Picture, dear reader, a ballroom in Saint-Petersburg where princes of finance waltz beneath chandeliers of candlelight. Among the swirling silk and gossip, a tall Norwegian fellow named Storebrand-holder of savings, insurer of reindeer-puffs out his chest. He boasts of vast riches, yet measures them merely in the clinking of coins. Now enter the barefoot guest in a Uniswap t-shirt, pockets bulging with tokens and a grin that says, “I’ll swap your kroner for magic beans on a Tuesday.”

Matt Hougan, the earnest maître d’ of Bitwise Asset Management, approaches with the solemnity of Pierre Bezukhov confronting Napoleon. “Gentlemen!” he declares. “Our dear Uniswap, that merry tinkerer of liquidity upon the Ethereum steppes, is deemed small-six billion dollars small! Nay, that is but the 400th chair in the orchestra of financial titans, somewhere between the tympani and the triangle.” 🎺💰

The crowd titters. One dowager whispers: “Only six billion? Why, my cousin from Trondheim raises goats worth half that!”

Yet beneath the laughter lies the ancient dread that stalks every Russian soul: uncertainty. Into the ballroom slithers SEC, disguised as a bureaucratic bear on roller-skates, waving forms and mumbling “clarity.” Will the peasants of DeFi be granted passports to polite society, or will the bear devour them with a single swipe? 🤷♂️🐻

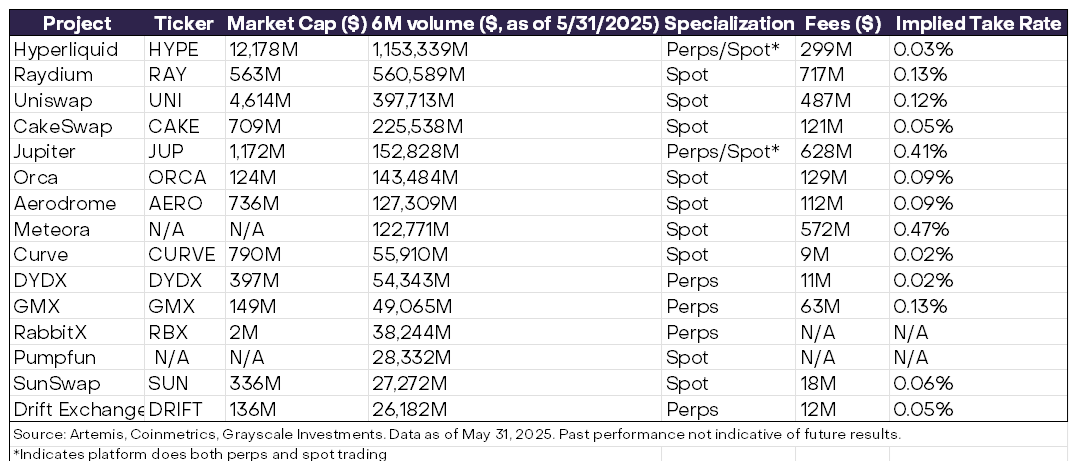

The chronicle’s scribes at Grayscale have placed Uniswap among the top ten of decentralized bazaars-a stall selling silk alongside onion-domed cathedrals of volume. From December to May, Uniswap spun $487 million in fees-sufficient to buy every loaf of black bread in Moscow-while rivals on the snowy Solana sleighed ahead: Raydium, Meteora, Jupiter… names that sound like vodka flavors.

Priced at $9.89, UNI glows not like the ruble’s fire, but more like a candle stub at 3 a.m.-up thirty-six percent this moon, yet still eighty-seven percent adrift from its May ’21 heroic heights. Is this comedy or tragedy? Depends which gilded opera box you’re sitting in. 😅📉

Meanwhile, Hougan gestures toward Ethereum, that grand duchess of blockchains. Her ETF inflows last July reached five-point-four billion-the largest monthly dowry ever presented, as if a caravan of Cossacks poured rubies into the Winter Palace vaults. The comparison, dear reader, is Tolstoyan in scale: Ethereum is to Bitcoin as a smallish samovar is to the entire trans-Siberian railway-yet in that samovar steams enough tea to drown an empire. 🚂🍵

So when Hougan exclaims, “Imagine Bitcoin ETFs seeing twenty-seven billion in one month!”, even the countess’s poodle raises a skeptical eyebrow-such sums could buy the moon itself, or at least annex Finland.

And thus, beneath the chandeliers of speculation and the flickering candle of regulation, the dancers continue-some in patent loafers, others in worn felt boots-spinning ever faster, ever hopeful that tomorrow the barefoot Uniswap shall sit not at the 400th chair but upon the dais itself, trading not just assets but destinies.

End of chronicle, comrade. Store your tokens next to your samovar.

Read More

- Darkwood Trunk Location in Hytale

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- Best Controller Settings for ARC Raiders

- How To Watch A Knight Of The Seven Kingdoms Online And Stream The Game Of Thrones Spinoff From Anywhere

- Ashes of Creation Rogue Guide for Beginners

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- Olympian Katie Ledecky Details Her Gold Medal-Winning Training Regimen

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- Arc Raiders Guide – All Workbenches And How To Upgrade Them

- Nicole Richie Reveals Her Daughter, 18, Now Goes By Different Name

2025-08-06 12:23