- Long-term BTC holders have continued to cash in.

- This has contributed to BTC’s struggle to break its psychological resistance.

As a researcher with years of experience tracking Bitcoin’s market dynamics, I’ve seen my fair share of rollercoaster rides. The recent sell-off by long-term holders is a classic case of “buy low, sell high” – it’s just that this time around, the ‘high’ was exceptionally high.

Over the last month, significant selling by long-term holders of Bitcoin (BTC) has been observed, representing the largest sell-off since April. With Bitcoin currently hovering around $93,000, this action raises questions about whether it indicates profit-taking or foreshadows a possible market correction.

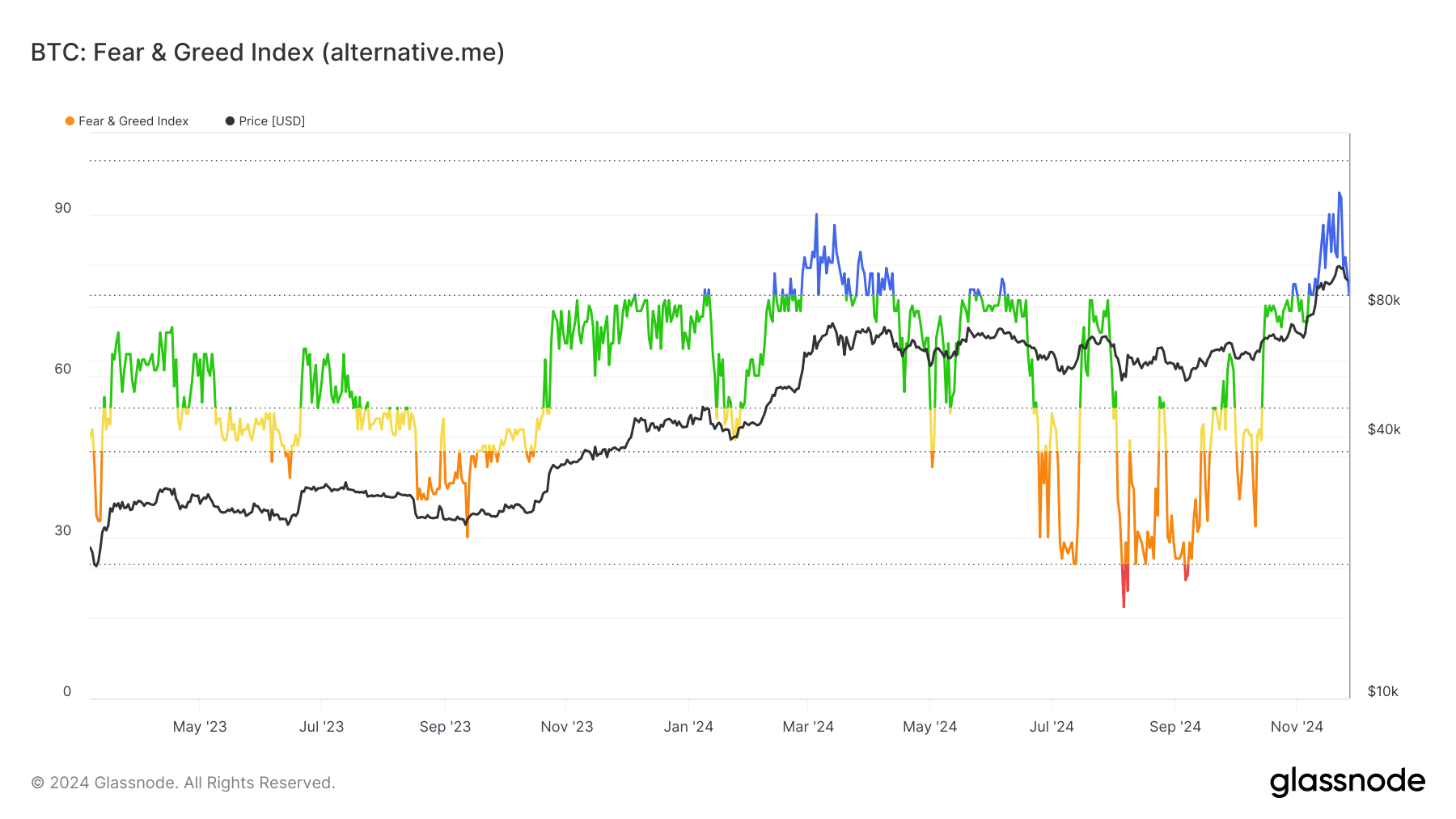

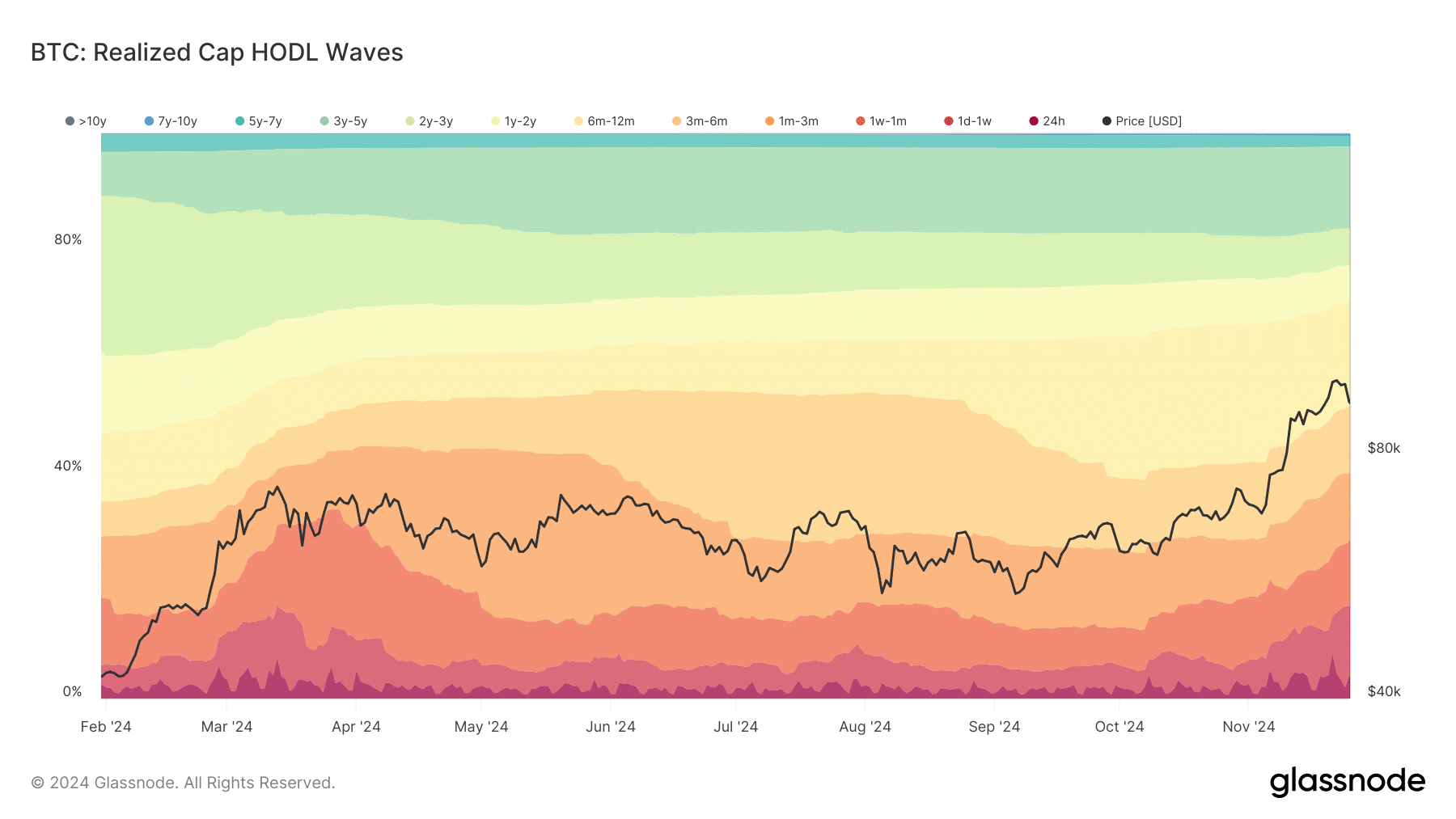

Observing significant patterns in metrics such as the Fear & Greed Index and HODL Waves, it seems possible that these price drops might influence Bitcoin’s short-term direction.

Long-term holders shed Bitcoin amid price surge

Long-term Bitcoin holders selling their assets at the same time as Bitcoin reached $93,000 recently has sparked curiosity over why such a large-scale selling would occur, feeding into theories about the reasons behind it.

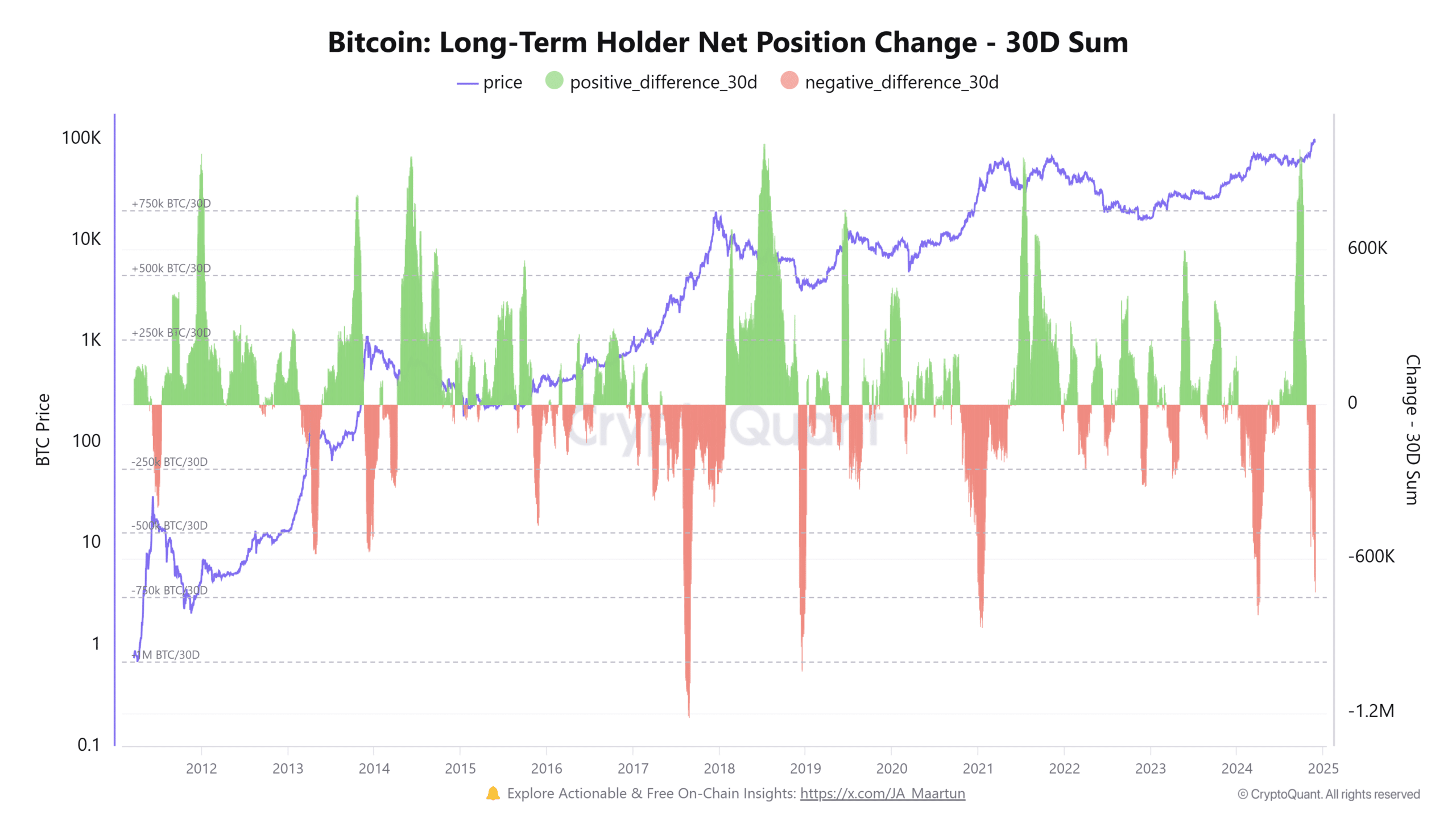

Analysis of the Long Term Holders Net position Change chart on CryptoQuant showed that it was negative. Over 728,000 BTC has been sold in the past 30 days, marking the largest sell-off since April.

Back in April, a sudden selling spree by long-term investors led to a brief price drop, leading some to ponder if this could happen again. As Bitcoin remains over $90,000, the market’s ability to withstand pressure is now under scrutiny.

Bitcoin Fear & Greed Index hits extreme levels

One more element contributing to the storyline is the Bitcoin Fear and Greed Index, presently indicating about 75, which signifies “intense greed” in the market. This kind of market sentiment frequently foreshadows corrections, as excessive investor confidence can result in pricing that’s not sustainable over time.

Considering the current index trends along with the selling spree by long-term investors, it might be prudent to exercise caution in the near future.

Younger coins dominate as HODL Waves shift

According to Glassnode’s Realized Cap HODL Waves analysis, there’s been a notable change in Bitcoin ownership distribution, with shorter-held coins (coins owned for less than six months) becoming more prominent within the market. This could imply that new investors or active traders are counterbalancing the selling pressure from long-term holders at present, keeping Bitcoin’s price relatively steady.

Nevertheless, it’s uncertain if these new market entrants will maintain the same level of commitment when volatility increases.

Outlook: caution or optimism?

Although the latest round of selling by long-time Bitcoin owners is significant, it doesn’t automatically mean a downturn in the market. Instead, the market seems to be displaying strength by maintaining crucial price points, with $90,000 serving as an important floor for potential buyers.

On the other hand, when there’s excessive greed among traders and a large amount of profits being cashed out, it increases the likelihood of market instability and price fluctuations.

Currently, the Relative Strength Index (RSI) of Bitcoin is at 61.44, suggesting that the asset is nearing the point where it may be overbought. In the past, these indicators have often coincided with a trend towards selling as investors tend to cash in on their profits, particularly when prices surpass significant psychological barriers.

Read Bitcoin (BTC) Price Prediction 2024-25

As I find myself inches away from reaching the psychologically significant price point of $100,000 with Bitcoin, it’s essential for me to stay vigilant about the actions of seasoned investors (long-term holders) and fresh market entrants alike. Their moves could greatly impact the market dynamics in the coming days.

As a researcher, I’m observing an intriguing balance in the Bitcoin market right now: it’s teetering on the edge of optimistic growth and careful pullback. The question remains whether this phase represents consolidation or a precursor to adjustments yet to come.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-11-27 17:12