- Ethereum has seen significant consecutive increases in the past 48 hours.

Whales have bought over $70 million worth of ETH within 24 hours.

On the 7th of April, Ethereum delivered its best gains for the month. This upward swing corresponded with a notable rise in purchasing volume from some large investors, referred to as “whales.”

At the same time, the network’s total transaction volume stayed roughly the same, and Layer 2 (L2) technologies were responsible for processing most of the transactions.

Ethereum increased by 7%

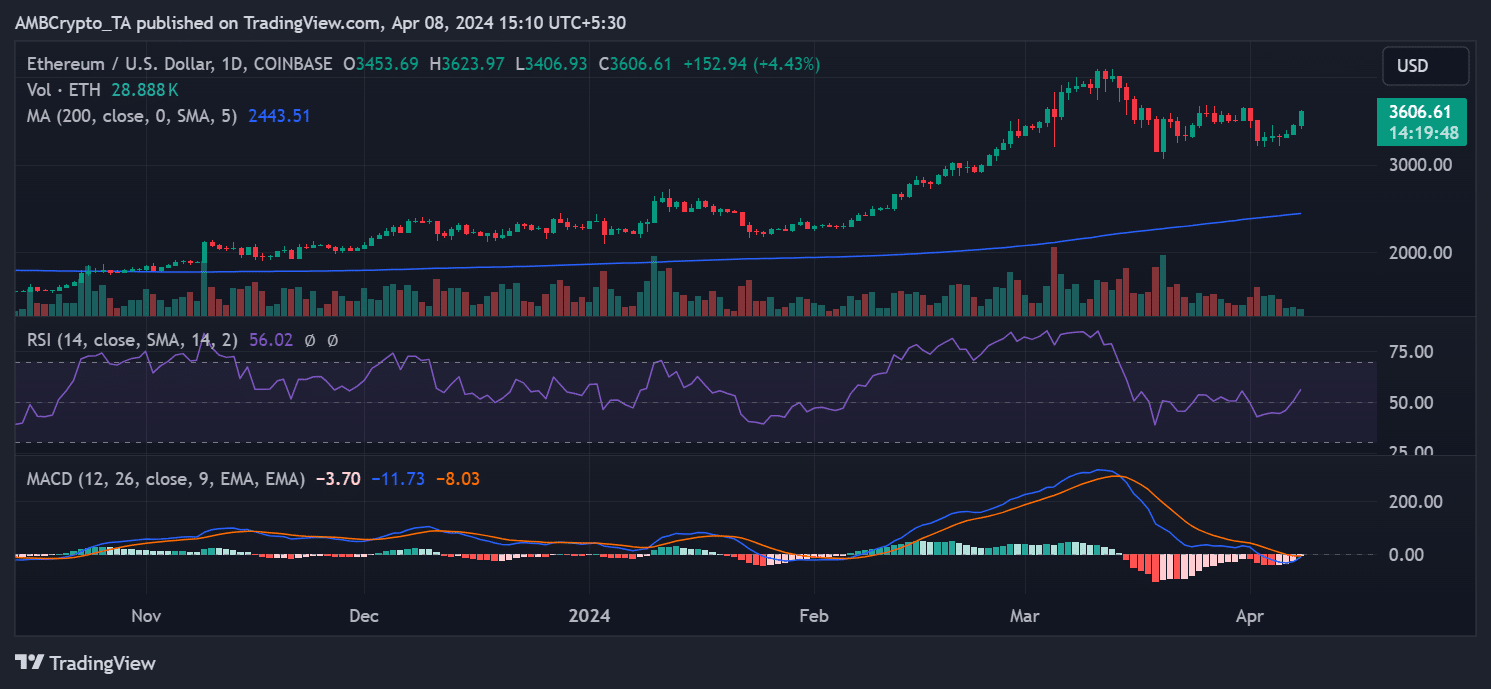

On the daily Ethereum chart examined, there was a noteworthy rise on April 7th, with Ethereum ending the day having gained more than 3% and surpassing $3,400 for the first time since notable declines.

Currently, Ethereum is seeing a more significant upward trend than when I wrote last, with Ethereum’s price climbing over 4%. The graph shows Ethereum being traded above $3,600 as a result of this recent spike.

Based on the graph’s analysis, the peak hit this year was approximately $4,000. With the present trajectory, there’s a strong likelihood of breaking this mark within the upcoming weeks.

An analysis of the graph showed that Ethereum’s price increase had put it back in an uptrend. The RSI figures suggested that Ethereum was now beyond the neutral level, suggesting a bull market.

Whales mop up more Ethereum

Lately, as Ethereum’s price climbs higher, notable buying behavior has emerged from some large investors, or “whales,” based on recent data from Spot on Chain. Specifically, within the past day, two such whales have shelled out over $35 million to acquire ETH.

Specifically, these whales acquired 10,322 ETH at an average price of around $3,400.

Further, when the price reached around $3,455, two more large investors sold off 11,657 Ether tokens, worth over $40 million, from a cryptocurrency exchange. This action from the whales implies increased buying activity, possibly in preparation for future price growth.

More cash flows into ETH

Based on an examination of Ethereum’s open interest data on Coinglass, there has been a noticeable decrease in recent times. Yet, a small surge occurred when this text was penned down, revealing a current open interest of over $13.3 billion.

The influx of capital into Ethereum could be a significant factor driving up its price even more.

Based on the present actions of whales and the rise in Open Interest, important indicators suggest that a new price point could be approaching soon.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-09 00:07