- ADA’s on-chain metrics with technical analysis indicated mixed sentiment among traders.

- 53.2% of top traders held short positions, while 46.8% held long positions.

As a seasoned analyst with over two decades of market experience, I find myself intrigued by Cardano’s [ADA] current standing. The technical analysis presents a bullish outlook for ADA, with its historical tendency to rally when it reaches the crucial support level of $0.315. Yet, the on-chain metrics hint at bearish sentiment among traders, suggesting potential volatility and liquidation risk.

In the world of cryptocurrencies, there’s a lot of mixed feelings right now. However, despite the confusion, Cardano (ADA) seems optimistic and looks set to experience a significant price surge in the near future.

Over the past few weeks, ADA has lost nearly 20% of its value and has reached a level where it previously experienced an impressive rally.

It’s plausible that ADA’s optimistic stance is primarily influenced by recent market trends and the approaching U.S. Presidential election.

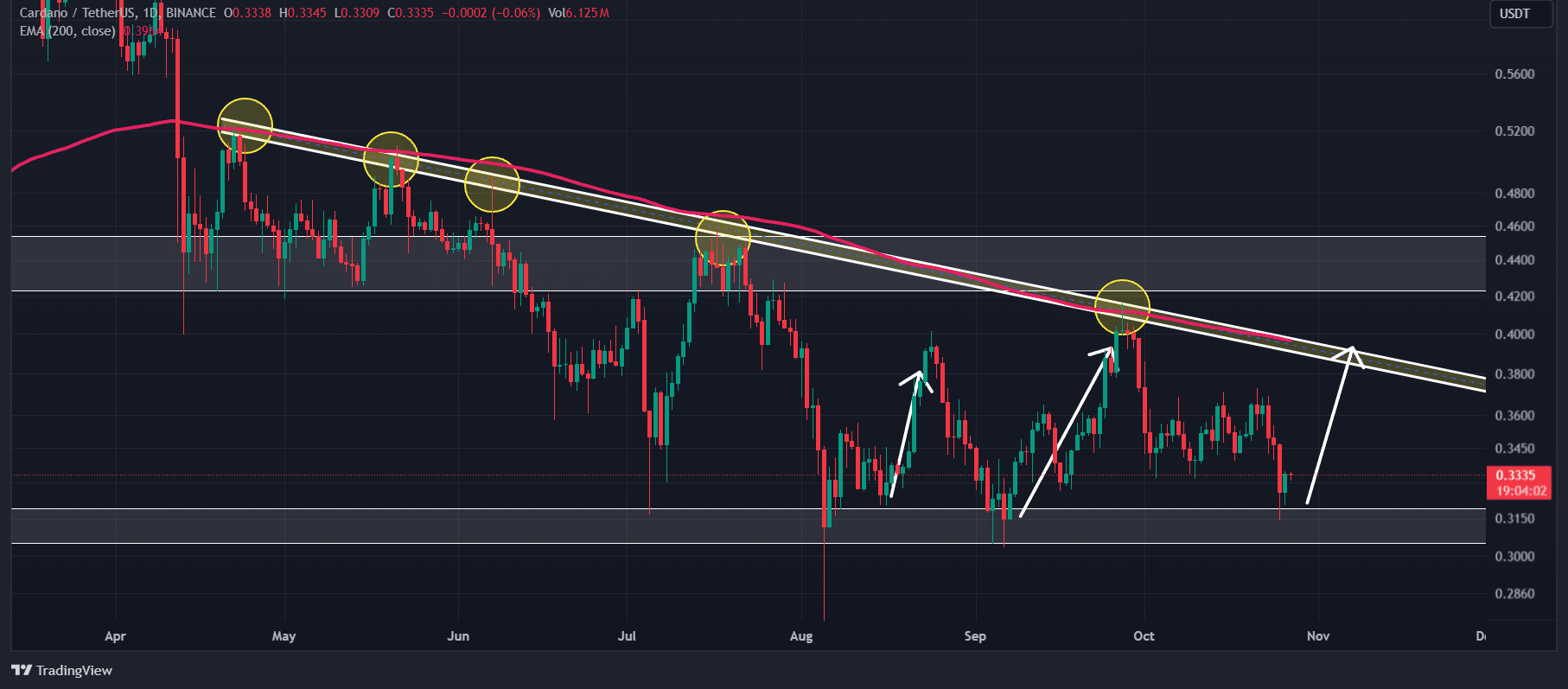

ADA technical analysis and key levels

Based on AMBCrypto’s technical assessment, the price of ADA had reached a significant support point at approximately $0.315 and was showing signs of moving upward. In the past, whenever ADA has touched this support level, it has often experienced increased buying activity, triggering a bullish trend that typically results in a rise of around 20%.

Beginning July 2024, this asset has touched its support level on three separate occasions. Each time, it saw an influx of buying interest and a surge in price by more than 20%, peaking at $0.40. Just like before, market participants anticipate another significant upward trend in the near future.

As a researcher, I’ve been closely observing the trends of ADA, and while I remain optimistic about potential rallies, it seems they might not materialize immediately. The on-chain data suggests a prevailing bearish sentiment among traders, as indicated by the high Long/Short ratio of 0.88, according to Coinglass. This ratio indicates that short positions (betting on price decrease) are significantly more popular than long positions (betting on price increase), suggesting a strong bearish outlook for ADA at this time.

Furthermore, it appears that the open interest for ADA decreased by 1.2% over the last 24 hours. This decrease might indicate that traders are closing their positions as a result of heightened volatility within the crypto market, potentially signaling liquidation.

At press hour, 53.2% of top traders held short positions, while 46.8% held long positions.

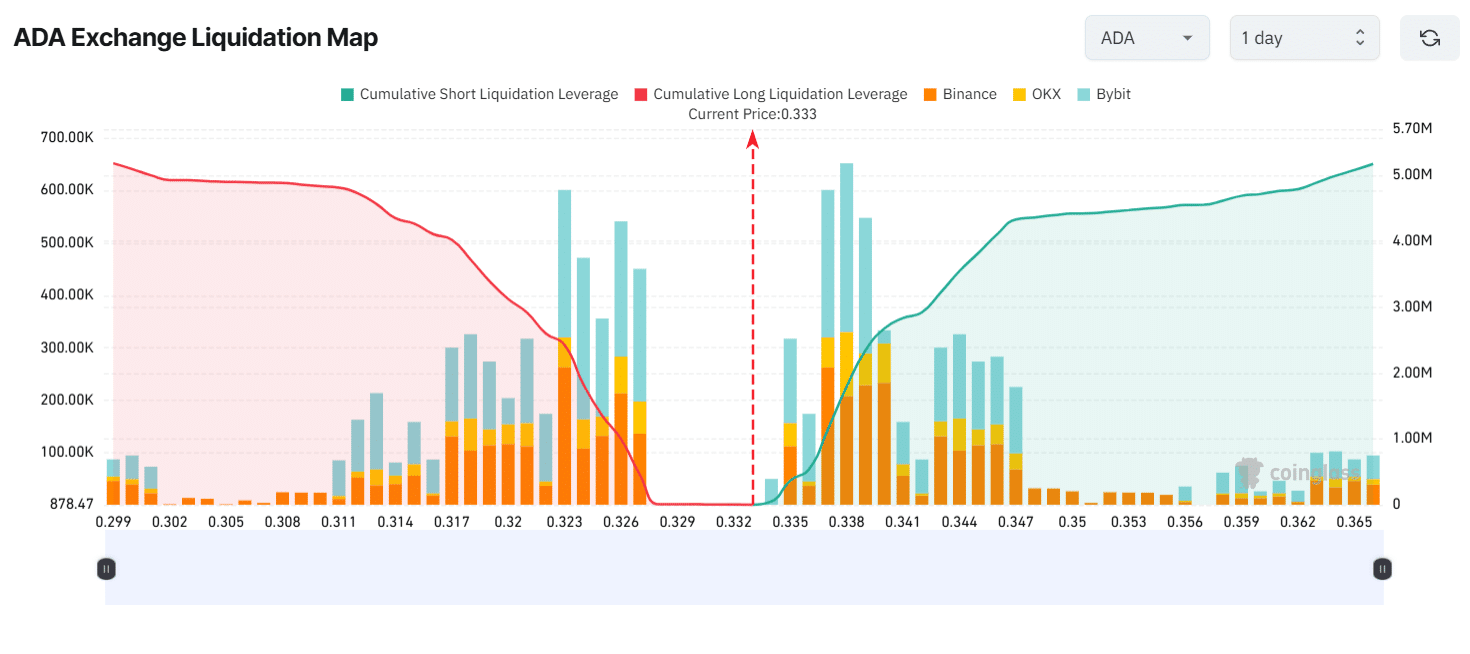

Major liquidation levels

At $0.323 and $0.338, the key points for liquidation were found, respectively, on the lower and upper ends, as indicated by the Coinglass data. Additionally, traders were found to be excessively leveraged at these price levels.

Should the feeling stay consistent and the price ascends to approximately $0.338, it would trigger a liquidation of around $1.79 million from positions taken in a short sale.

Read Cardano’s [ADA] Price Prediction 2024–2025

If the sentiment changes and the price falls to $0.323, around 2.43 million dollars’ worth of long positions may need to be sold off. A blend of these on-chain indicators with technical analysis suggests a varied outlook among traders.

Currently, as we speak, ADA was approximately at $0.33 in trades and showed no change for the past 24-hour span. Meanwhile, during this timeframe, the trading volume decreased by a significant 62%, suggesting less involvement from traders and investors compared to the preceding days.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-27 16:08