-

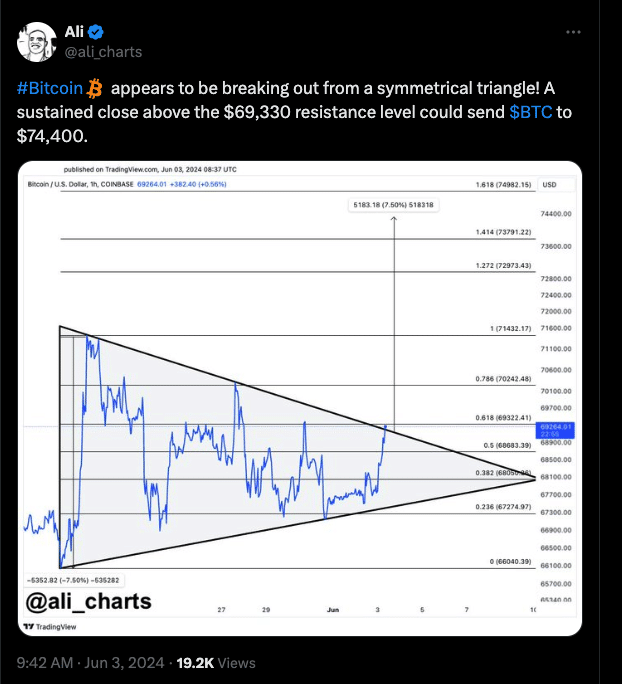

The 1-hour chart showed that BTC formed an asymmetric triangle, suggesting a breakout

If the price closes above the resistance, it could hit an all-time high soon.

As a researcher with a background in technical analysis, I find Bitcoin’s current price action intriguing. Based on my analysis of the 1-hour chart, it appears that Bitcoin has formed an asymmetric triangle, which is often a bullish indicator suggesting a potential breakout. If the price closes above the resistance at $69,330, it could lead to a significant increase in value and potentially hit an all-time high soon.

As a researcher studying Bitcoin‘s price movements, I’ve noticed an intriguing pattern: the price appears to be sending conflicting signals. If the positive signal manifests first, we could witness a significant increase in value. On the other hand, if the negative signal emerges beforehand, Bitcoin holders may face a disappointing price drop.

I, as Analyst Ali Martinez, shared my insights in two separate posts on X. In the first of these posts, I highlighted that Bitcoin displayed an asymmetrical triangle pattern on its 4-hour chart. This technical formation suggested a potential price surge towards $74,400.

It’s a breakout or breakdown

However, for the prophecy to become reality, Bitcoin must surpass the $69,330 resistance level in its closing price.

In an asymmetrical triangle pattern, two trendlines with opposite slopes come together. When price rises above the resistance level (upper trendline), a breakout occurs.

If the price falls into the support level instead, a significant correction may follow. Currently, Bitcoin is valued at $69,031, which is nearly at the resistance mark.

As an analyst, I’ve examined the price movements of Bitcoin closely in my recent analysis. Notably, I zeroed in on the TD Sequential indicator in my second post. Based on this technical tool, I identified a sell signal. If realized, this could potentially cause Bitcoin’s price to drop down to $68,050.

As an analyst, I would emphasize that the future trajectory of the Bitcoin price hinges significantly on the resistance levels discussed previously. However, it’s essential not to overlook the significance of analyzing Bitcoin’s behavior from an on-chain standpoint as well.

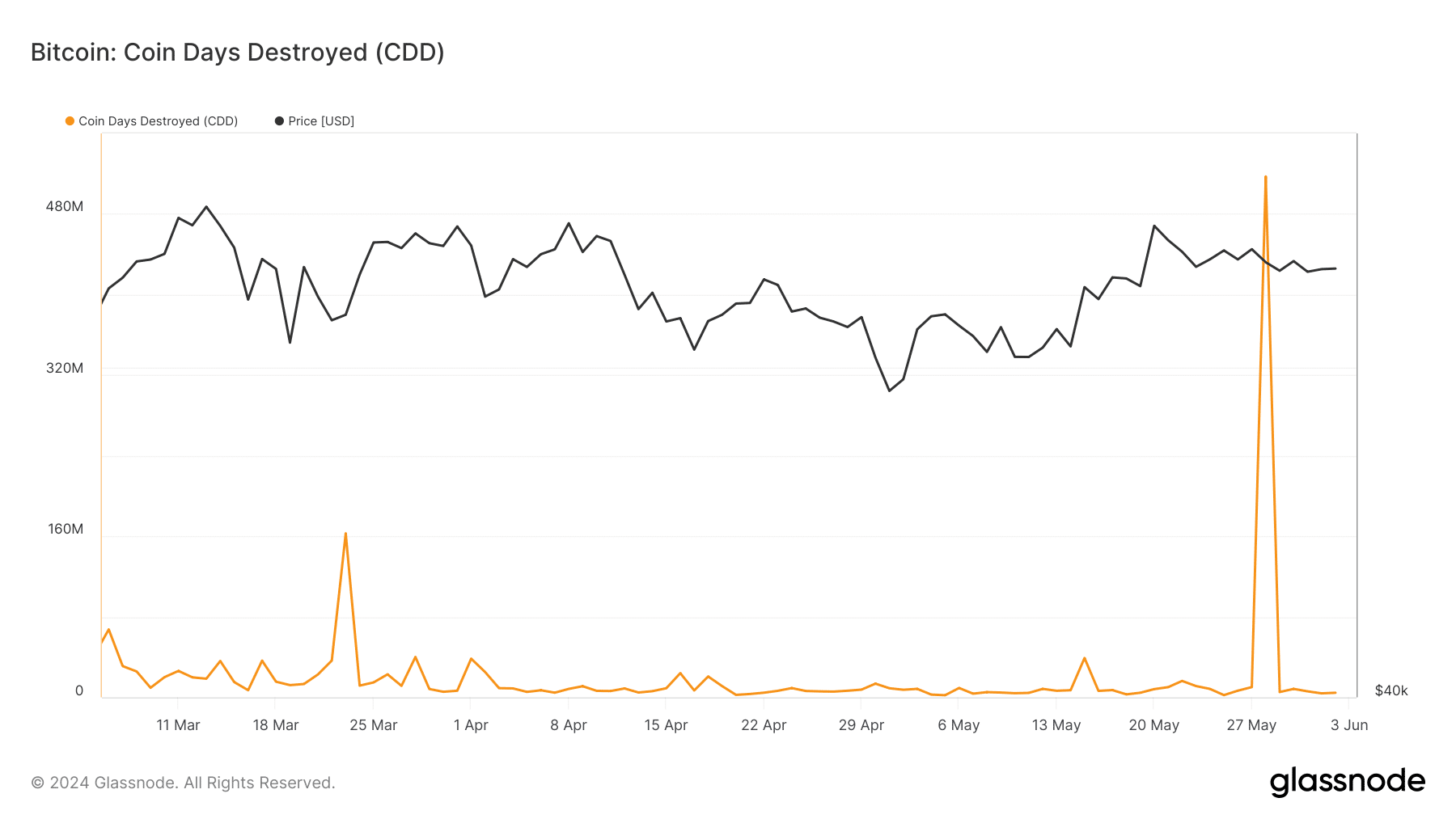

One method to express this in clear and conversational language is: The metric Coin Days Destroyed (CDD) evaluated by AMBCrypto indicates how far long-term coins have been moved in significant quantities.

HODLing continues as liquidity hunt begins

Should the Cumulative Demand Difference (CDD) be elevated, Bitcoin’s price may experience significant volatility, potentially leading to a downward trend due to increased selling pressure. An instance of this occurred with Bitcoin on the 28th of May.

At the cutoff point for this report, data indicated a decrease in the Circulating Distribution Day (CDD) figure to approximately 4.55 million. During this period, investors have shown a preference for holding onto their long-term cryptocurrency coins rather than engaging in transactions.

Should the current trend persist, the bullish forecast of $74,400 taking precedence over the possible drop to $68,050 becomes more likely. To strengthen this argument, AMBCrypto analyzed the liquidation map as well.

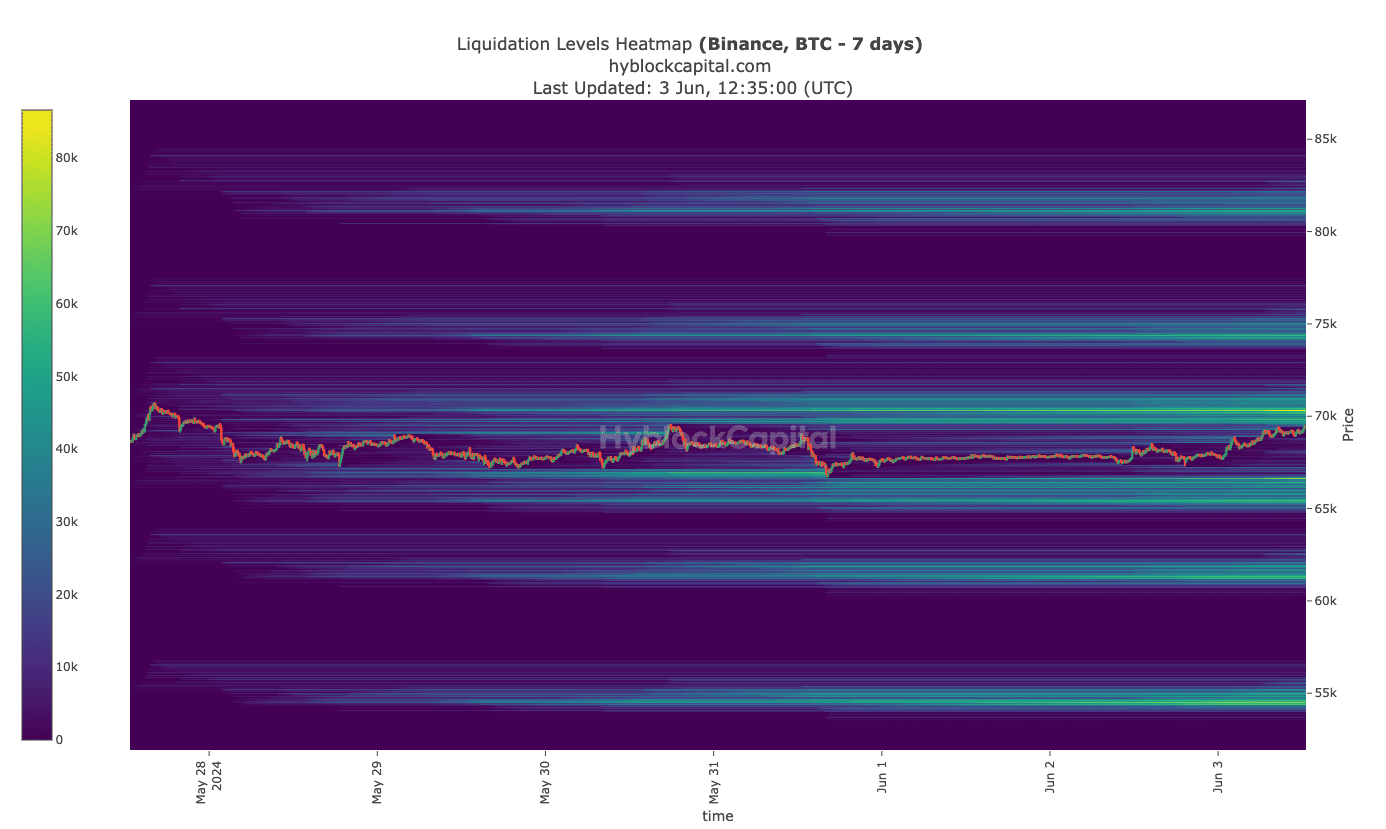

A heatmap serves as an effective tool for traders to locate zones with significant trading activity, denoted by high liquidity. In the event that a particular area exerts a strong pull, the Bitcoin price may be inclined to move in that direction, potentially reaching $70,300 at present, given the substantial liquidity detected there.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Reaching this level might trigger further growth towards $74,500, a region with notable resistance. Conversely, should the uptrend falter, Bitcoin may plummet down to $65,050.

But by the look of things and metrics analyzed, BTC looks set to climb above $74,000.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-04 06:15