ZORA’s price has nudged up by a modest 4% in the last 24 hours, seemingly basking in the glow of a broadly rebounding crypto market. It’s almost enough to make you think maybe, just maybe, things are finally looking up. Spoiler: don’t count on it.

But hold onto your digital hats! Beneath this shiny surface, all the technical and on-chain whisperings are screaming, “Beware! This rally might just be a mirage.” The bearish signals are still smugly hanging around like that one critic at a show who never laughs but also never leaves. It’s market sentiment in deep, gloomy shades.

ZORA’s Bullish Spell? More Like a Faint Whiff

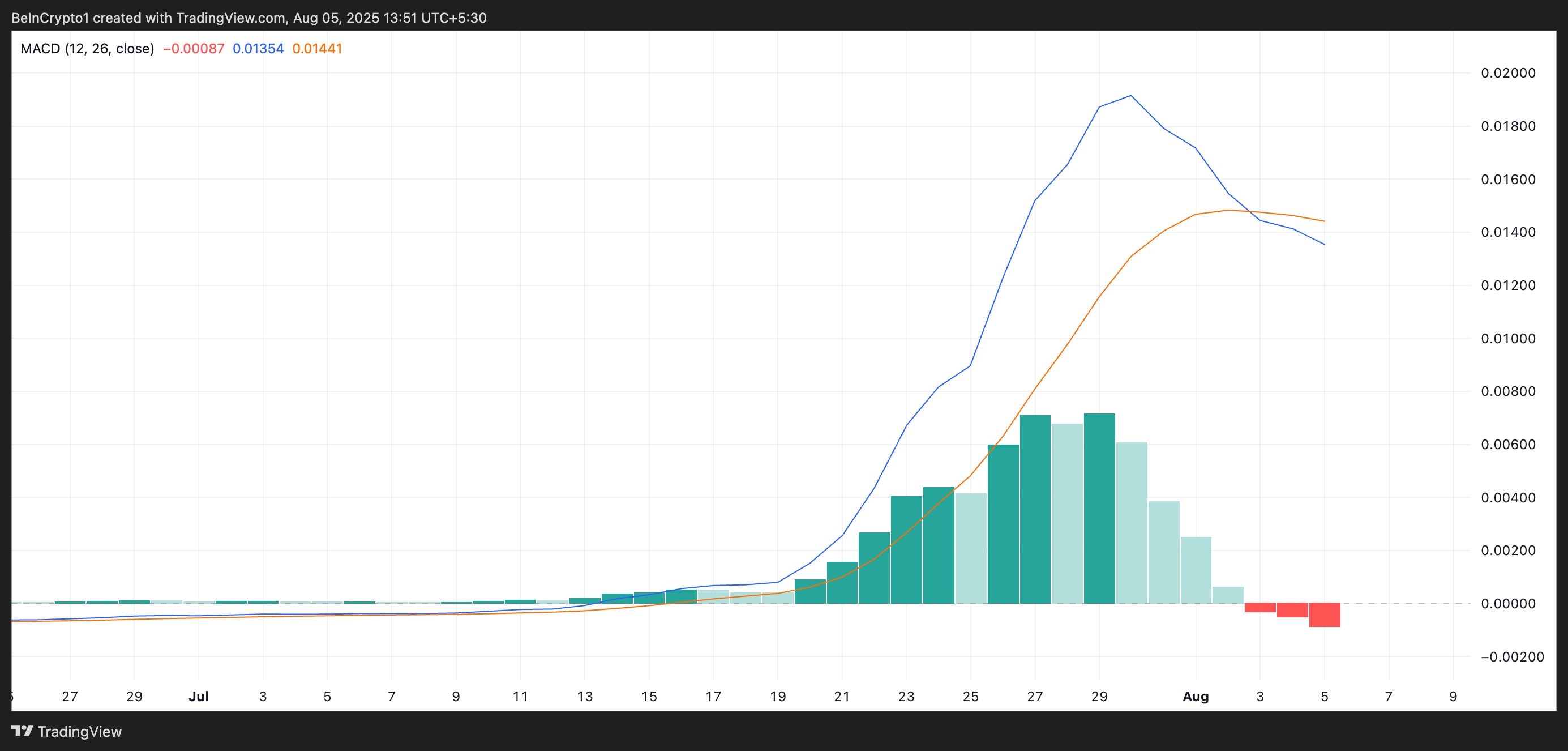

Peeking at the charts-because, who doesn’t love a good number parade-the daily view of ZORA/USD has shown a pretty clear sign of mischief: the MACD indicator (that’s the fancy graph that shows momentum) has just experienced a negative crossover. Think of it as the market’s version of a moody teenager smirking and turning away. The blue line (MACD) has dipped below the orange (signal line). Classic bearish sign, folks. It’s like graduation caps flying, but only if you’re only betting on gloom.

Need more about tokens and techno-babble? Sign up for Harsh Notariya’s Daily Crypto Newsletter. It’s the art of making market chaos sound classy.

The MACD-it’s basically market profile’s way of saying, “Are we going up or down? Only the lines will tell.” When the blue line dances above the orange, bullish vibes are in the air. When it dips below and dives toward zero-hello, fading momentum. Right now, ZORA’s doing the downward shuffle.

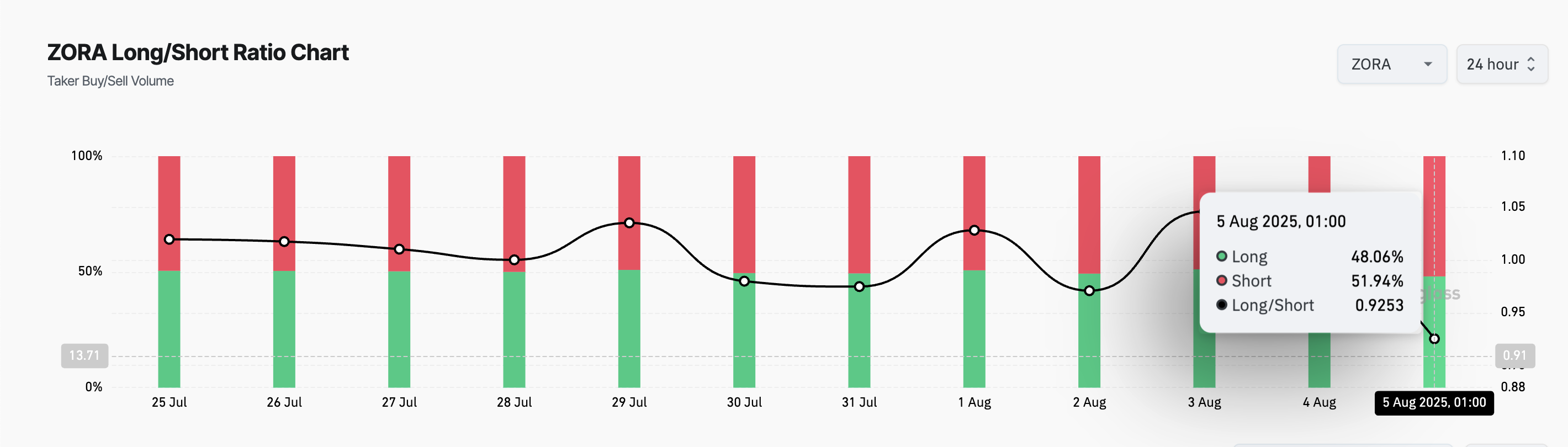

And guess what? The futures’ long/short ratio just hit a 14-day low of 0.92. The less-than-one sign says traders are starting to accept the possibility of a downturn. Maybe they’ve read the tea leaves-or just the charts.

In trader-speak, the long/short ratio is a popularity contest-more longs means everyone’s dreaming of higher prices; more shorts means everyone’s bracing for a tumble. Right now, it looks like the crowd’s bracing, clutching their digital wallets tightly.

The consensus? Most traders are sitting on the sidelines, fingers crossed for a correction, rather than betting on ZORA climbing to the moon anytime soon.

Resistance Levels: The Fort Knox of Crypto – Will ZORA Break Free or Sink?

At the moment, ZORA is hanging out just below $0.06802, playing a delicate game of “Let’s see if we can go higher.” If the bears get aggressive and prices drop, we could see it tumble all the way back to $0.05666-think of it as the crypto equivalent of a piñata at a bad party.

But! If the bulls rally and break through that resistance-well then, ZORA might just hobble or even sprint its way up to $0.08431. Keep your eye on the prize, or at least on your screen. It’s a high-stakes game, and the game is dealers’ choice right now.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Ashes of Creation Rogue Guide for Beginners

- 10 Best Anime Heroes Who Followed Goku’s Legacy

- DC’s Got a Brand New Kryptonian Superhero (But There’s a Catch)

- OMG, Binance Coin Is Basically a Rocket Ship to $1,000 🚀💸

- Jason Bateman Shares Why He Doesn’t See Sister Justine Bateman Often

2025-08-06 01:31