-

BTC holders continue to see profits on their investments.

This has remained despite the coin’s narrow price movements.

As a long-term Bitcoin (BTC) investor, I’m thrilled to see that my holdings continue to generate profits, even during this narrow price movement. The recent report by Glassnode further emphasizes the robust profitability of BTC investors. With over 87% of the circulating supply held in profit and an average unrealized profit of over 120%, it’s a reassuring sign that I made the right decision to invest in Bitcoin.

According to a recent analysis by Glassnode, Bitcoin [BTC] investors have chosen to keep their gains instead of selling, even as the cryptocurrency’s price has remained relatively stable over the past few weeks.

At the moment of publication, Bitcoin was trading at a price of $65,625. The cryptocurrency has been moving back and forth within a flat range, encountering resistance at $71,656 and finding support at $64,825. Yet, this “lack of clear direction” hasn’t affected Bitcoin investors’ profitability, which remains strong.

According to the on-chain data provider:

“Bitcoin prices are currently trading between a defined price band. The majority of investors continue to hold profitable positions, as over 87% of the existing Bitcoin supply was bought at lower prices than the current market rate.”

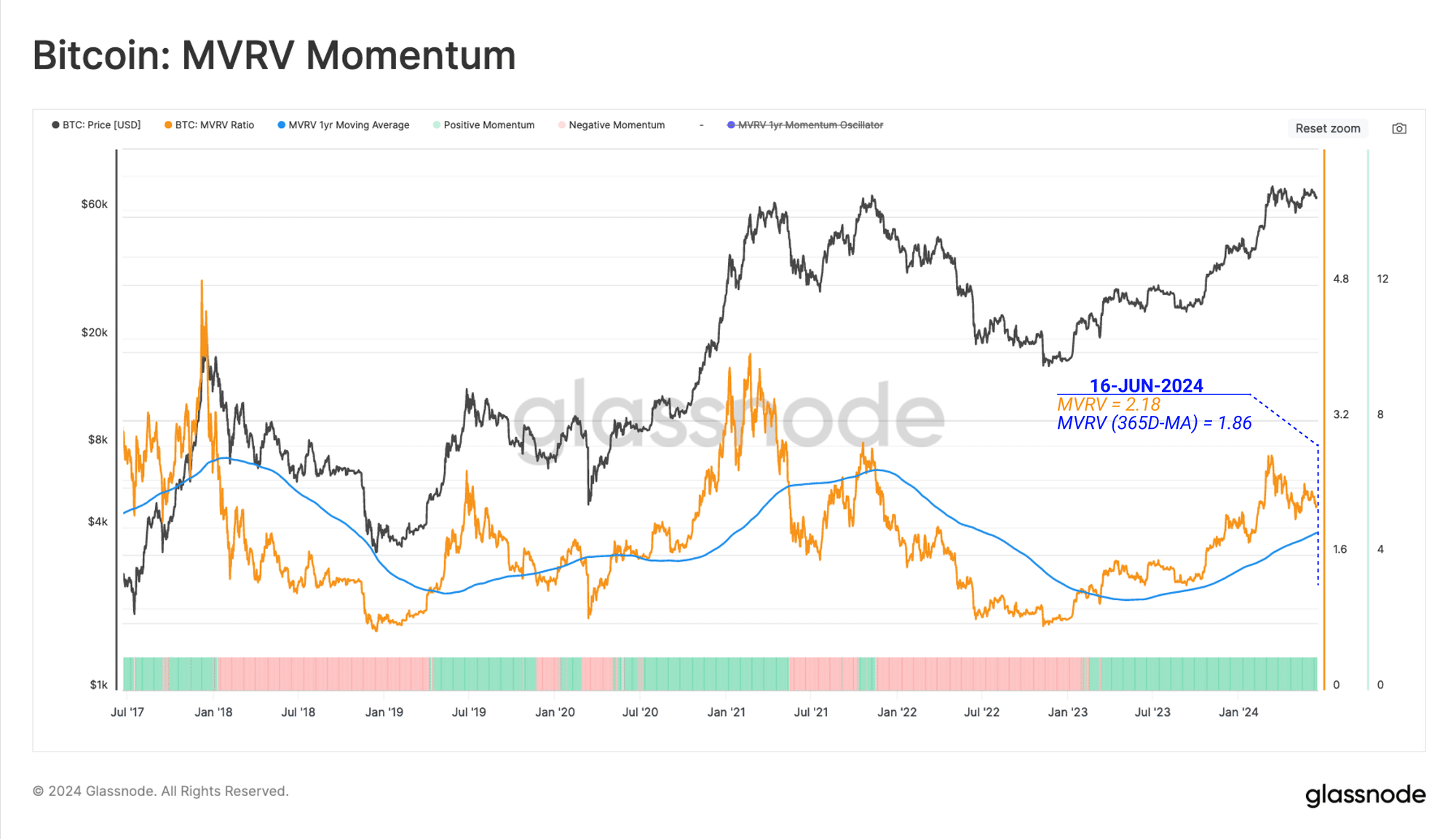

As a market analyst, I’ve examined the Market Value to Realized Value (MVRV) ratio for Bitcoin using Glassnode’s assessment. The findings reveal that on average, each Bitcoin in circulation is currently held with an unrealized gain exceeding 120%.

It’s intriguing that Bitcoin holders have reaped substantial profits since March’s record high, yet the number of coins transacted on the Bitcoin Network has seen a noticeable decrease.

According to Glassnode, this decrease signifies a diminished enthusiasm for speculative trading and a growing hesitance among investors.

Low exchange activity

The stabilization of Bitcoin’s (BTC) price has resulted in a decrease in the amount of BTC being transferred between exchanges. According to Glassnode, approximately 17,400 BTC, equivalent to $1.13 billion at present market prices, is sent by short-term holders (STHs) to exchanges every day.

These investors have held their coins for a relatively short period, typically less than 155 days.

The amount of Bitcoin these investors are sending to exchanges now is 68% lower than the 55,000 BTC they transferred during the peak price of $73,000 in March.

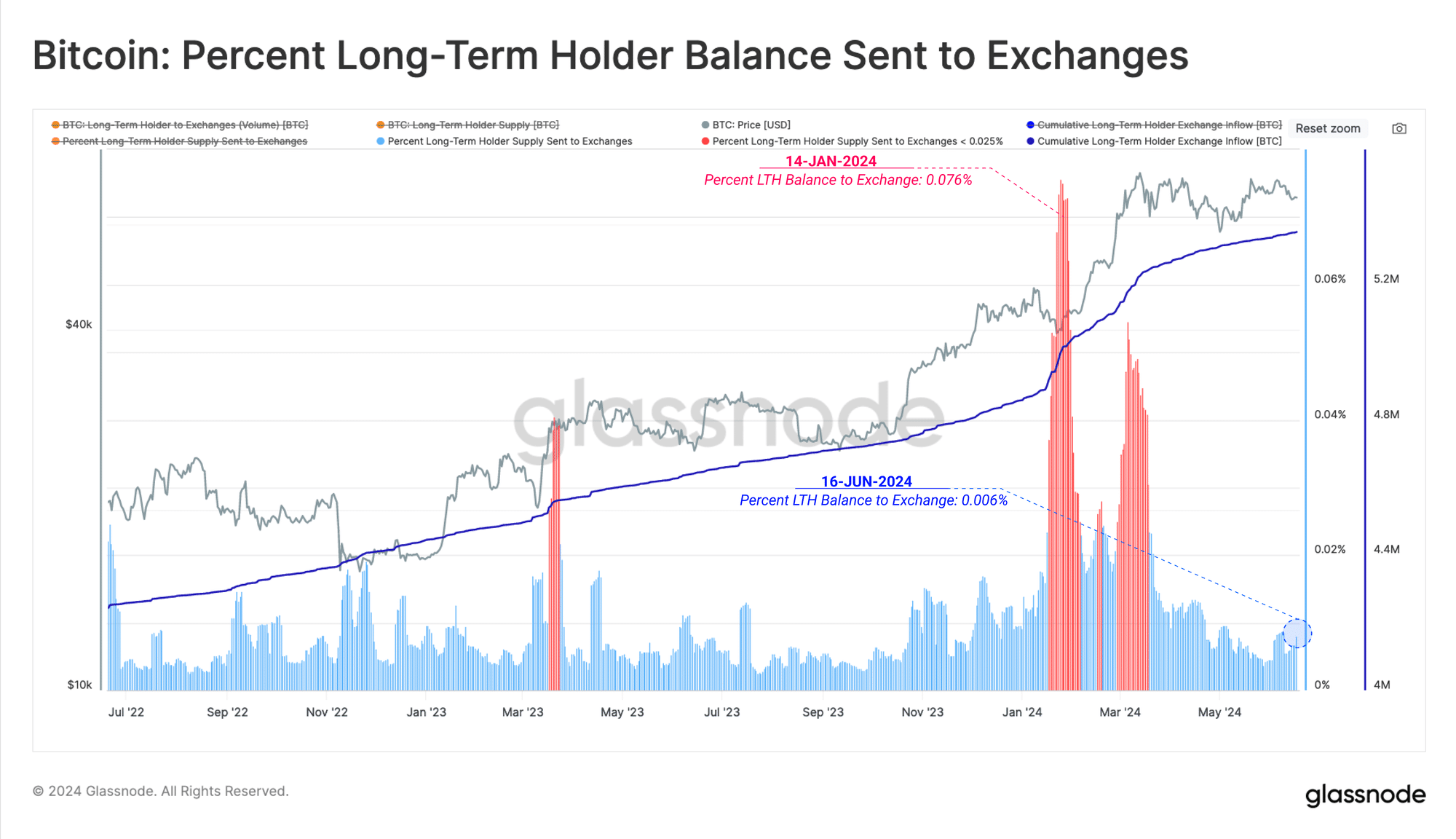

From my perspective as a researcher studying the behavior of long-term Bitcoin holders (LTHs), I’ve found that their daily inflows into cryptocurrency exchanges remain quite modest. Specifically, less than 1,000 Bitcoins with a value greater than $6 million at current prices are transferred into these platforms each day.

Glassnode said:

As a crypto investor, I’ve noticed that long-term holders (LTHs) are transferring only a minimal amount, less than 0.006% of their total crypto assets, into exchanges. This observation implies that this group has attained a balance and currently doesn’t feel the need to buy or sell more based on current market prices. Higher or lower price movements might be necessary to provoke additional actions from LTHs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying Bitcoin transactions, I’ve discovered that on average, individuals send approximately $5,500 worth of Bitcoin to exchanges for every transaction. This intriguing finding has motivated many long-term holders to cash in their profits by selling their Bitcoins.

The market is currently expecting a surge to reach its all-time high of $73,750. Yet, the existing demand fails to generate sufficient force to boost prices further above this level.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-20 04:07