-

Despite substantial token unlocks, Solana’s TVL has increased by 2.75%.

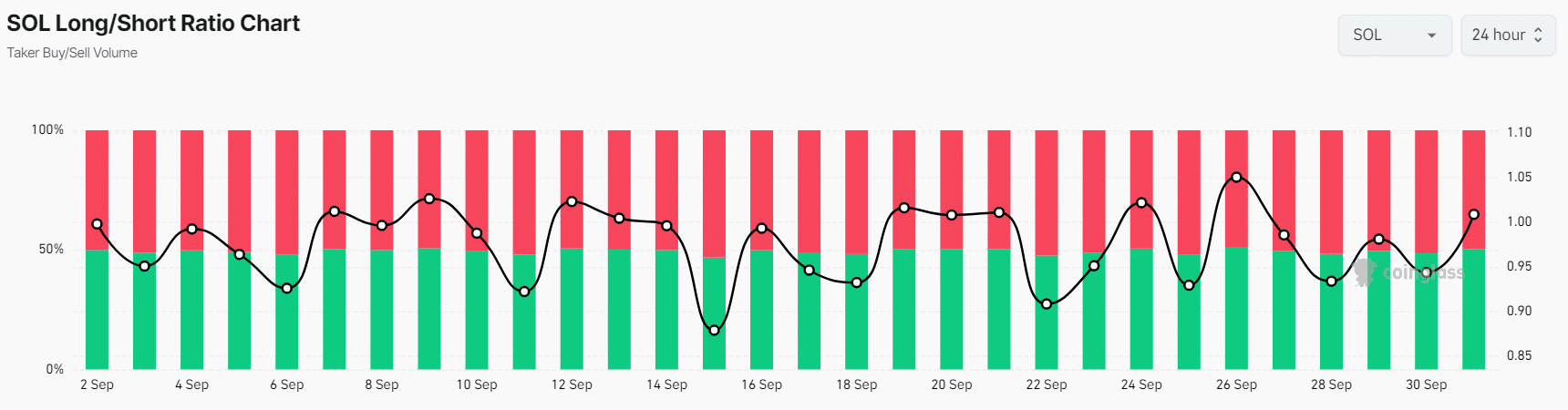

SOL’s Long/Short Ratio was 1.019, indicating bullish market sentiment among traders.

As a seasoned crypto investor with battle-scarred fingers from countless ups and downs, I’ve learned to navigate the tumultuous seas of digital assets with a mix of caution and optimism. The recent news about Solana’s token unlock has certainly raised some eyebrows, but as a wise man once said, “Don’t let a little water leak in the boat sink the ship.

The impending token release for Solana’s [SOL] has generated considerable interest among cryptocurrency aficionados, primarily because of concerns that it might lead to a decrease in the token’s price.

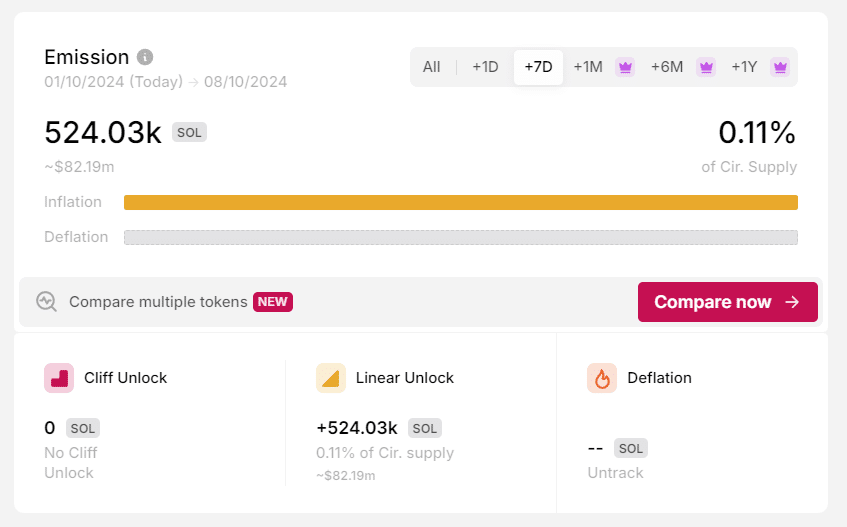

Solana’s token unlock

Over the next week from October 1st to October 7th, a total of 524,030 SOL, equating to approximately $81.56 million, will be made accessible and added to the circulating supply following token unlocks.

However, this unlock represents just 0.11% of Solana’s total circulating supply.

Based on the findings from this report, it’s likely that SOL may face increased selling and potentially decrease in price over the next few days.

Typically, a token unlock is seen as a potential bearish indicator because it increases the supply in the market, which might result in increased selling activity due to holders trying to cash out their tokens.

Current market sentiment

Over the past day, Solana’s Total Value Locked (TVL) has grown by approximately 2.75%, signaling a favorable outlook among traders. As of the current report, the TVL for Solana stands at around $5.506 billion, as per DeFiLlama’s data.

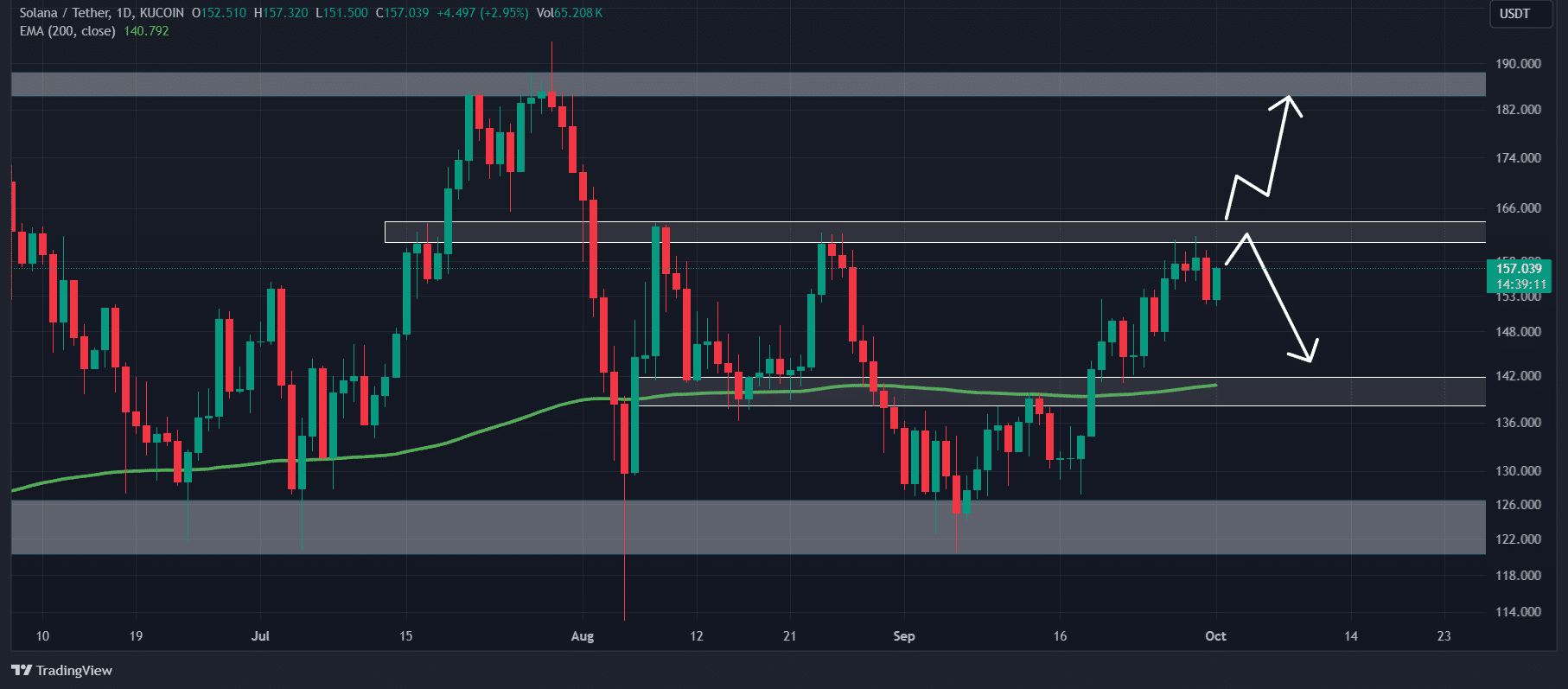

Based on AMBCrypto’s technical assessment, Solana (SOL) was experiencing an upward trend since it was transacting above its 200-day Exponential Moving Average (EMA), as observed on the day-to-day chart.

The 200 Exponential Moving Average (EMA) serves as a technical tool to help identify if a given asset’s price movement is trending upwards or downwards.

Given the current trend, it’s quite likely that SOL might first hit the potential resistance at around $165.

Should Solana (SOL) surpass its current resistance level and finish the daily trade above $170, it’s likely that the token may experience an additional 15% increase within the upcoming period.

Bullish on-chain metrics

This optimistic viewpoint is reinforced by data from blockchain, specifically. At the moment of reporting, according to the blockchain analytics company Coinglass, the Long/Short Ratio for SOL stood at 1.019, suggesting a predominantly bullish attitude among market participants.

Furthermore, there was a 2.2% increase in its Futures Open Interest over the last 24 hours, indicating that traders might be establishing longer-term investment positions.

Read Solana’s [SOL] Price Prediction 2024–2025

At press time, SOL was trading near $157 after a price surge of 0.25% in the last 24 hours.

In that timeframe, there was a 5.6% rise in trading activity, suggesting greater involvement from both traders and investors as the market undergoes a reversal.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-01 21:11