-

Most MATIC addresses are “out of the money”

Declining whale transactions may reduce short-term volatility and support a bullish reversal

As a seasoned crypto investor with a keen eye for market trends and technical analysis, I’ve seen my fair share of bear markets and bull runs. And while MATIC‘s current price action may seem disheartening, the latest data points suggest that a potential bullish reversal could be on the horizon.

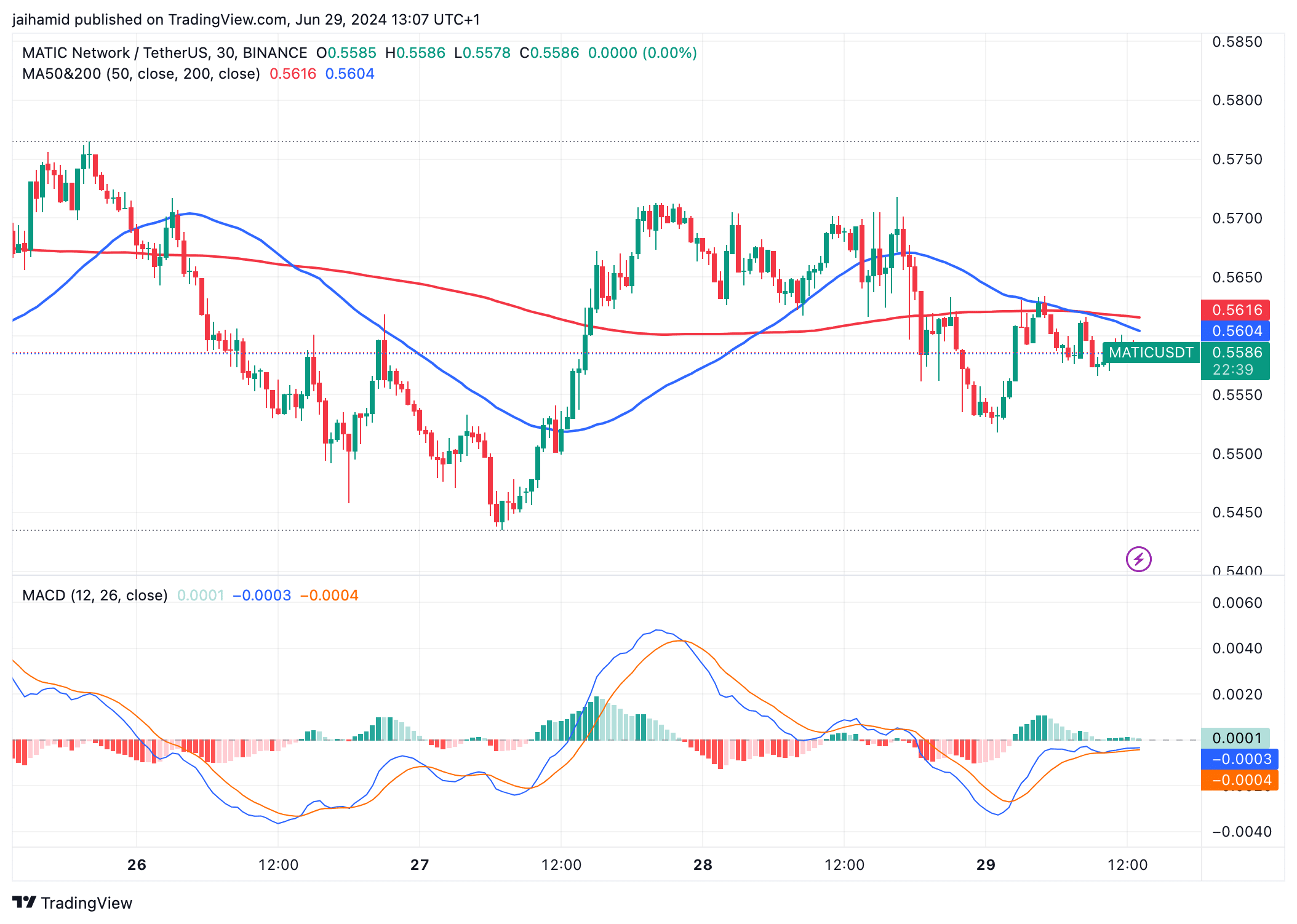

As a researcher studying the cryptocurrency market, I’ve noticed that Polygon‘s native token, MATIC, has reached a nine-month low recently, causing worry among investors and traders. However, an analysis of the Moving Average Convergence Divergence (MACD) indicators suggests that a bullish reversal could be imminent.

When I penned down this text, the MACD line was barely touching the Signal line, suggesting a bearish trend in the market based on the chart’s momentum. Yet, it was important to note that a potential bullish crossover could occur soon since the lines were very close to each other.

As a researcher studying the cryptocurrency market, I observed that the price of MATIC fell below not only the 50-day moving average but also the 200-day moving average. This is typically considered a bearish signal, suggesting a potential downtrend for MATIC in the immediate future.

At the current moment, the altcoin’s price is consolidating around specific levels, and the MACD indicator shows a bullish crossover. These signs indicate that buyers are gradually regaining power. This could potentially be the catalyst for renewed bullish momentum in the altcoin market.

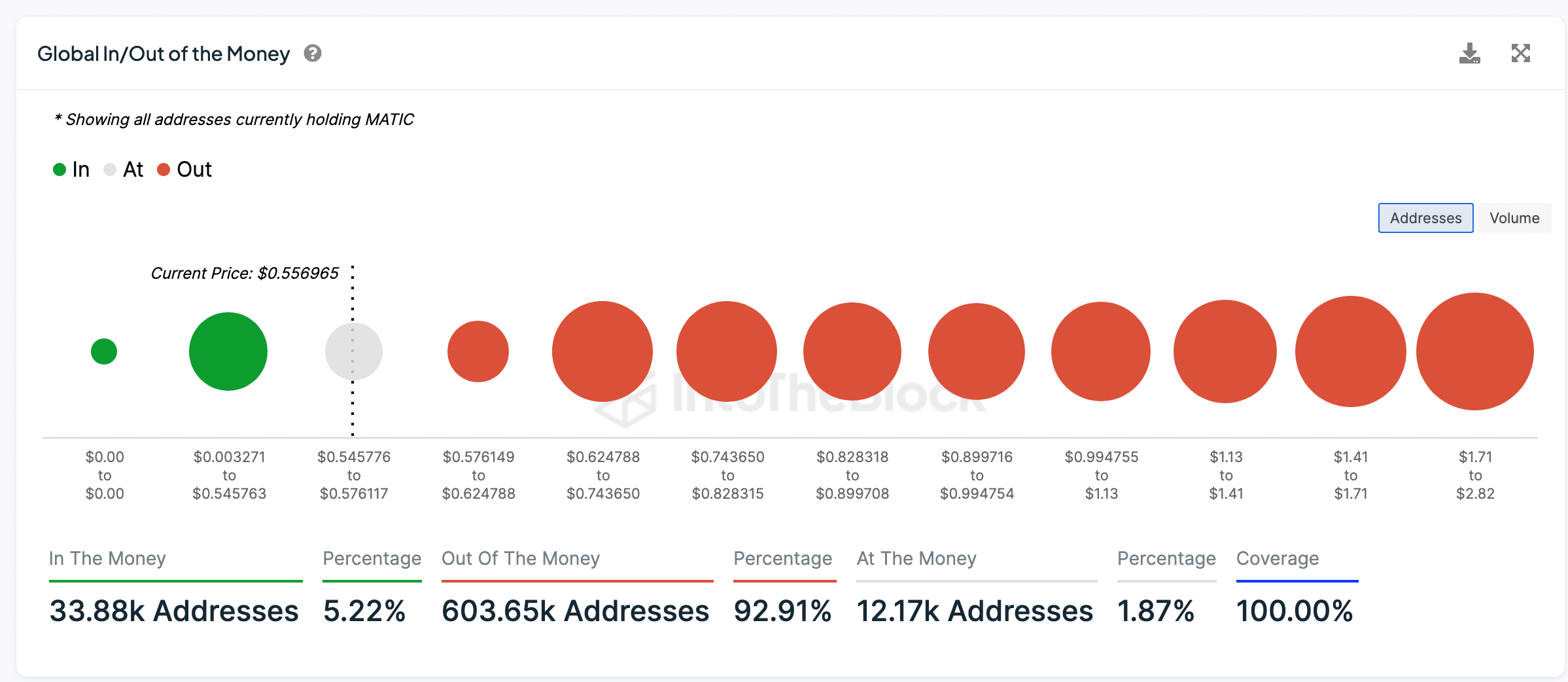

Market bears are still around

As a crypto investor, I’ve noticed that over 92. nineteen percent of MATIC address holders are currently facing losses, as the value of their investments is now lower than what they originally paid for them. In contrast, only a minor fraction, approximately 5. twenty-two percent, are enjoying gains and holding tokens worth more than their initial investment cost.

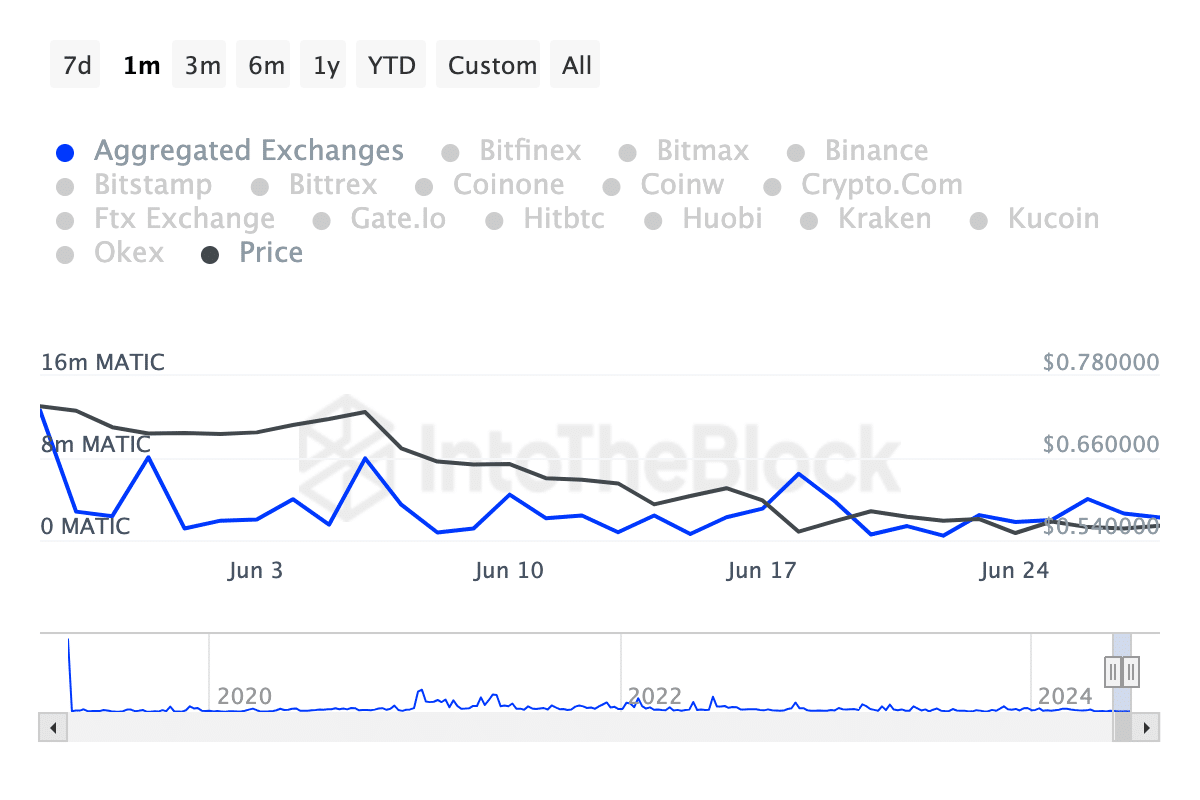

Exchanging platforms experienced significant surges in token inflows – A common indicator of increased selling activity among investors, who may be moving their tokens to these platforms for the purpose of selling.

As a crypto investor observing MATIC‘s trends, I’ve noticed a pattern of decreasing inflows lately. This could potentially indicate that the selling pressure is starting to ease up on the charts.

Despite the data showing some consistency in outflows, there hasn’t been a notable increase in selling activity recently.

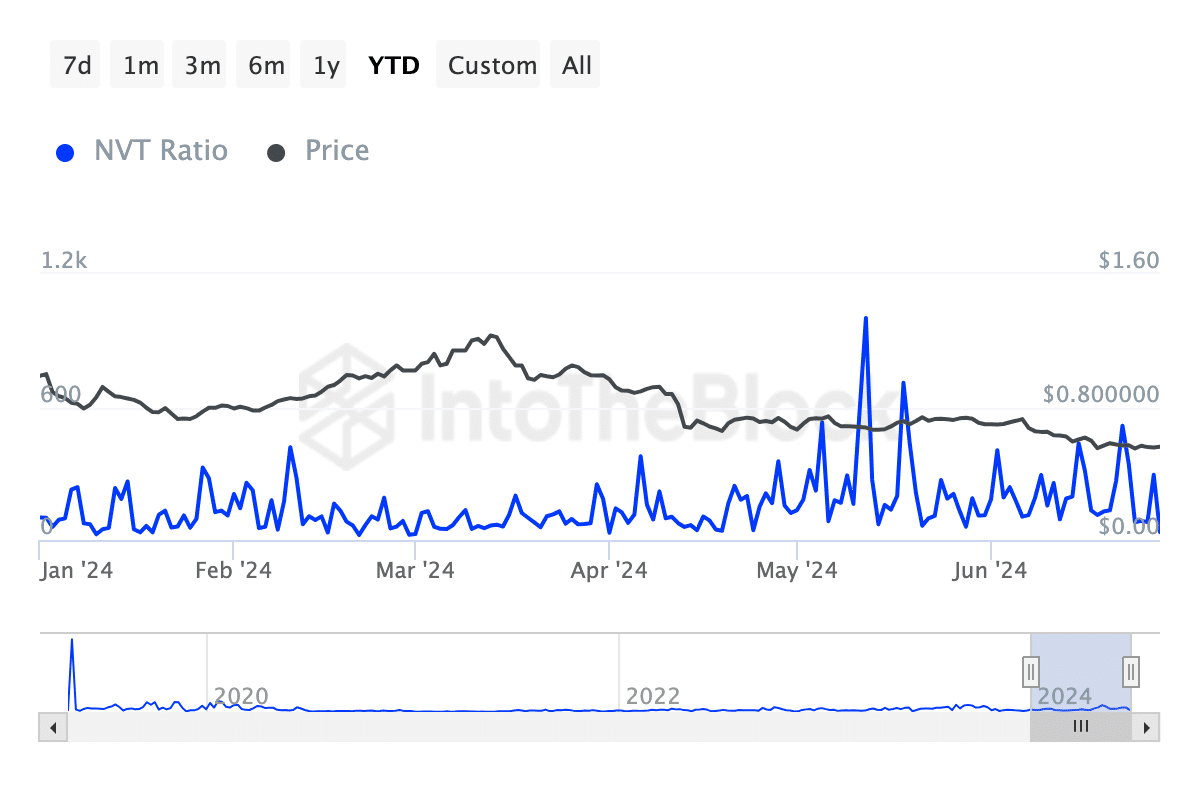

The NVT ratio exhibited some volatility, yet it was moving downward on the graph. This suggested either an increase in transaction activity or a decrease in network value. If the surge in transaction activity persists, this could be interpreted as a positive sign.

As a seasoned crypto investor, I’ve noticed a significant decrease in whale-sized transactions lately. These large-scale investments from major players have been on the wane, leading to fewer speculative trades with high volumes. The result? A more stable market with reduced short-term volatility.

To spark a significant reversal in the market with a bullish outlook, there must be a powerful catalyst – this could be a development within the industry or a broader economic shift.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-30 02:15