-

Bitcoin has seen more long positions in the last few weeks.

BTC has maintained the $60,000 price level in the last two days.

As a seasoned crypto investor with a few battle scars from market volatility, I find myself observing the current Bitcoin [BTC] trend with cautious optimism. The surge in long positions and the consistent maintenance of the $60,000 price level are indeed promising signs, but the high liquidation volume serves as a reminder that the crypto market can be as unpredictable as a roller coaster ride at an amusement park (and just as fun, if you ask me).

In the last few weeks, Bitcoin (BTC) has shown considerable fluctuations, dipping and soaring, but eventually regaining its position above the $60,000 mark.

Regardless of the market’s upheavals, most traders remain optimistic, preferring to take on long positions. Yet, fresh statistics indicate that these long positions have encountered some difficulties recently.

Bitcoin traders stay long

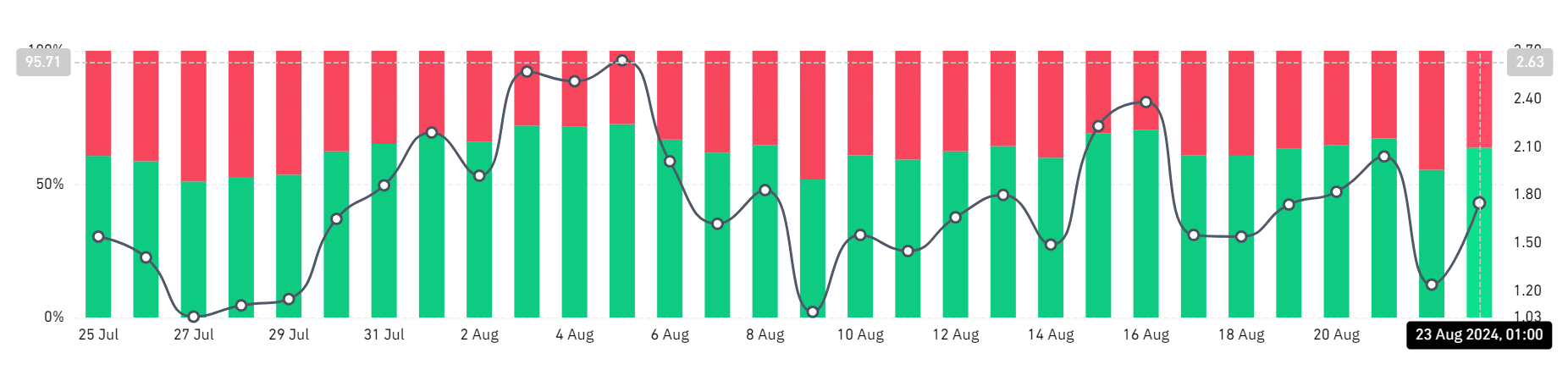

Recent data analysis from Coinglass has shed light on the ratio of long to short Bitcoin positions on Binance, the world’s largest cryptocurrency exchange.

According to recent data, more than 60% of accounts have been holding long positions for some time now, and this trend has continued. The most current figures show that the proportion of these long positions has increased to approximately 63%.

Over the past few months, particularly since July, there’s been a prevailing pattern where more traders are opting for long positions rather than short ones. This trend continues, even when Bitcoin’s value drops below the significant threshold of $60,000.

Based on my personal experience as a long-term Bitcoin investor and observer, I have noticed that traders generally maintain confidence in Bitcoin’s upward trajectory, even during periods of price volatility. This resilience is reminiscent of the “buy low, sell high” philosophy that has proven successful for many investors over time. However, it’s important to remember that every investment carries risk, and one should never invest more than they can afford to lose.

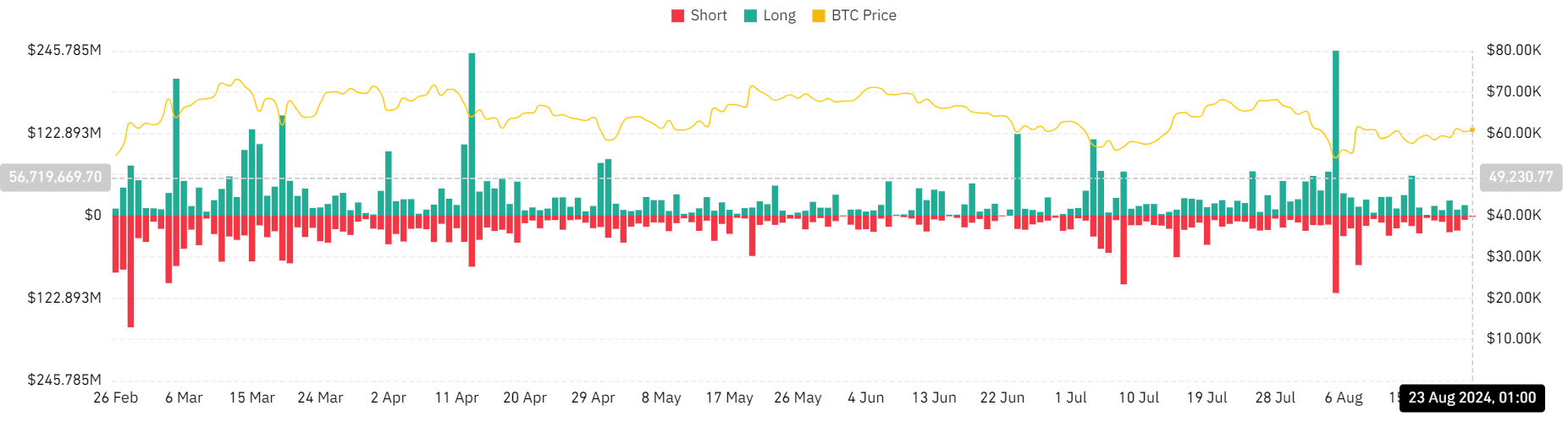

Liquidation volume shows the extent of volatility

As a crypto investor, I found AMBCrypto’s analysis on Bitcoin’s liquidation trend particularly captivating. It shed light on how long positions have been leading the market, offering me a fresh perspective on this dominant digital currency.

In contrast to most accounts holding onto their long positions, there’s been a significant rise in the closing out of these positions (long liquidations) over the past few weeks.

In August, the largest daily liquidation volume was recorded in more than a year, surpassing $245 million.

As I delve into the market trends, I find that when short liquidations are factored in, the significance of the trend increases noticeably. This underscores the inherent volatility and risks prevalent in this market, even amidst a generally optimistic outlook among traders who are predominantly bullish.

Bitcoin maintains its $60,000 price level

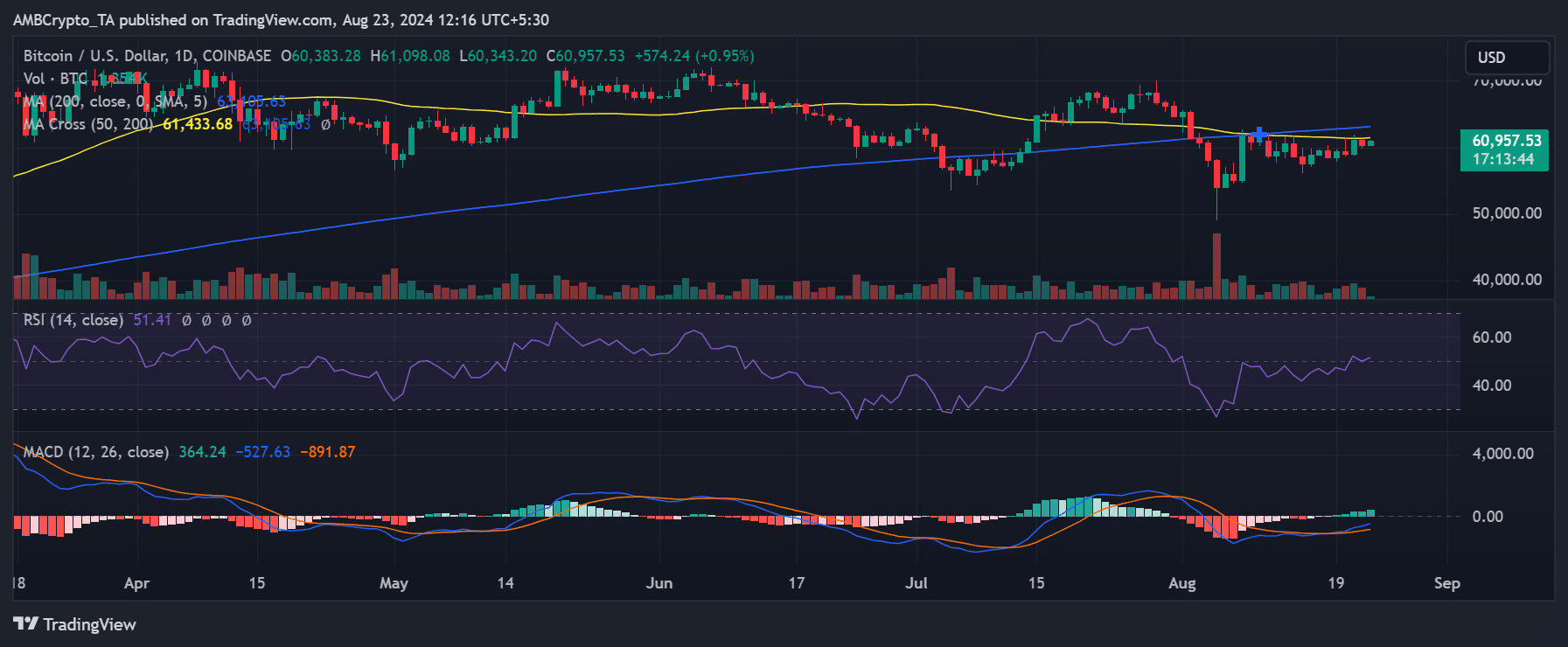

According to an analysis by AMBCrypto, Bitcoin’s price pattern shows it has difficulty maintaining its position above the $60,000 mark, even though it managed to temporarily reach this level in more recent times.

In the previous trading session, it closed with a slight decline of over 1% yet managed to stay within the $60,000 range.

Currently, at the moment of reporting, Bitcoin was being exchanged for around $60,900, marking nearly a 1% rise. Notably, Bitcoin, often referred to as the “king coin,” was hovering just under its short-term moving average (represented by the yellow line), with a noticeable trend of approaching it closely.

If the price surpasses its current moving average, coinciding with the resistance point approximately at $61,000, it could indicate a possible uptrend in the market.

Long positions to remain dominant

The pattern in Bitcoin’s price movement, combined with the ratio of long trades to short trades among top traders, suggests that long positions will continue to be predominant even during price volatility.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As an analyst, I observed that despite a significant drop in Bitcoin’s price to roughly $54,000 during the early part of August, the proportion of long positions remained relatively stable at around 60%.

This suggested that traders continued to favor long positions, maintaining a bullish outlook despite price declines.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-08-23 13:12