- Worldcoin continues to plunge further with the recent $6.6 billion raise by OpenAI failing to buoy prices.

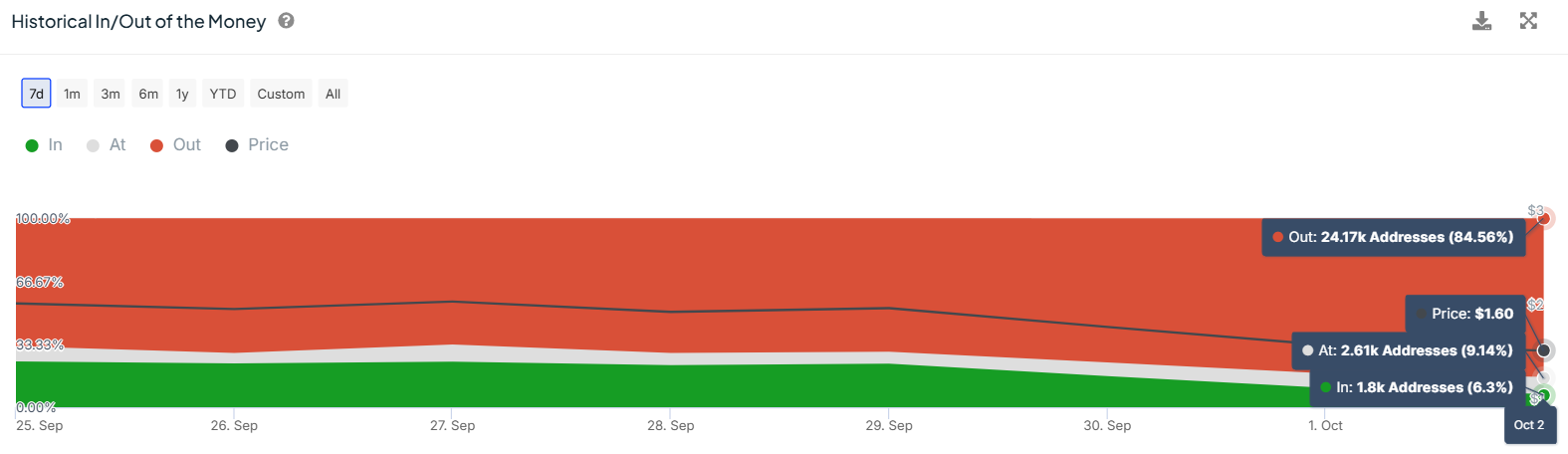

- The drop has led to wallets in losses spiking to 84% .

As a seasoned crypto investor who’s seen more market fluctuations than I care to remember, I can’t help but feel a sense of déjà vu looking at Worldcoin’s [WLD] performance these days. The recent $6.6 billion raise by OpenAI didn’t seem to lift WLD prices as expected, and the subsequent drop has left my portfolio reeling with a 84% loss in wallets.

On Thursday, October 3rd, the price of Worldcoin (WLD) stayed relatively low, following the trend of Bitcoin (BTC) and other cryptocurrencies. As we speak, WLD is trading at $1.56, a decrease of about 9% in the past day. Over the last week, the value of Worldcoin has dropped by approximately 25%.

Despite the fact that OpenAI has just secured $6.6 billion in new funding, valuing it at an impressive $157 billion, the value of Worldcoin has nonetheless experienced a decline in its price.

WLD tends to react to developments around OpenAI as the project is backed by OpenAI’s CEO Sam Altman. However, the coin has failed to react to this recent raise and instead, it has plunged to a weekly low as bears tighten their grip on price.

Worldcoin’s short-term trend turns bearish

Worldcoin’s value has dipped beneath its 50-day Simple Moving Average (SMA) on the daily chart, signaling a shift in the short-term trend towards bearishness. This decrease occurred following an unsuccessful attempt to maintain a significant support level at approximately $1.59.

In simpler terms, the MACD line’s crossing below the signal line supports the idea that the market is likely to rise (bullish hypothesis). Additionally, the MACD bars are now appearing red, which indicates an increase in downward pressure or selling activity within the market.

If this decline fails to attract dip buyers and WLD continues trending lower, the next support level to be tested is the 1.618 Fibonacci level ($1.15).

If the wider market rebounds and WLD increases, the next probable resistance could be $1.59, shifting the immediate trend towards bullish. Additionally, a significant resistance point can be found at the 0.618 Fibonacci level, which is approximately $1.78.

Worldcoin wallets in losses spike to 84%

According to data provided by IntoTheBlock, the recent drop in prices has led to a rise in Worldcoin wallets holding coins at a loss.

Over the past week, the number of WLD addresses that are making a profit has increased significantly, rising from approximately 68% (or 19,300) of the holders to around 84% (or 24,100) of the holders.

Conversely, the earnings from wallets have dropped substantially, going from 23% to just 6%. With an increasing number of traders experiencing losses, they may decide to sell in order to reduce their risk. This selling could intensify the downward trend for Worldcoin.

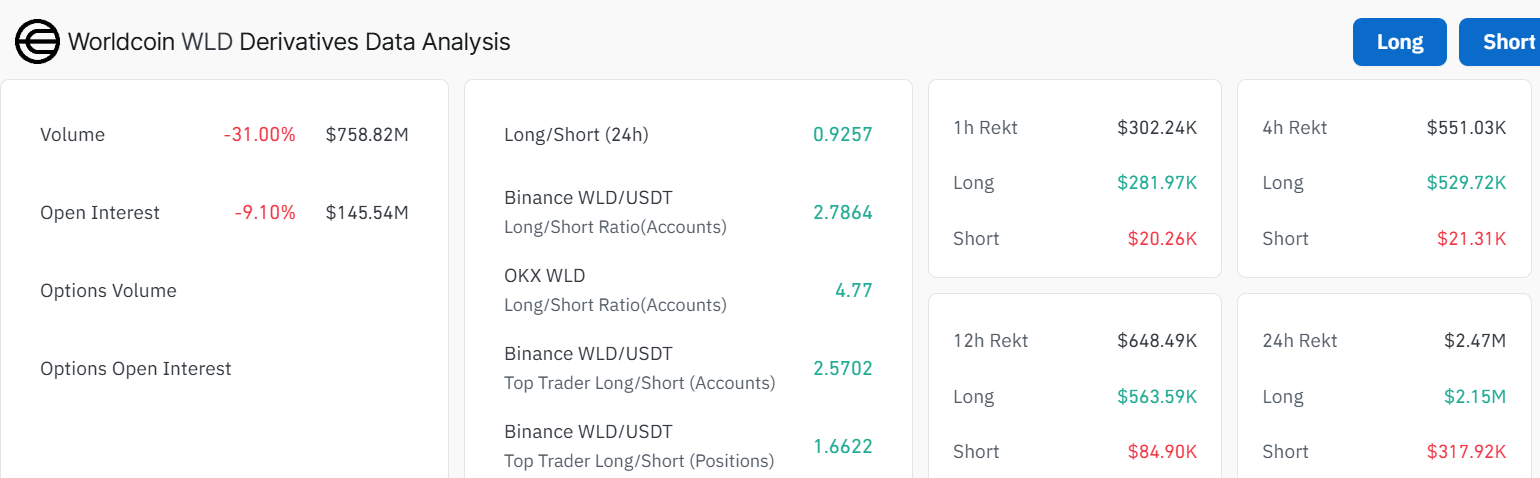

Derivatives data shows THIS

In simpler terms, the decline in open interest on the derivatives market by 9% over the past day seems to indicate that traders are liquidating their Worldcoin holdings, which could potentially strengthen the argument for a bearish outlook on Worldcoin. (Coinglass data suggests this trend.)

The pessimistic view might be due to a surge in sell-offs, as at the current moment, the total liquidation for WLD stands at approximately $2.47 million. Out of this figure, about $2.15 million were resulting from sell-offs (long liquidations).

The long/short ratio also stood at 0.925 at press time, showing a relatively neutral market.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

In other words, the data reveals that there were slightly more short positions than long ones, suggesting a general pessimism among traders regarding WLD‘s price trend.

Despite the fact that Worldcoin stands out as an AI-related crypto, it’s important to note that many similar cryptocurrencies are currently experiencing losses. At this moment, the combined market value of all AI-focused cryptos is estimated to have dropped by about 6% to approximately $26 billion, according to CoinGecko. This broader trend in the AI crypto market could potentially be contributing to Worldcoin’s less-than-stellar performance as well.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-03 19:04