-

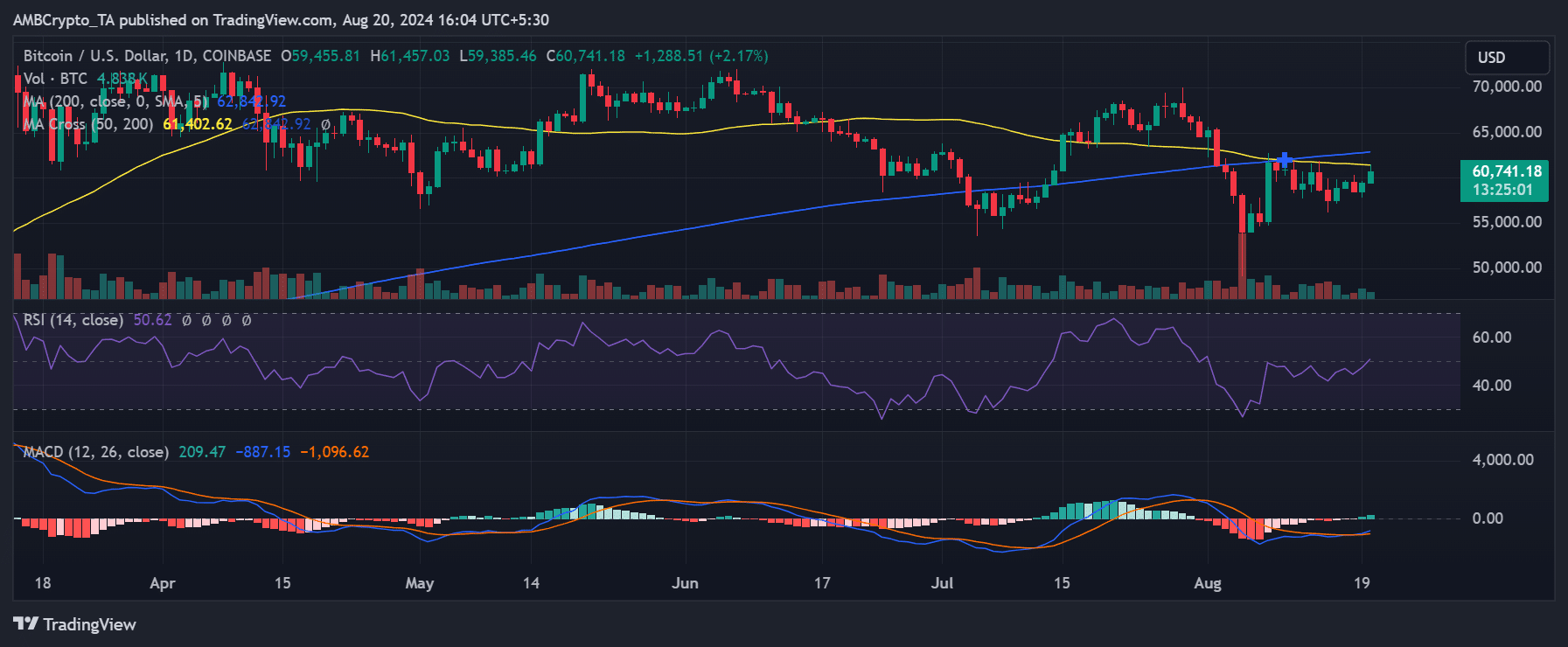

BTC crossed over to the $60,000 price level at press time.

Short holders have suffered more losses with the price volatility.

As a seasoned crypto investor with over a decade of experience navigating the volatile waters of Bitcoin, I can attest that the current market conditions are reminiscent of a rollercoaster ride. The recent surge above $60,000 is certainly a welcome sight after the tumultuous weeks we’ve witnessed. However, it’s disheartening to see the short-term holders bearing the brunt of this volatility, as over 80% are holding their investments at a loss.

In recent times, Bitcoin‘s value often falls below the crucial $60,000 mark that it’s trying to hold onto, suggesting some difficulty in staying above this price point.

The unpredictable changes in Bitcoin’s value have significantly affected those who own it for short periods. Many of these individuals currently possess their Bitcoin at a lower value because of its constantly shifting price.

Short Bitcoin holders at a loss

Based on the latest findings, it’s been shown that more than 8 out of 10 people who currently own Bitcoin for a short period have a negative return on their investment. This implies that the value of their Bitcoin holdings is currently lower than the amount they originally invested.

This situation arose as Bitcoin continues to struggle around the $60,000 price level.

The study found connections between the present situation and market circumstances akin to those seen in 2018, 2019, and midway through 2021.

During these times, many short-term investors found themselves in the red, causing widespread panic selling. This fearful response extended bearish market conditions as investors hurriedly tried to minimize their losses.

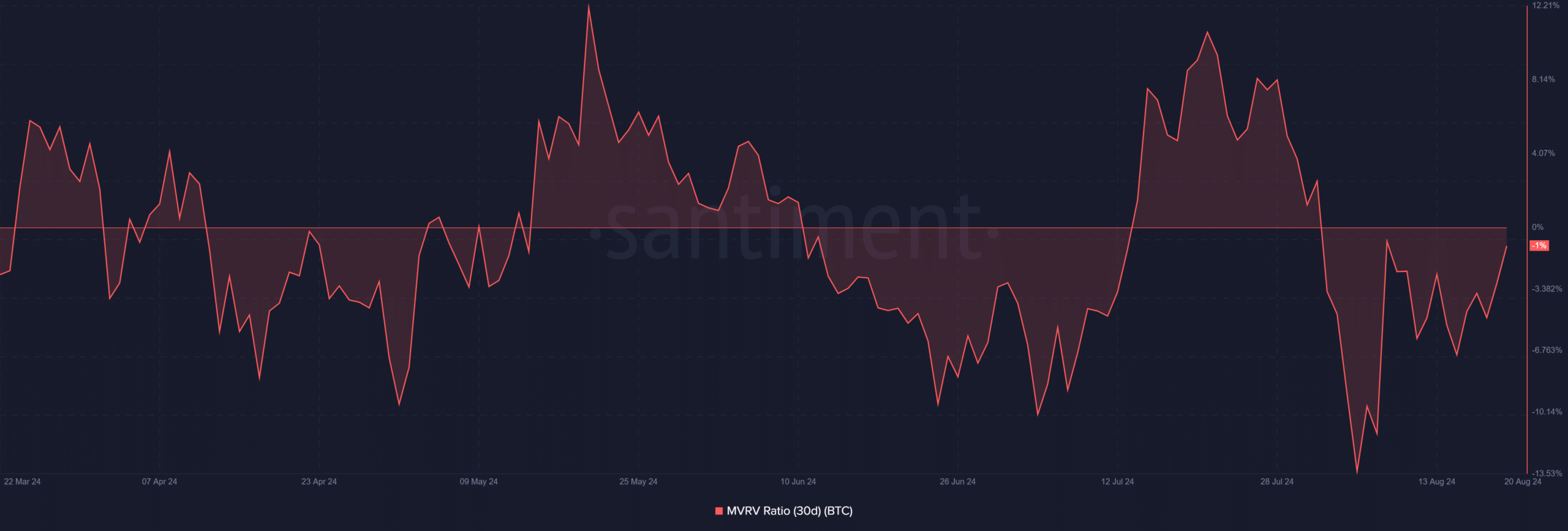

According to AMBCrypto’s recent analysis, the 30-day Market Value to Realized Value (MVRV) indicator on Bitcoin suggests that short-term investors are currently facing difficulties, as indicated by this financial metric.

Over the past few weeks, I’ve found myself in a losing position, as evidenced by the Metric Value Realized to Valuation (MVRV) metric being below zero. This suggests that my short-term investments have been underperforming, with most of them showing negative returns since the start of this month.

For quite some time now, the MVRM (Maximal Vehicle Realization Value) has been sitting below zero, suggesting that most short-term investors have been holding onto assets with unrealized losses.

On the 5th of August, the MVRV dropped to around -13%, highlighting the extent of the losses.

By the 18th of August, the MVRV figure was around -5%, indicating it’s still below zero but demonstrating a sign of improvement and potential recovery.

Over the past two days, I’ve noticed a significant improvement in the market conditions. Specifically, the MVRV has spiked up to approximately 1%, suggesting a bullish trend. This optimistic shift can primarily be attributed to recent price surges that have eased the strain on short-term investors.

More Bitcoin holders remain profitable overall

As a researcher examining Bitcoin’s dynamics, I find that when we broaden our perspective beyond short-term investors, the outlook becomes significantly more optimistic, focusing instead on the broader holder base.

As a researcher delving into cryptocurrency trends, I found an interesting insight from IntoTheBlock’s data analysis: A significant number of Bitcoin owners continue to reap profits amidst the latest market fluctuations.

Approximately 80% or about 45.45 million Bitcoin wallets contained Bitcoins that were purchased at a lower price compared to their current value.

Additionally, approximately 6.9 million wallets, representing about 12.9% of the total, were “underwater,” indicating that their owners were in a negative position due to current market prices. About 2% of these wallets were just breaking even.

Despite temporary losses experienced by short-term investors due to recent drops in prices, the market as a whole remains predominantly profitable over the long term.

In simpler terms, it’s not expected that quick traders, who often sell at a loss, will significantly influence the overall direction of Bitcoin prices in the long run.

Bitcoin price in the last 48 hours

At the moment I’m analyzing, Bitcoin has experienced a notable surge, with its price climbing over 2%, reaching roughly $60,800. This growth comes after a nearly 1% uptick in the preceding trading session, which brought it to approximately $59,452.

In simpler terms, Bitcoin has been edging near a significant barrier due to its latest advancements. This barrier is indicated by the yellow line representing its short-term average, which hovers around the $60,000 price point.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If Bitcoin manages to surpass the $60,000 barrier set by its short-term moving average, it could indicate a potential upward trend.

If we consider this scenario, the upcoming significant resistance point is approximately $63,000, denoted by the long-term moving average (represented by the blue line). This resistance point represents a key milestone that Bitcoin may aim for in its ongoing uptrend.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-08-21 06:16