-

Open BTC Futures on Binance jumped from 85K BTC to 90K this week.

BTC volatility is anticipated ahead of critical US inflation data and CZ’s jail release.

As a seasoned crypto investor with a few gray hairs to show for it, I can’t help but feel a mix of anticipation and apprehension as I watch the Bitcoin market dance around the 90K mark on Binance. The past few years have taught me that this volatility is just par for the course in the wild west of cryptocurrency.

The Binance (BNB) trading platform is experiencing an increase in the number of open Bitcoin (BTC) futures contracts as significant U.S. economic data releases and cryptocurrency-related events approach.

As a researcher, I observed an almost 7% surge in Open Interest (OI) on September 23rd, which significantly influenced Bitcoin Futures. At the moment of recording this observation, Bitcoin Futures had climbed from approximately 85,000 coins to around 90,000 coins.

Significantly, it has been announced that Changpeng Zhao, the previous CEO of Binance, is set to be discharged from prison on the 29th of September.

As a researcher, I noticed that speculators, particularly those trading on the Binance platform, seemed to have upped their risks by betting on Bitcoin. It appeared that they were confident in an upcoming Bitcoin price surge, possibly in anticipation of the US PCE Index (Price Consumption Expenditure) data release.

Speculators’ BTC appetite surge

Financial analysts are looking forward to the release of Personal Consumption Expenditures (PCE) data to estimate how quickly the Federal Reserve might adjust interest rates in the coming times. Consequently, Bitcoin’s price may respond to this data.

Some analysts believe that this occurrence could spark significant fluctuations in Bitcoin’s value. Translation: The period from September 27th to 29th might witness extreme price changes for Bitcoin, the leading cryptocurrency.

The significant rise in Open Interest (OI) suggests a growing market curiosity. Consequently, this trend also highlights the optimistic viewpoint of futures market speculators regarding their bullish perspective.

On the other hand, it likewise leaves speculators vulnerable to the threat of large-scale sell-offs, potentially causing additional market turbulence and price fluctuations in Bitcoin.

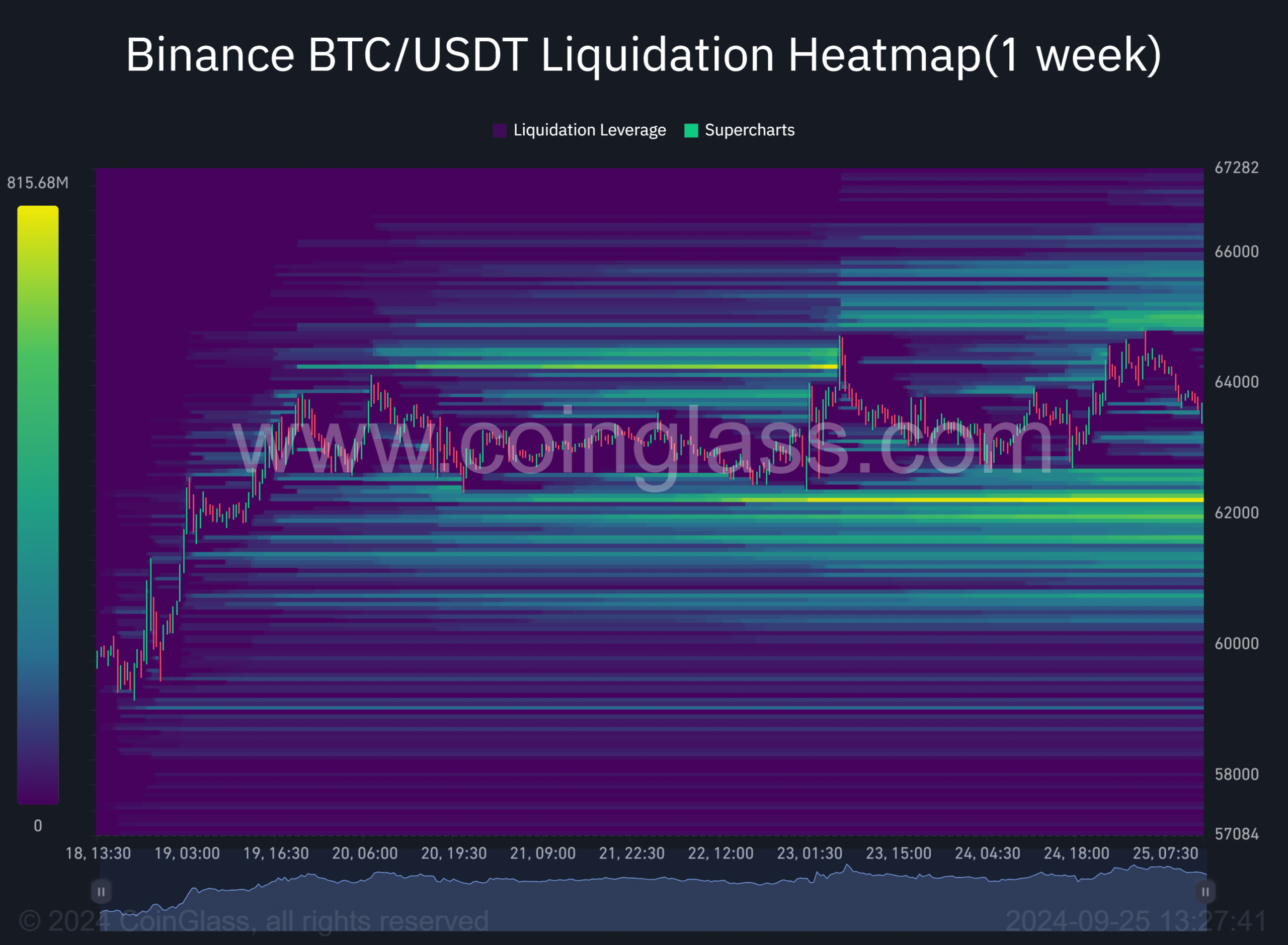

According to the 1-week liquidation chart by Coinglass, important price points to keep an eye on were around $62,000 and $65,000. There has been a significant accumulation of short positions close to the $65,000 mark.

Besides, there were also significant long positions at $62K (as shown by the bright orange color).

A sudden spike in price beyond $65,000 might forcefully close numerous short trades at that level, potentially causing bears to suffer immense financial losses. Conversely, a frenzied return to the $62,200 region could trigger over $800 million of long positions.

Bitcoin price action

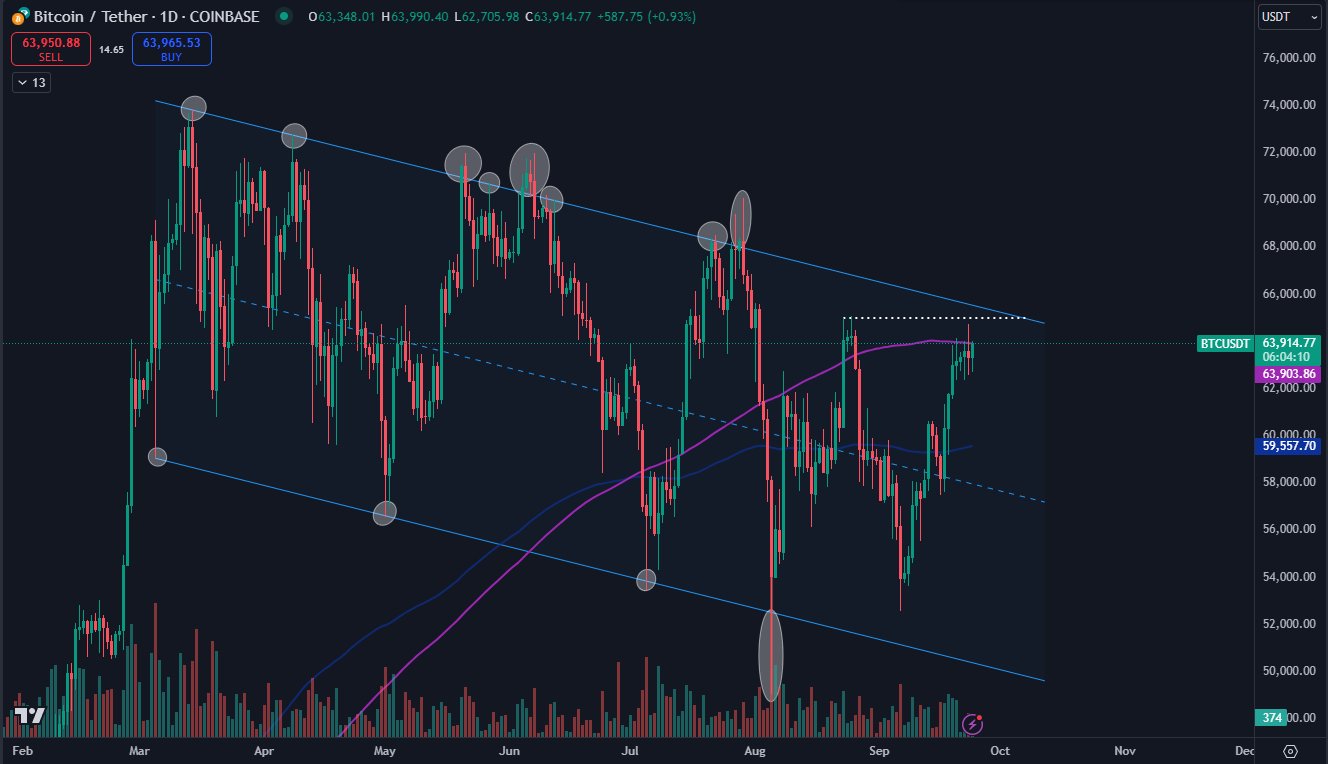

At the given moment, Bitcoin’s worth was under $64,000 and didn’t manage to exceed a significant benchmark, the 200-day moving average (MA), which was set at approximately $63,900.

According to trader Daan Crypto, if Bitcoin breaks through its current level and trend, it might signal a change in the market’s bullish structure. This could lead to a faster approach towards Bitcoin’s All-Time High (ATH).

As an analyst, I’m expressing that if Bitcoin (BTC) continues its upward momentum, it might lead to a short squeeze, potentially causing losses for bearish traders. It’s yet uncertain whether these triggers will propel BTC over the resistance level at $65K, a significant hurdle in its path.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-26 02:15