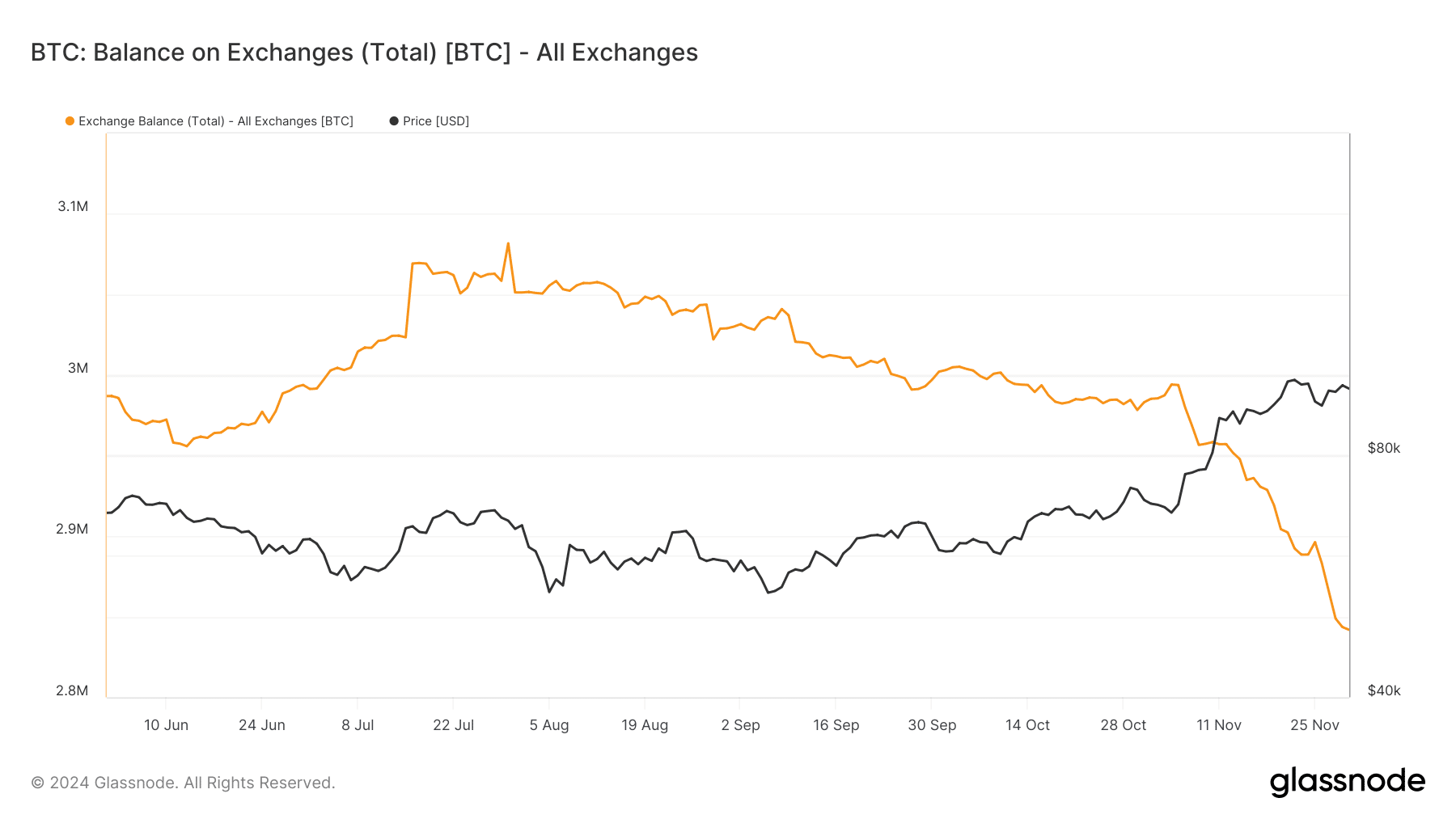

- Over 55,000 BTC were withdrawn from exchanges in 72 hours, highlighting strong accumulation and demand.

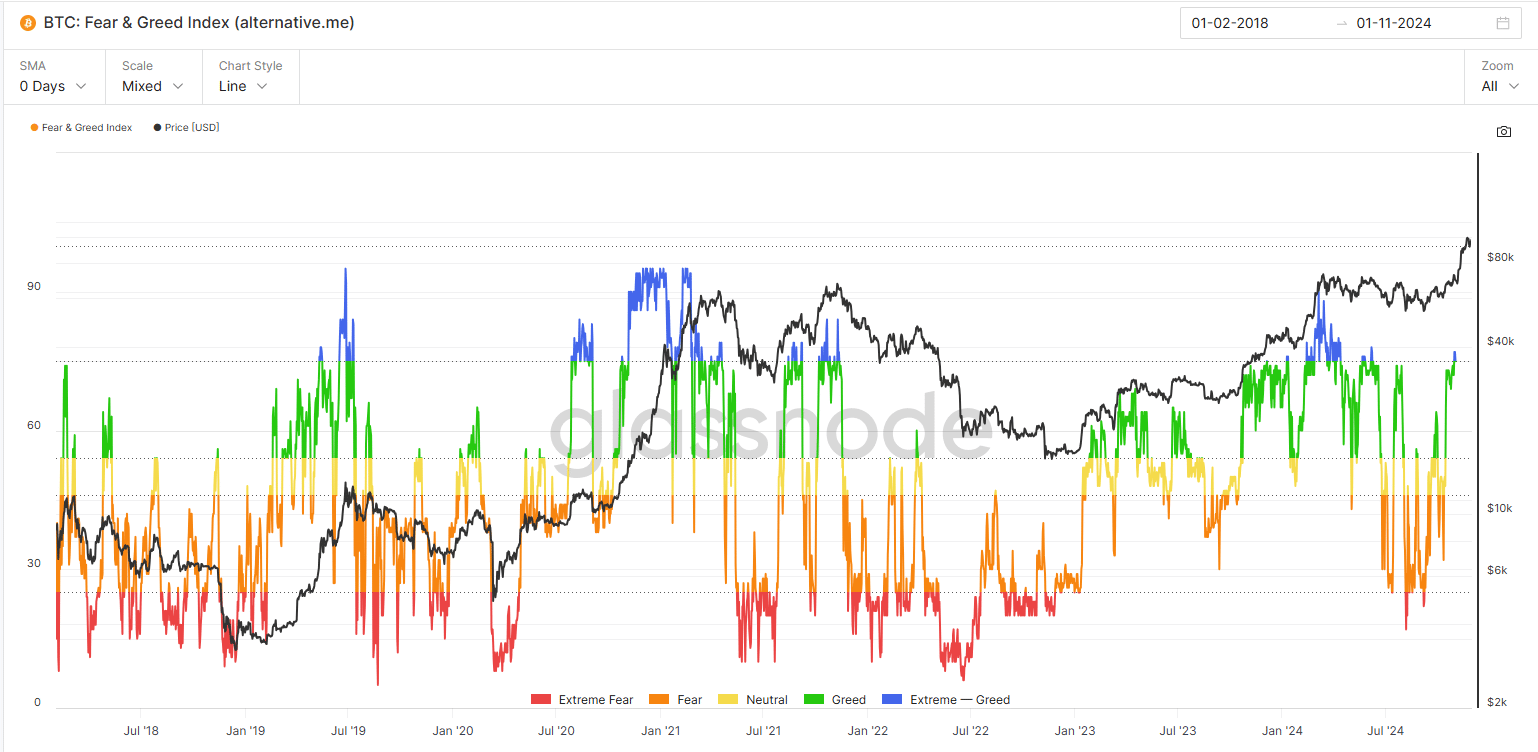

- Bitcoin’s “extreme greed” signals caution, as history shows high risk of market corrections

As a seasoned researcher who has navigated through the tumultuous seas of the crypto market since its inception, I must say that recent developments surrounding Bitcoin have piqued my interest once again. The massive withdrawal of over 55,000 BTC from exchanges in just 72 hours signals a strategic move by investors, and the rising Fear & Greed Index into “extreme greed” territory is reminiscent of conditions seen during the historic bull run of 2020-21.

In a stunning turn of events, Bitcoin (BTC) has managed to grab the spotlight yet again by withdrawing an astounding 55,000 BTC from various exchanges within only 72 hours – a transfer worth approximately $5.34 billion.

The mass departure, along with the current Fear & Greed Index indicating “high greed,” has sparked discussions on what could be its imminent significant shift.

The current atmosphere is similar to that of Bitcoin’s unprecedented surge in value, where overwhelming enthusiasm drove the price upward from $15,000 to $57,000 during the period spanning 2020 and 2021.

In the midst of these unparalleled market movements, investors find themselves questioning: Is it the edge of another spectacular surge, or could a significant decline be approaching instead?

The Bitcoin exodus

The significant decrease in Bitcoin’s exchange holdings (now below 2.8 million Bitcoins) for the first time since 2018 suggests that investors are making calculated decisions.

55,000 Bitcoins moving out lines up with elevated on-chain actions, implying substantial hoarding by investors. This transfer happens at a time when there’s an uptick in interest for personal custody due to decreasing trust in centralized services.

Furthermore, the increasing cost trajectory might indicate a possible shortage in supply. In the past, similar reductions in supply have often been followed by market surges (bull runs), as they lessen instant selling pressure on trading platforms and suggest a longer-term investment approach.

Riding the wave of “Extreme Greed”

The Bitcoin Fear & Greed Index has surged into “extreme greed” territory, reflecting heightened optimism among investors.

As I gaze upon the screen right now, I find myself perched well over the 80-mark, a position last enjoyed during the 2021 bull run. This elevated stance certainly stirs anticipation of an imminent surge, yet it equally underlines the necessity for vigilance.

From my perspective as an analyst, I’ve observed that excessive optimism or greed, fueled by market speculation, has often propelled remarkable price surges in the past. For instance, during the period of 2020-21, this was evident when the price skyrocketed from $15,000 to $57,000.

Yet, such phases frequently lead to market turbulence, as excessive optimism can cause an uptick in risky investments and sudden price adjustments.

As Bitcoin surpassed $99,000 in November, the market finds itself venturing into unexplored realms. The levels of exchange reserves have dropped to record lows from recent years, suggesting a tightening of the supply due to long-term investors taking control.

On the other hand, a blend of highly intense emotions and excessive heat indicates possible reversals or corrections, similar to the recent price adjustment observed within the past week.

Bitcoin reaching this significant milestone signifies a robust upward trend, yet it also highlights the delicate equilibrium between enthusiasm and prudence among investors, as they consider striking a balance between realizing profits and pursuing additional growth opportunities.

Catalysts, sustainability, and risks

The recent surge in Bitcoin’s value can be attributed to three primary reasons:

The consistent shortage in supply, along with increased long-term investor activity, sets a robust basis for continuous price growth.

On the other hand, significant dangers are on the horizon. An excessive appetite for profit, or “extreme greed,” increases the likelihood of forced selling due to high leverage, potentially leading to sudden price drops.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Furthermore, the extraordinary rise of Bitcoin fuels speculation, increasing its vulnerability to profit-making activities.

Maintaining the momentum of the rally requires consistent influx from institutions, a steady economic environment, and the skillful handling of fluctuations in investor sentiment without causing market instability.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-01 21:12