictions by Amberdata analysts, the outcome of the U.S. elections might cause a fluctuation in price between $6,000 and $8,000.

Part of its report read,

Consequently, significant price points could be around $60,000 (in case of a Kamala victory, causing a dip) or approximately $75,000/$77,000 if Trump wins, which would lead the spot back to its all-time highs and potentially surpass them due to election excitement exceeding the previous week’s peak.

As a seasoned investor with years of experience navigating volatile markets, I have come to appreciate the importance of hedging strategies. In my view, this recent behavior by hedge funds, where they position themselves for potential bullish outcomes while preparing for significant Bitcoin price fluctuations, seems like a prudent move. From my perspective, it’s all about minimizing risk and maximizing opportunities. I’ve seen firsthand how the cryptocurrency market can be unpredictable, so strategies that account for wild price swings are essential to maintaining long-term success in this space.

As a crypto investor, I’ve noticed that Bitcoin seems to react differently depending on the odds for the U.S. Presidential election. According to Bitwise analysts, if Trump wins, there’s a potential for Bitcoin to spike by approximately 10%. On the other hand, if Harris wins, there’s a possibility that Bitcoin could dip almost 10% in value.

Currently, as reported, the Deribit data indicates that options traders are estimating a 21% likelihood for Bitcoin to reach $80,000 before November concludes.

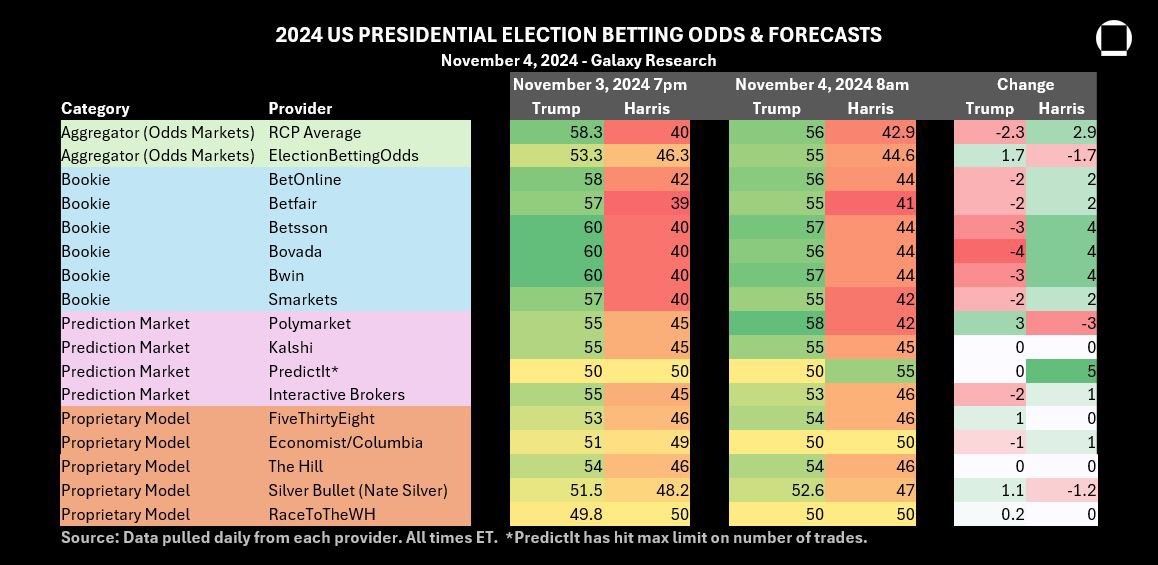

It’s not surprising considering that, on the 4th of November, Donald Trump was in front according to most election forecasts and prediction platforms based on the information from Galaxy Digital at that time.

Looking beyond the commotion surrounding the immediate U.S. elections, Bitcoin (BTC) has historically had a favorable influence on the market over the last three election cycles. According to Bernstein’s forecast, it could potentially reach $200,000 by 2025.

Speaking about the topic in question, Maria Carola, CEO of StealthEX cryptocurrency exchange, expressed optimism to AMBCrypto that a favorable outcome might occur post-elections. In simpler terms, she believes good things may happen following the voting process.

The data reveals a captivating trend: following every election, there has been significant expansion. Specifically, after the 2016 elections, Bitcoin’s price peaked at $1,110, and in 2020, it reached an all-time high of over $40,000.

However, she cautioned that the short-term volatility could spike if the results are contested.

It seems that Bitcoin’s volatility might stay low before the upcoming US election. However, volatility may spike following the election, particularly if the outcome is uncertain or contested.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-05 16:08