-

XRP’s Futures Open Interest has shown positive growth of 2.3% in the past four hours.

XRP’s OI-Weighted Funding Rate indicated that traders were bullish, as long positions were paying short positions.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by the recent developments surrounding XRP. The bullish sentiment among Binance traders, as evidenced by their significant increase in long positions, is a compelling sign that should not be ignored. However, this optimism unfolds against the backdrop of a sideways market and a struggling XRP price near the strong support level of $0.52.

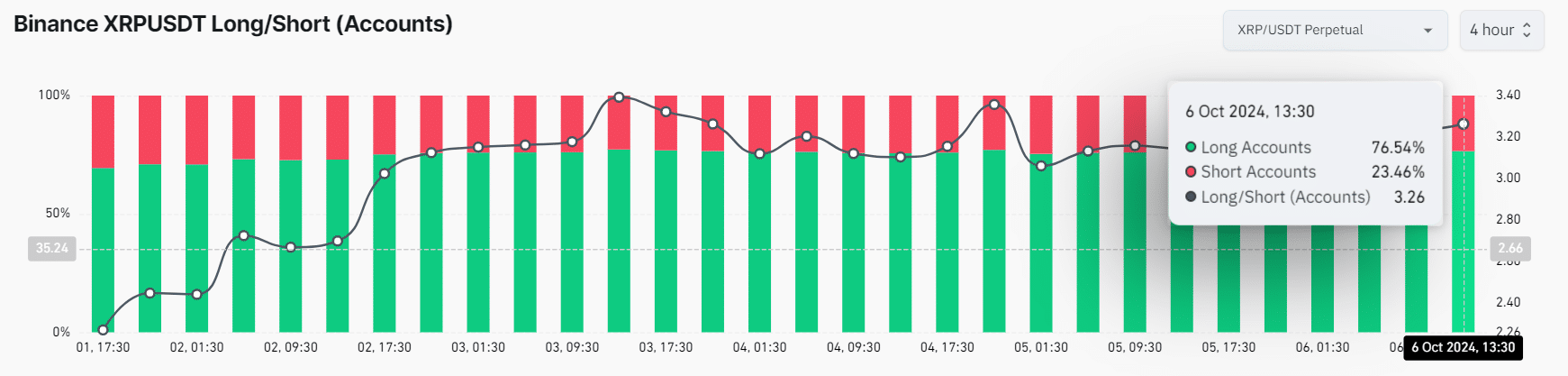

During the recent period of sideways movement in the cryptocurrency market, traders of XRP on Binance have shown optimism by substantially boosting their long positions over the last four hours, up to the point when the news was published.

Based on data from Coinglass, a company that analyzes blockchain transactions, about 76.54% of Binance’s XRPUSDT traders opted for buying (going long), while approximately 23.46% chose to sell (preferred short positions).

Binance traders go long on XRP

The extended holding of XRP on Binance indicates that traders are anticipating a rise in its price within the near future, as they have chosen to maintain a substantial stake.

Meanwhile, this bullish stance was established as XRP faced difficulties in building momentum close to its robust support at approximately $0.52.

Currently, Ripple (XRP) is being exchanged around $0.529, and it has seen a decrease in value by approximately 0.65% within the last day.

Currently, traders and investors seem reluctant to join in, due to a significant decrease – about 50% – in trading activity compared to the day before.

XRP’s bullish on-chain metrics

Regardless of market apprehension, there’s been a 2.3% increase in XRP Futures Open Interest over the last four hours. This suggests that more traders are placing their wagers, potentially signaling a positive outlook for XRP investors.

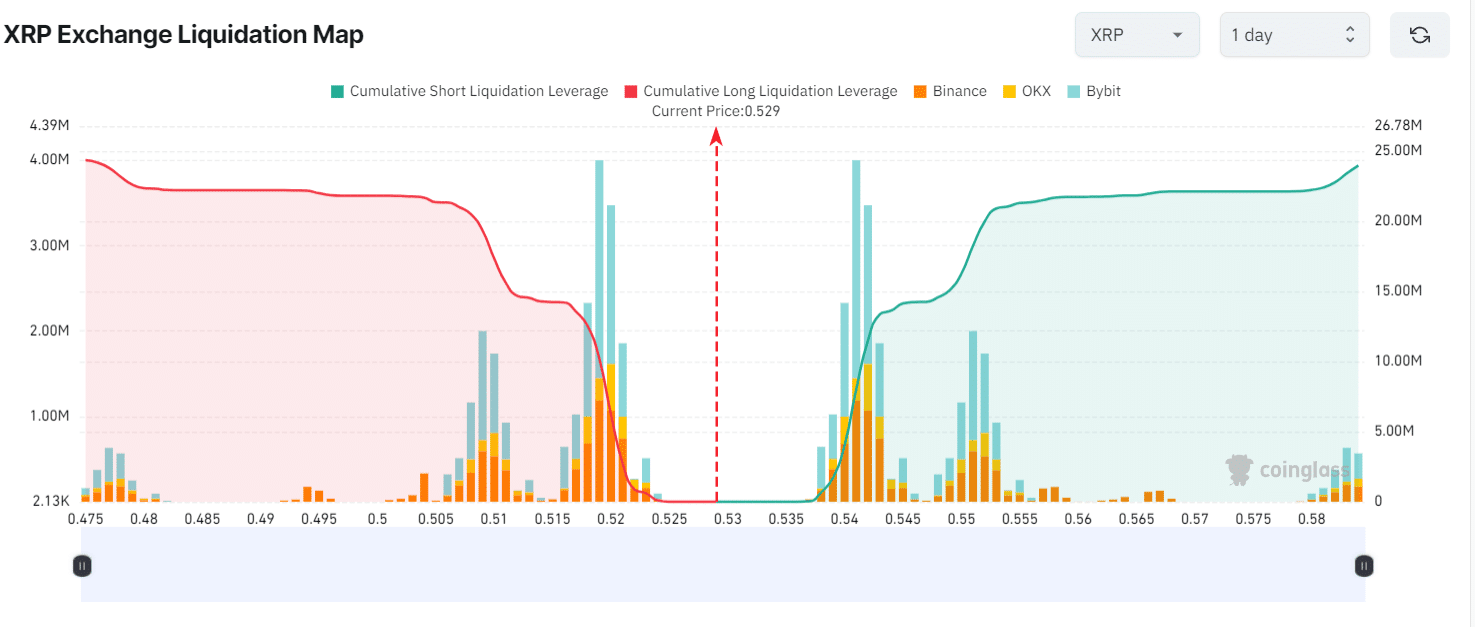

Currently, the key support level is around $0.519, while the resistance level hovers near $0.541, as per Coinglass data. At these price points, traders seem to be heavily leveraged.

Should the overall market opinion change to pessimistic and the value of XRP drops beneath the $0.519 mark, approximately $10.21 million in long positions may get automatically closed out.

If the sentiment becomes more positive and the price reaches around $0.541, it’s estimated that about $8 million in short positions will be closed out or “covered.

Furthermore, the bullish perspective is also backed by XRP‘s Open Interest (OI)-weighted Funding Rate, currently standing at a positive 0.0097%.

As a researcher, I can express this finding as follows: When the Funding Rate is positive, it suggests that traders have a bullish sentiment because they’re being compensated for holding long positions over short ones.

By examining factors like the Long/Short Ratio, Futures Commitments of Traders Report (Open Interest), stop-loss orders, and Funding Rates, it seems that the market is at present controlled by the bulls, suggesting a possible increase in asset prices ahead.

XRP technical analysis and key levels

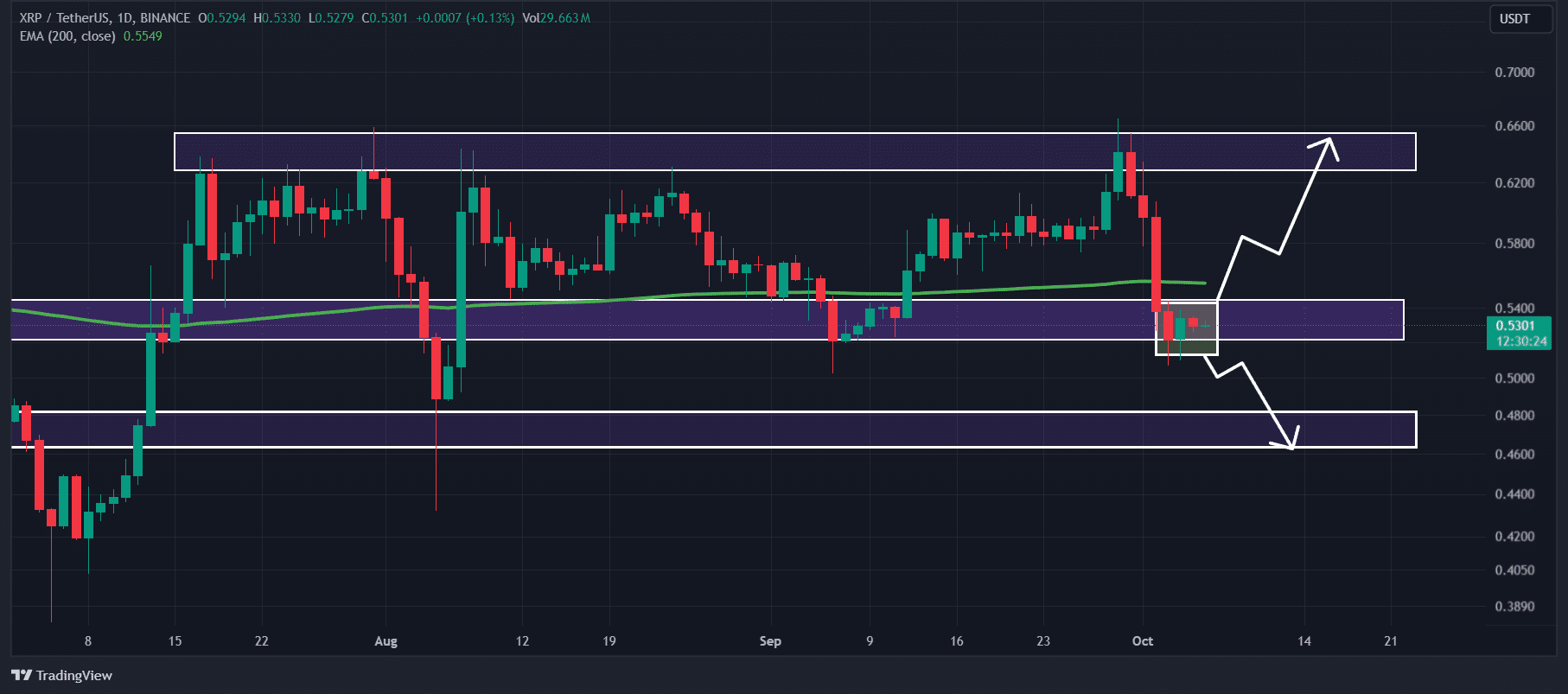

As reported by AMBCrypto’s technical assessment, the value of XRP has been holding steady within a narrow band, oscillating between approximately $0.518 and $0.545 over the last three days. This price movement is happening close to a significant support level at $0.52.

However, a breakout from this consolidation zone will determine the next movement in XRP’s price.

Read XRP’s Price Prediction 2024–2025

As an analyst, I’ve noticed that historically, when XRP surpasses the $0.545 mark and concludes the daily candle above this level, it often experiences a substantial rise. Given this pattern, there’s a significant chance that XRP could escalate by approximately 17% to touch the $0.65 level.

If XRP falls below the lower limit of its current range ($0.515) and ends the day at that level or lower, there’s a possibility it might decrease by approximately 12%, reaching around $0.455 in the upcoming days.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-10-06 19:04