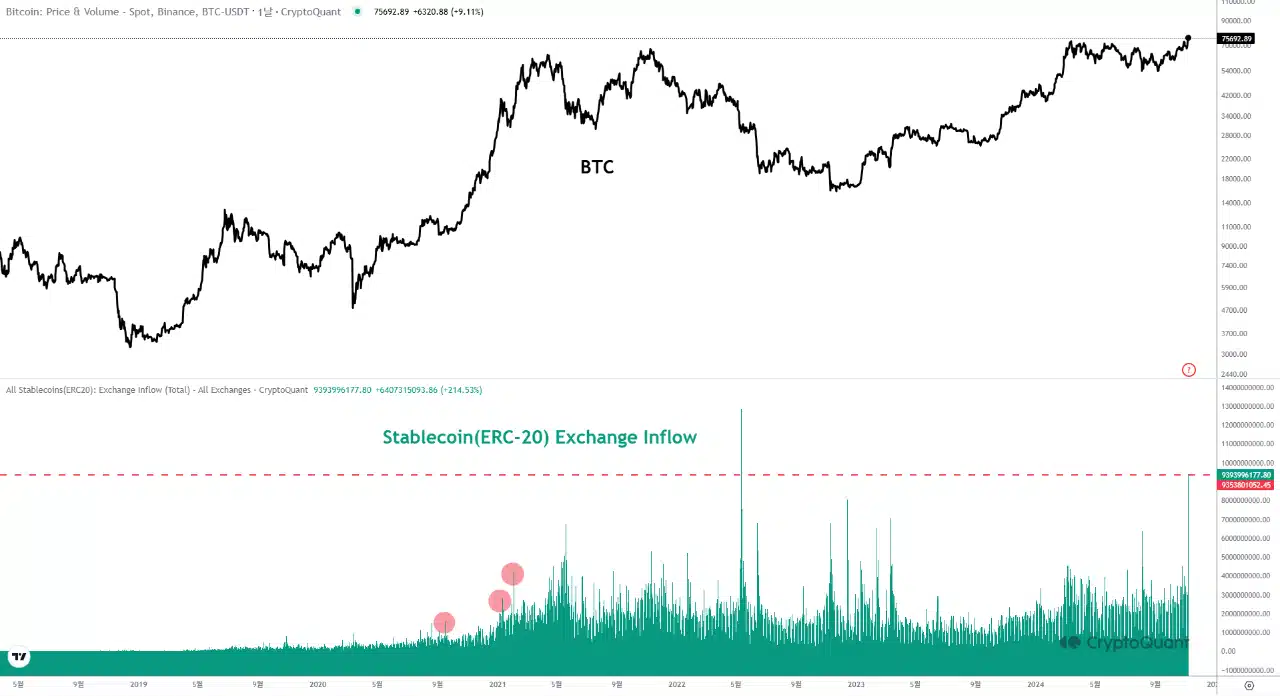

- Deposits of $9.3 billion in ERC-20 stablecoins into major exchanges could signal a bullish Ethereum rally.

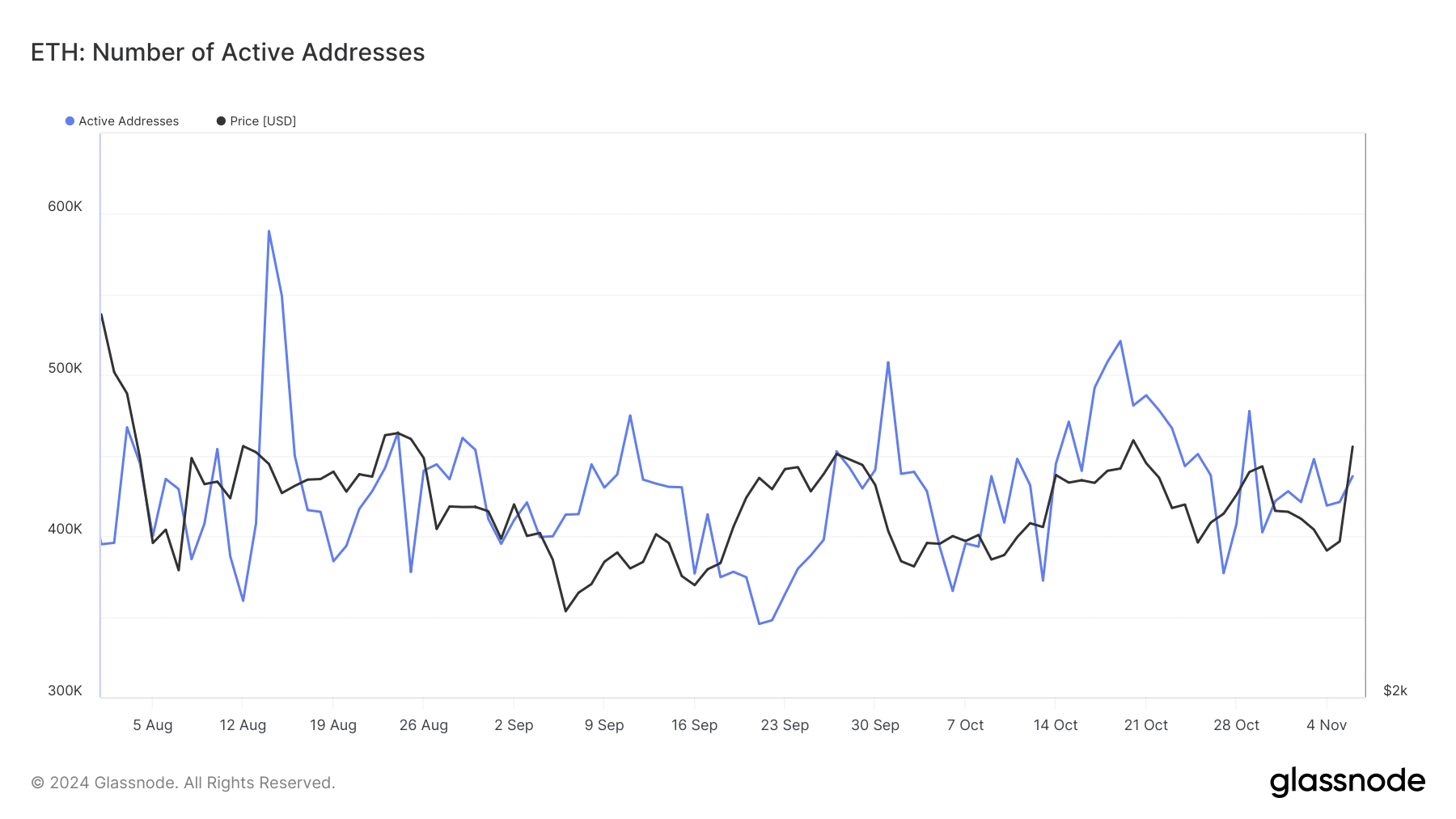

- Increased activity in Ethereum’s active addresses suggested rising retail interest in the asset.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. However, the recent surge in Ethereum [ETH] is truly captivating. The combination of massive stablecoin inflows into major exchanges and the rise in active addresses suggests that we might be on the brink of another bullish rally for ETH.

Ethereum (ETH) is currently experiencing a surge of optimistic energy, mirroring the overall increase in value that the cryptocurrency market has recently experienced.

Even though Ethereum hasn’t yet matched its old peak value, it has seen a substantial rise in recent times. To be precise, over the last few days, this cryptocurrency has spiked by over 8%, reaching a maximum of $2,872 at the moment of reporting.

This signifies a significant improvement, as the value now stands around 57.3% lower than its peak of $4,878 in November 2021.

Lately, the surge in value indicates growing investor curiosity, and it underscores the altcoin’s durability, as it remains a focus of market interest along with Bitcoin‘s recent price rise.

Currently, an interesting discovery within the Ethereum network has been pointed out by a well-known CryptoQuant analyst named Mac.D.

As a crypto investor, I’ve noticed that following the U.S. presidential election, an impressive $9.3 billion in ERC-20 stablecoins have been flowing into cryptocurrency exchanges, according to the analysts’ reports.

This represents the second-largest influx of ERC-20 stablecoins since their inception.

In summary, Binance took in approximately $4.3 billion, Coinbase gathered around $3.4 billion, and the rest went to smaller trading platforms.

Previously, such significant surges tended to coincide with positive market trends (bullish rallies), as was observed from September 2020 through February 2021.

If this pattern holds, Ethereum and the broader market may be poised for another upward trend.

Ethereum’s rising retail interest and network activity

Beyond the rising influx of ERC-20 stablecoins, there’s a noteworthy uprising in retail involvement with Ethereum as well.

According to data provided by Glassnode, there’s been an increase in the number of actively used Ethereum accounts, which is a significant indicator of growing retail involvement and network activity.

After dipping below 400,000 active wallets in late October, the count has since increased to more than 430,000.

This rise indicates an escalation in network usage, hinting at revived engagement from individual users and potentially higher network requirements.

The growth in active addresses can have meaningful implications for Ethereum’s price trajectory.

Boosting the level of activity generally indicates a growing need and more frequent use of the network, which might lead to an increase in the asset’s worth due to supply and demand dynamics.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As retail investors increase their involvement with Ethereum, it may lead to higher liquidity levels and more stable prices, reflecting a rising trust and faith in the market.

The combination of this ongoing trend, increasing steadycoin investments, and robust trading action suggests a positive outlook for Ethereum’s short-term prospects.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-08 00:08